OANDA to Transfer Prop Trading Business to FTMO Platform

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:With economic shifts, central bank policies, and geopolitical events shaping currency movements, 2025 presents a mix of opportunities and risks. Whether you're a beginner or an experienced trader, selecting the most reliable and profitable pairs can boost your trading performance.

The forex market is constantly evolving, and staying ahead means choosing the right forex pairs to trade. With economic shifts, central bank policies, and geopolitical events shaping currency movements, 2025 presents a mix of opportunities and risks. Whether you're a beginner or an experienced trader, selecting the most reliable and profitable pairs can boost your trading performance. Here is the List of 10 Best Forex pairs

1. EUR/USD -The Most Traded Pair

EUR/USD remains the most liquid and widely traded pair. Its ideal for all experience levels due to tight spreads and consistent price movement. With the Eurozone and U.S. economies continuing to influence global finance, this will stay among the top forex pairs to trade.

2. GBP/USD -Volatile and Profitable

Also known as “The Cable,” GBP/USD offers excellent volatility and trading volume. Interest rate changes and economic data from the UK and U.S. make this pair a great choice for active traders in 2025.

3. USD/JPY - A Safe Haven Option

USD/JPY is often seen as a safe-haven pair, especially during global uncertainty. The Bank of Japans long-standing low-interest rate policy contrasts with U.S. Fed rate movements, creating frequent trading opportunities.

4. AUD/USD - Commodity-Driven Volatility

As a commodity currency, AUD/USD is highly influenced by Chinas economy and global demand for raw materials. It's one of the most dynamic forex pairs to trade for those who follow macroeconomic trends.

5. USD/CAD - Oil-Linked Movements

The Canadian dollar is closely tied to oil prices. USD/CAD can be highly profitable for traders who track the energy market and global supply dynamics.

6. EUR/GBP -Brexit Impacts Continue

This pair reflects the economic divergence between the UK and the Eurozone. EUR/GBP is great for range traders and those looking to profit from ongoing political developments in Europe.

7. NZD/USD - A Niche Commodity Pair

Like AUD/USD, NZD/USD is influenced by global agriculture and commodity prices. It offers decent volatility and is often less crowded than major pairs.

8. EUR/JPY - Euro Meets the Yen

EUR/JPY combines two powerful economies. It's known for smooth trends and is ideal for swing trading strategies.

9. USD/CHF -The Swiss Safe Haven

USD/CHF is a popular choice during market uncertainty. The Swiss franc is considered stable, and this pair often mirrors risk sentiment in global markets.

10. GBP/JPY -High Volatility for Brave Traders

This is one of the most volatile forex pairs to trade. GBP/JPY offers large price swings, making it attractive for short-term and scalping strategies.

Conclusion

Selecting the right forex pairs to trade in 2025 is essential for maximizing profit and managing risk. While major pairs offer stability, cross and commodity pairs bring exciting opportunities. Always align your pair selection with your trading style and market knowledge.

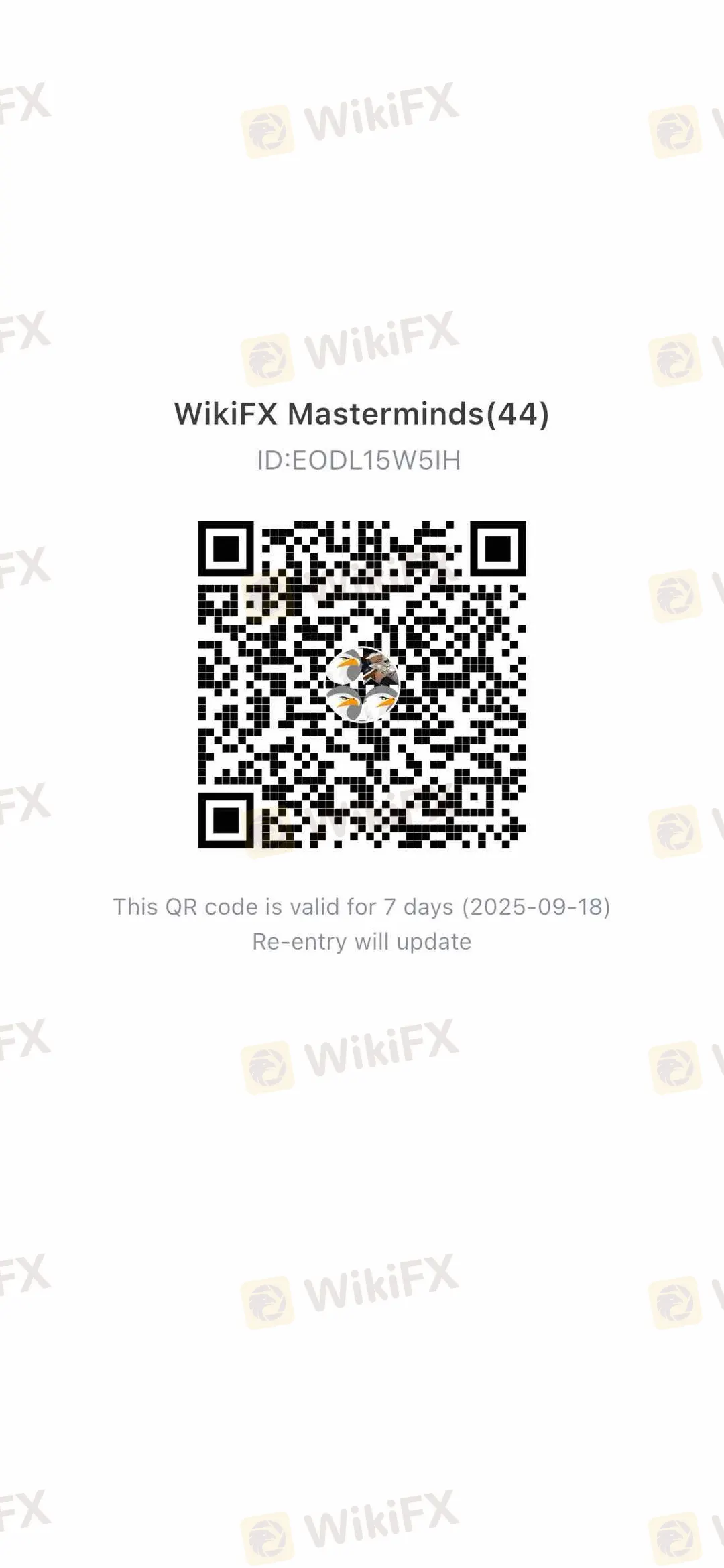

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

If you’ve spent more than a few weeks in the forex markets, you already know that leverage is a feature that many traders use, but did you know just how risky it is? Understanding what leverage truly does, and how it connects to pips, margin calls, and risk management, is what separates intermediate traders from beginners.

Although no large-scale public complaints have yet surfaced, we have identified a coordinated cluster of suspicious investment platforms exhibiting strong characteristics of organized fraud operations.