简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AccuIndex Review & Evaluation 2025: Is it a Scam? License Check and Profit Complaints

Abstract:Is AccuIndex safe? While regulated by CySEC, the broker faces serious allegations regarding profit cancellations and bonus disputes. Read our 2025 review for a detailed breakdown of user risks.

Introduction: A Regulated Broker Facing Scrutiny

AccuIndex is a recognized name in the online trading industry, legally operating under the oversight of the Cyprus Securities and Exchange Commission (CySEC). With a WikiFX Score of 5.71/10, the broker demonstrates a legitimate corporate structure and high scores for software reliability.

However, despite its regulatory credentials, the platform has accumulated a significant number of user complaints. These reports primarily concern the handling of profitable accounts and promotional bonuses, raising important questions for prospective traders regarding the practical experience of client withdrawals.

Regulatory Analysis: CySEC Regulation and Risk Alerts

The primary pillar of trust for AccuIndex is its authorization by CySEC (License No. 340/17). This Tier-2 regulation mandates strict compliance standards, including the segregation of client funds and participation in the Investor Compensation Fund (ICF).

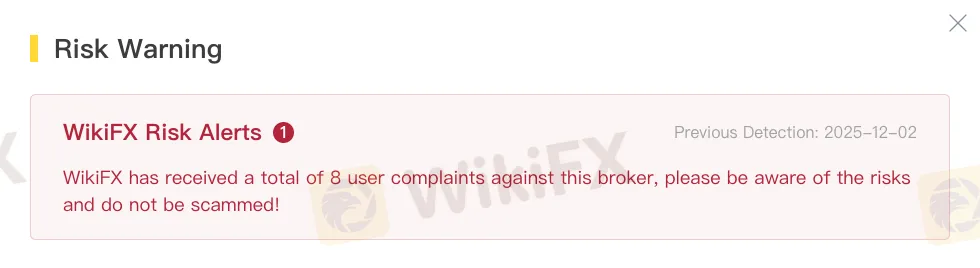

Despite this legal framework, WikiFX has issued a Risk Alert due to the volume of verified complaints received. This alerts investors that holding a license does not automatically immunity from operational disputes, particularly regarding how a broker interprets trading terms and conditions.

User Exposure: Patterns of Disputes

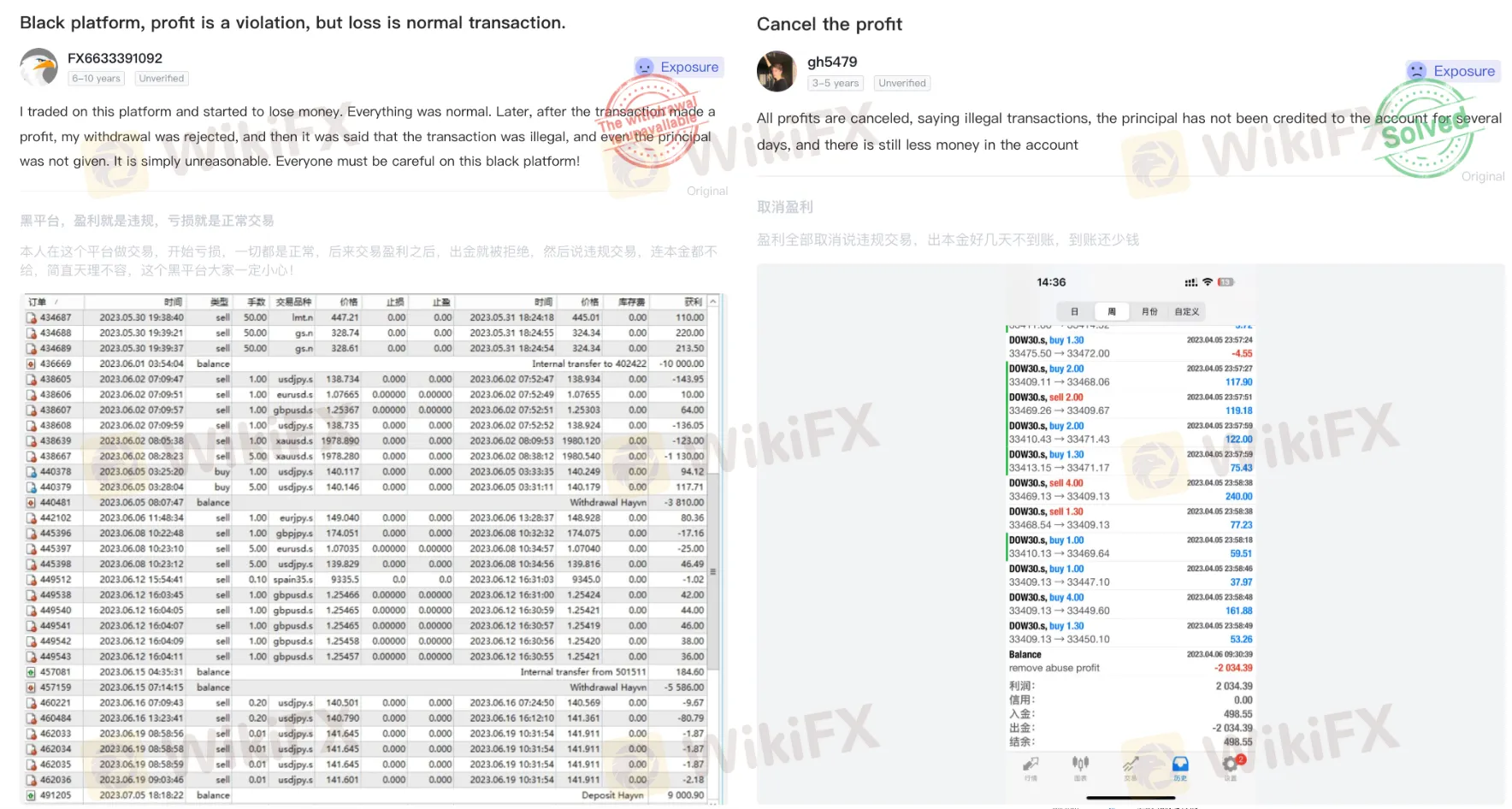

A detailed analysis of user feedback reveals two distinct categories of complaints: the cancellation of realized profits based on “illegality” clauses, and disputes regarding promotional bonus terms.

Allegations of Profit Cancellation and “Illegal” Trades

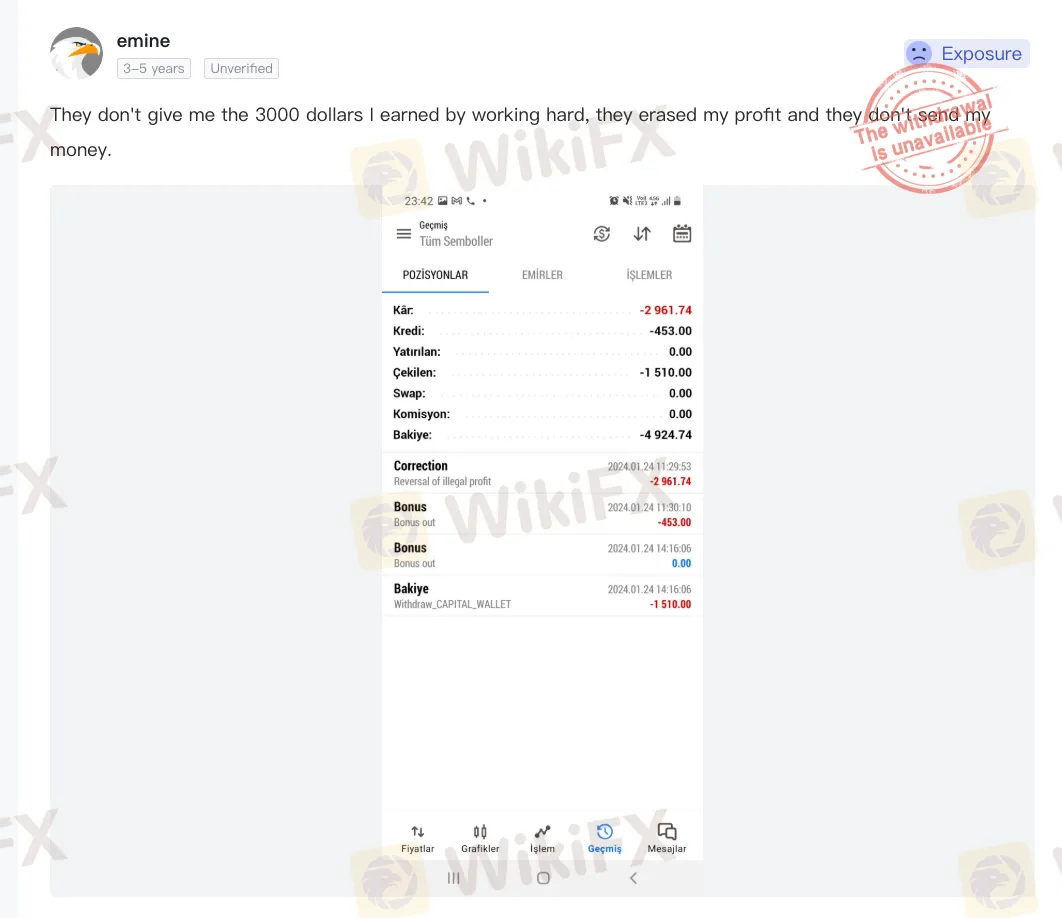

The most concerning pattern involves multiple traders who reported having their profits wiped out after successful trading sessions. Several users shared screenshots showing balance adjustments labeled as “Correction: Reversal of illegal profit” or “Reverse of illegal profit.” In one instance, a trader claimed to have earned approximately $3,000 through hard work, only to see the entire amount deducted and the withdrawal refused.

Users consistently stated that they were not provided with clear evidence of manipulation, simply receiving emails stating the transactions were invalid, leaving them with no recourse.

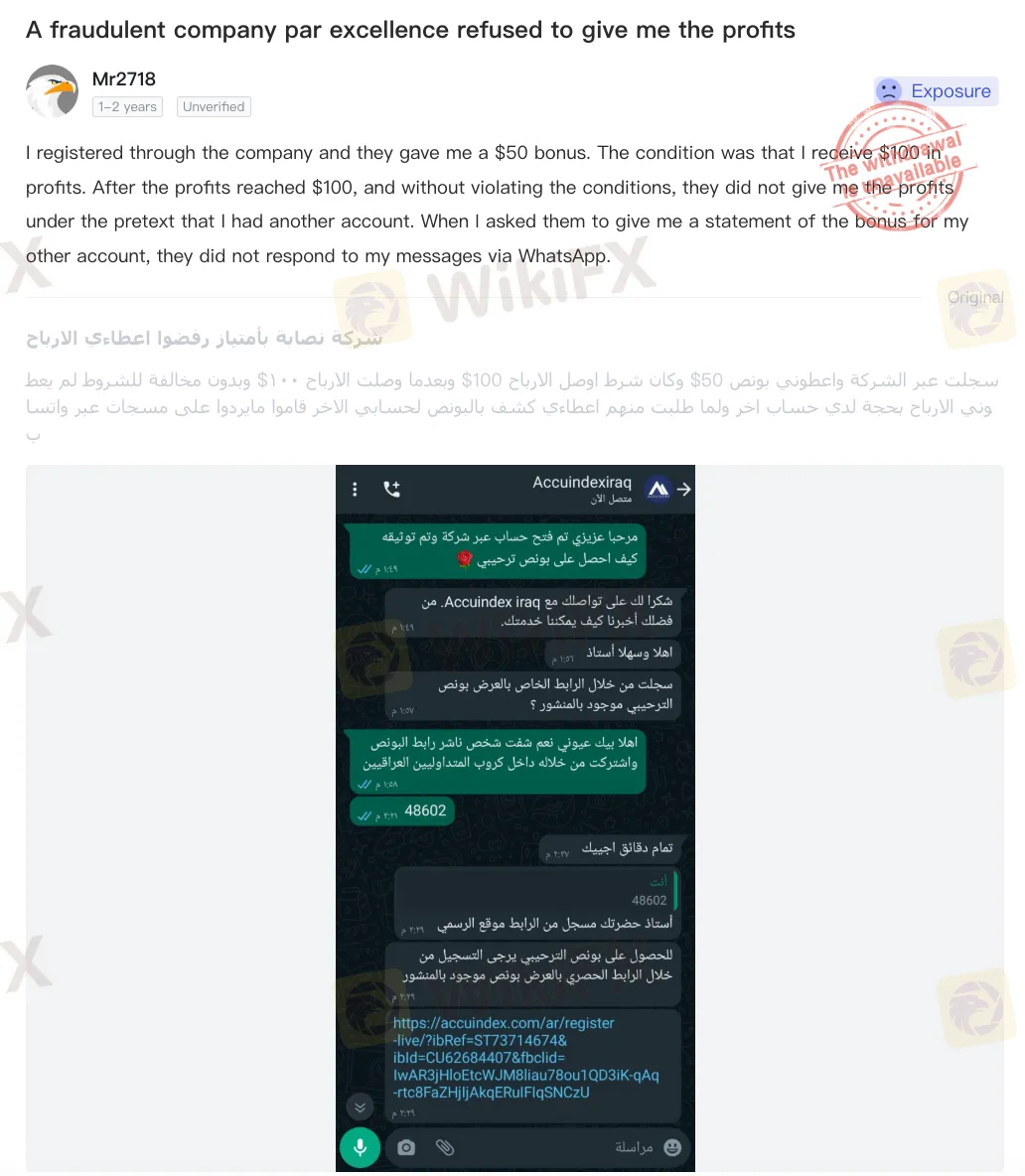

Bonus Traps and Account Access Issues

A secondary stream of complaints focuses on promotional schemes. Several clients reported signing up for a $50 bonus with the understanding that they could withdraw profits once a $100 target was reached. However, after meeting these conditions, users alleged that the broker refused the payout, citing reasons such as “duplicate accounts” without providing proof.

WikiFX Final Verdict

AccuIndex holds a valid CySEC license, which places it above unregulated offshore entities in terms of safety. However, the recurring nature of complaints regarding “illegal profit” reversals is a significant operational red flag. The strict and sometimes opaque enforcement of trading clauses to cancel profits creates a high-friction environment for profitable traders. While the broker is legally compliant, investors should carefully study the terms regarding prohibited trading strategies and bonus conditions to avoid unexpected capital loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Currency Calculator