Abstract:HTFX broker faces mounting scam complaints over withdrawal delays and unprocessed funds. Learn about user experiences, regulation, and red flags before trading.

A surge of negative HTFX broker reviews has brought attention to serious HTFX withdrawal issues, prompting traders across Asia, Europe, and the Americas to question the platform's reliability and legitimacy. Based on firsthand trader reports and regulatory data, this exposé uncovers mounting HTFX complaints, examines the HTFX regulation status, and alerts readers to potential offshore broker risks.

Alarming Rise in HTFX Withdrawal Complaints

In August 2025, HTFX attracted 40 active complaints out of 55 total user reviews, the vast majority focused on delayed withdrawals—a sharp increase over previous months. Traders from Vietnam, Indonesia, Russia, Thailand, Cambodia, Singapore, Turkey, and the United States report similar stories: withdrawal requests remain pending for days or weeks, with little to no communication from customer support. For example, Vietnamese user Tran Thi Tam requested a $5,000 withdrawal on July 11, 2025; as of early August, the funds had not been processed despite repeated inquiries. Another trader, Đỗ Hồng Nhung, reported two unprocessed withdrawal orders totaling $12,188, initiated on July 10 and still unresolved by late July.

These are not isolated incidents. Users once praised HTFX for speedy transactions—sometimes completed within one to three days—but since July 2025, the trend has reversed, with withdrawal processing time now stretching indefinitely. Several reviewers explicitly warn others against depositing funds, calling HTFX a “scam platform” and urging fellow traders to steer clear.

Regulatory Status: Is HTFX a Safe Broker to Use?

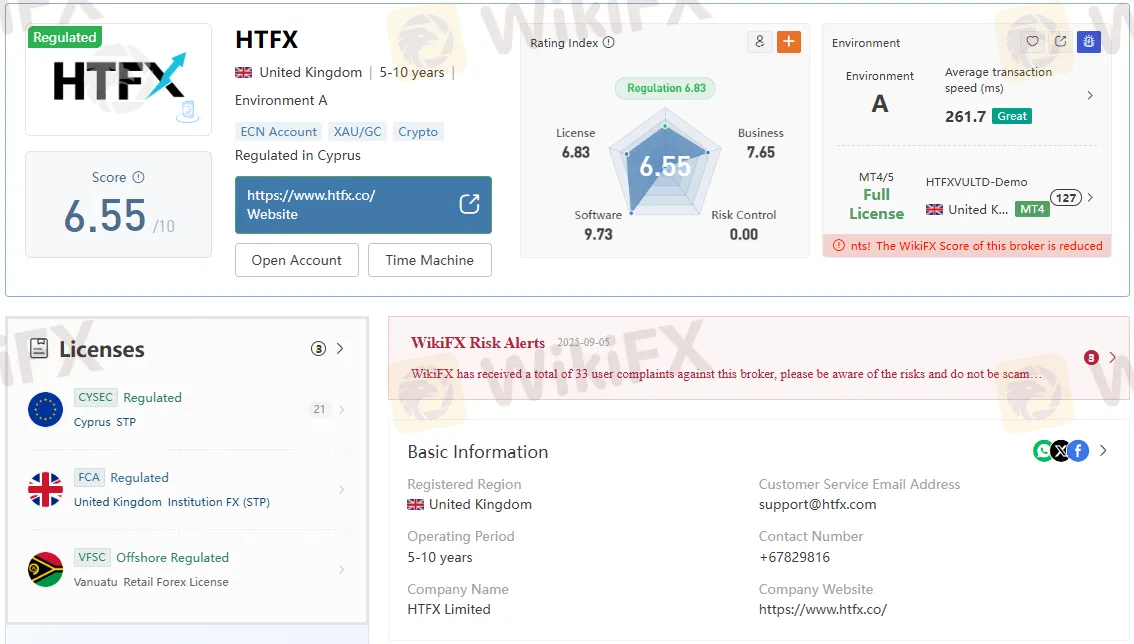

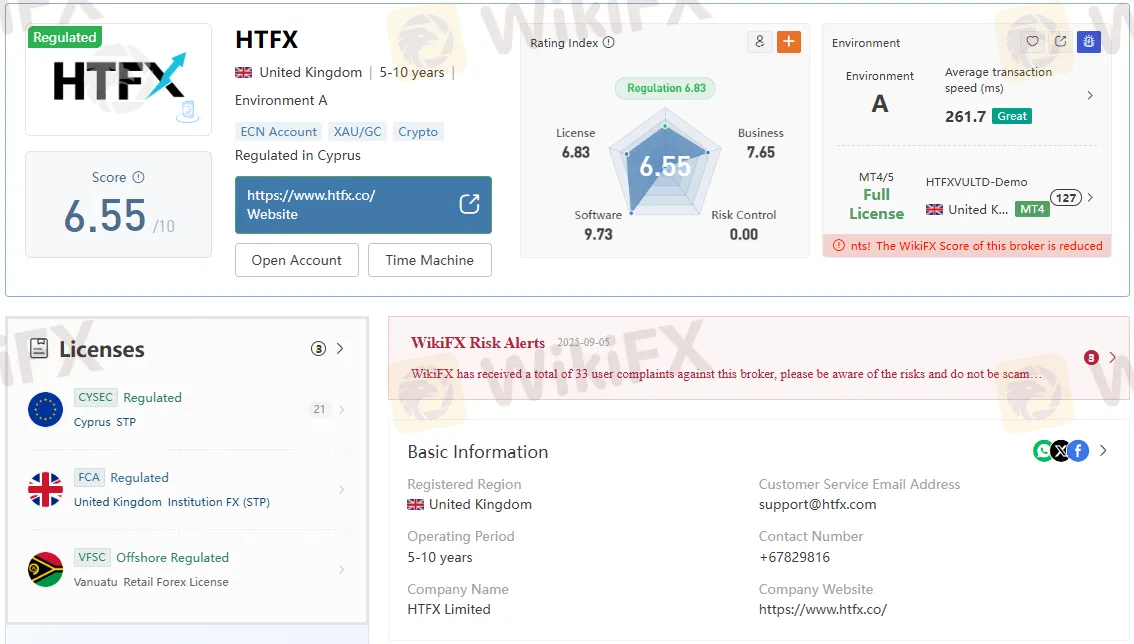

HTFX maintains multiple licensing claims, including regulation by the UKs Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CYSEC), and Vanuatu Financial Services Commission (VFSC). The FCA and CYSEC licenses are generally associated with stronger oversight, while the VFSC is widely recognized as an offshore regulator with comparatively lax requirements.

Despite these credentials, the financial regulator alerts section on WikiFX notes 33 user complaints as of September 5, 2025, a substantial number that has triggered a risk alert for the broker. The discrepancy between formal regulation and a growing volume of unresolved trader disputes raises questions about HTFXs trader protection mechanisms and dispute resolution efficacy.

Customer Support and Broker Dispute Resolution Failures

A recurring theme in HTFX customer feedback is the inadequacy of customer support and broker dispute resolution. Users report that responses are vague, scripted, and offer no concrete timelines for resolving withdrawal requests. One Singapore-based trader, after two weeks of waiting, was told: “We have urged the finance department to handle your issue, and we sincerely apologize”—an answer that did not result in the release of funds.

For some, the situation escalates beyond delays: multiple users allege that HTFX demands additional payments—ostensibly for taxes, account activation, or unexplained “fees”—before processing withdrawals, a red flag often associated with fraudulent activity. One Russian user with a $10,700 account balance claims HTFX required repeated payments totaling $535 (5% of the balance) without ever releasing the funds. Such practices are not typical of reputable, regulated brokers.

HTFX Trading Platform Review: Functionality vs. Trust

The HTFX trading platform itself is technically robust, offering MetaTrader 4 and 5 support, a web trader, and access to forex, commodities, stocks, indices, and cryptocurrencies. Leverage up to 500:1 is available, and the platform accepts a wide range of deposit methods, including crypto and regional payment processors. However, advanced features matter little if users cannot withdraw their profits.

The core issue lies not with the platform‘s trading functionality but with its account verification delays and withdrawal processes. Users report that once funds are deposited, the broker’s responsiveness deteriorates, especially when withdrawal requests are initiated.

HTFX Scam or Legit? Assessing the Evidence

The HTFX scam or legit debate is intensifying as withdrawal complaints mount. While the company is technically regulated in several jurisdictions, the concentration of unresolved complaints—especially regarding fund access—suggests systemic issues. The WikiFX risk alert advises traders to “be aware of the risks and do not be scammed,” and the platforms score has dropped due to negative user experiences.

Some users have threatened to report HTFX to regulators in their home countries, a step that highlights the breakdown in broker dispute resolution and the need for financial regulator alerts to protect the public. The warning signs are clear: when a brokers withdrawal system stalls repeatedly and support offers no real solutions, traders should exercise extreme caution.

How to Protect Yourself from Offshore Broker Risks

For anyone considering HTFX or similar platforms, trader protection begins with due diligence. Always verify HTFX regulation status directly with the relevant authorities, not just the brokers website. Cross-check licensing numbers and confirm that the broker is authorized to serve clients in your country of residence—HTFX, for example, explicitly restricts service to residents of some nations, including the US and Japan.

Monitoring HTFX broker reviews on independent platforms like WikiFX can provide early warning of withdrawal issues, delayed withdrawals, or account verification delays. If you encounter a problem, document all communications and consider reporting the broker to your national regulator. In cases where disputes cannot be resolved, some jurisdictions offer compensation schemes, though these may not apply to offshore-regulated entities.

Conclusion: Proceed with Caution and Verify Before Trading

The recent wave of HTFX complaints over withdrawal delays and inadequate customer support underscores the importance of trader protection when selecting a forex broker. While HTFX presents itself as a regulated entity with a global client base, user experiences in 2025 tell a different story—one of rising frustration, financial loss, and dwindling trust.

Expert tip:

Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone for real-time alerts and peer reviews.

The lesson for traders is clear: regulation alone does not guarantee safety. Vigilance, research, and community feedback are essential defenses against offshore broker risks. For now, HTFXs withdrawal issues and unresolved complaints suggest that traders should look elsewhere for a secure and reliable trading experience.

Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone