Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

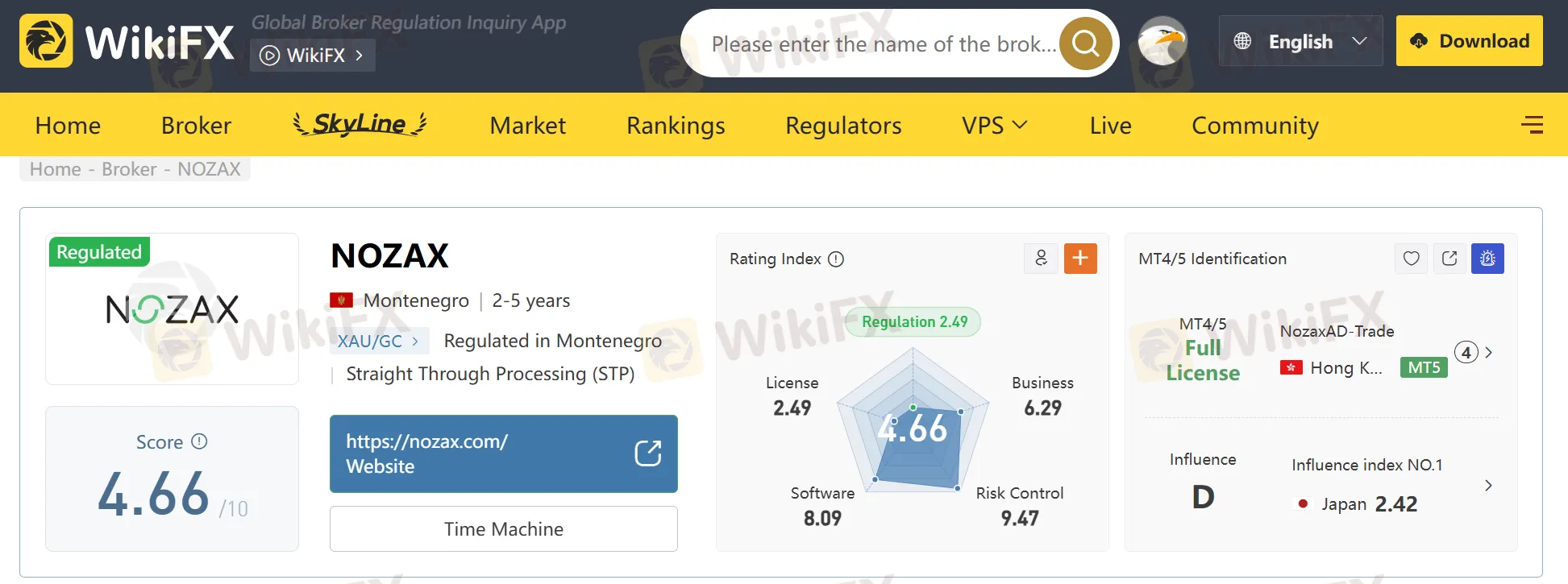

Abstract:NOZAX is a Montenegro-registered forex and multi-asset broker founded in 2017. It offers MetaTrader 5 access to forex, shares, indices, and commodities, and three account tiers (NZX ZERO, NZX CORE, NZX CENT).

NOZAX is a Montenegro-registered forex and multi-asset broker founded in 2017. It offers MetaTrader 5 access to forex, shares, indices, and commodities, and three account tiers (NZX ZERO, NZX CORE, NZX CENT). The broker advertises raw ECN-style spreads on its NZX ZERO account, institutional STP pricing on CORE/CENT, and a headline maximum leverage of 1:500. NOZAX states it is regulated in Montenegro by the local capital markets regulator. Traders should verify current licence details and weigh regulatory scope before funding an account.

Why does this review matter?

This NOZAX review explains account types, fees, leverage, and platform support so traders can quickly assess whether the brokers offering fits their needs. We keep the tone neutral and do not recommend investing — instead, we point out the facts and the checks every trader should perform before depositing.

At a glance — key facts

Platform & instruments

NOZAX supports MT5, a full-featured multi-asset trading platform with advanced charting, EAs, and order types. Instruments include major and minor forex pairs, select shares, indices, and commodities — suitable for traders who prefer a single platform for multiple asset classes.

Account types & pricing (what to expect)

Important: Published commission numbers can vary across listings. Always confirm the live fee schedule and how commissions are applied (per lot, per side, minimums) on NOZAXs official fee page.

Leverage & risk

NOZAX advertises a maximum leverage of 1:500, which amplifies both gains and losses. High leverage increases liquidation risk and is restricted in many major jurisdictions — check what leverage will actually be offered to your country and instrument before trading.

Regulation & client protection

NOZAX is registered in Montenegro and says it is overseen by the local capital markets regulator. This is different from being licensed by larger, well-known regulators (e.g., FCA, CySEC, ASIC). Regulatory scope matters: it affects supervision intensity, client money segregation rules, and available dispute/compensation mechanisms. Traders should verify licence numbers and current status directly with the regulator.

Deposits, withdrawals & support

NOZAX lists multiple deposit and withdrawal methods and claims responsive customer service. Public listings vary — best practice is to test with a small deposit and a withdrawal to confirm processing times, fees, and KYC steps in your jurisdiction.

Pros & cons

Pros

Cons/cautions

Bottom line

NOZAX is a functioning Montenegro-registered broker offering MT5, raw spreads on an ECN account, and a range of instruments. We do not recommend or discourage using NOZAX. Instead, traders should:

Short FAQ

Is NOZAX regulated?

NOZAX is registered in Montenegro and states it is supervised by the local capital markets regulator. Confirm current license status with the regulator before opening an account.

What platform does NOZAX use?

NOZAX supports MetaTrader 5 (MT5) for desktop and mobile trading.

What accounts does NOZAX offer?

Three accounts: NZX ZERO (ECN/commission), NZX CORE (STP/spread), NZX CENT (cent account).

What is the maximum leverage?

NOZAX advertises up to 1:500 leverage; actual available leverage may vary by jurisdiction and instrument.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.