简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

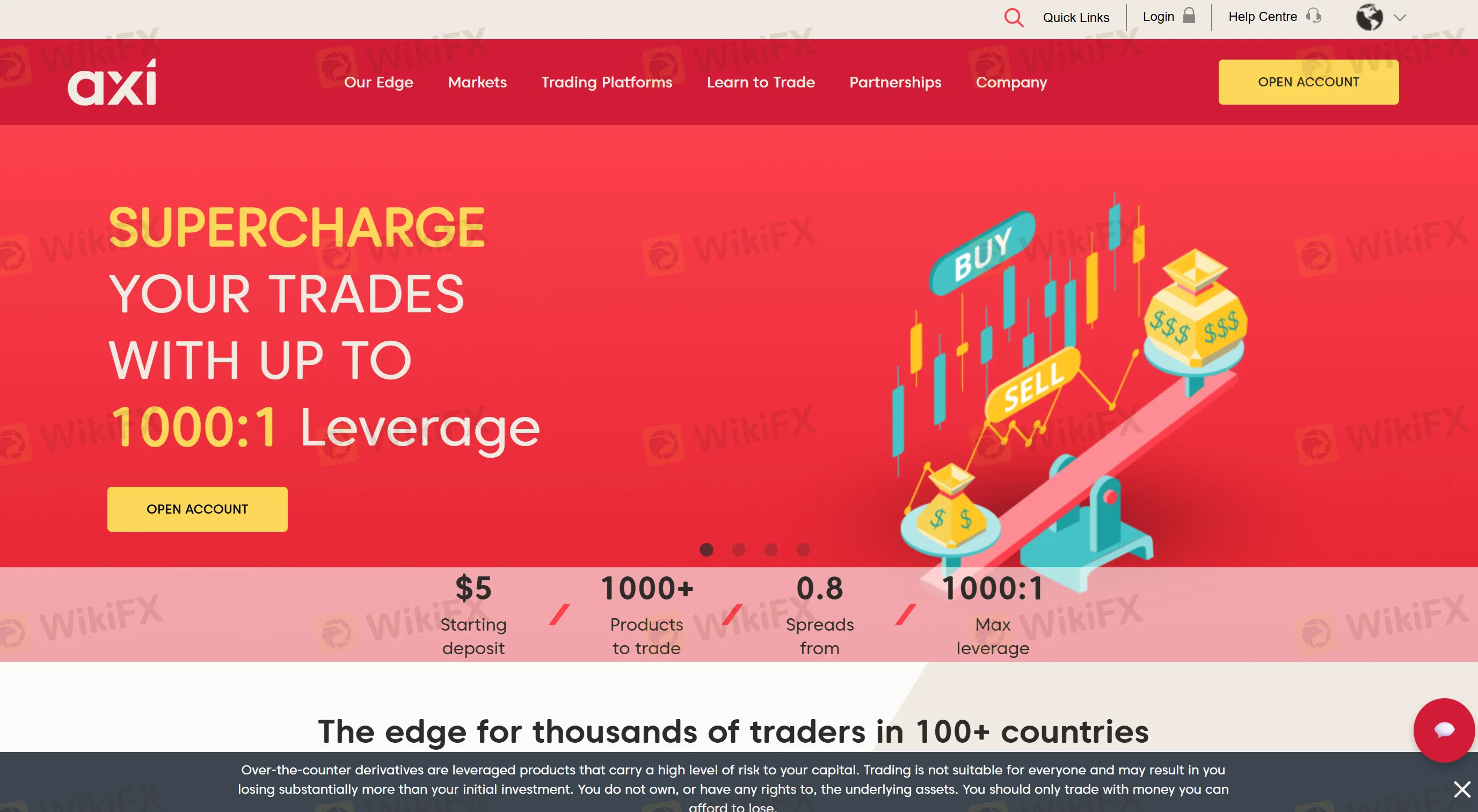

Axi Broker Forex Trade Review

Abstract:Expert review of Axi broker evaluates forex trading conditions, platform reliability, account types, and overall trading experience.

Axi Broker Overview

Axi provides high liquidity forex trading, reliable execution, and multiple regulatory protections across jurisdictions. The copy trading platform allows following experienced traders strategies to optimize learning and performance. Competitive spreads and multi-asset coverage make Axi a comprehensive choice for traders.

Pros and Cons of Axi

| Pros | Cons |

| Multiple regulated entities ensure fund security | Not service for residents of France, overseas French territories, Australia, or New Zealand |

| Supports MT4/MT5 and Copy Trading | |

| Low spreads with high liquidity | |

| Variety of account types for different trader needs |

Trading Conditions and Platform Insights

Execution speeds are fast and spreads on major forex pairs are competitive. MT4/MT5 platforms provide advanced charting, automation, and order management. Copy trading enables strategy replication with minimal delay.

Regulatory Compliance and Safety

Axi is regulated by ASIC (Australia), FCA (United Kingdom), CySEC (Cyprus), FMA (New Zealand), and DFSA (UAE). Client funds are segregated and operations are monitored, providing strong protection for traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Your Entries Are Always Late (And How to Fix It)

Biggest 2025 FX surprise: USD/JPY

NFA Charges Japan’s Forex Wizard and Mitsuaki Kataoka With Delaying Withdrawal Requests

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

Treasury vs. Fed: Bessent leads Trump's Campaign to Reshape US Monetary Policy

Ceasefire on the Brink: 14 Nations Condemn Israel as Geopolitical Risk Premiums Rise

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Ringgit hits five-year high against US dollar in holiday trade

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Currency Calculator