简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG AUDUSD Market Report December 19, 2025

Abstract:On the AUDUSD H4 chart, the pair is showing a clear trend reversal after maintaining a strong and consistent bullish trend since November. The bullish rally peaked near 0.6685, where price faced firm

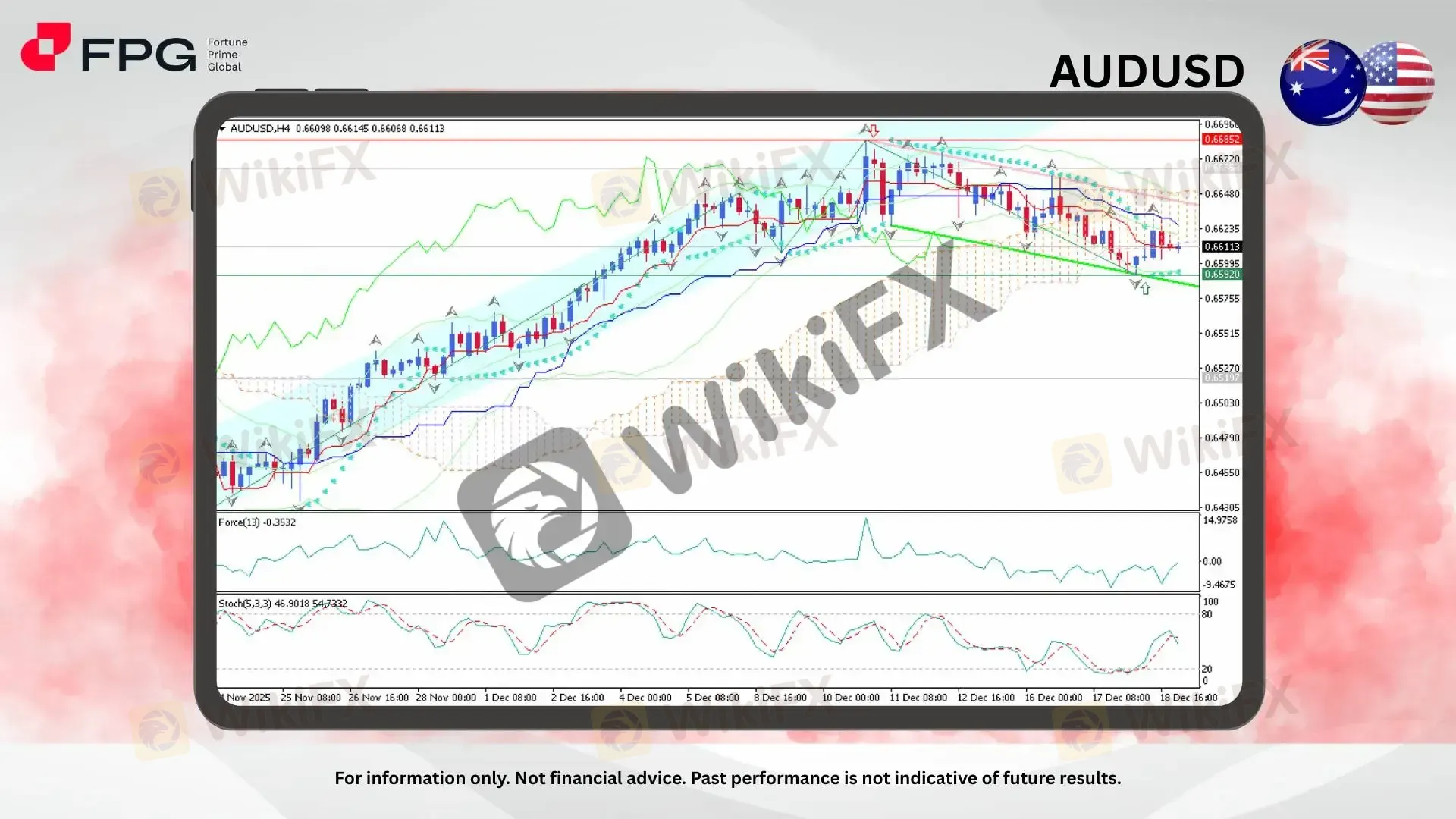

On the AUDUSD H4 chart, the pair is showing a clear trend reversal after maintaining a strong and consistent bullish trend since November. The bullish rally peaked near 0.6685, where price faced firm rejection, signaling the emergence of selling pressure. Following this rejection, AUDUSD entered a corrective phase and is now trading around 0.6611, moving within a well-defined bearish channel, indicating a shift in medium-term market control from buyers to sellers.

Price action is currently positioned below key short-term moving averages and drifting toward the lower Bollinger Band, reflecting sustained downside pressure. The Ichimoku Cloud has begun to act as dynamic resistance, with price trading below the cloud structure, reinforcing the bearish bias. Force Index (13) remains mostly in negative territory, confirming weakening bullish participation and persistent selling momentum. Meanwhile, Stochastic Oscillator (5,3,3) is recovering from oversold levels but remains below the mid-range, suggesting that any short-term bounce is likely corrective rather than a confirmed bullish reversal.

The transition from a prolonged bullish trend into a bearish channel highlights a structural shift in momentum, which generally appears to be driven by impactful fundamental factors. This condition suggests that AUDUSD may continue its bearish trajectory today, especially if selling pressure remains dominant. With several upcoming economic news releases that could directly or indirectly influence both AUD and USD sentiment, traders should remain highly attentive, as these events may trigger sharp price reactions and increased volatility.

Market Observation & Strategy Advice

1. Current Position: AUDUSD is currently trading around 0.6611, consolidating within a bearish channel after rejecting the prior bullish peak.

2. Resistance Zone: Immediate resistance is located around 0.6648 – 0.6685, aligning with channel resistance and the prior rejection zone. A sustained break above this area would weaken the bearish structure.

3. Support Zone: Key support is seen near 0.6592, followed by deeper support at 0.6550, which represents a significant demand area from previous price structure.

4. Indicators: Force Index remains negative, Stochastic Oscillator signals corrective recovery only, and Ichimoku Cloud positioning continues to support bearish bias.

5. Trading Strategy Suggestions:

Bearish continuation setup: Look for sell opportunities on rejection near 0.6645 – 0.6680, targeting 0.6590 and 0.6550, with stops above 0.6690.

Breakdown strategy: Consider short positions on a confirmed H4 close below 0.6590, aiming toward 0.6550.

Risk management: Stay cautious around high-impact economic releases that could trigger sharp volatility spikes.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1722 +0.01%

USD/JPY 155.67 +0.14%

Today's Key Economic Calendar:

US: Net Long-term TIC Flows

JP: Inflation Rate YoY

UK: GfK Consumer Confidence

JP: BoJ Interest Rate Decision

DE: GfK Consumer Confidence

UK: Retail Sales MoM & YoY

UK: CBI Distributive Trades

CA: New Housing Price Index MoM

CA: Retail Sales MoM Final & Prel

EU: Consumer Confidence Flash

US: Existing Home Sales

US: Michigan Consumer Sentiment Final

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

QuoMarkets Review 2025: Safety, Features, and Reliability

Strifor Review 2025: A Risk Analysis of This Unregulated Broker

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

Titan Capital Markets Review 2025: Safety Warning and Scam Analysis

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

Currency Calculator