简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Souq Capital Exposed: DFSA Warns of Fake Licensing Claims and Unauthorized Status

Abstract:DFSA warns Souq Capital for fake licensing claims. WikiFX rates the broker 1.74/10 with "No Regulation" status. Read the full scam alert here.

The Dubai Financial Services Authority (DFSA) has issued an urgent public alert regarding Souq Capital, an online trading platform operating via souqcapital.com. The regulator has accused the firm of fabricating credentials to masquerade as a legitimate financial services provider within the Dubai International Financial Centre (DIFC).

Fabricated Credentials: The “Clone” Tactic

The core of the DFSA‘s warning centers on Souq Capital's deceptive marketing. The firm has been displaying a counterfeit DFSA “Registered” number, attempting to convince traders that it is a licensed stakeholder in the UAE’s premier financial free zone.

The DFSA explicitly clarified that Souq Capital has no legal presence in the DIFC and holds no authorization to conduct financial services in or from the jurisdiction. This tactic, often referred to as “cloning,” allows unregulated entities to mimic the credibility of compliant firms, thereby bypassing investor due diligence.

WikiFX Analysis: “No Regulation” and Low Score

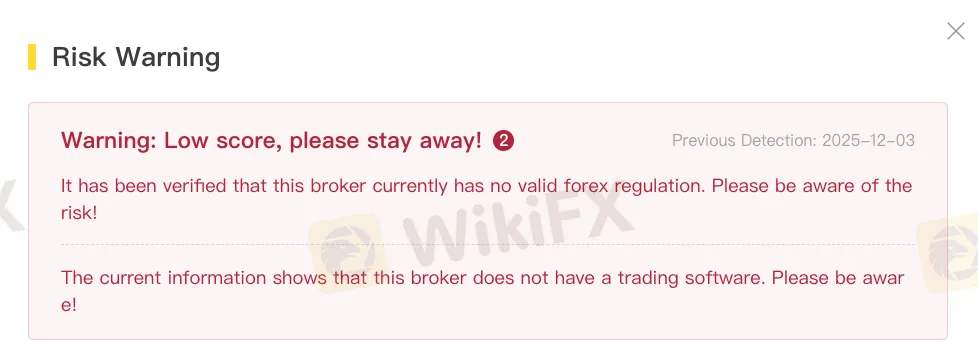

Independent data from WikiFX corroborates the regulator's warning, painting a bleak picture of the broker's reliability. According to the WikiFX database, Souq Capital holds a “No Regulation” status and has been flagged for a “Suspicious Regulatory License”.

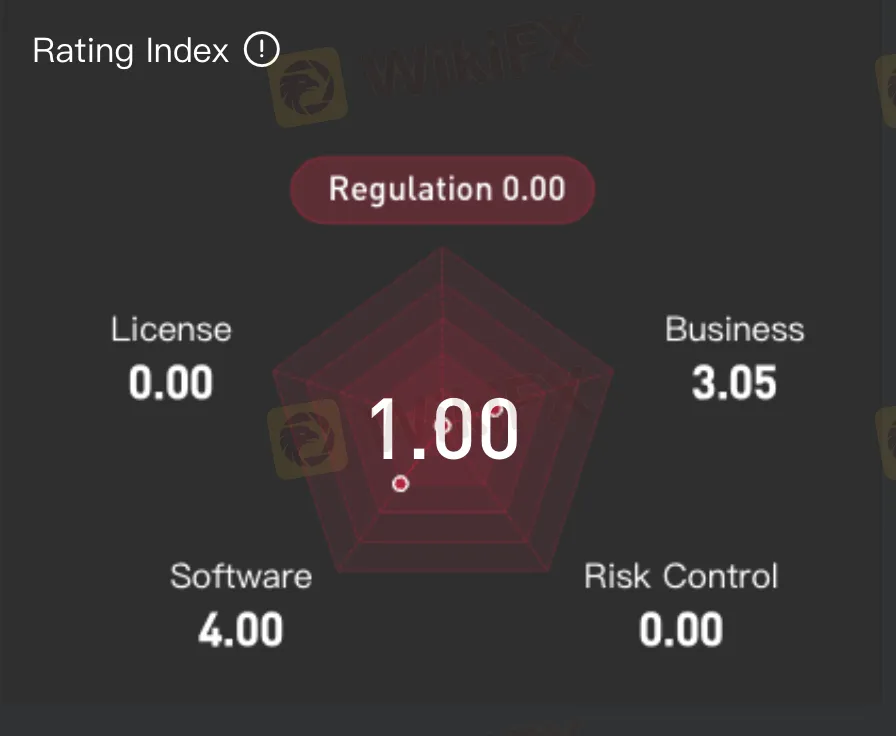

The platforms safety metrics are alarmingly low:

- WikiFX Score: A dangerous 1.74/10.

- Regulatory Index:0.00, confirming the lack of valid oversight.

- Risk Control Index:0.00, indicating zero protection mechanisms for client funds.

The Danger to Investors

The DFSA emphasized that the consequences of engaging with such entities are severe. Because Souq Capital operates entirely outside the regulatory perimeter, its clients are stripped of all standard protections. If the firm fails or engages in malpractice, investors have no access to official complaint channels or compensation schemes, leaving them with no legal recourse to recover losses.

How to Verify Safety: Use WikiFX to Spot Red Flags

In light of these sophisticated scams, relying solely on a broker's website claims is dangerous. Industry experts recommend using WikiFX as a primary verification tool before transferring any funds.

By searching for a broker on the WikiFX App, investors can instantly cross-reference regulatory claims against valid databases. As seen with Souq Capital, a quick check reveals the 1.74 low score and “No License” warning, providing definitive proof to avoid the platform entirely.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Najm Capital Ltd: Regulated Forex Broker Strengthens Its Presence in the MENA Online Forex Market

HEADWAY Rebate Service Review 2026: Is this Forex Broker Legit or a Scam?

UAE SCA Rebrands as CMA: What It Means for Forex and CFD Brokers?

OmegaPro Review 2026: Is This Forex Broker Safe?

Legal Headwinds for Tariffs: US States Sue to Block Trump's Trade Agenda

Is Malaysia Losing Control of the Online Scam Economy?

FINRA Fines Altruist Financial $150,000 for Supervisory Failures in Securities Lending Program

Angel One Exposure Review: Low Score & Unregulated Forex Broker Risks

A Complete Xlibre Review: High Leverage and Major Warning Signs to Consider

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Currency Calculator