Abstract:FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

SogoTrade Faces $75K FINRA Fine as Synthetic Indices Trading Grows

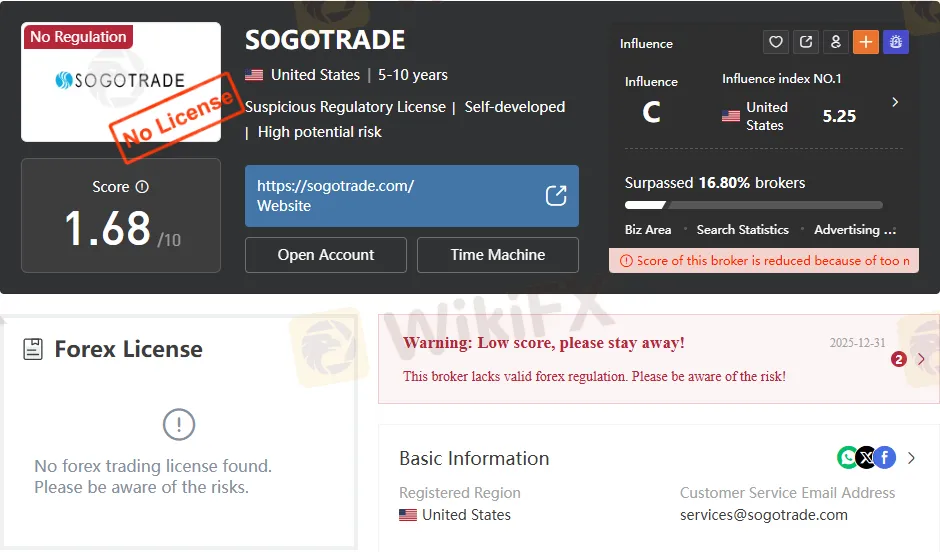

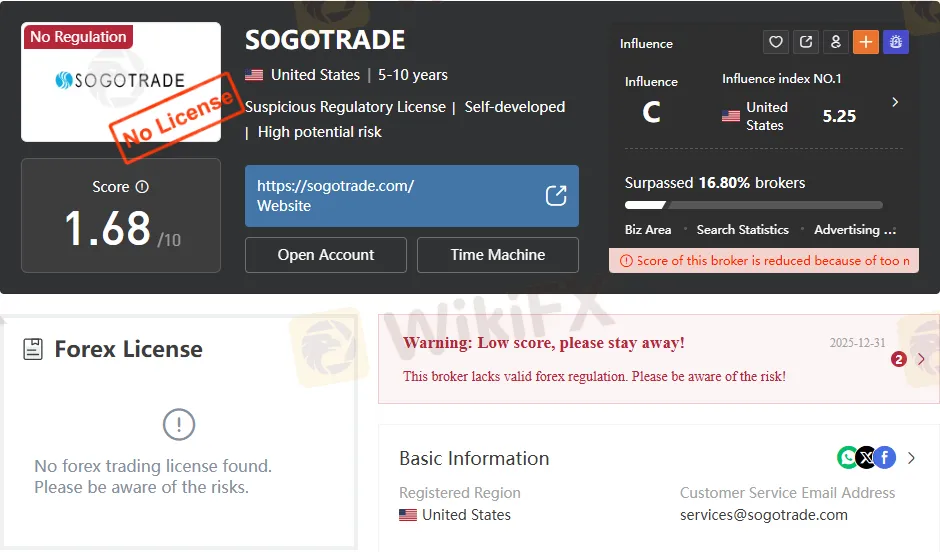

Financial Industry Regulatory Authority (FINRA) has fined SogoTrade, Inc. $75,000 for failing to maintain adequate risk management controls and supervisory procedures over its market access business. The action underscores growing regulatory scrutiny even as traders worldwide explore modern tools like synthetic indices trading on the cTrader platform, offered by innovative brokers such as TopFX.

According to FINRA, from January 2018 onward, SogoTrade failed to establish and document systems designed to prevent the entry of erroneous orders, violating several sections of the Securities Exchange Act and FINRA rules. Furthermore, the firm did not complete annual reviews and CEO certifications required under federal market access regulations. In addition to the fine, SogoTrade accepted a censure and agreed to remediate its compliance issues.

While legacy brokers like SogoTrade address internal control failures, new technology-driven firms are setting higher operational standards. TopFX, for instance, continues to expand its multi-asset trading solutions and features, attracting traders seeking stability and flexibility. The companys synthetic indices trading on the cTrader platform enables investors to trade non-correlated assets that mirror global market movements, providing continuous trading access 24/7 — a key advantage of trading synthetic indices.

But how do synthetic indices work in trading? Unlike traditional assets tied to real-world markets, synthetic indices simulate price behavior through algorithms, offering consistent volatility and reduced exposure to geopolitical risks. TopFX synthetic indices features and benefits include real-time execution speeds, transparent pricing, and seamless integration across asset classes.

As regulatory bodies tighten oversight on risk controls, the rise of algorithmic and synthetic instruments highlights a shift toward more resilient, technology-enabled market participation — where compliance, speed, and innovation increasingly define competitive advantage.