简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

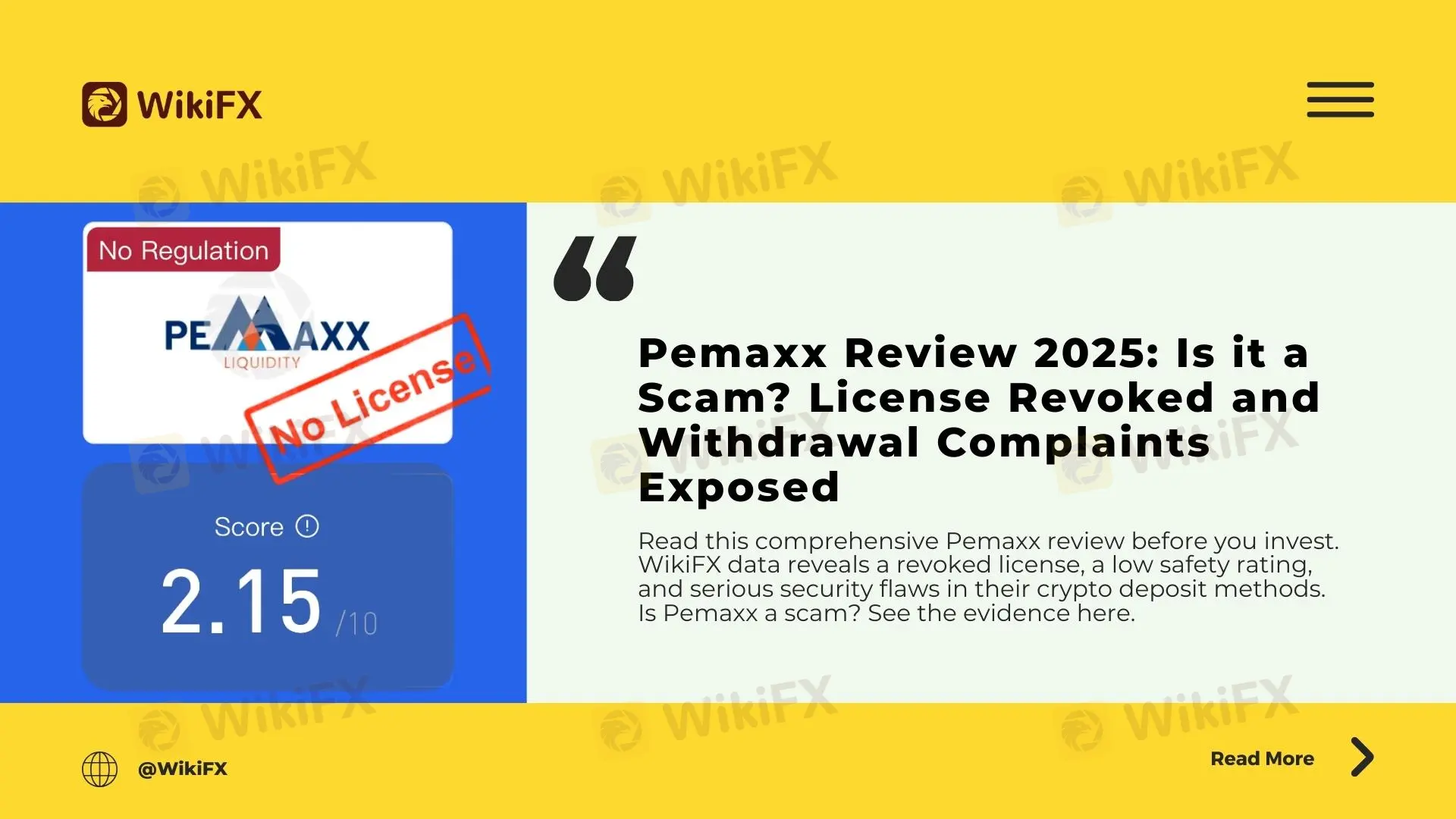

Pemaxx Review 2025: Is it a Scam? License Revoked and Withdrawal Complaints Exposed

Abstract:Read this comprehensive Pemaxx review before you invest. WikiFX data reveals a revoked license, a low safety rating, and serious security flaws in their crypto deposit methods. Is Pemaxx a scam? See the evidence here.

Introduction: A High-Risk Warning

In the rapidly expanding world of online trading, the distinction between a legitimate broker and a potential scam often lies in regulatory compliance. Pemaxx Global Limited has recently become a subject of concern within the trading community. According to the latest data from WikiFX, the broker holds a “Danger” rating with a low WikiFX Score of 2.15/10. This comprehensive review examines the broker's regulatory collapse, critical operational loopholes, and growing user complaints to determine the platform's reliability.

Regulatory Status: License Revoked

The primary pillar of trust for any financial service provider is a valid regulatory license. Previously, Pemaxx Global Limited held only an Investment Dealer License from the Financial Services Commission (FSC) of Mauritius (License No. C24209694).

However, according to official inquiries, this sole license has now been Revoked. While the certificate indicates an expiration date of July 1, 2025, the current status confirms that the regulation is no longer valid. Consequently, Pemaxx currently operates without valid regulation from any major authority.

Operational Investigation: Security Flaws in Deposits

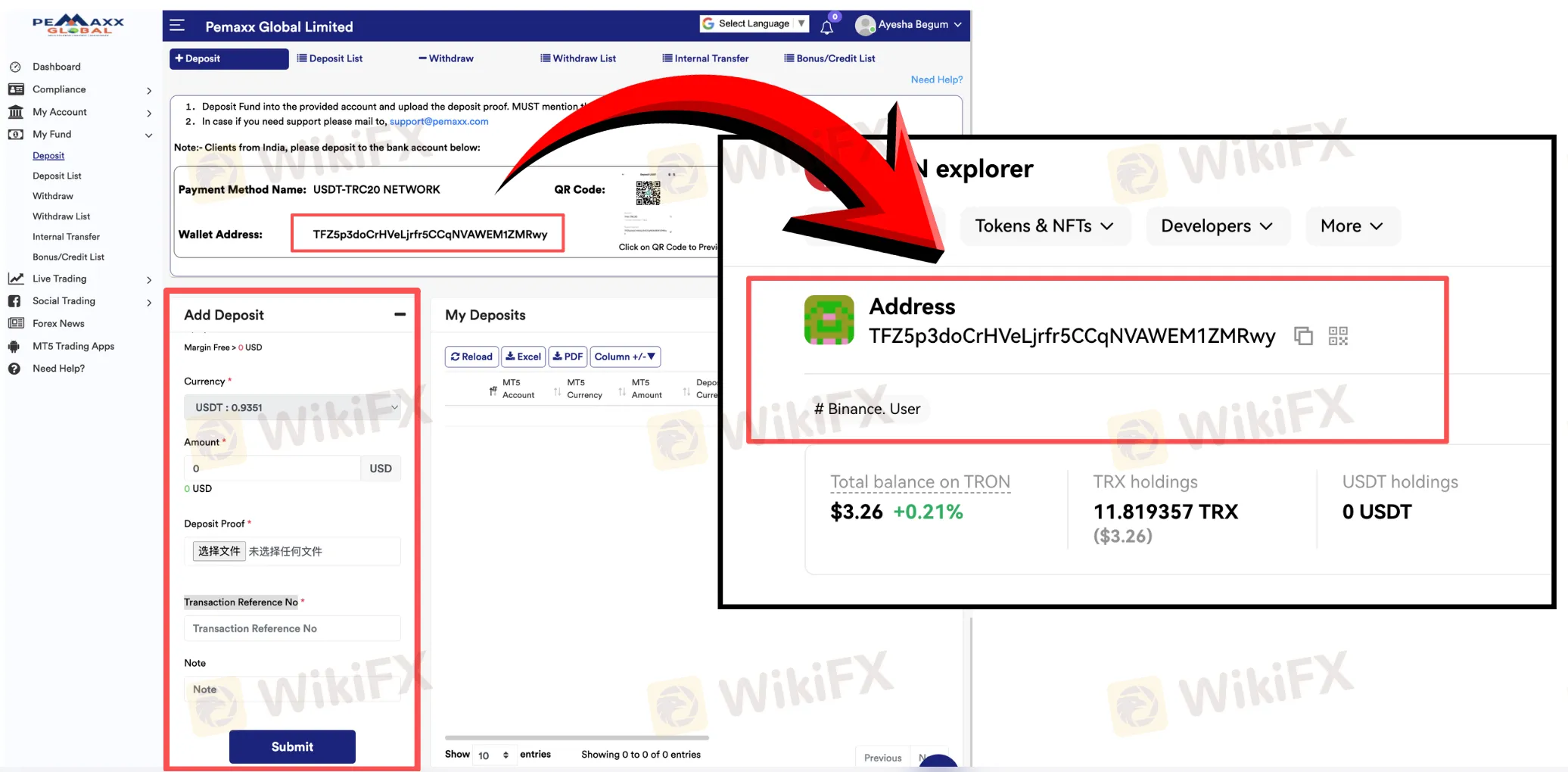

WikiFX conducted a comprehensive registration and security test on the Pemaxx client portal. This hands-on evaluationrevealed alarming security gaps regarding fund safety and Know Your Customer (KYC) protocols.

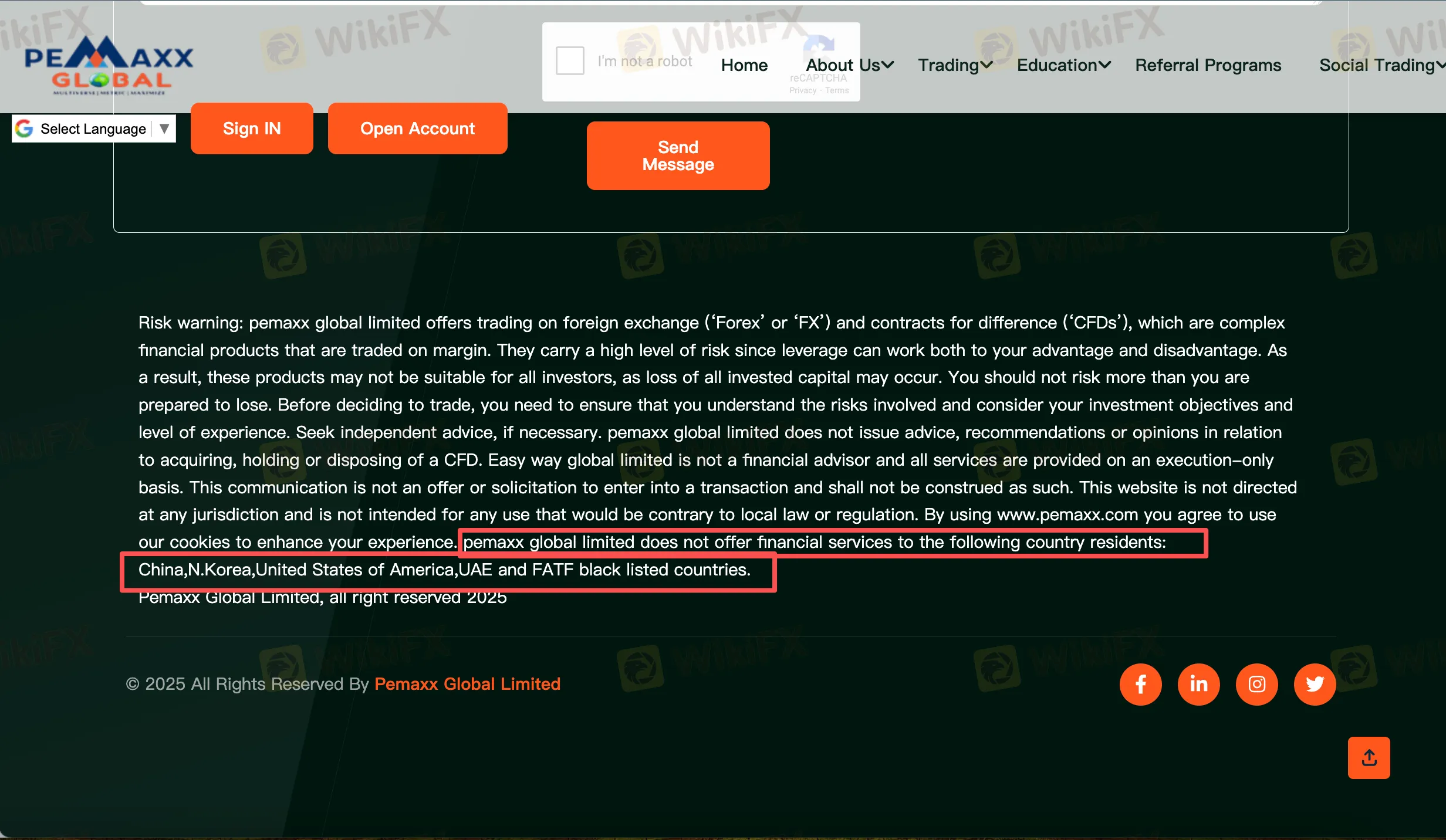

- Registration Loopholes Although the websites footer claims that services are not offered to residents of specific jurisdictions—including China, the USA, and the UAE—WikiFX's test registration proved otherwise. The system lacks effective IP blocking or identity verification during the sign-up process, allowing users from “prohibited” regions to open accounts easily.

- The Blockchain Deposit Risk The most concerning finding involves the platform's deposit channels. Of the six available payment methods, only one strictly requires KYC compliance. The cryptocurrency channels, specifically USDT-TRC20, operate on a manual verification system that poses a high risk of manipulation.

When we attempted to deposit via the TRON network, the system did not generate a unique, segregated wallet address. Instead, it directs funds to a general exchange address. Users are then required to manually upload a screenshot of the transaction and input the Reference Number.

This mechanism is highly irregular for a professional broker. A legitimate trading platform should utilize automated blockchain integration with unique wallet generation. The current manual method is opaque, making it difficult to track funds and easy for a dishonest broker to deny receiving a deposit, or for bad actors to forge transaction proofs.

User Exposure: Scam Allegations and Complaints

The “Exposure” section on WikiFX offers a glimpse into the actual experiences of traders. The feedback is overwhelmingly negative, with multiple users accusing the broker of scam tactics.

- Account Deletion After Profits: One documented case involves a trader who generated a profit of $7,000. Upon requesting a withdrawal, the request was ignored for five days. Subsequently, the user's access to the trading software was revoked, and the account was deleted entirely.

- Withdrawal Blocks: Multiple reports cite an inability to withdraw funds. Users state that after depositing and trading, support channels stop responding, and withdrawal requests remain pending indefinitely.

- Unauthorized Trading: Reports have surfaced regarding accounts being traded without the owner's consent, leading to significant losses—a common tactic used to wipe out client balances artificially.

- Bonus Traps: Complaints also highlight issues with promotional bonuses. Agents allegedly promised profit withdrawals after meeting lot volume targets (e.g., 10 standard lots). However, once the target was met and the equity grew (in one case to $1,800), the broker refused the withdrawal and disabled account access.

Conclusion

Based on the evidence, Pemaxx Global Limited presents a severe risk to retail investors. The combination of a revoked license, a high volume of unresolved withdrawal complaints, and insecure deposit protocols suggests a high probability of capital loss.

WikiFX Verdict:

- License: None (Revoked).

- Score: 2.15 (Danger).

- Recommendation: Stay Away.

Investors are strongly advised to avoid this platform and utilize the WikiFX app to search for brokers with a valid license and a high credit rating to ensure fund safety.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Najm Capital Ltd: Regulated Forex Broker Strengthens Its Presence in the MENA Online Forex Market

HEADWAY Rebate Service Review 2026: Is this Forex Broker Legit or a Scam?

UAE SCA Rebrands as CMA: What It Means for Forex and CFD Brokers?

OmegaPro Review 2026: Is This Forex Broker Safe?

Legal Headwinds for Tariffs: US States Sue to Block Trump's Trade Agenda

Is Malaysia Losing Control of the Online Scam Economy?

FINRA Fines Altruist Financial $150,000 for Supervisory Failures in Securities Lending Program

Angel One Exposure Review: Low Score & Unregulated Forex Broker Risks

A Complete Xlibre Review: High Leverage and Major Warning Signs to Consider

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Currency Calculator