Abstract:Learn how to build, test, and deploy your own forex trading robot. A complete beginner’s guide covering strategy, risk control, tools, and platforms.

Is forex robot trading really achievable for beginners? Absolutely. With the right strategy and tools, anyone can build an automated trading system—even without prior experience. In fact, a 2024 survey revealed that 88% of consistently profitable forex traders now rely on trading robots to support their performance.

This isnt just a trend—it reflects a deeper shift in how modern traders approach the market. Automated systems remove emotion, operate 24/7, and follow instructions with perfect discipline. If you combine them with a clear process, robust testing, and strict risk control, you can trade with confidence and consistency—even as a beginner.

Forex Robot Trading Basics

Takeaway: A forex robot executes trades based on predefined rules, removing emotions and operating with precision around the clock.

A forex trading robot is a piece of automated software that executes currency trades on your behalf. It analyzes price charts, applies technical indicators, and places trades based on pre-programmed rules—no human intervention required.

These bots run around the clock, reacting to market movements in real time. Whether youre asleep or at work, your robot keeps scanning for opportunities and managing open positions with speed and discipline.

A well-designed forex robot does more than just automate trade entries. It can:

- Monitor the market 24/7 without fatigue

- Apply technical indicators like RSI, MACD, or Bollinger Bands to make trading decisions

- Eliminate emotional reactions such as fear or greed

- Automatically place stop-loss and take-profit levels to manage risk

- Run non-stop when hosted on a forex VPS for stable execution

- Adapt to changing volatility through updates to its parameters

By automating these functions, a forex robot becomes a powerful assistant that helps you trade smarter—not harder.

5 Common Myths About Forex Robots—Debunked

Many new traders are skeptical about automated systems, and rightly so—theres a lot of hype out there. But to make smart decisions, you need to separate fact from fiction.

Lets clear up five of the most persistent forex robot myths:

1. “Robots guarantee profits.”

False. No algorithm can predict the market with 100% accuracy. Robots follow logic—not intuition—and markets can be unpredictable.

2. “Robots replace human traders.”

Automation complements your strategy—it doesnt replace market understanding, news awareness, or experience.

3. “All robots are the same.”

Not at all. A robot‘s effectiveness depends entirely on the strategy it follows and how well it’s tuned to market conditions.

4. “You can set it and forget it.”

Every bot needs ongoing monitoring and periodic adjustments. Markets evolve—and so should your system.

5. “Tech failures never happen.”

They do. VPS outages, broker delays, or bugs can disrupt trading. Always have a manual backup plan.

Tip: Always forward test your bot on a demo account before going live. Its the safest way to validate logic and avoid expensive surprises.

What Skills and Tools Do You Need to Build a Forex Robot?

Before building a forex robot, you must understand the foundation of currency trading. Learn how major pairs behave, what drives exchange rate fluctuations—like interest rates, inflation, or macroeconomic data—and how to read price charts. Without this knowledge, any automation will be blind and unreliable.

If youre building your own bot, some programming knowledge goes a long way. The most widely used languages for forex robot programming include:

Others like JavaScript, C++, or R are used in advanced or custom institutional setups. But if youre new, start with Python or MQL5—they strike a great balance between simplicity and power.

Not a coder? Youre not alone. Thanks to modern platforms, you can now create a fully functional forex robot without writing a single line of code. These no-code forex bot builders turn strategy ideas into automated trading logic through visual or natural language interfaces.

Top tools include:

- Capitalise.ai: Build bots using plain English instructions

- DeepSeek AI: Generate Pine Script from your strategy description

- MetaTrader + ChatGPT: Prompt-based code generation for EA development

- AlgoBuilder by Switch Markets: Drag-and-drop strategy builder for MetaTrader bots

These platforms lower the barrier to entry—but dont confuse accessibility with reliability. You still need rigorous backtesting and forward testing before you go live.

Tip: Leverage tools like ChatGPT to refine logic or test prompts. But always validate results with real data.

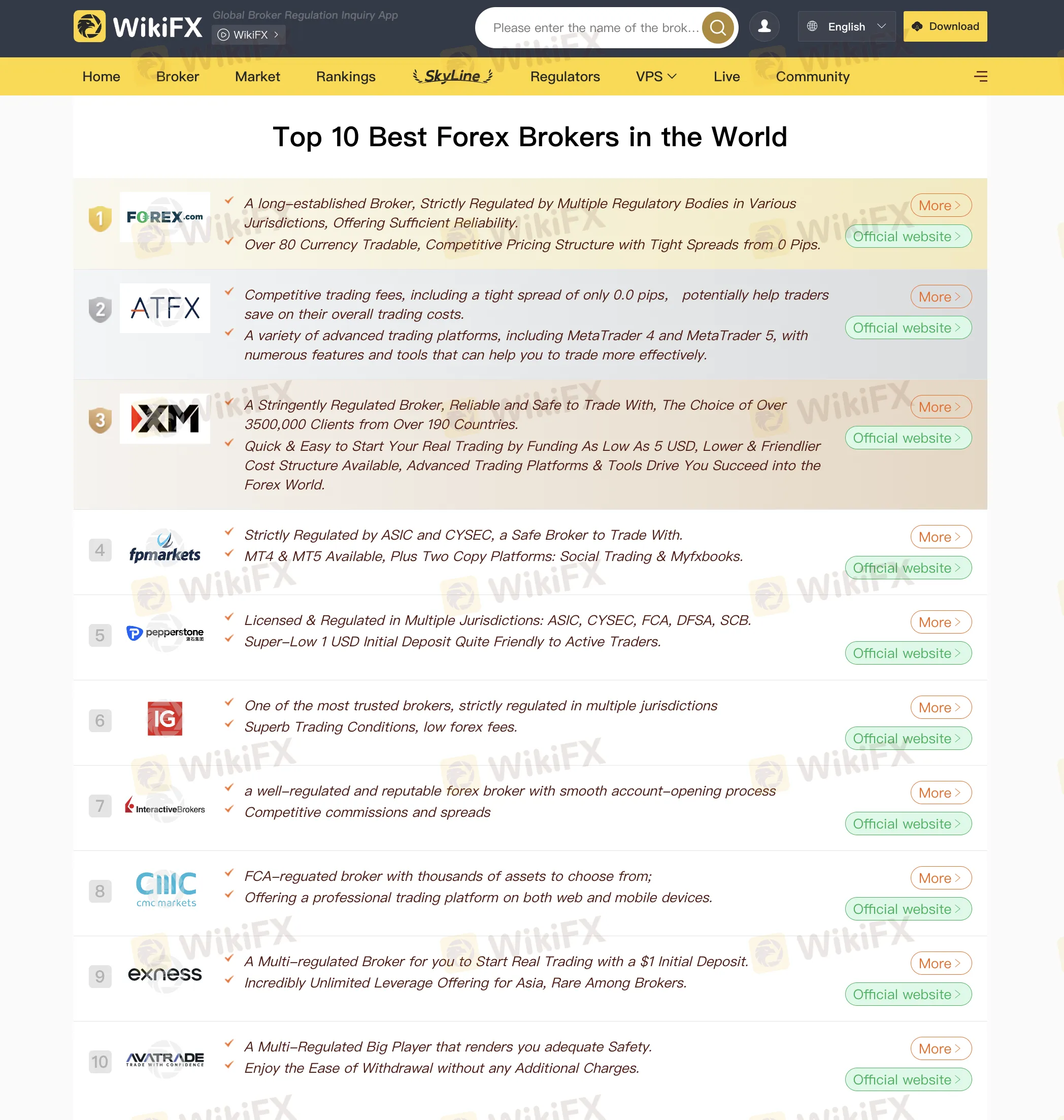

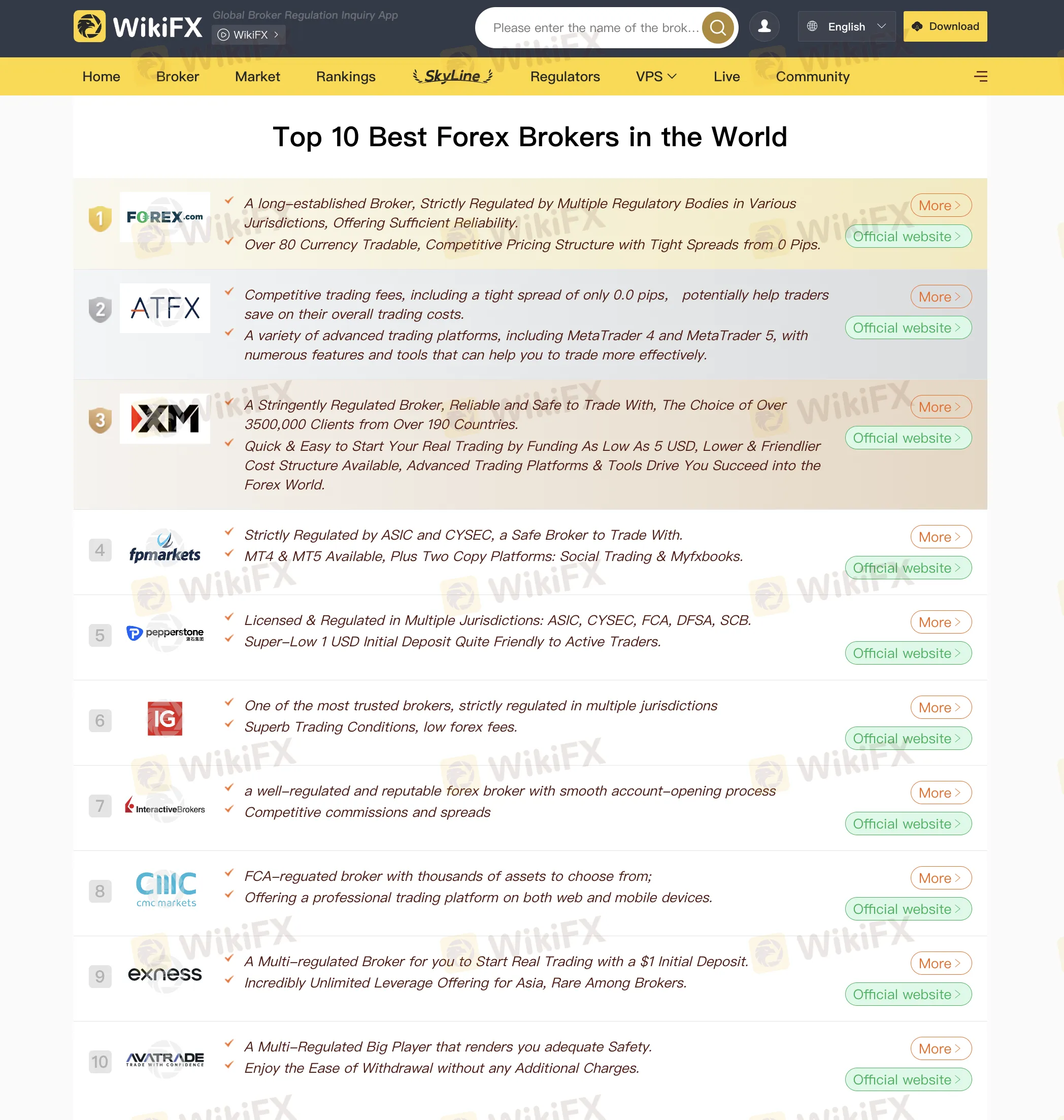

Choosing Platforms and Brokers

Your forex robot is only as good as the environment it operates in. Thats why choosing the right trading platform and regulated broker is critical to your success.

For platforms, MetaTrader 4 and MetaTrader 5 remain the most popular choices for forex EAs. They support expert advisors (EAs), offer rich indicator libraries, and connect to thousands of brokers globally.

When selecting a broker, heres what to prioritize:

- Regulation: Work only with licensed brokers under authorities like FCA, ASIC, or CySEC

- Execution speed: Latency matters. Even milliseconds can impact algorithmic trading

- Security: Ensure client fund segregation and negative balance protection

- Platform compatibility: Confirm EA support and no restrictions on auto-trading

- Responsive support: Quick help is essential when bots misfire or servers go down

The best setup combines a reliable EA, fast infrastructure, and a broker that wont interfere with your automation.

Strategy Building for Beginners

Takeaway: Start simple, follow trends, and focus on rules you can test and repeat consistently.

Start Simple—And Stay Consistent

When building your first forex trading robot, simplicity is your greatest asset. A straightforward strategy reduces risk, simplifies debugging, and speeds up testing. One of the most popular entry points is the moving average crossover—your robot opens a trade when a short-term average crosses above or below a long-term one. You can also add an RSI filter to detect overbought or oversold conditions, making the signals more reliable.

Avoid countertrend setups at the beginning. Instead, design your bot to follow the prevailing market trend. For example, pair momentum-based entries with filters based on major economic events, like rate decisions or payroll data. This helps your robot operate on high-probability moves without unnecessary complexity.

Define the Rules Before You Code

No trading bot can succeed without clear rules. Precision is essential. Start by defining exactly when your robot should enter and exit trades. A simple rule might be: “Buy when the 9-period moving average crosses above the 21-period average; sell when it crosses below.” Then, layer in stop-loss and take-profit targets to manage outcomes.

Beyond entries and exits, make sure your rules also cover:

- Maximum risk per trade (e.g., 1–2% of total capital)

- Behavior during high-volatility events or news releases

- How to interpret your chosen indicators

- Exit logic for sudden market reversals

- Documentation of every condition before coding starts

Planning your logic in advance helps avoid coding mistakes and ensures your robot behaves as expected under pressure.

Set Realistic, Testable Goals

Your robot needs a clear mission. Dont aim for unrealistic returns or overly complex strategies at first. Instead, build a system that reacts consistently to specific market conditions—like price moves after a central bank statement or a strong breakout from a support zone.

Your development process should include:

- One clear, backtested trading idea

- Logic that works across different currency pairs and timeframes

- Code that is modular and easy to troubleshoot

- A results-driven testing framework with detailed metrics

- Constant awareness of drawdown and risk-to-reward performance

Focus on repeatability, not brilliance. Your first trading robot should be reliable, low-maintenance, and transparent—something you trust to run even when youre away from the screen.

Building Your Forex Robot: From Plan to Execution

Before you write a single line of code—or drag a block in a no-code tool—you need a structured trading plan. Outline every rule your robot will follow, from entry signals to risk controls. This eliminates confusion later and ensures your system is logical and testable.

Heres a practical workflow to follow:

- Define how your bot exits trades: set a fixed pip target or let indicators (like moving averages) determine take-profit points.

- Program your stop-loss strategy: use fixed stop-losses or dynamic trailing stops that adjust as price moves in your favor.

- Build a money management model: either fixed lot sizes or dynamic sizing based on account balance percentage.

- Gather high-quality historical data for testing. Accuracy here directly impacts your strategys reliability.

- Backtest your strategy across different market conditions to check for stability, not just profitability.

- Forward test on live or out-of-sample data to evaluate performance in real-world conditions.

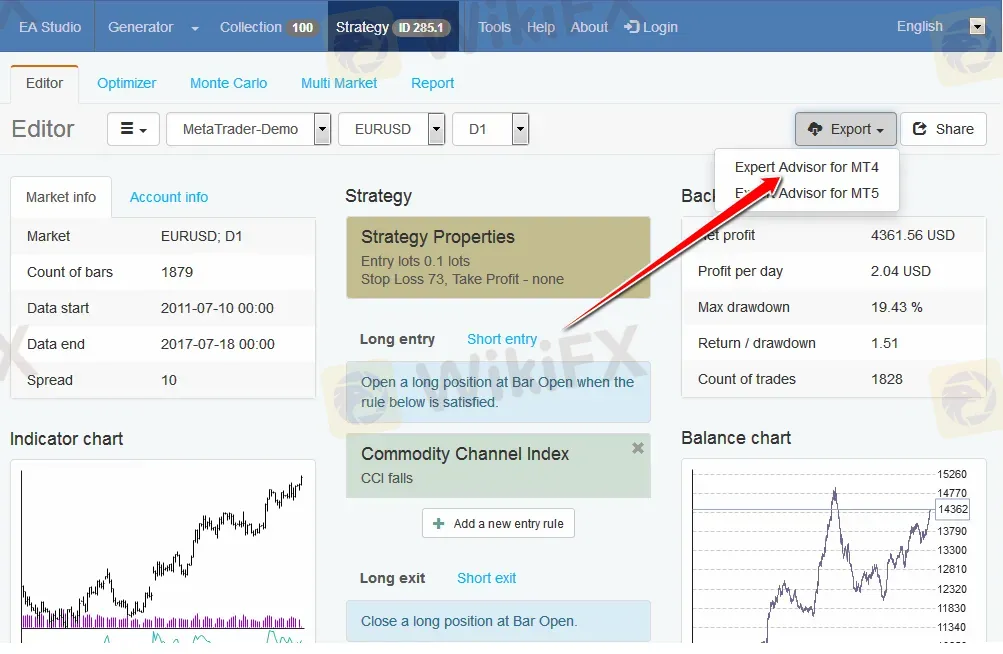

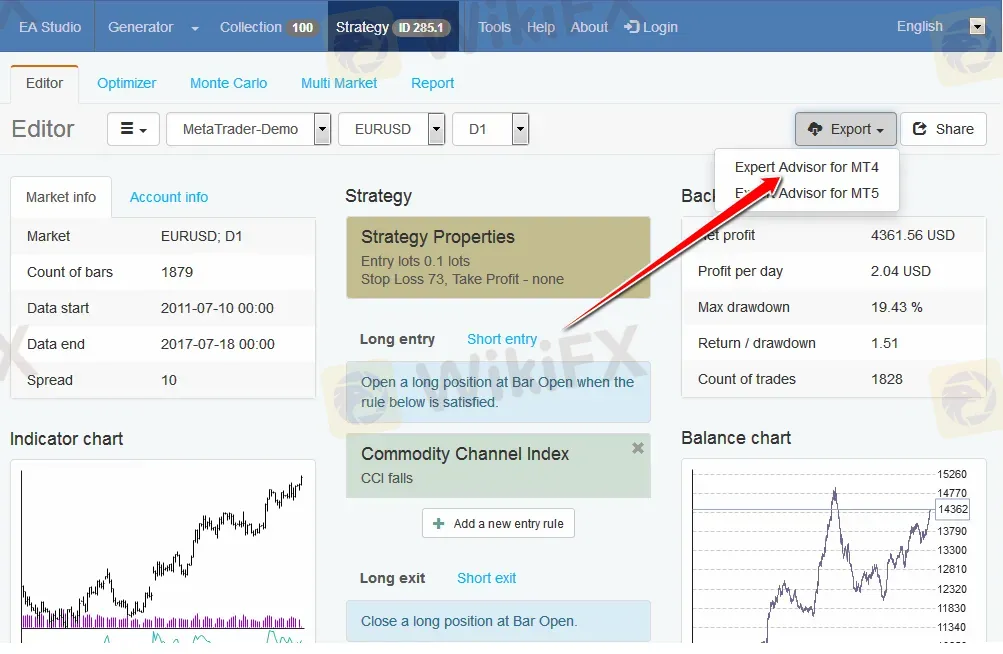

- Build your robot using code (e.g., MQL4, MQL5, Python) or no-code tools like EA Studio or AlgoBuilder.

- Stick to what you understand. Complex strategies you dont fully grasp are hard to debug or adapt.

- Run aggressive demo testing before going live. Validate every edge case.

- Keep refining. A robot should evolve with the market.

Tip: Document every element—your logic, conditions, and assumptions. This makes debugging and optimization faster and cleaner.

Code or No-Code? Choose Your Build Path

You can either code the robot yourself or use visual tools. Each has advantages. If youre technically inclined, coding gives full control. If not, no-code platforms make building much easier.

If youre coding:

- Use MQL4/MQL5 for MetaTrader, or Python for flexible external integration.

- Write clean, modular code. Use descriptive variable names and comments to simplify maintenance.

- Test each logic block before integrating it into the full system.

If youre using no-code tools:

- Platforms like EA Studio, AlgoBuilder, or Capitalise.ai let you define strategy logic through visual blocks or plain English.

- Combine indicators like RSI, MACD, and moving averages to form clear entry/exit conditions.

- Set stop-loss, take-profit, and lot size rules visually.

- Run immediate backtests and visualize metrics like win rate, profit factor, and drawdown.

- Export your bot directly to MetaTrader and launch in a few clicks.

Regardless of the path you choose, avoid overfitting. Your robot must work across timeframes and market conditions—not just one narrow setup. Re-test frequently and optimize conservatively.

Backtesting and Optimizing Your Trading Robot

Backtesting is your safety net. It shows how your robot would have performed historically using real price data. It wont predict the future—but it reveals flaws in your logic before real capital is on the line.

Steps for a reliable backtest:

- Use clean, high-resolution historical data—tick-level if possible. Sources like Dukascopy are excellent.

- Match your brokers live trading conditions: spreads, swap, leverage, and execution time.

- Simulate trades using a large sample size—at least 100,000 candles—to ensure statistical reliability.

- Focus on key metrics: drawdown, consistency, and profit-to-risk ratio—not just total profit.

After backtesting, move to optimization. But dont blindly chase the best parameter set. That leads to curve-fitting. Instead, look for stable settings that perform well across different markets and timeframes.

Use advanced tools like:

- Walk-forward testing to validate optimization robustness

- Monte Carlo simulations to identify failure scenarios

This is where many robots fail—dont skip it.

Forward Testing: Prove It in Real Time

Takeaway: Real-time testing reveals issues that no simulation can—dont go live without it.

Backtests show what could work. Forward testing proves what does work—right now.

Deploy your bot in a demo environment with live market data. Watch how it handles:

- Real execution slippage

- Market spikes during economic events

- Delays in indicator response

- Unexpected drawdowns or missed signals

This step often reveals issues your backtest missed. Only after your bot performs reliably in forward testing should you risk live capital. Start small, and track every trade outcome vs. expectation.

Deployment and Monitoring in Live Markets

Once you‘ve tested thoroughly, it’s time to go live. But launching a trading robot doesnt mean stepping away. Monitoring is critical.

Live deployment checklist:

- Install on MetaTrader 4/5 or your preferred platform

- Enable AutoTrading and load your configuration

- Start with small capital and conservative risk settings

- Monitor daily: review trade logs, drawdown, profit/loss, and trade behavior

- Adjust only when necessary—dont micromanage unless performance shifts

Markets evolve. You must re-optimize and update periodically. Use VPS hosting for 24/7 uptime and low latency. Treat your robot like a living system—it wont run on autopilot forever.

Risk Management and Ongoing Improvement

Managing Risk in Forex Robot Trading

No forex robot can succeed without a solid risk management plan. Automation doesnt protect you from poor decisions—it amplifies them. Treat risk control as a non-negotiable foundation from day one.

Make sure your system includes:

- A stop-loss and take-profit rule for every trade to cap downside and secure gains

- Strict control over leverage—never risk more than you can afford to lose

- Diversification across strategies and currency pairs to spread risk

- Smart position sizing: typically 1–2% of your account per trade, adjusted for volatility

- A trading journal to record logic, entries, exits, and results for future analysis

- Daily monitoring of performance—even with automation, you stay in command

Tip: Stick to a minimum risk-reward ratio of 1:2. This helps your winners consistently cover your losses.

Avoiding Common Mistakes

In automated trading, small mistakes can scale into large losses. Prevent these common errors before they happen:

- Dont overfit your strategy. A backtest that looks too perfect usually fails in live conditions

- Dont ignore your broker. Choose one with reliable execution, tight spreads, and minimal slippage

- Dont panic. Emotional decisions in live trading often lead to costly adjustments

- Dont set and forget. Market conditions shift, and your risk settings must adapt with them

Note: Always test your robot in a demo environment first. Its your last line of defense before going live.

Continuous Improvement Keeps Your Robot Relevant

The forex market is dynamic—and your robot must evolve to keep pace. Improvement is not a one-time task, but a continuous cycle.

Heres how to maintain performance:

- Re-backtest and optimize with the latest data before every redeployment

- Code risk-management logic directly into your robot, not just in your manual routine

- Adapt to macro events, volatility spikes, and structural changes in currency behavior

- Explore new technologies like AI or reinforcement learning for smarter logic building

- Use a reliable Forex VPS to maintain 24/7 execution with minimal latency

- Stay informed. Study algorithmic trends, macro news, and platform updates regularly

Callout: A robots performance reflects the quality of your thinking. Keep improving both.

Final Checklist Before Going Live

Before you launch your forex robot with real money, make sure everything is in place:

- Youve built your system using either code or no-code platforms

- Youve completed backtesting and forward testing in demo mode

- Key metrics—like drawdown, consistency, and profit factor—have been validated

- Youre using a regulated, low-latency broker with strong execution

- The robot is hosted on a stable VPS for uninterrupted operation

- Risk rules are in place: stop-loss, leverage limits, and trade sizing

- Youve started small and prepared for continuous updates

Let the robot trade. You remain in control.

FAQ: Forex Robot Trading

Can I build a forex trading robot without coding?

Yes. With tools like EA Studio, AlgoBuilder, or Capitalise.ai, beginners can create fully functional robots using drag-and-drop or plain-English instructions.

How long does it take to build and test a forex robot?

Usually 7–14 days. Planning and strategy take a few days. Backtesting and forward testing require another week for reliable validation.

Do I need to monitor my forex robot after it goes live?

Absolutely. Automated doesnt mean unattended. You must track performance, watch for bugs, and update strategy parameters over time.

Whats the biggest risk when using a forex robot?

Over-optimization. A strategy tuned too tightly to historical data may collapse under live conditions. Always test with fresh, unseen data before deployment.