Simulated Trading Competition Experience Sharing

Champion Strategy Revealed: Get a Head Start on Winning

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:ZarVista changed its name from ZaraFX in September 2024. It claims to be a worldwide broker offering various services. It offers the popular MetaTrader 5 (MT5) platform, high leverage of up to 1:500, and various account types tailored to different traders. However, when we look closer, we find many serious risks that anyone thinking about using it should know about. The main problem is how it's regulated - it operates in offshore locations that don't watch financial companies very closely. This gets worse when you add the many user complaints about problems getting their money out, plus a serious legal investigation by Indian authorities in 2025. This review will break down these problems and give you a clear picture of this broker. You need to do careful research, and we suggest you check any broker's current regulatory status and user reviews yourself. A tool like WikiFX can give you current information and important risk warnings.

ZarVista changed its name from ZaraFX in September 2024. It claims to be a worldwide broker offering various services. It offers the popular MetaTrader 5 (MT5) platform, high leverage of up to 1:500, and various account types tailored to different traders. However, when we look closer, we find many serious risks that anyone thinking about using it should know about. The main problem is how it's regulated - it operates in offshore locations that don't watch financial companies very closely. This gets worse when you add the many user complaints about problems getting their money out, plus a serious legal investigation by Indian authorities in 2025. This review will break down these problems and give you a clear picture of this broker. You need to do careful research, and we suggest you check any broker's current regulatory status and user reviews yourself. A tool like WikiFX can give you current information and important risk warnings.

A broker's regulatory status is the foundation of trader safety. It decides the rules, how safe your money is, and what you can do if something goes wrong. With ZarVista, the regulatory foundation is very weak, putting it clearly in the high-risk category.

ZarVista operates under two main licenses, both considered offshore and offering limited protection to traders.

· Comoros (MISA): The Mwali International Services Authority (MISA) license (No. T2023293) is from a small island nation. This regulator has very low international recognition and is known for its hands-off approach to financial oversight. For traders, this means almost no enforcement and virtually no safety net.

· Mauritius (FSC): The Mauritius Financial Services Commission (FSC) license (No. GB23202450) is held under the name Zarvista Capital Markets (MU) Ltd. While the FSC is better than MISA, it has a serious transparency problem: it doesn't publicly show the website names connected to its licensed companies. This creates a big risk of identity fraud, making it hard for clients to be completely sure whether they are dealing with the correctly regulated broker.

The choice of offshore regulation has real and serious consequences for traders. These risks are not just theoretical; they are connected to real-world problems reported with the broker.

· High-Risk Profile: The combination of a Comoros and a non-transparent Mauritius license immediately marks ZarVista as a high-risk broker. These locations do not offer the same strict oversight as top-level regulators such as the UK's FCA or Australia's ASIC.

· Lack of Investor Protection: A critical problem is the absence of any investor compensation plan. Unlike brokers regulated in the UK (FSCS) or Cyprus (ICF), if ZarVista were to go bankrupt, clients would have no funds to claim compensation from. Your capital is not protected by a safety net.

· The Indian Investigation: In August 2025, the Indian Enforcement Directorate (ED) raided four locations connected to the broker (then operating as ZaraFX). The authorities froze about $445,000 in bank assets, claiming the company was running an illegal foreign exchange trading platform that violated Indian monetary laws. The investigation also targeted CEO Jamsheer Thazhe Veettil. While the company has said it doesn't operate in India, such serious legal action from a national enforcement agency is a huge red flag about its operational integrity and compliance standards.

ZarVista offers four different account types designed for traders with different capital and experience. The main differences are in the minimum deposit requirements, spreads, and commission structures.

| Account Type | Minimum Deposit | Spreads (from) | Commission | Best For |

| Starter | $50 | 1.5 pips | None | Beginners and small-volume traders |

| VIP | $500 | 0 Pip | $5 per lot | Elite traders seeking premium services and exclusive benefits |

| Professional | $250 | 1 pip | None | Experienced traders seeking tighter spreads and advanced tools |

All account types are available as Swap-Free (Islamic) versions, for traders who cannot pay or receive interest due to religious beliefs. Also, demo accounts are available for all levels, allowing users to practice and test the platform's conditions without risking real money.

Beyond account types, the specific trading conditions determine the day-to-day experience. ZarVista offers a standard range of features, but with some notable limitations and risks.

The broker provides very high leverage, which can increase both profits and losses. It's important to understand the risks, especially when paired with an offshore broker where stop-out levels and terms can be less reliable.

· Forex: Up to 1:500

· Gold/Silver: Up to 1:100

· Indices: Up to 1:50

· Crude Oil: Up to 1:20

High leverage is a powerful tool, but it dramatically increases the risk of quick, significant losses. Leverage conditions can also change based on your account, location, and market volatility. We advise traders to always check the latest terms by using an independent source, such as WikiFX, before putting their capital.

ZarVista provides access to over 350 CFD instruments across several major asset classes.

· Forex: A selection of over 40 currency pairs, including majors, minors, and exotics.

· Metals: Gold, Silver, Platinum, and Palladium against the USD.

· Energies: Crude Oil (WTI, Brent) and Natural Gas.

· Indices: CFDs on major global stock indices like the S&P 500 and FTSE 100.

· Commodities: A range of soft commodities.

A key missing piece for many traders is the lack of Stock CFDs. If you want to trade individual company shares, you will need to look elsewhere.

ZarVista operates on a hybrid Market Maker/STP/ECN model with market execution. This means orders are filled at the next available price, which can lead to slippage during volatile periods. Spreads are floating, meaning they widen or narrow based on market liquidity. A critical detail for risk management is the stop-out level, which is set at 20% for Starter and Professional accounts and 30% for the VIP account. This means if your margin level drops to 20% or 30%, the platform will automatically start closing your losing positions to prevent a negative balance.

Technology is central to the trading experience. ZarVista relies on industry-standard platforms while also offering its own solutions for social trading and account management.

This platform offers advanced features over its predecessor. These include 21 timeframes, 38 built-in indicators, an integrated economic calendar, and superior backtesting capabilities for automated strategies (Expert Advisors).

ZarVista has developed its own systems to meet the growing demand for social trading. This includes a Copy Trading feature that allows users to automatically copy the trades of successful strategy providers. They also offer PAMM/MAM solutions for fund managers handling multiple client accounts.

To improve the trading experience, ZarVista integrated AnalysisIQ from Acuity Trading in late 2024. This tool provides AI-driven market analysis, sentiment data, and technical insights.

However, a critical limitation exists with their own mobile app. Based on our analysis, the app, available for Android and iOS, is designed only for account management. You can monitor statistics, transfer funds, and contact support, but you cannot place or manage trades directly from it. For actual trading on mobile, you must use the separate MT5 mobile applications.

A broker's reliability is most clearly tested during the withdrawal process. While ZarVista offers a convenient array of funding methods, the reality reported by many users paints a concerning picture.

On paper, the process seems straightforward and modern.

· Deposit Methods: Bank Wire, Local Bank Transfers, Visa/MasterCard, E-wallets (Skrill, Neteller), and Cryptocurrencies (BTC, ETH, USDT).

· Deposit Time: E-wallets and crypto are typically instant, while bank wires can take 1-3 business days.

· Withdrawal Policy: The minimum withdrawal amount is a low $20, while the broker claims to process requests within 24 hours.

A large number of user reviews across platforms, such as Trustpilot and WikiFX, directly contradicts the official policy. A clear pattern of withdrawal problems emerges from user-generated feedback.

· Extended Delays: Many users report that withdrawal requests remain in a “pending” state for days, weeks, or even longer, with no communication or progress.

· Unhelpful Support Team: When questioned about delays, customers frequently receive repetitive and unhelpful responses from support, such as “the relevant team is processing your request,” without any concrete timeline or resolution.

· Blocked Accounts & Cancelled Profits: There are serious claims from some traders who say their accounts were blocked or profits were cancelled immediately after they submitted a withdrawal request. Often, the broker cites alleged violations of terms, such as the use of certain Expert Advisors (EAs), which the users themselves deny.

This stark contrast between the advertised policy and the reported user experience is a major red flag.

To summarize our findings, here is a side-by-side comparison of what ZarVista offers versus the inherent risks and shortcomings.

| Advantages (What They Offer) | Disadvantages (The Risks & What's Lacking) |

| ✅ Diverse account types for different budgets | ❌ Severe Regulatory Risk (Offshore Licenses) |

| ✅ High leverage up to 1:500 | ❌ Widespread User Complaints of Withdrawal Delays |

| ✅ MT5 platform supported | ❌ No Investor Compensation Fund for Protection |

| ✅ Social/Copy trading features available | ❌ Active Legal Investigation in India (as of 2025) |

| ✅ Multiple funding methods including crypto | ❌ Lack of key assets like Stock CFDs |

| ✅ Swap-free Islamic accounts offered | ❌ Limited educational resources for beginners |

After a thorough evaluation, our conclusion on ZarVista is one of extreme caution. The broker presents an appealing package on the surface, with high leverage, modern platforms, and a tiered account structure. These ZarVista account features are designed to attract a broad spectrum of retail traders.

However, these benefits are heavily overshadowed by fundamental and critical red flags. The combination of weak offshore regulation from Comoros and a non-transparent license from Mauritius provides a fragile foundation for fund safety. This regulatory weakness is not just a theoretical risk; it is highlighted by the serious legal investigation in India and, most importantly, by the significant volume of user complaints detailing severe difficulties with withdrawing funds.

For any trader, the ability to securely access one's money is non-negotiable. The reported pattern of withdrawal delays and disputes at ZarVista makes it an unacceptable risk for those who prioritize the security of their investment. While some users may have a positive experience, the weight of the evidence points to a high-risk environment.

Before considering any broker, and especially one with this profile, it is essential to conduct your own independent verification. Check ZarVista's complete profile, including live user reviews and regulatory updates, on a trusted third-party platform like WikiFX to get the most current picture of their operations and associated risks.

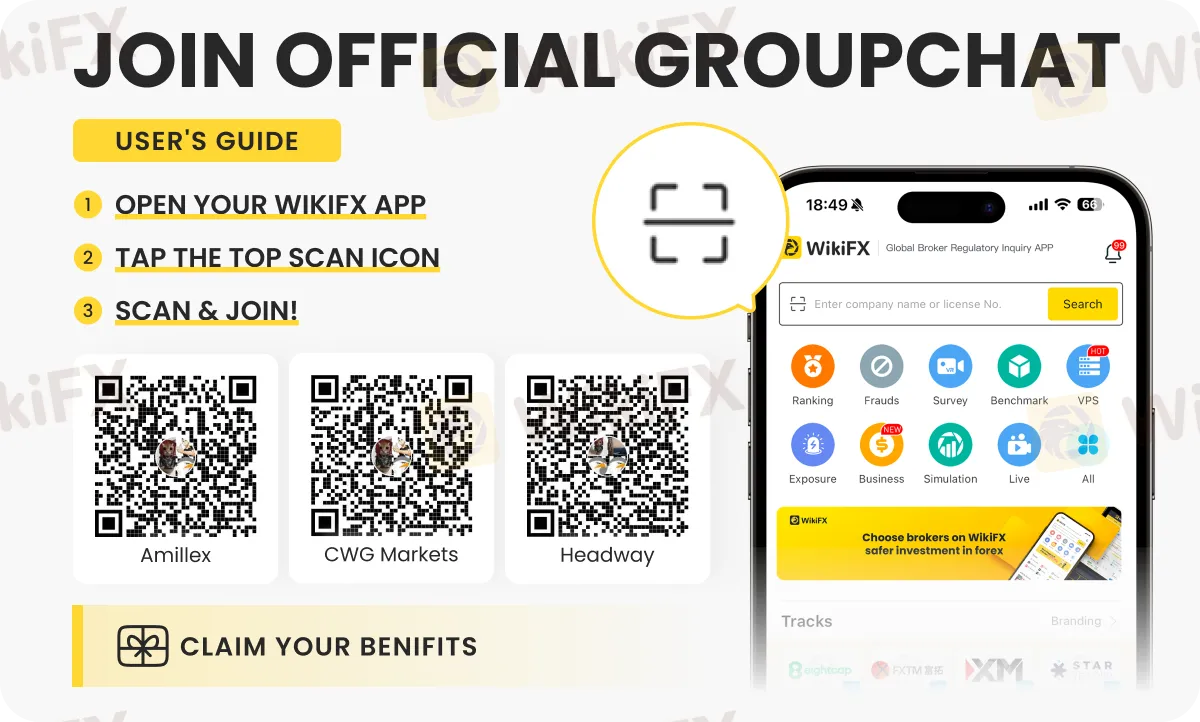

Want to gain the latest forex updates, insights, tips and strategies? Join these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Champion Strategy Revealed: Get a Head Start on Winning

The formation of the SkyLine Guide 2026 Thailand judge panel has officially begun. This year’s selection brings important upgrades to both the evaluation mechanism and participation approach, further emphasizing the role of local perspectives and authentic investor experiences within the judging framework.

WikiFX Elite Club Focus is a monthly publication created exclusively for members of the WikiFX Elite Club. It spotlights the individuals, ideas, and actions that are genuinely driving the forex industry toward greater transparency, professionalism, and long-term sustainability.

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!