Abstract:Acting as an intermediary between traders and brokerage firms, Introducing Brokers (IBs) can be both a company and an individual. They do not have a role in trade execution or account management. Their role is to offer advice and let clients open trading accounts and trade on the platform. In this article, we have discussed the meaning of the term 'introducing broker,' its role, payment structure, and other related aspects. Read on!

Imagine how simple yet insightful tips can help traders elevate their forex trading game. As the market continues to fluctuate based on news developments and technical factors, implementing these tips can help traders maximize gains or minimize losses. The best part is that such support is available to forex traders through an Introducing Broker (IB).

Acting as an intermediary between traders and brokerage firms, IBs can be both a company and an individual. They do not have a role in trade execution or account management. Their role is to offer advice and let clients open trading accounts and trade on the platform. In this article, we have discussed the meaning of the term 'introducing broker,' its role, payment structure, and other related aspects. Read on!

Explaining the Role of Introducing Brokers in Forex Trading

The primary function of IBs is to refer new clients to a forex brokerage house and help them with market insights, financial information, trading strategies, account setups, and choosing the appropriate trading platforms. Offering language-specific or localized support, IBs let clients navigate the global forex market.

How are IBs Different from Full-service Brokers?

The role of introducing brokers is solely focused on helping traders navigate the forex market, whereas a full-service broker does everything - whether it is about acquiring clients, executing trades, offering customer support, or managing portfolios.

The Earning of Introducing Brokers

IBs receive a portion of the spread charged by the brokerage firm as commission. For the unversed, a spread remains the difference between bid and ask prices for each trade made by the trader. Based on the trading volume and frequency, the IBs may receive a rebate. Some brokers may offer IBs a fee for every successful client referral, irrespective of the trading volume. This is called Cost Per Acquisition (CPA). Depending on the IB-brokerage agreement, the exact earnings may differ.

Tips to Become a Successful IB

The path to becoming a successful introducing broker lies in complying with the steps shown below.

Gain Market Knowledge

Becoming a successful and reliable introducing broker requires mastering the art of forex trading. As a prospective IB, you need to understand how different trading platforms work and gain in-depth knowledge of several brokerage structures.

Select a Broker Partner

Choosing a reputable broker offering an IB program comes next. Make sure to review the commission structures, client services and platform support of several forex brokers. This will help you figure out the right alternative.

Register and Comply with Necessary Regulations

To gain more trust from brokers and their traders, you need to register and comply with investor-friendly regulations of the forex market regulator in your region. For instance, in India, forex market regulations are governed by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). As clients prefer investment safety, having registration and compliance with the necessary regulations makes them feel confident about the introducing broker.

Make Your Business Identity Clear

Do you want to work as an individual or a corporate IB? This has to be made clear to the trading community. After that, you can create a website with marketing materials and client support tools.

Assist Clients

Reach out to traders using educational content, webinars and social media tools. This helps ensure you carve an empathetic image of yourself in traders minds.

Summing Up

Introducing Brokers play a crucial role in the forex trading ecosystem by bridging the gap between traders and brokerage firms. While they do not execute trades or manage accounts, their guidance, market insights, and localized support help traders make informed decisions. For aspiring IBs, success depends on strong market knowledge, choosing the right broker partner, regulatory compliance, and building trust through consistent client support. When approached ethically and transparently, the IB model can be mutually beneficial for traders, brokers, and the introducing brokers themselves.

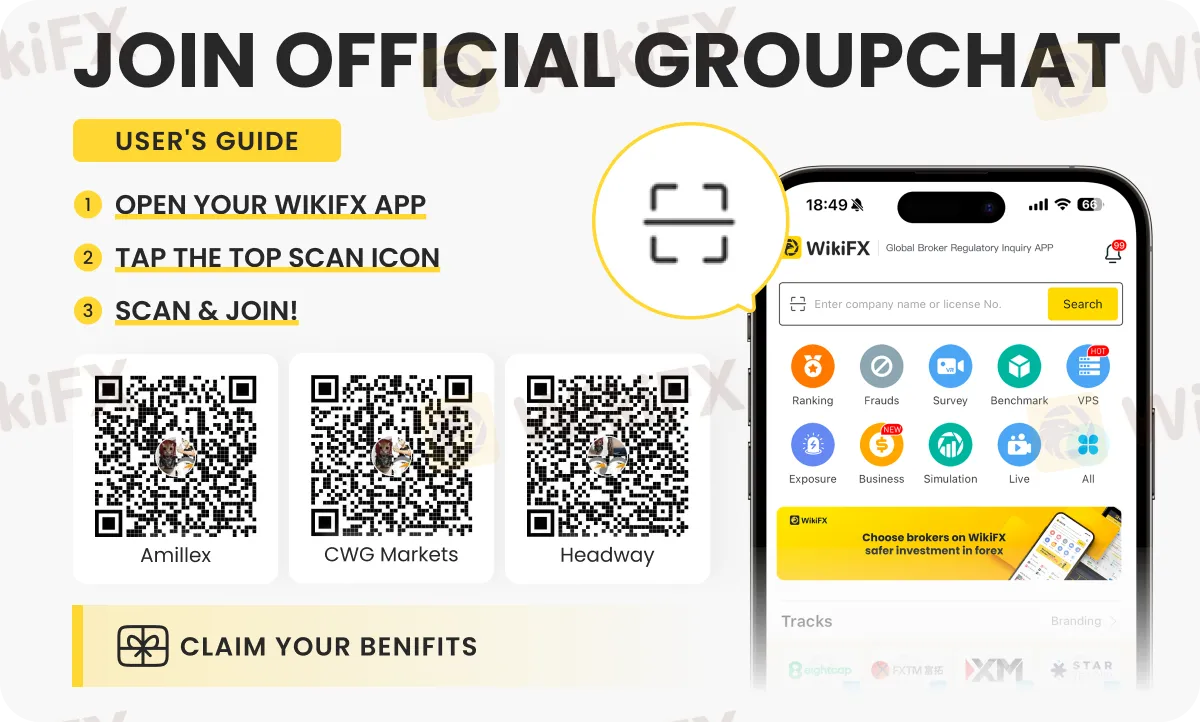

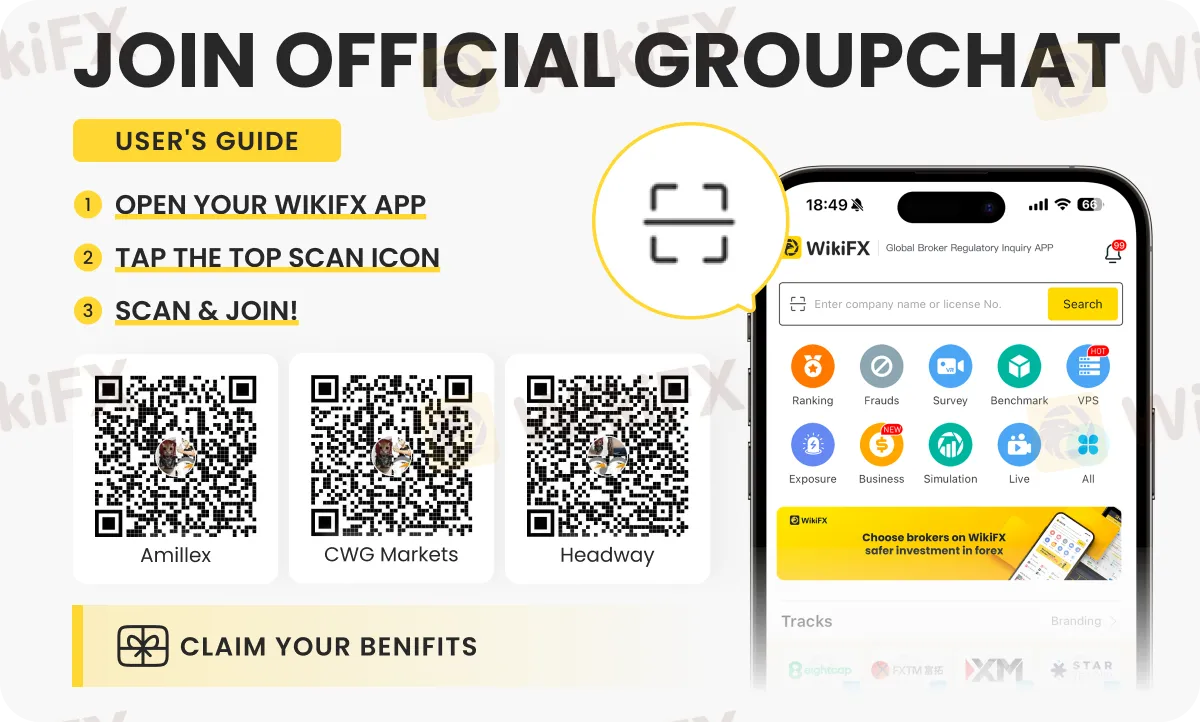

To know more about the IB and other forex trading aspects, join our special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G.