Global Brokers Expand Into Crypto Trading While Testing Prediction Market Models

Regulators are scrutinizing prediction markets as brokers add crypto assets to their platforms. Is innovation outpacing compliance?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

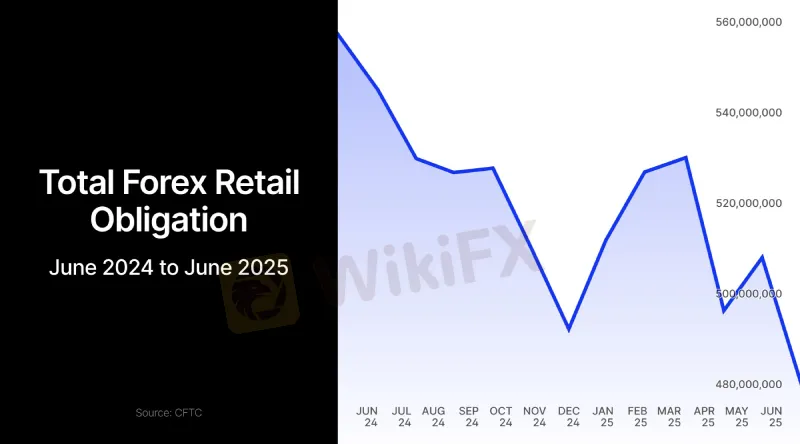

Abstract:US forex deposits drops 5.8% to $479.5M in June as the dollar hit multi-year lows, leaving major brokers facing sharp declines and shifting market flows.

Key Takeaways:

US forex deposits contracted to $479.5 million in June, marking a 5.8% monthly decline as sustained dollar index weakness weighed on risk appetite and prompted withdrawals across US retail forex platforms. GAIN Capital remained the market leader despite a 5.6% monthly drop to nearly $204 million, reflecting the largest recent monthly retreat for the platform amid softer client engagement. Charles Schwab bucked the trend with a 0.96% rise to $62.1 million, suggesting differentiated strategies among larger retail cohorts during the prolonged USD slump. Interactive Brokers slipped 1.7% to $34.7 million, while tastyfx fell 7.0% to $38.7 million, underscoring how client bases reacted unevenly to extended currency moves.

The June downswing coincided with the US Dollar Index (DXY) probing its lowest levels in more than three years, capping a months-long slide that reshaped positioning and sentiment across FX markets. Throughout late June, multiple market trackers noted the DXY touching multi-year lows as investors priced in rate cut prospects and navigated trade policy uncertainty, reinforcing headwinds for USD exposure. Investment strategy updates during mid-June highlighted the magnitude of the decline and recommended hedging or reducing USD allocations amid a deteriorating macro impulse for the greenback.

Monthly deposit figures derive from mandatory filings by Futures Commission Merchants (FCMs) and Retail Foreign Exchange Dealers (RFEDs) to the Commodity Futures Trading Commission, a process designed to safeguard customer funds and surface early signs of systemic stress. The CFTCs Financial Data for FCMs portal indicates updates are typically posted within roughly 12 business days after firms file reports, reinforcing the cadence and transparency of the reporting regime. Technical guidance clarifies that reported retail forex obligations aggregate money, securities, and property in retail forex accounts, adjusted for realized and unrealized P&L, while firms remain subject to capital and segregation requirements under the rule set.

If the dollars weakness persists, US retail forex platforms may continue to face uneven deposit flows, with larger institutions and niche brokers potentially diverging based on client profile and hedging strategies. Continued transparency via CFTC monthly forex reports should help market participants monitor broker market share shifts, capital strength, and evolving risk dynamics across US retail forex platforms.

Stay tuned for the latest news on the financial market. Scan the QR code below to download and install the WikiFX app on your smartphone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Regulators are scrutinizing prediction markets as brokers add crypto assets to their platforms. Is innovation outpacing compliance?

In forex trading, what truly determines risk is often not market volatility itself, but whether information is authentic, transparent, and fully visible.

Share Your Expertise on What’s Moving the Market.

Strong retail participation in 2026 is driving forex and CFD trading volumes higher, as investors expand beyond equities into macro-sensitive markets.