Abstract:WikiFX’s analysis of IOSCO I-SCAN data for Q3 2025 shows a sharp rise in forex/CFD scam alerts, driven by unauthorized brokers and clones

Executive Summary

As the forex market continues to attract retail investors amid volatile global conditions, fraudulent schemes targeting currency trading platforms have escalated, posing acute threats to participants worldwide. This Q3 2025 report, published by WikiFX and drawing on data from the International Organization of Securities Commissions (IOSCO) International Securities & Commodities Alerts Network (I-SCAN), examines over 12,694 fraud alerts issued through September 30, 2025, with a particular emphasis on the forex sector. Key highlights include a 27% quarter-over-quarter (QoQ) increase in alerts from Q2 2025, and a 45% year-over-year (YoY) rise compared to Q3 2024, driven largely by unauthorized forex and derivatives platforms.

In Q3 alone (July-September 2025), 1,450 new warnings were issued, of which 35% involved forex-related products like CFDs and swaps. Unauthorized entities dominate at 72% of cases, often mimicking legitimate brokers to lure traders with promises of high-leverage trades. The UK's Financial Conduct Authority (FCA) issued the most alerts, underscoring Europe's role as a forex fraud hotspot, while Thailand's SEC highlighted social media-driven scams prevalent in Asia.

This analysis equips forex traders, brokers, and regulators with data-driven insights to navigate these risks, emphasizing verification and vigilance in an industry where cross-border operations amplify vulnerabilities.

Key Findings

1. Volume and Temporal Trends

I-SCAN alerts reflect heightened regulatory action against forex fraud, with 2025 year-to-date (YTD) totals reaching 3,440 through September 30, 2025—a 45% YoY increase from the same period in 2024. Q3 2025 saw 1,450 alerts, up 27% QoQ from Q2's 1,140, signaling accelerating enforcement amid summer market surges.

Forex-specific alerts surged 52% YoY in Q3, often tied to fake ECN/STP brokers promising unrealistic spreads. Peak activity in September underscores seasonal spikes during economic data releases.

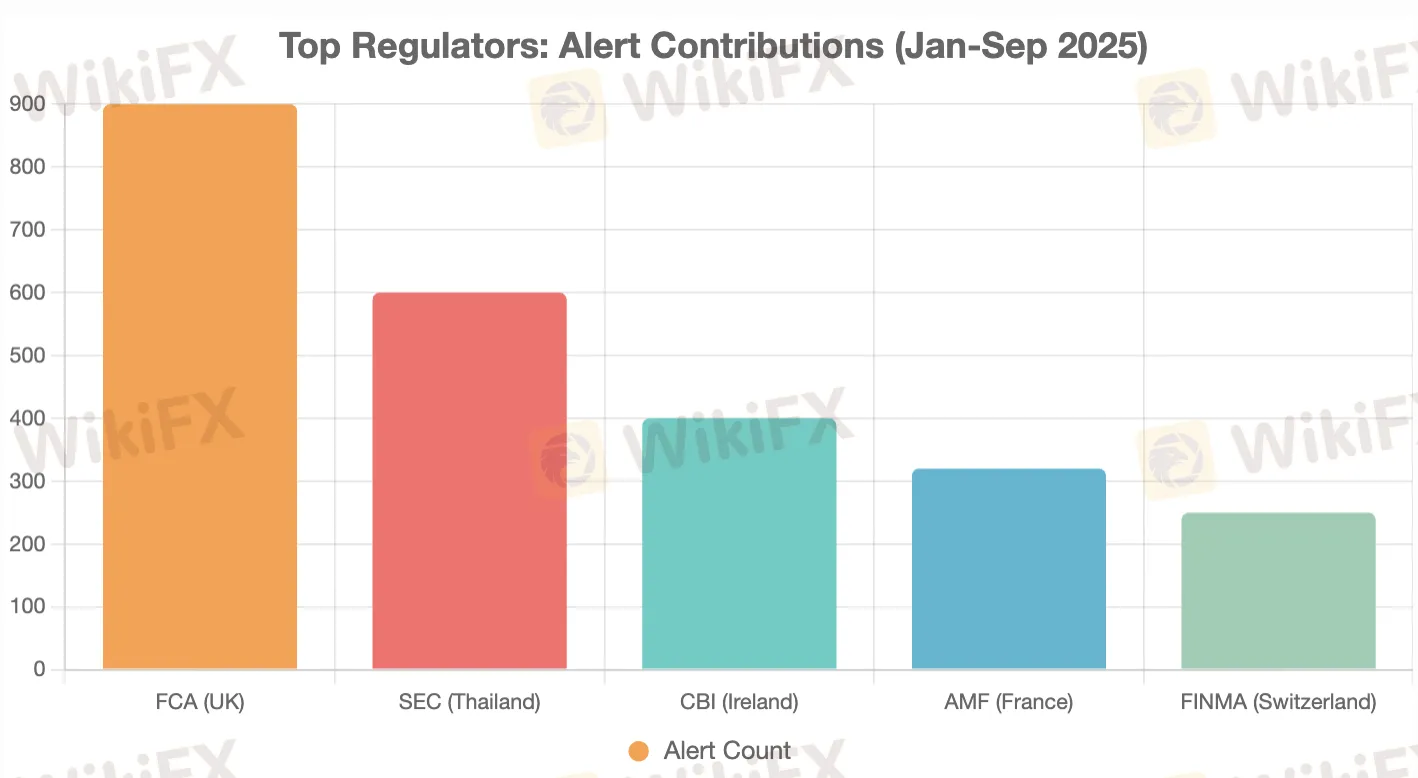

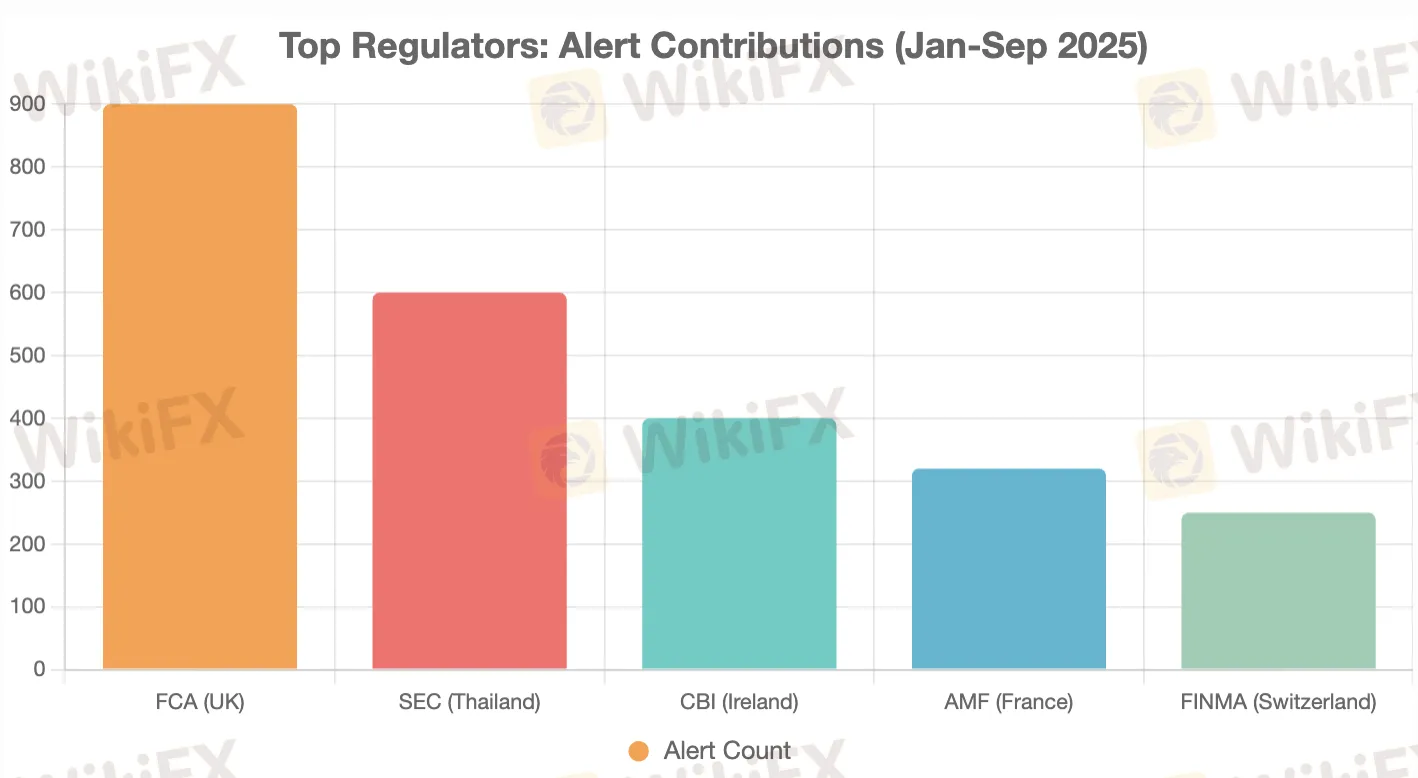

2. Regulatory Hotspots

The FCA leads with 900 alerts YTD (26% of 2025 total), focusing on unauthorized forex apps. Thailand's SEC follows with 600 (17%), targeting Line/Facebook scams promoting binary forex options. Ireland's Central Bank issued 400 (12%), emphasizing clone sites of EU-regulated brokers.

These hotspots reveal forex fraud's global footprint, with Europe and Asia accounting for 68% of alerts.

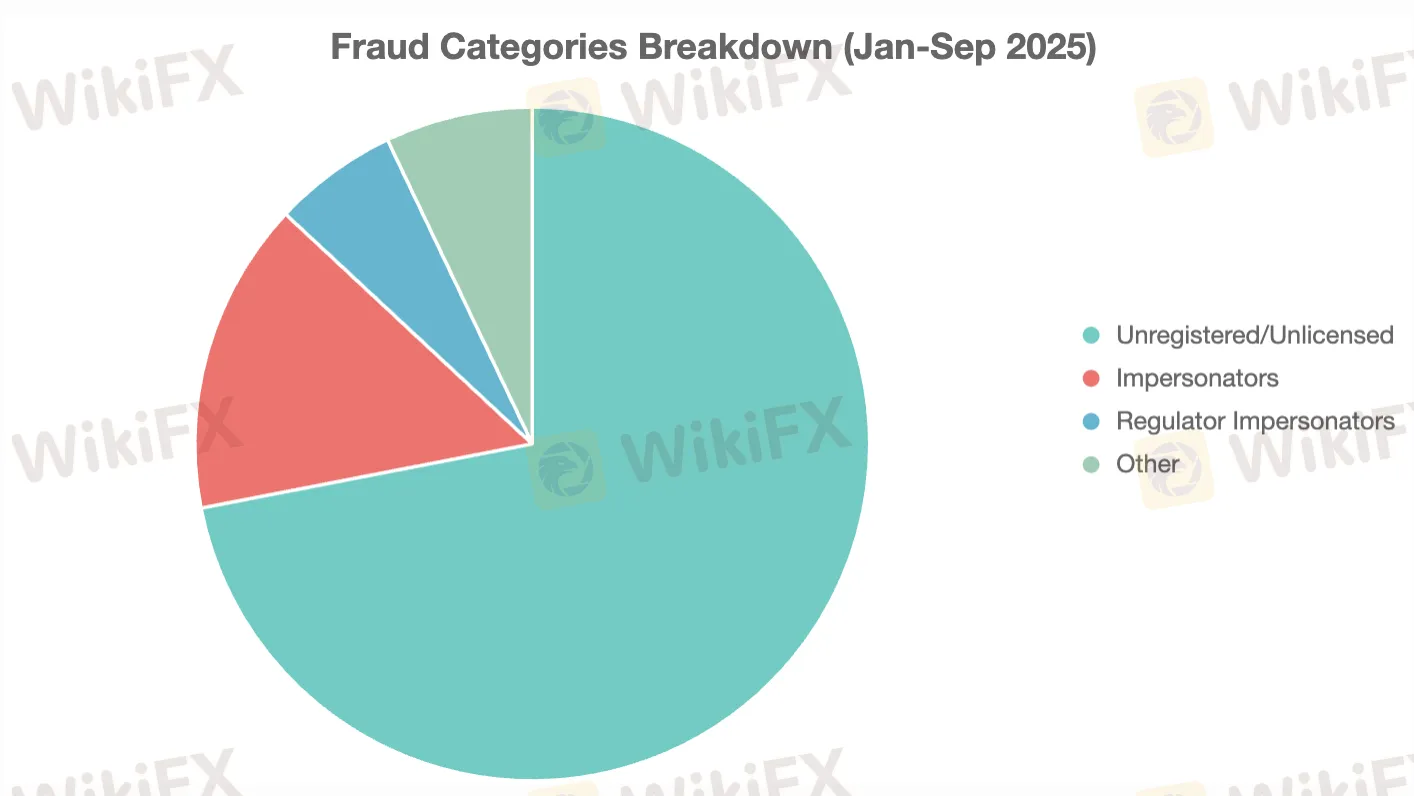

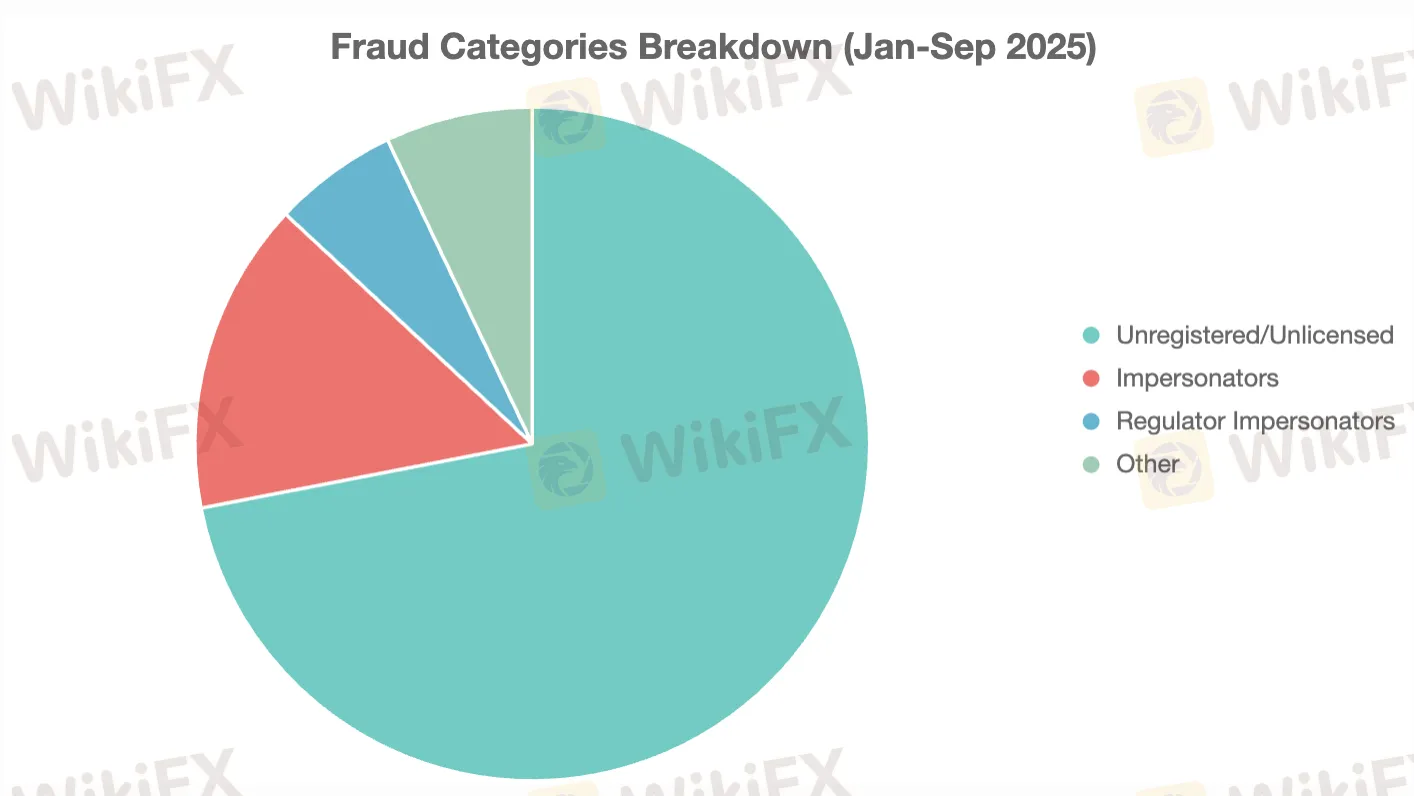

3. Fraud Categories Breakdown

Unregistered/unlicensed entities comprise 72% (2,475 cases YTD), frequently posing as forex brokers without oversight. Impersonation rose 22% YoY in Q3 to 15% (218 cases), including clones of firms like IC Markets. Regulator impersonators hit 6% (82 cases), using fake FCA/SEBI emails to endorse sham forex signals.

Forex ties: 65% of impersonations target derivatives platforms, exploiting trader trust in regulated names.

4. Targeted Products and Tactics

Derivatives—including forex, CFDs, and binary options—feature in 36% (1,238 YTD alerts), up 40% YoY, often bundled with crypto for hybrid scams. Pure forex alerts total 1,200 (35% of 2025), focusing on unregulated leverage trading.

Tactics in forex scams:

- Websites/Domains: 65% of alerts (e.g., optimaltrd.org mimicking FCA firms).

- Social Media: 20% in Asia (e.g., Thai Line IDs pushing forex bots).

- Impersonation: Clones like “Finance Advisory AG” claiming EU licenses.

- Geotargeting: False local claims (e.g., Quebec alerts on Montreal forex fakes).

Q3 saw a 35% QoQ rise in forex boiler rooms using cold calls for CFD trades.

Visual Insights

All visualizations are based on I-SCAN data through September 30, 2025.

Alert Volume by Month

This line chart shows monthly trends from January to September 2025, highlighting the Q3 acceleration.

Fraud Categories Distribution

A pie chart of primary categories through September 30, 2025.

Top Regulators by Alert Share

A bar chart of the top 5 regulators' contributions through September 30, 2025.

Conclusion

Q3 2025 I-SCAN data signals a forex fraud epidemic, with unauthorized platforms exploiting trader enthusiasm for leveraged trades. As volumes climb 45% YoY, proactive verification remains paramount.

Data through September 30, 2025. For updates, consult IOSCO resources. This report is informational and not financial advice.