简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 21, 2025

Abstract:NFP Shock Sends Markets Tumbling: Dollar Surges, Tech and Crypto RetreatVolatility Surges After Strong NFPGlobal markets reacted sharply to the long-delayed September Nonfarm Payrolls (NFP) report. St

NFP Shock Sends Markets Tumbling: Dollar Surges, Tech and Crypto Retreat

Volatility Surges After Strong NFP

Global markets reacted sharply to the long-delayed September Nonfarm Payrolls (NFP) report. Strong labor data confirmed the resilience of the U.S. economy, collapsing expectations for a December Fed rate cut and triggering a pronounced risk-off rotation.

The Nasdaq led losses, falling 2.2%, while the S&P 500 dropped 1.6% and the Dow turned a 700-point rally into a 0.8% decline. Tech stocks, initially buoyed by NVIDIAs earnings, reversed sharply as higher-for-longer rates challenged stretched valuations.

Hawkish Signals from Strong NFP

The equities sell-off and broader risk-asset decline were largely driven by the long-delayed NFP report, which injected massive volatility and reshaped expectations for the Federal Reserve.

· NFP Outcome: Job creation surged +119K, well above consensus, highlighting U.S. labor market resilience. The unemployment rate rose slightly to 4.4%, offering marginal relief for dovish expectations.

· Policy Implications: The data reinforced the Feds recent hawkish pivot. Markets sharply reduced the probability of a December rate cut to below 50%, while Treasury yields spiked.

With hiring momentum intact, the Fed has little urgency to accelerate easing. Current market pricing implies only a 27% probability of a December cut (CME FedWatch).

Risk-Off Flow Dominates: U.S. Dollar & Treasury Yields

The U.S. Dollar remains the clear beneficiary of strong NFP data and hawkish policy signals.

The Dollar Index held above the 100.00 key psychological level, closing near 100.25 and confirming its structural rally. This push above 100 signals a renewed bullish bias, exerting pressure across G10 currencies.

USD Index, H4 Chart

Technically, the Dollar‘s momentum remains intact near 100, though a cautious technical pullback is possible at this key resistance level. Overall, the Dollar’s uptrend remains favorable, and dips may present buy-the-dip opportunities.

Equities Market Sell-Off

With rate-cut expectations evaporating, broad-based selling hit U.S. equities, and tech overvaluation concerns resurfaced after the brief NVIDIA-led optimism.

Tech stocks—including NVIDIA, AMD, and Micron—led declines after initial earnings optimism faded. The Nasdaq remains highly sensitive to higher-for-longer rate expectations due to elevated P/E ratios in tech and AI sectors.

UT100, H4 Chart

As we covered earlier, the 25,000–25,200 zone remains a crucial resistance, which has now seen another sell-off, reflecting that the corrective phase is ongoing.

For now, 24,000 holds as the next imminent major support. While the corrective phase is definitely in place, the Nasdaq is yet to be poised for a major setback or bear market. Still, if no clear shift occurs in the market landscape, the Nasdaq is still on track toward further downside.

Cryptocurrency: More “Damage” to Come

The crypto market, led by Bitcoin, faced an accelerated sell-off due to its sensitivity to global liquidity and risk appetite.

Bitcoin (BTC) fell sharply below the 90,000 zone after the NFP release, confirming that investors are unwinding speculative risk tied to the fading prospects of aggressive Fed easing.

The market sees this as a fundamental liquidity drain. Bitcoin and other high-beta tokens will remain vulnerable to further downside until the Federal Reserve signals a clear return to dovish policy.

BTCUSD, Daily Chart

Technically, Bitcoin broke below the 90,000–86,000 marks, which could set further downside, with the near-term BTC likely to trade within the lows of the range seen in March earlier.

That being said, BTC could still face another leg down toward the next major key level near 77,000.

Gold: Awaits Next Move

Meanwhile, gold showed little movement after yesterdays NFP release. Despite broad risk-off sentiment, investors favored the U.S. Dollar and U.S. Treasury bonds as safe-haven alternatives due to elevated yield expectations.

Despite that, gold may remain a favorable asset in the current market landscape—while it hasnt moved up, it continues to attract demand.

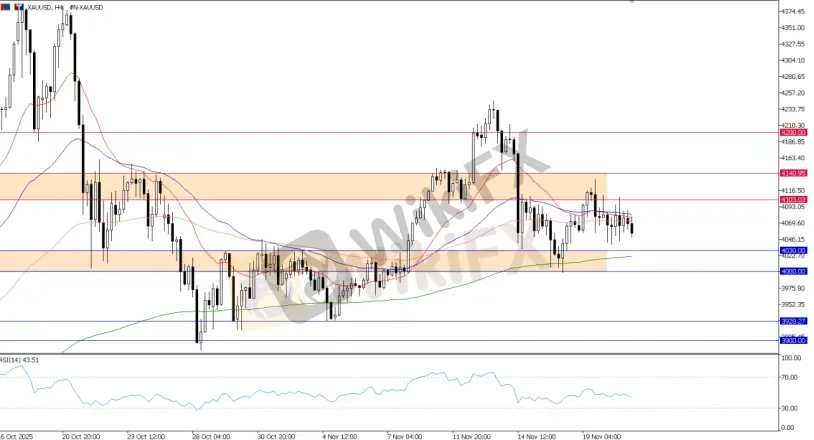

XAU/USD, H4

Gold is holding support above $4,000 for now. Technically, the outlook remains consistent with our earlier coverage.

The $4,000–$4,100 range remains a key zone to watch, and a breakout in either direction—still slightly favorable to the upside at present—could trigger a significant move.

Bottom Line

The delayed September Nonfarm Payrolls report injected extreme volatility across global markets, reaffirming the resilience of the U.S. labor market and collapsing expectations for a December Fed rate cut.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

Currency Calculator