简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG EURGBP Market Report October 31, 2025

Abstract:EUR/GBP continues to trade within a mild correction phase after a strong bullish surge earlier this week. The pair is currently trading around 0.8794, retreating slightly from its recent high of 0.881

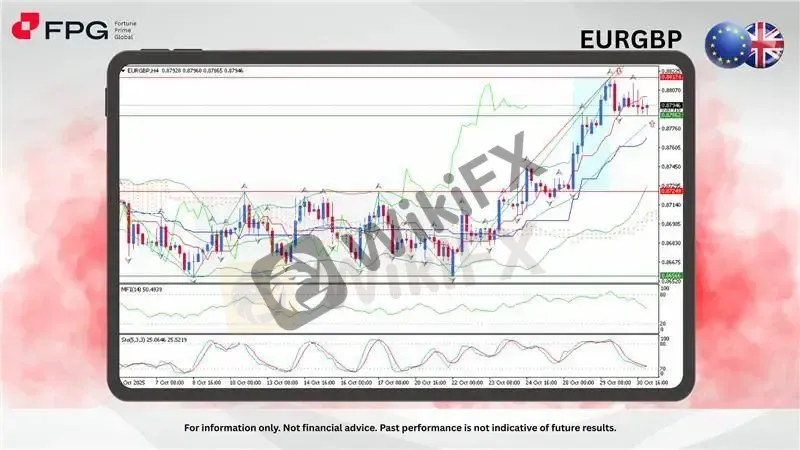

EUR/GBP continues to trade within a mild correction phase after a strong bullish surge earlier this week. The pair is currently trading around 0.8794, retreating slightly from its recent high of 0.8817 as buyers take profit and price consolidates above key support. Despite the short-term pullback, the overall bias remains constructive while the pair holds above the ascending trendline and Ichimoku Cloud, indicating that the medium-term uptrend remains intact.

Technically, the price structure shows EUR/GBP maintaining an upward trajectory after breaking through the 0.8725 resistance zone, which now acts as support. The pair remains above the Ichimoku Cloud and within the upper Bollinger Band, suggesting underlying bullish momentum despite the current pause. Candlestick activity near 0.8790–0.8800 indicates mild exhaustion among buyers, though the absence of strong bearish follow-through suggests only a temporary consolidation before potential continuation higher.

Momentum indicators are moderating from overbought levels. The Money Flow Index (14) stands near 50.49, reflecting a balanced state between buying and selling pressure, while the Stochastic Oscillator (5,3,3) hovers around 25.06, entering oversold territory and signaling that downside momentum may be losing strength. Together, these readings point to a possible near-term rebound if the price holds above key support.

Market Observation & Strategy Advice

1. Current Position: EUR/GBP is traded around 0.8794, consolidating after a strong bullish leg while maintaining its position above short-term moving averages.

2. Resistance Zone: Immediate resistance stands at 0.8817–0.8822. A sustained break above this zone could push the pair toward the next target near 0.8850.

3.Support Zone: Key support is observed at 0.8725, aligned with the previous breakout level and the Ichimoku baseline. A clear drop below could signal the start of a broader correction toward 0.8656.

4. Indicators: The MFI indicates neutral momentum, suggesting consolidation, while the Stochastic Oscillator shows potential for a rebound from oversold levels. Bollinger Bands remain expanded, confirming active market volatility. As long as price remains above 0.8725, the medium-term bias stays bullish, though short-term fluctuations are likely before another upward push.

5. Trading Strategy Suggestions:

Buy on dips: Consider buying near 0.8775–0.8786 if the price holds above the mid-line of the Bollinger Band and Ichimoku base line, targeting resistance levels at 0.8817 and 0.8830.

Sell near resistance: Watch for rejection or reversal patterns around 0.8817–0.8830 to initiate short positions, targeting 0.8770 or lower.

Wait for confirmation: If the pair breaks below 0.8770 with strong bearish momentum, expect an extended pullback toward 0.8725 before potential recovery.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1575 +0.10%

USD/JPY 153.83 −0.18%

Today's Key Economic Calendar:

CN: NBS Manufacturing PMI

FR: Inflation Rate YoY Prel

EU: Inflation Rate YoY Flash

US: Core PCE Price Index MoM

US: Personal Income & Spending MoM

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

INTERPOL, AFRIPOL Crack Down on Africa Terror Finance

Forex Scam Checker Philippines: Verify Brokers with WikiFX

MH Markets Review 2025: Trading Platforms, Pros and Cons

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

D Prime to Exit Limassol Office Amid Doo Group Restructure

WikiFX Elites Club Committee Concludes Voting! Inaugural Lineup Officially Announced

Fake Trading Platforms Are Spreading Fast Across Asia | How Investors Are Being Tricked

eToro CopyTrader Expands to U.S. Investors

Is MH Markets Safe or a Scam? Regulation and Fund Security Explained

Currency Calculator