简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETO Markets Global Pulse: Gold Whipsaws $40 After CPI Shock

Abstract:Market Review According to ETO Markets monitoring, on Thursday, December 18, spot gold spiked sharply intraday and briefly surged to USD 4,374 per ounce, marking a near two-month high. Heavy selling p

Market Review

According to ETO Markets monitoring, on Thursday, December 18, spot gold spiked sharply intraday and briefly surged to USD 4,374 per ounce, marking a near two-month high. Heavy selling pressure then emerged at elevated levels, forcing prices to retreat quickly. Gold eventually closed at USD 4,332.31 per ounce.

During early Asian trading on Friday, December 19, gold remained range-bound and edged down around 0.15%. Prices are trading near USD 4,325 per ounce, as market sentiment turns more cautious following heightened volatility.

Global Headlines

US CPI Misses Expectations Sharply

U.S. November CPI rose 2.7% year-on-year, well below the 3.1% market forecast. The headline suggested easing inflation and supported rate-cut expectations. However, data credibility was questioned due to missing components linked to the government shutdown.

Economists Question CPI Data Accuracy

Several economists flagged unusually flat housing prices. Missing October rent and owners equivalent rent data may have artificially lowered November inflation. Many institutions prefer to wait for December data before reassessing the inflation trend.

Precious Metals Show Diverging Moves

After silver hit a record high of USD 66.88 per ounce earlier, prices fell around 1.5% to USD 65.3. Platinum and palladium outperformed, with platinum rising 1.2% to a more than 17-year high. ETO Markets notes faster sector rotation within precious metals.

Trump Reiterates Aggressive Rate-Cut Bias

Trump said the Fed Chair decision will be made in the coming weeks. He again stressed his preference for aggressive rate cuts to lower financing costs. His remarks continue to shape market expectations.

Goldman Sees $4,900 Gold Target

Goldman Sachs reiterated a bullish medium-term outlook. The bank forecasts gold could reach USD 4,900 per ounce by December 2026. Central bank buying and geopolitical risks remain key drivers.

Venezuela Tensions Lift Safe Havens

Venezuela ordered its navy to escort oil shipments amid rising external pressure. Regional risks escalated quickly, boosting safe-haven demand and offering short-term support to gold.

Gaza Ceasefire Talks Enter Key Phase

U.S. officials confirmed new talks with Qatar, Egypt, and Türkiye to discuss the second phase of the Gaza ceasefire. Concerns over negotiation setbacks keep geopolitical risks in focus.

ETO Markets Analyst View (Spot Gold)

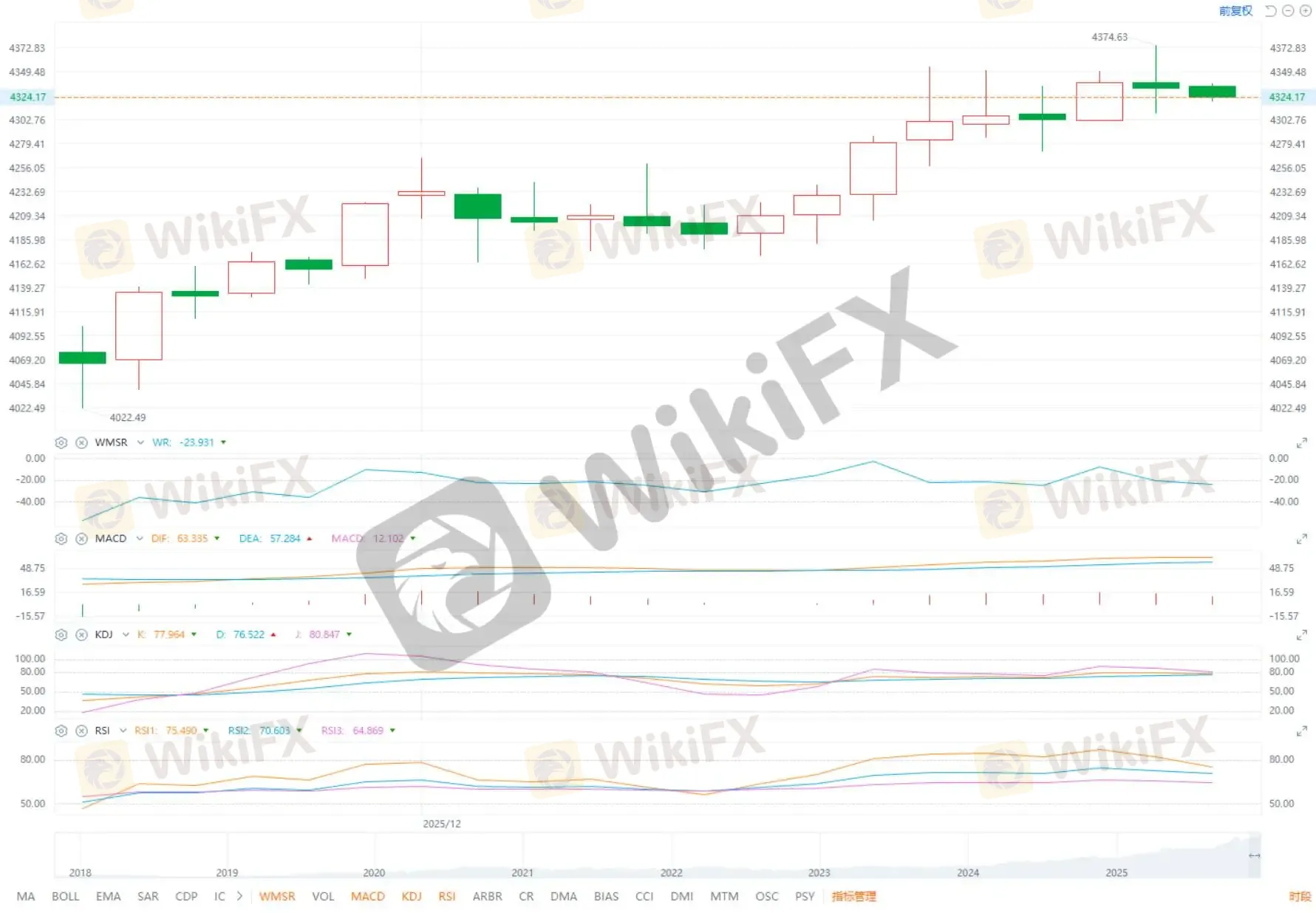

From a technical perspective, spot gold remains without a clear short-term direction. The USD 4,354 per ounce level acts as a key pivot. As long as prices stay below this level, near-term bias leans toward consolidation and mild pullbacks. Downside targets are seen at USD 4,307 and USD 4,290.

If gold reclaims USD 4,354, prices may retest USD 4,374, with further upside toward USD 4,400. RSI signals remain mixed and do not confirm a clear trend. With data and geopolitical events overlapping, gold is more likely to digest volatility through high-level consolidation rather than form a one-way move.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

XTB Review 2025: Pros, Cons and Legit Broker?

Cabana Capital Review 2025: Safety, Features, and Reliability

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

Currency Calculator