Abstract:DFSA issued a warning naming Tell LTD for false license claims. Discover the risks of broker impersonation and how to protect your funds.

Warning overview

The Dubai Financial Services Authority (DFSA) has issued an investor alert naming Tell LTD for impersonating a DFSA-authorised firm. The alert explains that the operators use DFSAs name and regulatory language to look legitimate while not appearing on the DFSA Public Register.

Typical touchpoints include polished websites, social-media ads, unsolicited emails or messaging-app outreach, and follow-up calls by “account managers” who push quick onboarding. Victims are urged to transfer money to third-party accounts or to send crypto to wallets the promoters control.

The warning stresses a few essentials: being “based in Dubai” or citing the DIFC in marketing does not equal DFSA authorisation; screenshots of “certificates,” licence numbers pasted on webpages, or logos embedded in PDFs are not proof of a licence; and investors should treat any request for remote-access apps or identity documents as a red flag. The regulator urges the public to refuse payments, preserve evidence (URLs, emails, wallet addresses, phone numbers), and report the incident.

How to recognise an impersonation playbook

Scams that pretend to be regulated usually follow repeatable patterns. Watch for these tells:

- Name mismatch. The company name on the website or contract doesnt match any entry in an official register; the legal entity changes across pages, footers, or bank beneficiary details.

- Look-alike domains. One-letter swaps, extra hyphens, or different TLDs that mimic a known brand.

- Fuzzy “proof.” Blurry “licences,” unverifiable licence numbers, or links to self-hosted “verification” pages rather than an official register.

- Payment detours. Requests for crypto, e-wallets, or transfers to private/overseas accounts that dont match the named firm.

- Pressure and promises. Pushy deadlines, “limited slots,” or claims of effortless returns.

- No audit trail. Missing client agreements, no complaints procedure, generic webmail addresses, and phone numbers that constantly change.

If just one of these shows up, pause. If several appear together, walk away.

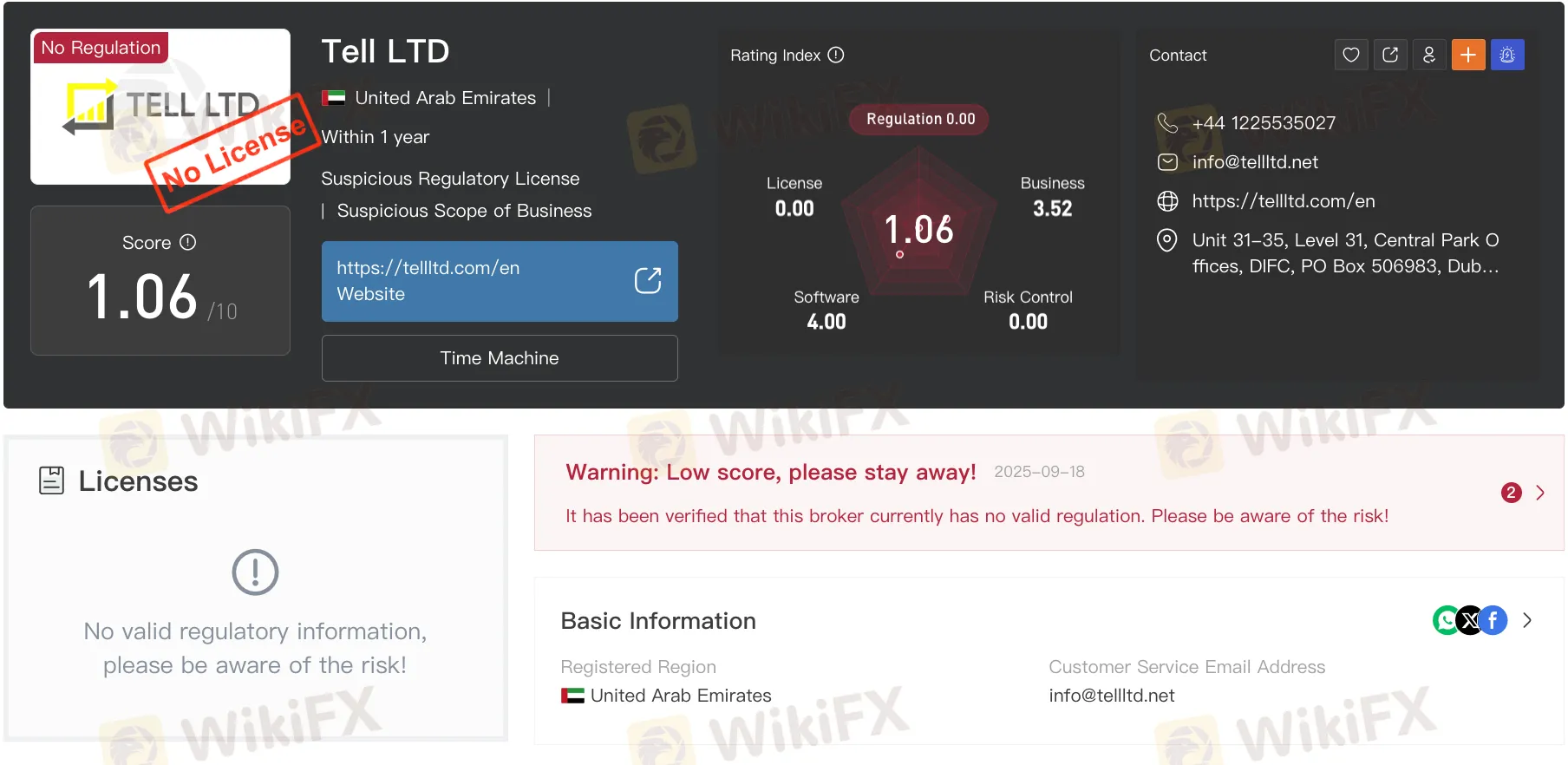

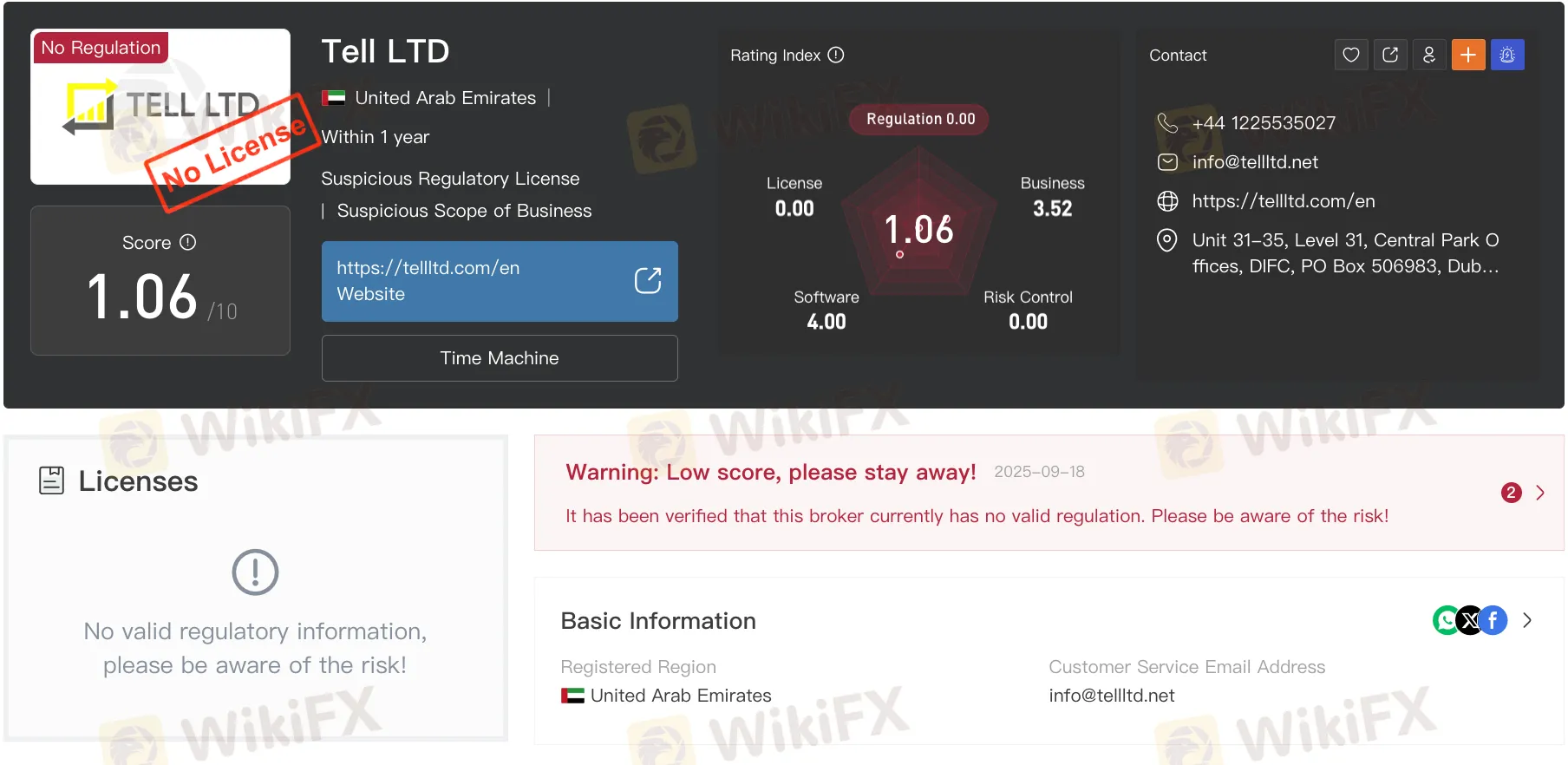

One-stop verification with WikiFX

Before you fund any account, run a background check on WikiFX. The platform aggregates licence status, risk alerts, and user exposures across regions in a single broker profile.

For Tell LTD, the WikiFX page does not show a DFSA licence—in fact, it shows no valid authorisation from recognised regulators. That alone is a deal-breaker for risk-aware traders. Use the broker profile to read recent exposure posts, compare entity names, and confirm whether the website youre viewing matches any licensed corporate body. If the licence section is blank or labelled “unverified/revoked,” treat it as a hard stop.