简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

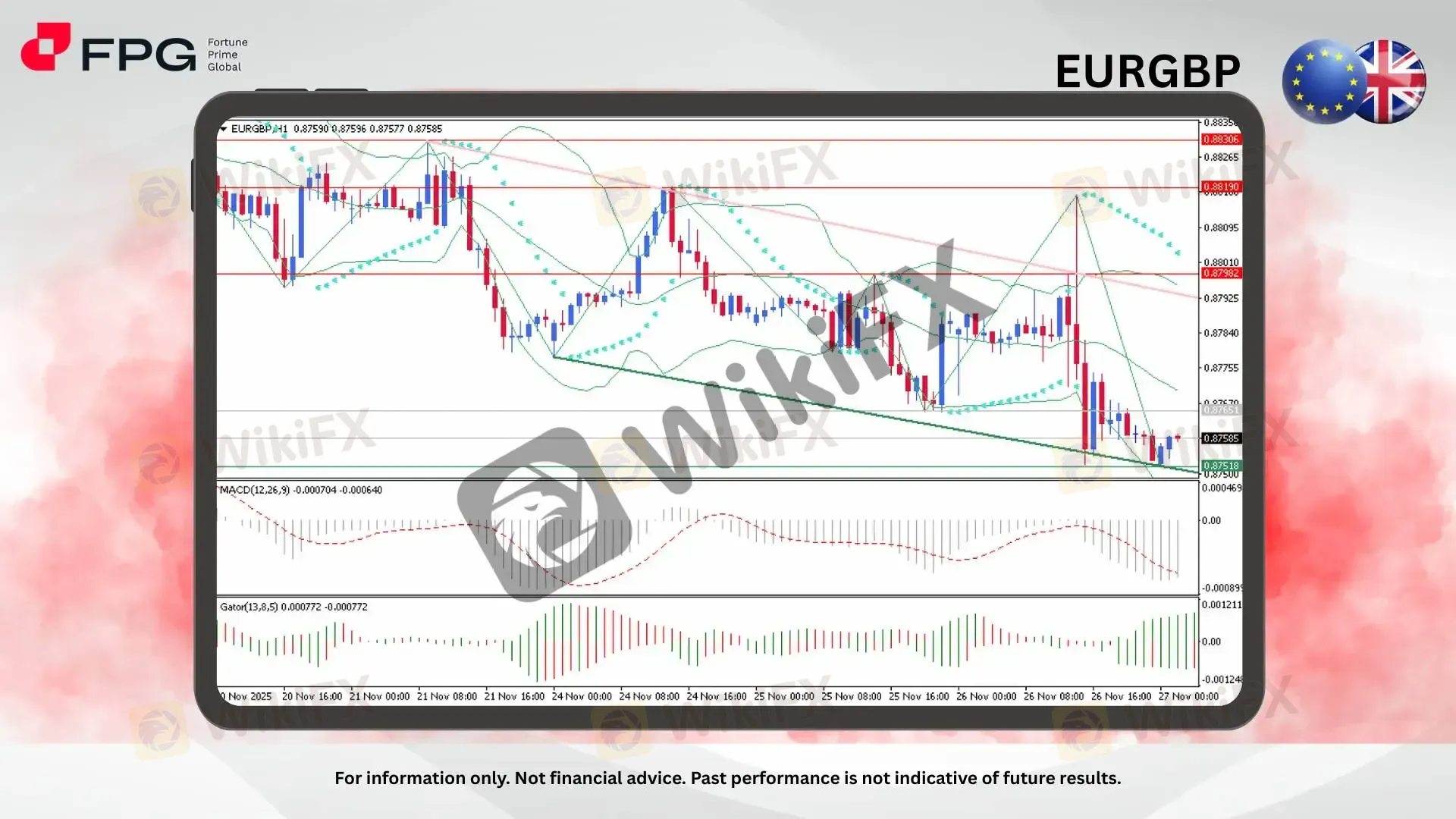

FPG EURGBP Market Report November 27, 2025

Abstract:EURGBP is currently trading around 0.8758, maintaining a bearish tone within a well-defined descending channel. Market structure shows consistent lower highs and lower lows, reflecting sustained selle

EURGBP is currently trading around 0.8758, maintaining a bearish tone within a well-defined descending channel. Market structure shows consistent lower highs and lower lows, reflecting sustained seller dominance. The price is hovering near a crucial demand zone at 0.8751, indicating a possible short-term reaction but still under strong downside pressure.

From a structural perspective, price action remains capped below the mid-Bollinger Band, confirming the absence of bullish strength. Parabolic SAR dots continue to position above price action, signaling persistent bearish momentum. Price has repeatedly tested the lower boundary of the descending channel, where mild buying pressure emerges but lacks conviction. The recent candles are small-bodied, suggesting hesitation but without any clear reversal signal for now.

Momentum indicators reinforce the bearish outlook. MACD histogram stays below zero, with the signal line trending sideways, showing consistent bearish bias but with weakening sell momentum. The Gator Oscillator indicates a potential buildup before a directional breakout. This contraction signals that a strong move could occur once price decisively breaks either above 0.8798 or below 0.8751.

Market Observation & Strategy Advice

1. Current Position: EURGBP trades around 0.8758, sitting at the lower boundary of a descending channel and testing a key support area with weakened bearish momentum.

2. Resistance Zone: Primary resistance sits at 0.8798, a previous supply rejection area. A break above may expose the upper channel line near 0.8819.

3. Support Zone: Immediate support lies at 0.8751, forming a structural base and channel support. A break below here could accelerate bearish continuation toward 0.8735.

4. Indicators: MACD remains below the zero line, keeping bearish momentum intact despite contraction. Gator Oscillator signaling potential price compression before a breakout. Parabolic SAR continues to plot above price, confirming bearish bias with no valid reversal signal yet.

5. Trading Strategy Suggestions:

Sell Continuation Setup: Sell stop below 0.8751 targeting 0.8735 and 0.8718, with stop-loss above 0.8763.

Rebound Pullback Play: Buy limit at 0.8752–0.8754 targeting 0.8785 and 0.8798, stop-loss below 0.8745.

Breakout Retest Strategy: If price breaks and sustains above 0.8798, look for buy setups toward 0.8819, with protective stops below 0.8787.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1602 +0.07%

USD/JPY 156.07 −0.24%

Today's Key Economic Calendar:

EU: ECB President Lagarde Speech

JP: BoJ Noguchi Speech

DE: GfK Consumer Confidence

EU: Economic Sentiment

EU: ECB Monetary Policy Meeting Accounts

CA: Current Account

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

CFTC Polymarket Approval Signals U.S. Relaunch 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

Malaysia’s SkyLine Guide Top 25 Brokers Are Out!

Currency Calculator