Abstract:You are asking an important question: Is Amillex safe or a scam? The simple answer is that Amillex works in an unclear area that needs careful study. It is not a complete scam like fake websites that steal your money right away, but it also does not meet the safety rules of the best, well-regulated brokers. Read on to explore more details.

The Simple Answer

You are asking an important question: Is Amillex safe or a scam? The simple answer is that Amillex works in an unclear area that needs careful study. It is not a complete scam like fake websites that steal your money right away, but it also does not meet the safety rules of the best, well-regulated brokers.

The truth is complicated. Whether Amillex is right for you depends completely on how much risk you can handle and if you understand what you might give up. This article will not give you a simple YES or NO answer. Instead, we will give you a clear, fact-based guide. We will examine its rules, security methods, and user experience, helping you make your own smart choice about the safety of your money.

Quick Summary

For those who need a fast overview, we have broken down what we found into the most important trust factors. This table gives you a high-level answer before we go into the detailed study.

Deep Look into Rules

The foundation of any broker's trustworthiness is its regulatory status. This is not just a small detail; it is the single most important factor that determines the safety of your money. To properly judge Amillex, we must first understand the difference between regulatory levels.

Top-level regulators, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), have extremely strict rules. These include:

· Required participation in investor compensation programs (e.g., the FSCS in the UK protects client funds up to £85,000 if a broker becomes unable to pay debts).

· Requirements for separated accounts to be checked regularly.

· Strict marketing and execution rules to ensure fair treatment of clients.

· Negative balance protection for regular clients.

Offshore regulators, such as those in St. Vincent and the Grenadines (SVG FSA), Vanuatu (VFSC), or the Mwali International Services Authority (MISA), work with much lighter rules. They offer faster and cheaper registration for brokers but provide much less client protection. The amillex broker regulation country is a key piece of this puzzle. Our research shows Amillex is registered as an International Business Company (IBC) and may cite regulations from an offshore area, such as the Mwali International Services Authority.

What does this mean to you? A company regulated by MISA or registered in SVG does not have to provide an investor compensation fund. While they may require separate accounts on paper, the enforcement and checking of these rules are far less careful than with a top-level regulator. In a dispute or broker failure, your legal options are limited and complex. The clear difference is that an FCA-regulated broker's failure would start a clear compensation process, whereas with an offshore-regulated one, your funds are at a much higher risk.

Checking Security Measures

Beyond the formal license, a broker's internal security practices are vital for protecting your funds and data every day. We need to look at how Amillex handles client money and secures its digital systems.

Client Fund Separation

Amillex, like most brokers, claims to hold client funds in separate accounts. This is a critical practice where the broker keeps your funds in a separate bank account from its own operational funds. In theory, this means the broker cannot use your deposits to pay its own expenses, and your capital should be protected from the broker's creditors if the company fails.

The key issue with offshore-regulated brokers is verification. While it claims separation, the lack of strict, independent checks required by top-level regulators makes it difficult to confirm this is being properly enforced. You are largely relying on the broker's word.

Digital Security Checklist

Your personal data and account access are just as important as your funds. Here is a checklist of standard digital security features you should look for and how Amillex measures up.

· SSL Encryption: Does the website use a secure, encrypted connection (look for “https://” and the padlock icon in your browser)? Yes, Amillex's website uses standard SSL encryption to protect data sent between you and their servers.

· Two-Factor Authentication (2FA): Does the platform offer 2FA for logins and withdrawals? This is a crucial security layer that requires a second code (usually from your phone) to access your account. We strongly recommend enabling 2FA if Amillex provides it, as it greatly reduces the risk of unauthorized access.

· Platform Security: Is the trading platform itself stable and secure? This is harder to assess from the outside, but frequent crashes or problems reported by users can be a warning sign of poor technical systems.

The Real-World Test

Rules and security policies are one thing; the actual user experience is another. How a broker manages your funds and your problems in the real world is the ultimate test of its legitimacy. This is where many “scam” accusations come from, often from frustration concerning withdrawals and support.

The All-Important Withdrawal

The Amillex Broker withdrawal speed is a primary concern for many traders. Officially, Amillex may state processing times of 24-48 hours for e-wallets and 3-5 business days for bank transfers. However, real-world user experiences appear to be mixed. Some traders report receiving their funds within the stated timeframes, while a significant number of online complaints point to delays that stretch for weeks.

It's important to understand that not all delays mean the broker is a scam. The most common reasons for hold-ups include:

1. Incomplete KYC/AML Verification: This is the biggest cause of withdrawal delays across all brokers. If your identity and address documents are not fully approved, no withdrawal will be processed.

2. Withdrawal Method Mismatch: For security reasons, most brokers require you to withdraw funds using the same method you used for your deposit.

3. Bonus Term Violations: If you accept a deposit bonus, you are likely subject to strict trading volume requirements that must be met before you can withdraw any funds.

To ensure the smoothest possible withdrawal process, follow these steps:

· Complete your full account verification immediately after registration, before you even deposit significant funds.

· Double-check that the name on your trading account matches your bank account and verification documents exactly.

· Read the terms and conditions of any bonus offer carefully before accepting it.

· Start a small test withdrawal early on to confirm the process works as expected.

> To see the latest official withdrawal processing times and understand their account verification requirements firsthand, we recommend you explore more Amillex forex trading account here.

The Customer Support Experience

When a withdrawal is delayed or you have a platform issue, the quality of customer support becomes very important. Amillex typically offers support through live chat, email, and sometimes a phone number.

Based on our assessment of user feedback, the experience is inconsistent. Live chat may be responsive for simple, pre-sales questions, but when it comes to complex issues such as withdrawal problems, users often report being given generic answers or being told to wait for an email response from the “relevant department.” This can be incredibly frustrating when your money is on the line. A good sign is a support team that is knowledgeable and empowered to solve problems, while a bad sign is one that acts as a gatekeeper, deflecting issues without resolution.

Red Flags vs. Green Flags

To help you make a final decision, we've compiled a due diligence checklist. This framework moves beyond a simple review and gives you a model for assessing any broker's trustworthiness.

Use this table to weigh the evidence. Amillex shows several items from both columns, which is why the decision is not straightforward and depends on your personal assessment of these risks and benefits.

The Broader Picture

A broker can seem acceptable when viewed alone. The real test is comparing it to industry leaders. This comparison highlights what you might be giving up in exchange for the features an offshore broker might offer, such as higher leverage.

Let's compare Amillex against a typical top-level broker, which we'll call “Broker A”.

· Regulatory Body:

· Amillex: Regulated by an offshore authority like MISA or registered in SVG.

· Broker A: Regulated by top-level authorities like the FCA (UK) and ASIC (Australia).

· Investor Compensation Scheme:

· Amillex: No. There is no safety net if the broker goes bankrupt.

· Broker A: Yes. For example, under the FCA, clients are protected by the FSCS up to £85,000.

· Publicly Traded Company:

· Amillex: No. As a private company, its financial health is not public.

· Broker A: Often, yes. Being listed on a stock exchange (e.g., LSE, NYSE) requires the highest level of financial transparency and regular public audits.

This comparison makes the trade-off clear. With Amillex, you gain access to potentially higher leverage or different account types, but you sacrifice the immense regulatory protection and financial transparency offered by market leaders.

> While top-level brokers offer more regulatory security, they may have different account types or asset offerings. The best way to see if Amillex's platform fits your specific trading style is to view it directly.

Our Final Verdict

After a thorough analysis of its regulation, security, and user experience, we can return to the central question: Is Amillex safe? The answer is complex and depends on your definition of “safe.”

Amillex is not a clear scam designed to steal your deposit instantly. It is a functional trading brokerage operating under offshore regulation. The platform allows for trading, and some users successfully withdraw funds.

However, due to its lack of top-level regulation and the absence of an investor compensation scheme, it carries a significantly higher risk than brokers licensed in areas like the UK, Australia, or Cyprus. The mixed reports on withdrawal speeds and customer support increase this risk.

Our final verdict is framed by risk appetite:

· For beginners or any trader whose primary concern is the absolute safety of their capital, we cannot recommend Amillex. The peace of mind and legal protections offered by a top-level regulated broker are non-negotiable for this group.

· For highly experienced traders with a strong appetite for risk, who fully understand the implications of offshore regulation and are perhaps seeking features, such as very high leverage, Amillex could be considered. This type of trader must be prepared for potential challenges with support and withdrawals and should only invest capital they are fully prepared to lose.

The knowledge you now have is your best tool. You understand the regulatory landscape, the security protocols to check, and the real-world challenges to anticipate.

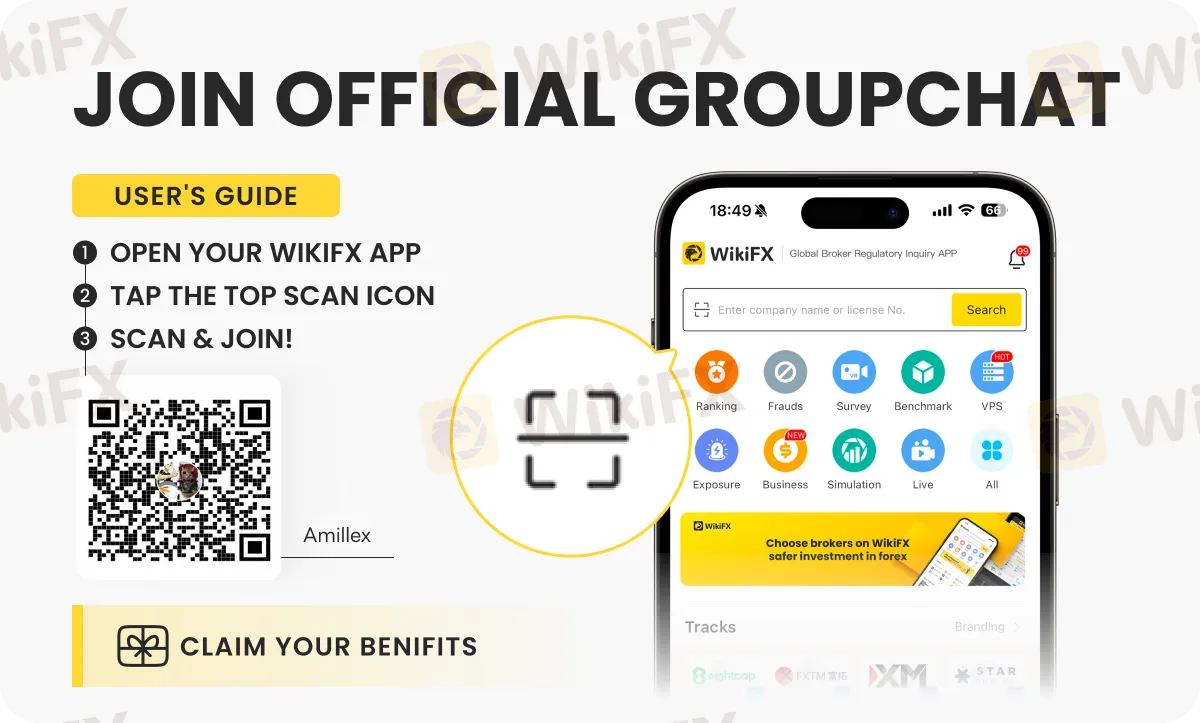

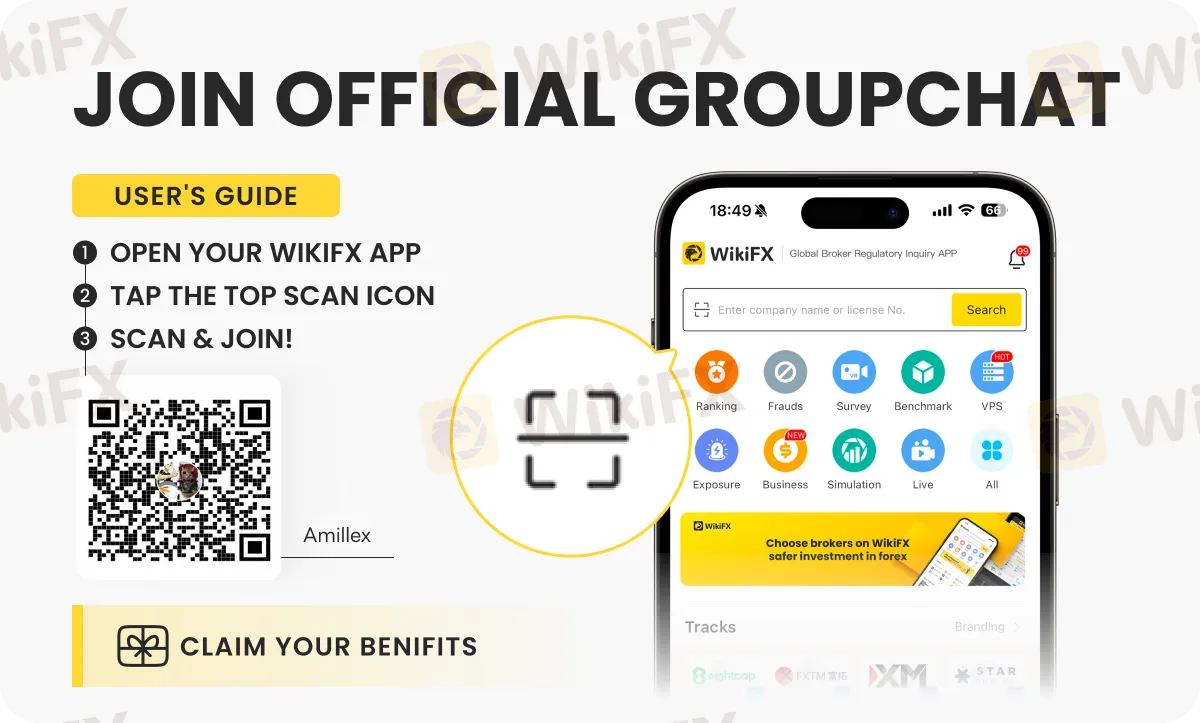

To know the latest on Amillex, please join our special chat group (HJKSQRCTLJ) by following the instructions shown below.