Abstract:Gold reached its latest record high during quiet trade on Monday. The question for traders now is whether it can sustain momentum into the year end with depleting volumes.

Gold prices have moved back into the spotlight after breaking above the previous October high, a move that has caught the attention of many market watchers as the year draws to a close. Spot gold was the first to push past the record level on Monday, with futures following shortly after. There was no single headline or major event driving the breakout, but in this case, one may not have been necessary. Gold has been on a steady uptrend since its October low, and seasonal patterns, combined with thinner trading volumes heading into Christmas and year-end, have helped keep the bullish momentum intact.

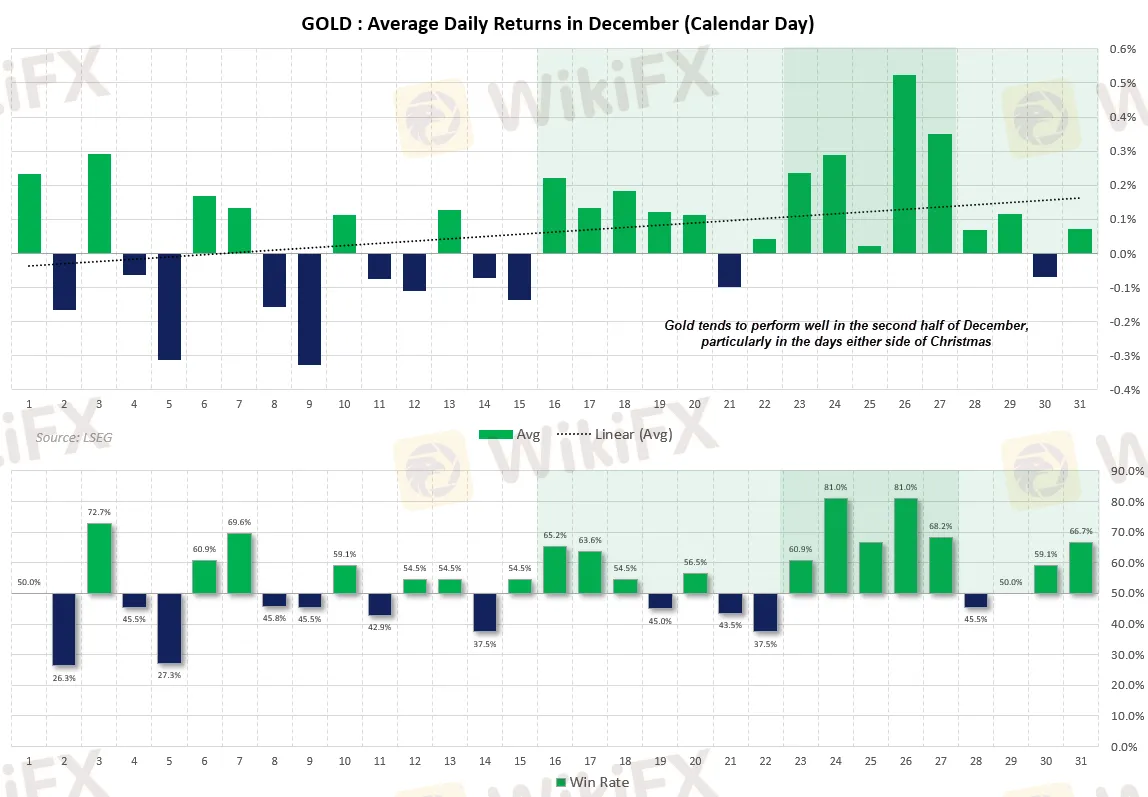

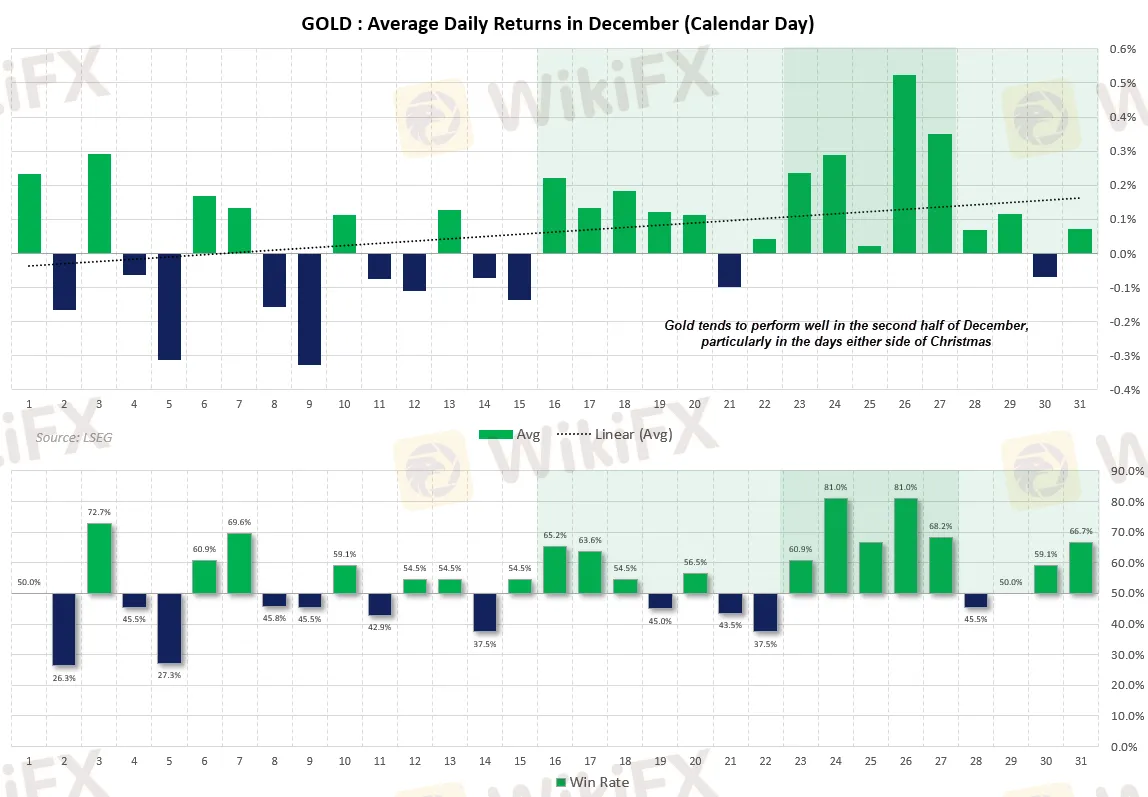

December has historically been a supportive month for gold, although the results are not always straightforward. Looking back over the past 50 years, gold has posted average and median gains of about 1.1% during the month, suggesting a generally positive bias. That said, the win rate sits at around 52%, which means gains are far from guaranteed every year. Still, when December is a winning month, the upside can be meaningful, with average returns close to 4.8%. In contrast, losing Decembers tend to see smaller declines, averaging around 2.9%. This uneven pattern reflects why traders often remain optimistic but cautious during this period.

With only about a week of real trading left before the year ends, some caution is still warranted. Gold has already climbed roughly 4.3% so far this December, and lower liquidity during the holiday period can sometimes lead to consolidation or short-term profit-taking. That said, there are no clear technical signs pointing to an immediate top. The 14-day RSI has only just moved into overbought territory, which is typical during a healthy uptrend rather than a warning signal on its own.

Seasonal trends also continue to favour the bulls. Historically, gold tends to perform well in the sessions around Christmas, with average daily returns leaning positive and win rates relatively high. This keeps the door open for another push higher before any end-of-year profit-taking comes into play. Looking beyond the holidays, the broader outlook for gold remains constructive, with any pullbacks likely to attract buyers looking to add on dips rather than exit the market altogether.