简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 25, 2025

Abstract:Fed AI Fuel Risk Rally, PPI in Focus Next; Outlook in Dollar, Gold, CryptoRisk-On Returns on Tech Rate Cut HopesGlobal markets opened the week with a decisive shift toward risk appetite, driven by a

Fed & AI Fuel Risk Rally, PPI in Focus Next; Outlook in Dollar, Gold, Crypto

Risk-On Returns on Tech & Rate Cut Hopes

Global markets opened the week with a decisive shift toward risk appetite, driven by a dual engine of dovish Federal Reserve rhetoric and renewed AI optimism.

The Nasdaq Composite surged 2.69%, led by a massive rally in the "Magnificent Seven." Alphabet (Google) jumped over 6% following the launch of Gemini 3, while semiconductor giant Broadcom soared over 11%, lifting the entire chip sector.

The risk-on mood spilled into other asset classes. Bitcoin reclaimed the $85,000 handle, and Gold closed above $4,100/oz for the first time in two weeks. The US Dollar, instead, entered a tight consolidation phase, holding between 100.00 – 100.30, as traders await validation from inflation data.

The Fed Pivot & Sentiment Lifts

The market narrative has shifted rapidly from "hawkish caution" to "imminent easing," driven by influential Fed officials and the unique data landscape.

Following dovish signals from NY Fed President Williams last Friday, influential Governor Christopher Waller joined the chorus on Monday, explicitly stating he favors a rate cut in December.

· Why It Matters: Waller has historically been a leading hawkish voice. His pivot suggests a consensus is forming within the FOMC to prioritize labor market stability over sticky inflation.

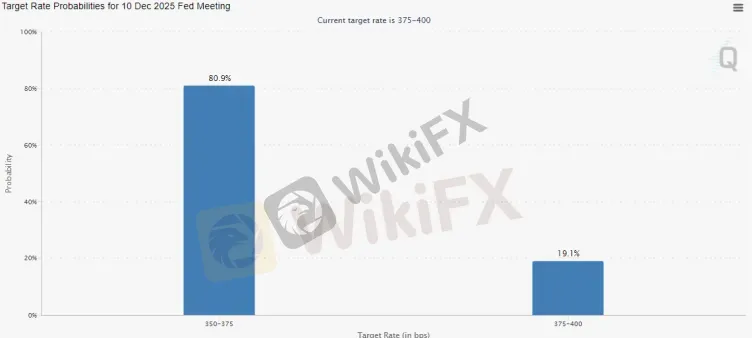

· Market Impact: Interest rate futures aggressively repriced, with the probability of a 25-basis point cut in December skyrocketing to 81%, providing immediate fuel for non-yielding assets like Gold and high-growth Tech stocks.

December Rate Cut Probabilities ; Source: CME Group

In addition to that, Alphabets release of its Gemini 3 AI model acted as a major catalyst for the tech sector.

Despite CEO Sundar Pichais warning about "irrational exuberance" in AI capital spending, the technical leap of Gemini 3 convinced investors that Google is back in the top tier of the AI arms race, reigniting the broader tech momentum trade.

September PPI: The Inflation Proxy

With the October CPI report officially cancelled/delayed due to the government shutdown data collection gaps, tonight's release of the delayed September Producer Price Index (PPI) (9:30 PM GMT+8) has taken on outsized importance.

In the current "data vacuum," the PPI is the only reliable inflation metric available to the Fed before the December meeting.

· Weak/Soft PPI: Would validate Wallers dovish stance, cementing the December cut and likely pushing the Dollar below 100.00 while boosting Gold.

· Hot PPI: Would contradict the easing narrative, creating a violent "hawkish snapback" in the Dollar and pressuring risk assets.

Key Asset Outlook: Risk Sentiment in Play

1. U.S. Dollar Index: Hanging on the Edge

The US Dollar Index extending its consolidation, trapped between the Feds dovish signaling and the lack of concrete data to prove.

USD Index, H2 Chart

Technically, the Dollar is compressing within the 100.00 – 100.30 range in recent, forming a tight consolidation. The 100.00 psychological level is the critical line in the sand.

2. Gold: Reclaiming Bullish Structure

Gold has continued to benefited significantly from the surge in rate cut expectations (lower yields) and the bearish dollar bias.

XAU/USD, H2 Chart

The recent bullish breakout above the $4100 signalling a resumption of the bullish momentum. The immediate focus is on whether the prices can hold above this breakout level, should 4100 hold, upside is likely.

3. Bitcoin & Ethereum: Recovery Faces Structural Hurdle

The cryptocurrency market staged a necessary relief rally, closely tracking the Nasdaq's surge, but both major assets remain structurally sensitive to tightening global liquidity conditions.

BTCUSD, Daily Chart

Bitcoin has successfully reclaimed the $85,000 level following last week's flush, establishing a near-term floor. However, bulls face a massive test at the $90,000 resistance.

A decisive break and hold above this level are essential to confirm that the bearish momentum is truly over; otherwise, the current move remains characterized as a technical "relief bounce" within a broader downtrend.

ETHUSD, Daily Chart

Meanwhile, Ethereum is attempting to stabilize above the $2,800 mark, which acts as crucial pivotal support. Maintaining ground above $2,800 is vital to prevent a deeper technical breakdown and a revisit to recent lower lows.

Bottom Line

The market has decisively pivoted from "Fear of the Fed" to "Pricing the Fed's Pivot." Tonights PPI release is the final key data point before the December decision, and its outcome carries the ultimate verdict.

If the data aligns with dovish expectations, the path is open for a strong risk-on rally across equities and crypto, built directly upon a weaker U.S. Dollar.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The 350 Per Cent Promise That Cost Her RM604,000

"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

Garanti BBVA Securities Exposed: Traders Report Unfair Charges & Poor Customer Service

Private payroll losses accelerated in the past four weeks, ADP reports

INZO Commission Fees and Spreads Breakdown: A 2025 Data-Driven Analysis for Traders

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

Core wholesale prices rose less than expected in September; retail sales gain

Consumer confidence hits lowest point since April as job worries grow

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Currency Calculator