Warren Bowie & Smith Review: No Regulation, Risk Alert

Warren Bowie & Smith lacks valid regulatory oversight, raising serious risk concerns. Read this broker review and check warning signs now with the WikiFX App.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

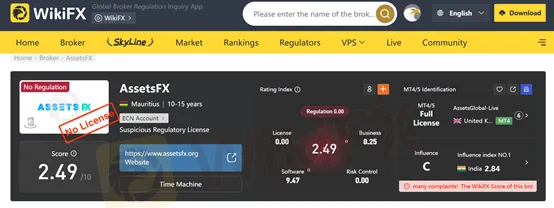

Abstract:Founded in 2013 and headquartered in Mauritius, AssetsFX presents itself as an online broker offering forex and CFD trading services to global clients. The broker provides access to a variety of financial instruments, including forex pairs, commodities, indices, cryptocurrencies, and stocks. While AssetsFX markets itself as a versatile and technology-driven broker, recent complaints and a low WikiFX score of 2.49/10 raise questions about its reliability and trustworthiness.

Founded in 2013 and headquartered in Mauritius, AssetsFX presents itself as an online broker offering forex and CFD trading services to global clients. The broker provides access to a variety of financial instruments, including forex pairs, commodities, indices, cryptocurrencies, and stocks. While AssetsFX markets itself as a versatile and technology-driven broker, recent complaints and a low WikiFX score of 2.49/10 raise questions about its reliability and trustworthiness.

AssetsFX gives traders exposure to multiple global markets through a range of tradable instruments:

To support trading across these instruments, AssetsFX provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are compatible with Windows, macOS, Android, iOS, and web browsers, ensuring that traders can access their accounts and execute trades anytime and anywhere.

AssetsFX aims to appeal to both beginner and professional traders with a range of account types—each designed to suit different trading styles and budgets:

| Account Type | Minimum Deposit | Leverage | Spread | Commission |

| CENT | $1 | Up to 1:500 | From 2.2 pips | None |

| STANDARD | $100 | Up to 1:500 | From 1 pip | None |

| ECN | $500 | Up to 1:500 | From 0.0 pip | $3 per lot |

| ECN PRO | $1,000 | Up to 1:500 | From 0.0 pip | $2 per lot |

| ZERO ECN | $5,000 | Up to 1:200 | From 0.0 pip | None |

This tiered structure allows traders to choose an account that best matches their risk appetite and capital availability. The CENT and STANDARD accounts are suitable for newcomers due to their low entry requirements and commission-free trading, while the ECN and ECN PRO accounts are better suited for experienced traders seeking tighter spreads and faster executions.

The ZERO ECN account, although requiring a higher deposit, offers zero commissions and reduced leverage of 1:200, designed for traders prioritizing stability and lower exposure.

AssetsFX offers high leverage up to 1:500 on most account types, enabling traders to amplify their trading positions. However, while this can magnify profits, it also significantly increases risk—especially for inexperienced traders.

Spreads vary depending on the account type, with the lowest spreads (0.0 pips) available on ECN-based accounts. Commissions are competitively priced, ranging from $2 to $3 per lot, depending on the account tier.

Despite offering competitive trading conditions and advanced platforms, AssetsFXs regulatory transparency remains questionable. The broker is registered in Mauritius, but it is not clearly stated whether it holds a valid license from the Financial Services Commission (FSC) of Mauritius or any other recognized financial authority.

WikiFX, a global forex broker review platform, has given AssetsFX a low score of 2.49/10, citing potential red flags. Recently, WikiFX has also received several user complaints against the broker, mainly related to withdrawal delays and unresponsive customer service. Such feedback suggests possible operational and transparency issues that prospective traders should take seriously.

While AssetsFX promotes itself as a client-focused broker, recent reports indicate growing dissatisfaction among traders. Some users have claimed issues with fund withdrawals and limited customer support responsiveness, both of which are serious concerns when evaluating a brokers credibility.

A low rating combined with unresolved complaints highlights the importance of verifying a brokers regulatory status before depositing any funds.

AssetsFX offers a wide range of account types, competitive spreads, and access to MT4/MT5 platforms, appealing to traders with different experience levels. However, the lack of regulatory clarity, recent customer complaints, and a low WikiFX score paint a concerning picture.

Traders are strongly advised to exercise caution and verify all licensing information before opening an account with AssetsFX. Choosing a fully regulated forex broker can provide greater security, transparency, and peace of mind in todays volatile trading environment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Warren Bowie & Smith lacks valid regulatory oversight, raising serious risk concerns. Read this broker review and check warning signs now with the WikiFX App.

VIDEFOREX lacks any license, raising red flags for withdrawal issues and account freezes. Traders report payout problems with this unregulated forex broker. Download the WikiFX App for scam alerts before investing.

Germany’s BaFin has issued a fresh wave of warnings against several websites suspected of offering unauthorised financial, investment, lending, and crypto-related services, with some cases also involving identity fraud.

Did your good trading experience with TAG MARKETS reverse when applied for fund withdrawals at the Mauritius-based forex broker? Besides withdrawal denials, did you also witness account blocks or deletions by the broker? Did the broker’s customer support team fail to provide you a proper reason for these trading activities? Have you also witnessed glitches on deposit bonus? These allegations have only grown further in 2026. Read on as we share these allegations in this TAG MARKETS review article.