简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETO Markets Global Pulse: Gold Shrugs Off NFP, Holds Above $4,300

Abstract:Market Review According to ETO Markets monitoring, spot gold traded in a high-level consolidation range on Tuesday, December 16. Prices briefly dipped to around USD 4,272 per ounce before rebounding s

Market Review

According to ETO Markets monitoring, spot gold traded in a high-level consolidation range on Tuesday, December 16. Prices briefly dipped to around USD 4,272 per ounce before rebounding sharply to test USD 4,335, eventually closing near USD 4,302 per ounce, little changed on the day. Price action highlighted persistent two-way positioning as bulls and bears continued to contest direction at elevated levels.

During early Asian trading on Wednesday, December 17, gold extended its narrow consolidation pattern, trading near USD 4,306 per ounce. Overall volatility has continued to compress, with the market awaiting fresh macroeconomic signals for clearer directional guidance.

Global Headlines

US Jobs Data Shows Divergence

U.S. November non-farm payrolls increased by 64,000, exceeding expectations, while the unemployment rate rose to 4.6%, the highest level in over four years. The headline payroll gain briefly supported the U.S. dollar, but the rise in unemployment reinforced rate-cut expectations, allowing gold to find support and rebound after initial weakness.

Markets Remain Dovish Post Cut

Following the Federal Reserve‘s 25-basis-point rate cut last week, Chair Powell emphasized downside risks to the labor market. Interest rate futures indicate markets are pricing in two additional rate cuts in 2026, totaling approximately 59 basis points. The U.S. Dollar Index briefly fell to 98.22, a two-month low, while Treasury yields declined in tandem, enhancing gold’s appeal to overseas investors.

Geopolitical Risks Continue Supporting Gold

The Russia Ukraine conflict remains active, with ongoing clashes and continued discussions between the U.S. and Europe regarding post-ceasefire security arrangements. German Chancellor Merz stated that peacekeeping forces could take military action if necessary and highlighted that the U.S. may provide NATO-like security guarantees under a ceasefire scenario. Persistent geopolitical uncertainty continues to offer underlying safe-haven support for gold.

Global PMI Signals Slowing Momentum

The preliminary U.S. December Composite PMI fell to 53.0, a six-month low, with growth in new orders and employment moderating simultaneously. Signs of cooling economic momentum have strengthened expectations for further monetary policy easing.

Fed Chair Succession Uncertainty Rises

Hassett reiterated his support for Federal Reserve independence, while U.S. Treasury Secretary Bessent confirmed that interviews with potential candidates will continue this week. Former President Trump is also considering interviewing Fed Governor Waller, increasing uncertainty around future leadership and adding potential volatility to policy expectations.

Copper Prices Hit Record Highs

U.S. stockpiling activity combined with AI-related demand has pushed copper prices to record highs. Goldman Sachs warned that concentrated speculative positioning could amplify price swings, increasing the risk of a near-term correction.

ETO Markets Analyst View (Spot Gold)

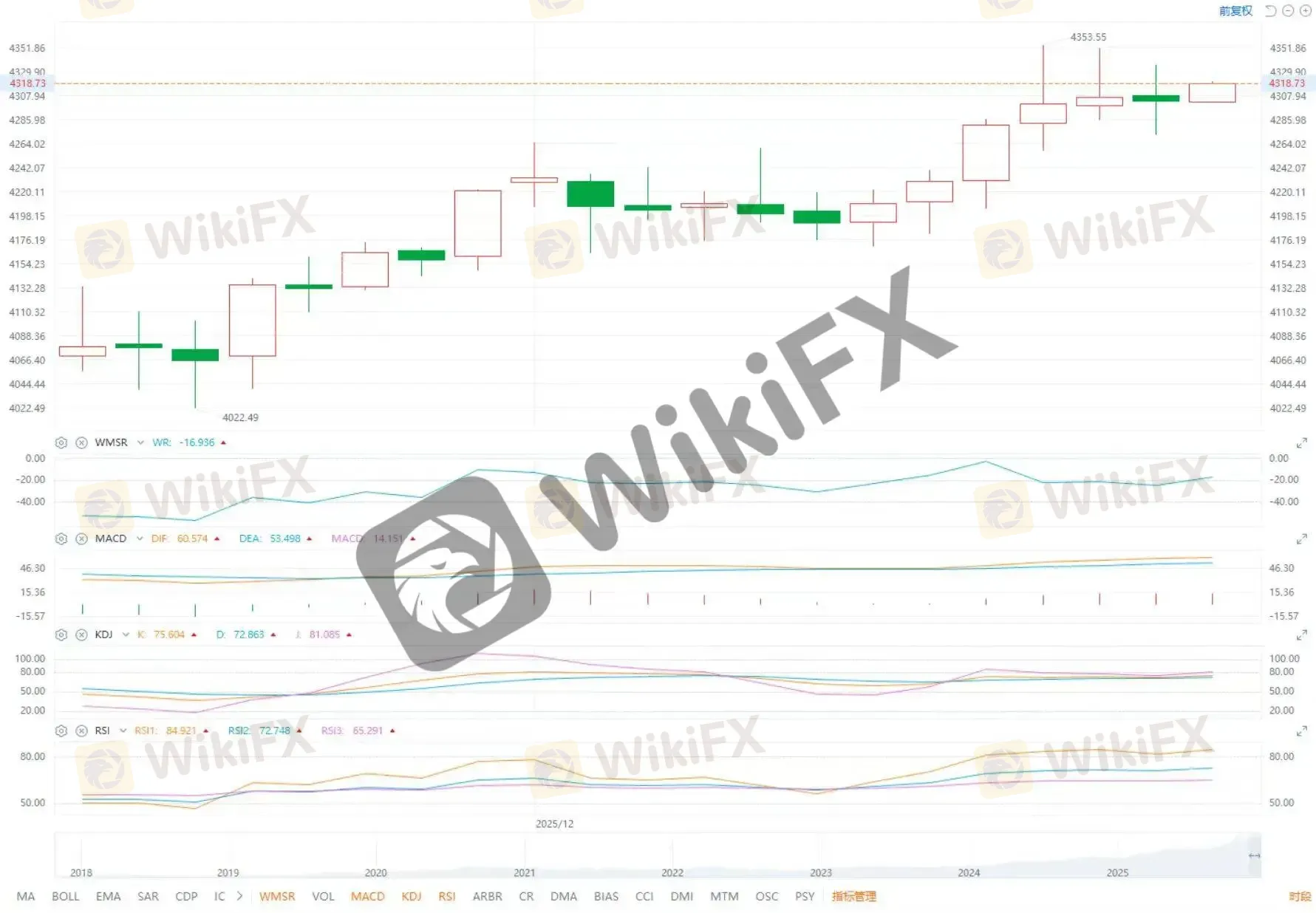

From a technical perspective, spot gold remains in a range-bound structure, with clear short-term support established near USD 4,275 per ounce, which also serves as the key pivot for near-term price action. As long as prices remain above this level, the broader bias favors consolidation with a mild upside tilt. On the upside, resistance is seen at USD 4,335, followed by USD 4,353.

A decisive break below USD 4,275 could open the door to a deeper pullback, with downside levels to watch at USD 4,257 and USD 4,240.

Overall, ahead of a dense macro data calendar, market-driven catalysts remain limited, and gold is more likely to digest price action within a range rather than trend decisively.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AmariFX Review: Traders Annoyed by Slippage, Login & Withdrawal Issues

Headway Broker Regulation and User Reviews

Vida Markets Regulation and Broker Review

MBFX Review: Withdrawal Denials, Fund Scams & Poor Customer Support Service

Saxo Bank Review 2025: Regulatory Status and Safety Score

FXORO Under the Microscope: Revoked Licenses and The "Advisory" Trap

XXLMARKETS Review: Regulatory Status and Trading Conditions

IUX Review 2025: Regulatory Status and Withdrawal Complaints

The "Broker Group" Abyss: How OmegaPro Trapped Thousands in a Digital Dead End

Libertex Investigation: When "Expert Advice" Leads to Total Ruin

Currency Calculator