Abstract:An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Profile Overview

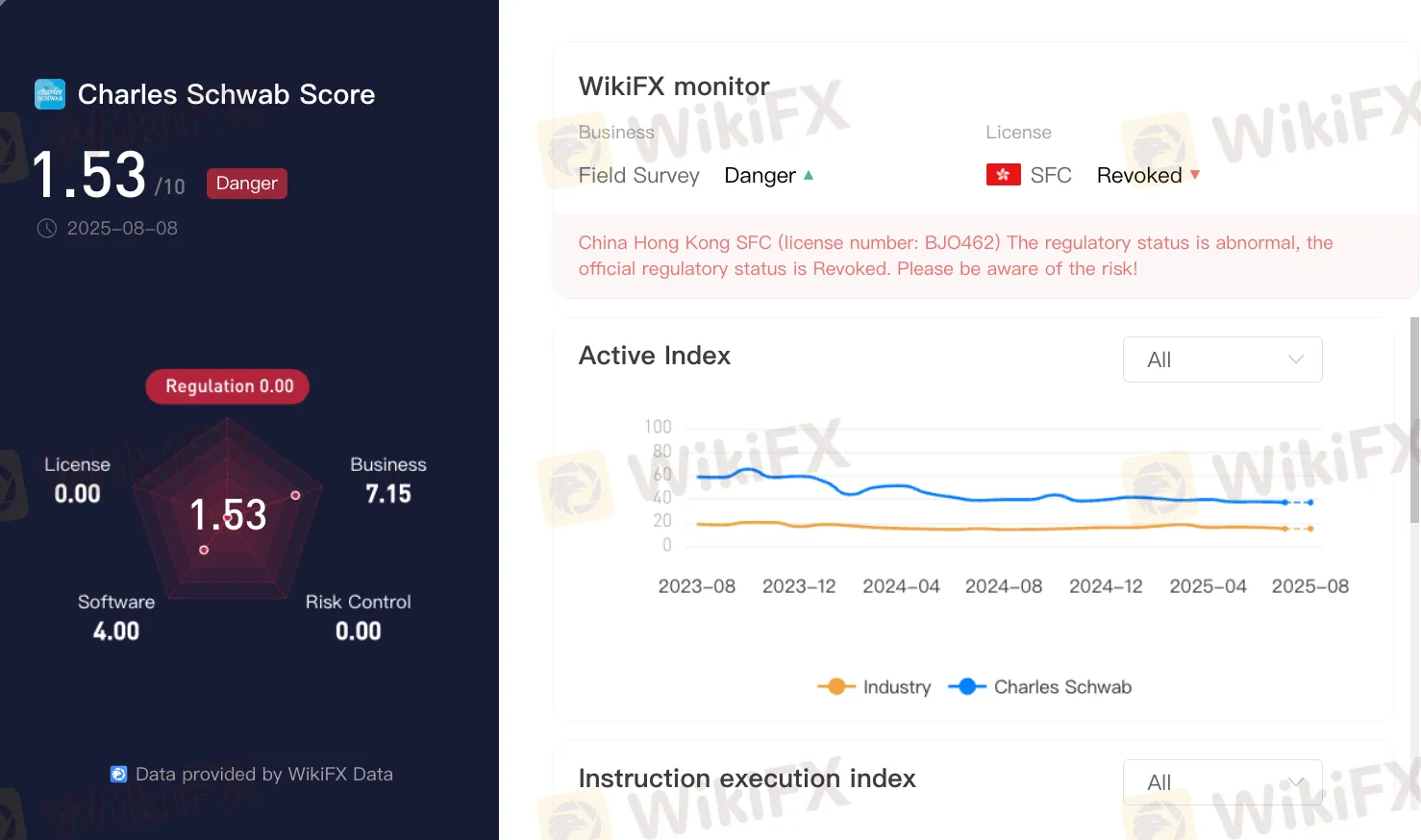

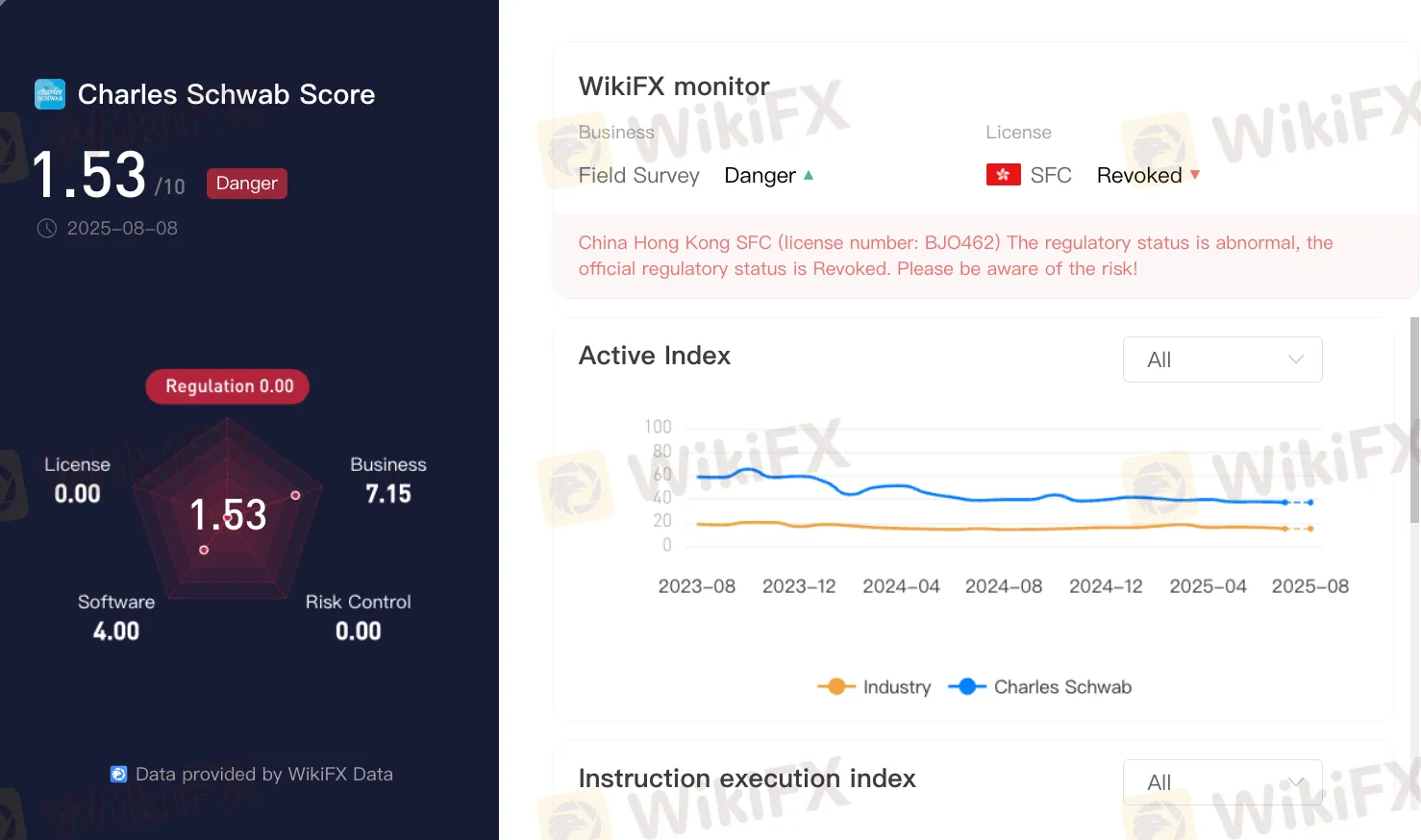

Charles Schwab is widely known as a major U.S. brokerage brand, but its presence in the forex market is limited. According to its broker profile, the company holds a rating of 1.53/10 with clear risk alerts and no active forex regulation displayed. Historical records also show a revoked Hong Kong futures licence connected to a previously affiliated entity.

Regulation and Historical Licensing

The profile data shows no current forex-specific regulatory licence. The revoked licence on record pertains to a Hong Kong futures authorisation, which is no longer active. While Charles Schwab operates in highly regulated U.S. securities and futures markets, these frameworks do not substitute for dedicated retail forex oversight in jurisdictions where such licensing is required.

Trading Services and Platform Offering

Schwab offers foreign exchange access primarily through Charles Schwab Futures and Forex LLC, focusing on select clients who meet eligibility requirements. This service is integrated within the companys proprietary trading systems rather than popular retail platforms like MT4 or MT5. For traders accustomed to retail-oriented FX environments with flexible account options and high-frequency execution, the structure may feel restrictive.

Geographic and Client Limitations

The forex service is not universally available. Access depends on client residency, account type, and meeting specific eligibility criteria. In some regions, Schwab does not provide retail forex trading at all, aligning more with its institutional and professional focus.

Assessment for Retail Traders

From a forex-only perspective, the combination of a low profile rating, absence of active FX regulation on record, and limited retail access makes Charles Schwab an unsuitable choice for traders seeking a dedicated, retail-focused forex broker. While the brand remains reputable in equities, ETFs, and wealth management, its role in the forex market is specialised and not designed for broad retail participation.

Conclusion

Charles Schwabs strength lies in its traditional brokerage and investment services, not in providing a wide-access retail forex platform. For traders whose primary interest is forex, especially on MT4/MT5 with competitive retail terms, alternative brokers with active forex regulation and higher FX-focused ratings should be considered.