Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Equiti and its licenses.

Equiti is a multi-jurisdictional broker offering financial services under several regulatory frameworks. With licenses issued by both established and offshore regulators, Equiti demonstrates a broad geographic presence. WikiFX assigns Equiti a WikiScore of 6.25 out of 10, reflecting a moderate performance in areas such as compliance, trading conditions, and operational transparency.

Equiti holds a license from the Cyprus Securities and Exchange Commission (CySEC) under license number 415/22. CySEC is a well-recognized regulatory authority within the European Economic Area, responsible for overseeing investment firms, financial transactions, and collective investment schemes in Cyprus. The license held by Equiti falls under the Straight Through Processing (STP) model, which typically indicates that the broker routes client orders directly to the market without internal dealing desk intervention. This regulatory approval enhances the brokers credibility within the European market.

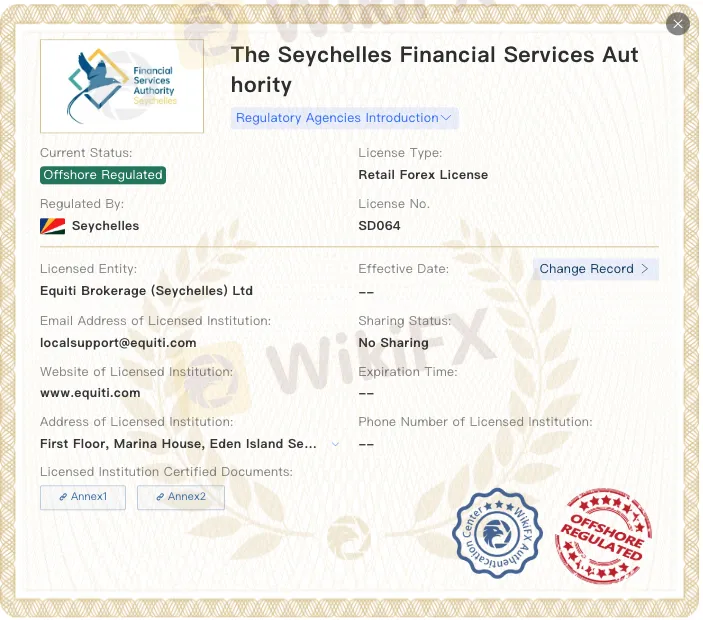

The broker is also licensed by the Seychelles Financial Services Authority (FSA) under license number SD064. The FSA governs non-bank financial services in Seychelles, including retail forex brokers. This offshore license allows the broker to operate with fewer regulatory constraints, but may also offer a lower degree of investor protection compared to more strictly regulated jurisdictions.

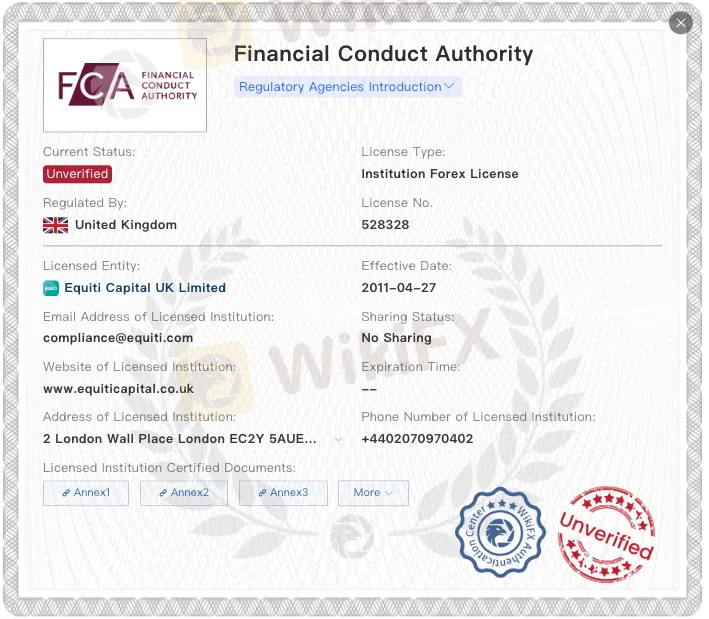

In addition, Equiti is listed under the United Kingdom‘s Financial Conduct Authority (FCA) with license number 528328. The FCA is a highly regarded financial watchdog known for its rigorous compliance standards. However, it is important to note that this license is currently marked as unverified, suggesting the need for caution and additional research to confirm the broker’s regulatory status under the FCA framework.

With a WikiScore of 6.25/10, Equiti is placed in the mid-range among global brokers listed on WikiFX. This score takes into account various factors, including licensing integrity, business operations, trading environment, risk management, and user feedback. The combination of onshore and offshore licenses reflects a diverse operating strategy, although the presence of an unverified FCA listing may require further clarification for clients focused on regulatory security.

Equiti operates under a mix of regulatory licenses, including those from CySEC in Cyprus and the FSA in Seychelles, offering a balance between regulatory oversight and operational flexibility. While the verified CySEC license adds credibility, the offshore license and unverified status under the FCA raise questions that should not be overlooked by potential traders. As with any financial service provider, individuals are advised to carry out thorough due diligence and understand the scope and limitations of the regulatory coverage before engaging with the broker.