简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is LMAX Group Safe? Regulators Say Yes, Traders Say No

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about LMAX Group and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about LMAX Group and its licenses.

Regulatory Background

LMAX Group is a London-based broker that has established itself as a trading venue for institutional and retail clients. The firm operates under several licences across different jurisdictions, signalling its efforts to maintain a regulated profile. In the United Kingdom, the broker is authorised by the Financial Conduct Authority (FCA) under licence number 783200, allowing it to act as a Market Maker (MM). This is a significant credential, as the FCA is widely regarded as one of the worlds most stringent regulators.

Additionally, LMAX Group holds a licence from the Cyprus Securities and Exchange Commission (CySEC) under licence number 310/16. This licence authorises it to operate as a Straight Through Processing (STP) broker, giving it access to clients across the European Economic Area.

However, not all of the group‘s regulatory records present a reassuring picture. LMAX Group is listed on New Zealand’s Financial Service Providers Register (FSPR) under licence number 612509, but here, the situation is less straightforward. The broker has been found to exceed the authorised business scope under this licence. This essentially means that while the company is registered, its activities extend beyond what the licence permits, creating regulatory inconsistencies.

Similarly, in the United Kingdom, under FCA licence number 509778, the company is recorded as holding an Investment Advisory Licence. Yet, according to WikiFX, this licence is also exceeded, as it pertains to non-forex services. These irregularities raise questions about whether LMAX Group is operating in areas not fully supervised by regulators.

WikiScore and Evaluations

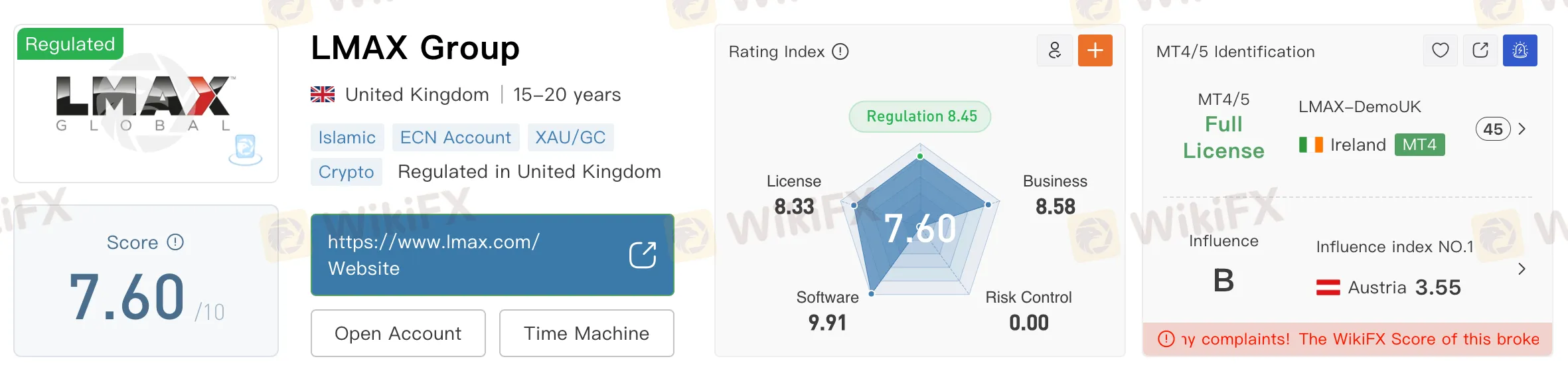

According to WikiFX, a global broker regulatory query platform, LMAX Group holds a WikiScore of 7.60/10. While this rating may appear relatively strong, it does not tell the entire story. WikiFX evaluates brokers across multiple dimensions, including regulatory standing, trading environment, software stability, risk control, and business operations.

View WikiFXs full review on LMAX Group here: https://www.wikifx.com/en/dealer/0001815826.html

A deeper look into the platform reveals that LMAX Groups score has been negatively impacted by a high number of user complaints. These complaints play a crucial role in shaping the overall evaluation, as they provide a real-world reflection of trader experiences beyond the official regulatory framework.

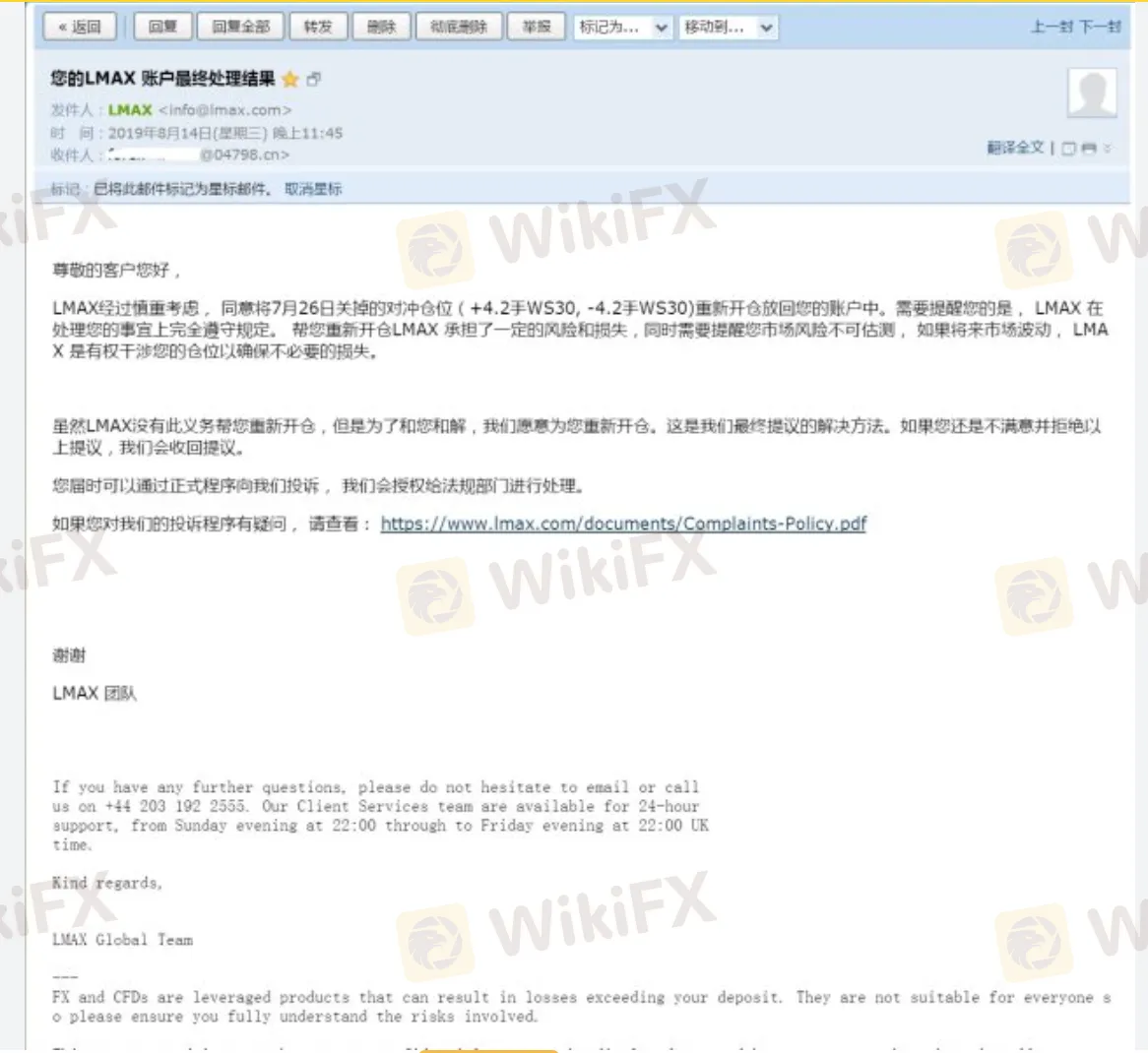

User Complaints and Exposure Posts

The Exposure section on WikiFX has documented numerous grievances from traders dealing with LMAX Group. Some of the most common complaints include:

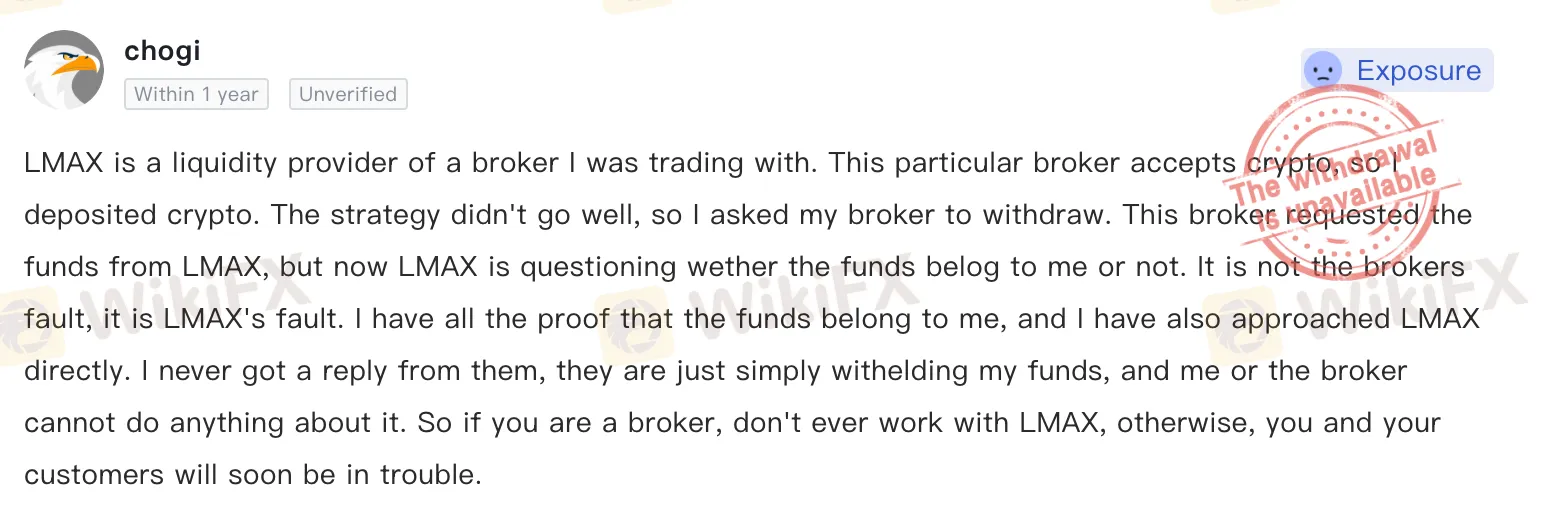

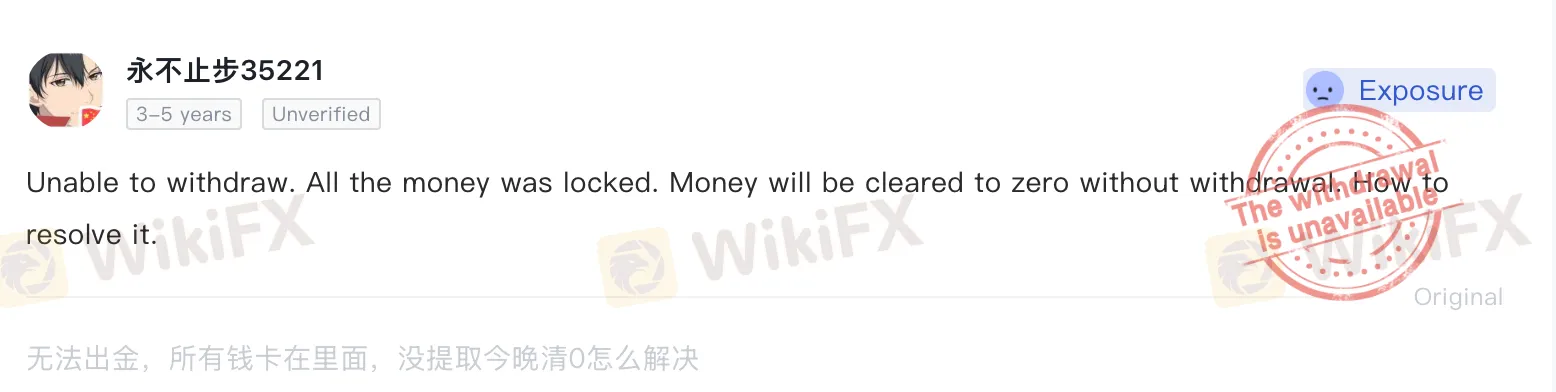

- Withdrawal Issues: Several users reported difficulties in withdrawing funds, with delays extending for weeks or months. In some cases, traders claimed they never received their money at all.

- Account Restrictions: A number of traders described sudden account freezes or restrictions that prevented them from accessing their balances or executing trades.

- Lack of Transparency: Multiple complaints pointed to unclear fee structures, unexpected charges, and poor communication from customer support.

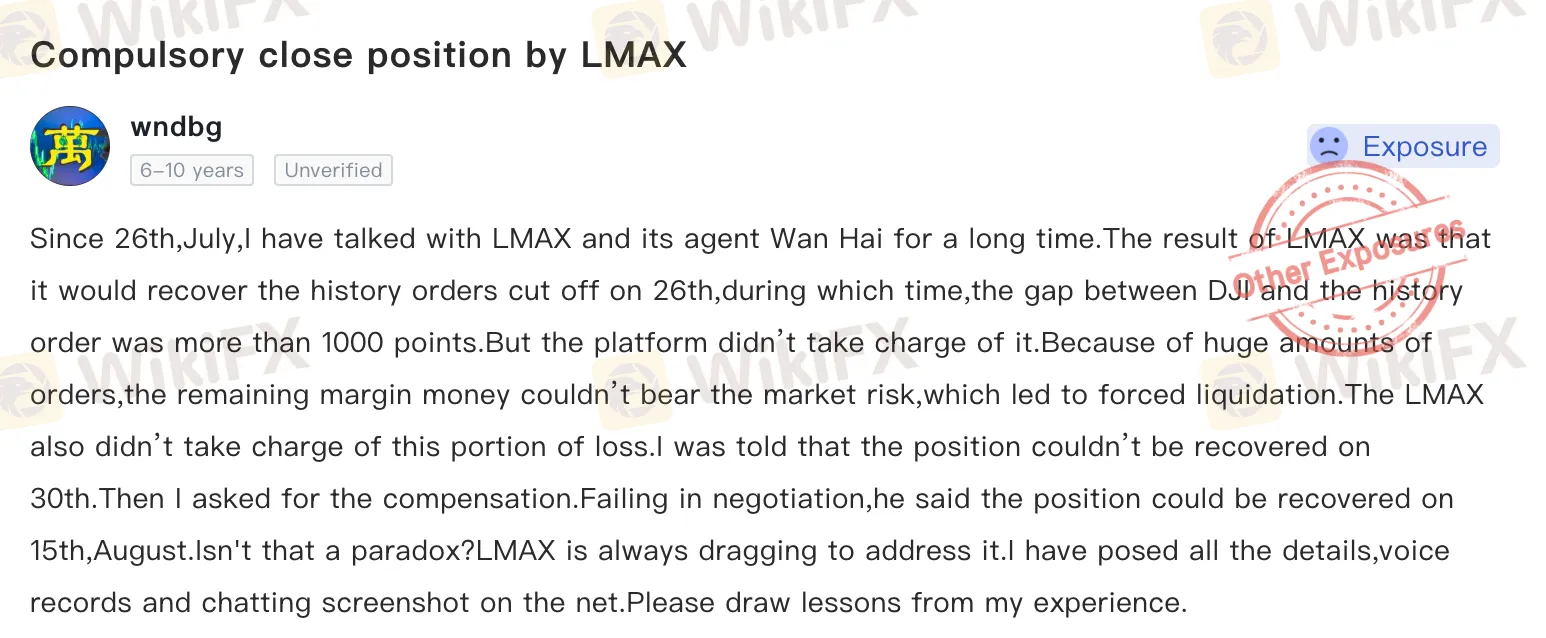

- Execution Problems: Some traders alleged that orders were not executed at the requested price, raising concerns about slippage and order manipulation.

The benefit of WikiFXs Exposure posts lies in their public visibility. By providing a space where traders can share first-hand experiences, WikiFX helps to increase transparency in the trading industry. This information allows other traders to make better-informed decisions when selecting brokers.

Why These Issues Raise Red Flags

While holding licences in respected jurisdictions such as the UK and Cyprus might suggest credibility, the discrepancies in business scope and the volume of user complaints tell a different story. A broker that exceeds its licensed authority may be engaging in activities that are not properly supervised, creating risks for investors.

Moreover, consistent reports of withdrawal problems and account restrictions strike at the core of trust in any financial service provider. The combination of these issues raises important red flags for potential clients, particularly those who may be considering depositing significant sums of money.

Its Not Entirely Safe for Malaysian Traders

For Malaysian traders, the picture requires careful consideration. At present, LMAX Group has not been listed on the Securities Commission of Malaysias Investor Alert List, and there are no recorded complaints from Malaysian investors about this broker. On the surface, this might suggest that Malaysian clients have not yet encountered the same problems reported elsewhere.

However, it is vital for Malaysian traders to look beyond domestic records and take into account the broader findings provided by platforms such as WikiFX. The global nature of online trading means that issues experienced by traders in one jurisdiction can easily surface in another. By reviewing the complaints and analyses shared internationally, Malaysian investors can better assess the potential risks of engaging with LMAX Group.

Importance of Global Oversight

The case of LMAX Group displays the importance of global oversight in the trading industry. While local regulators play an essential role, the interconnectedness of financial markets means that traders cannot rely solely on national watchdogs. Resources like WikiFX help bridge this gap by aggregating information from across multiple jurisdictions and providing traders with an independent assessment.

Conclusion

LMAX Group presents a complex case for traders. On one hand, it holds respected licences in the UK and Cyprus and maintains a reasonably strong WikiScore. On the other hand, its record of licence exceedances, offshore registrations, and mounting user complaints cannot be ignored.

For prospective clients, whether in Malaysia or elsewhere, the safest course of action is to approach LMAX Group with caution. Conducting thorough due diligence, consulting independent resources like WikiFX, and paying close attention to the experiences of other traders are crucial steps before committing funds.

Ultimately, transparency and trust are the cornerstones of any trading relationship. Until LMAX Group addresses the concerns raised by regulators and its clients, doubts will remain about whether the broker can provide the level of security and reliability that traders expect.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Currency Calculator