WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Have you been encountering frequent forex losses? Finding it hard to gain the trading momentum? Can’t understand whether your current forex strategy is in line with the shift in economic indicators or the geopolitical climate? Overcomoming these will require a change to your forex investment strategy. Learn those smart strategic changes here.

Have you been encountering frequent losses in forex trading? Finding it hard to gain the trading momentum? Can‘t understand whether your current forex strategy is in line with the shift in economic indicators or the geopolitical climate? Your concerns are genuine! Although losses can happen in forex trading due to adverse market conditions, excessive use of leverage, and other negative indicators, they have to stop eventually. This is where you must understand how to use forex calls better. This will require a calibrated change to your forex investment strategy. In this article, we will guide you on the times when you need to change your forex strategy. Let’s begin!

If you have been facing forex losses for a long time, start introspecting before you lose interest in this investment, which actually benefits investors over time. Consistent losses will likely be due to a flawed trading strategy. Poor risk management practices, erroneous market analytic tools, or bad trade executions are some strategic errors traders can commit. These errors prove costly with a mountain of losses.

Before it gets too late, start finding the exact reason for losses. If excessive leveraging contributes to losses, you need to reduce the position size in line with the account size. Or if you are struggling to estimate correct price movements, look for a change in the analytical tool. The tool you have may not have the right insights to make correct price-related decisions. A robust analytic tool will provide you with genuine insights to make accurate price estimations, helping you reverse the losses.

Forex markets dont remain the same; they keep changing based on the changes in economic indicators, investor sentiment, and geopolitical scenarios. The changes in these can lead to a shift in the market dynamics. As a result, there can be variations in price trends, asset correlations, and volatility levels. You would wonder how to use forex strategies to align with changing market trends. This calls for adapting to the new market environment by adjusting your forex investment strategies. As the market continues to remain highly volatile, you need to implement multiple stop losses or change your position size relative to your trading account.

The Dynamic Regulatory Environment

Changes introduced by the market regulators significantly impact currency trading access, practices, and compliance norms. You need to stay updated with the changing regulatory requirements and figure out how they influence your forex trading activities. Regulatory changes may lead to restrictions in trading strategies such as high-frequency shorting or trading. They may even impose fresh compliance norms necessitating changes to risk management practices and operational procedures.

Do Emotions Dictate Your Currency Trading Activities? Start Making Practical Decisions

Forex trading can bring all sorts of emotions such as greed, impatience and fear. Making decisions based on these is a sure-shot loss-making proposition. For example, if price movements go as expected, you use massive leverage to take control of a wide market position. Suddenly, the market reverses and converts your gains into sharp losses, making you wonder what went wrong. Making changes to the position by keeping an eye on technical and economic indicators is pivotal to navigating a fluctuating forex market.

Wrapping Up

Forex investments are for long-termers, and changing strategies to align with evolving market needs will help you prevail for an extended period. With necessary modifications, you will be in control of how to use forex investments amid changing times.

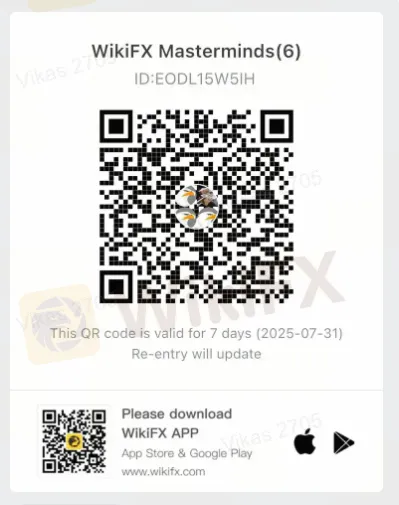

Join WikiFX Masterminds where you can learn groundbreaking forex trading strategies, the latest trends, and more. Scan this QR code to join our community.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.