简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IC Markets Review: A Global Choice for Forex & CFD Traders

Abstract:With industry-leading spreads, excellent execution infrastructure, and extensive range of investment opportunities, IC Markets Global bills itself as a top-notch multi-asset trading platform. With over 2,250 tradable instruments and creative trading technology, it attracts to both institutional and personal clients all around.

Overview of IC Markets

| IC Markets Global | |

| |

| Registered in | Seychelles |

| Regulatory Status | Regulated(ASIC, CYSEC) |

| Year Founded | 2007 |

| Market Instruments | Forex, Commodities, Indices, Cryptocurrencies, Bonds, Futures, Stocks CFDs |

| Minimum Spread | From 0.0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Deposit/Withdrawal Methods | Credit/Debit Cards, PayPal, Skrill, Neteller, and more |

With industry-leading spreads, excellent execution infrastructure, and extensive range of investment opportunities, IC Markets Global bills itself as a top-notch multi-asset trading platform. With over 2,250 tradable instruments and creative trading technology, it attracts to both institutional and personal clients all around.

Pros and Cons

| Pros | Cons |

| Spreads starting from 0.0 pips | Services unavailable in restricted countries(USA, Canada, and Israel) |

| Over 2,250 tradable instruments across multiple asset classes | No bonuses or promotional offers compared to some competitors |

| Supports advanced trading platforms (MT4, MT5, cTrader) | |

| Free VPS access for algorithmic traders | |

| Dedicated infrastructure for fast execution (under 40ms average speed) |

Where IC Markets Global Shines

✅ 2,250+ tradable instruments: Forex, commodities, cryptocurrencies, indices, bonds, futures, and stocks CFDs are among the 2,250+ trading assets IC Markets Global offers as investing choices.

✅ Low spreads: Spreads starting from 0.0 pips.

✅ Flexible account types: The platform accepts Standard, Raw Spread, and cTrader accounts

✅ High-performance trading infrastructure: Equinix NY4 data centers and low-latency servers provide a high-performance trading infrastructure that IC Markets Global guarantees quick execution rates of less than 40ms.

✅ Comprehensive trading platforms: Traders can choose from MetaTrader 4, MetaTrader 5, and cTrader.

✅ Algo-trader friendly: Supported by free VPS access and institutional-grade liquidity, over 60% of trades are algorithmic, algo-traders friendly.

Where IC Markets Global Falls Short

❌ Service restrictions: The platform does not provide services to residents of countries, like the United States, Canada, and Israel.

❌ No bonuses or promotional offers

IC markets Regulation

IC markets is regulated by ASIC and CYSEC.

| Regulatory Authority | License Type | License No. | Licensed Institution | Country | Effective Date |

| Australia Securities & Investment Commission (ASIC) | Market Making (MM) | 335692 | INTERNATIONAL CAPITAL MARKETS PTY. LTD. | Australia | 2009/7/2 |

| Cyprus Securities and Exchange Commission (CySEC) | Market Making (MM) | 362/18 | IC Markets (EU) Ltd | Cyprus | 2018/6/25 |

You can review the regulatory situation and other information about IC Markets Global on WikiFX, the most used forex broker database worldwide. From broker credentials to regulatory compliance to historical data to user comments and risk assessments, WikiFX provides insights. Using information from more than 60 worldwide regulatory bodies, WikiFX is a reliable tool for evaluating brokers such as IC Markets Global's dependability and openness.

IC Markets Global Review on Products

Investing with IC Markets Global provides something for everyone, much like having access to a well-stocked buffet would. Its roughly 2,250 traded instruments spanning a broad spectrum of asset classes allow traders diversify their portfolios and properly control risks. Should your Forex positions provide difficulties, for example, your commodities or stock CFDs could assist in performance balance. Here is a closer view at IC Markets Global's offerings:

- Forex CFDs: Starting from 0.0 pip, trade 61 money pairings including majors, minues, and exotics with close spreads.

- Cryptocurrency CFDs: View 21 well-known cryptocurrencies including Ripple, Ethereum, and Bitcoin. These are open for trading around-the-clock using leverage of 1:200 on MT4/MT5 and 1:5 on cTrader.

- Bonds CFDs: Trade 9 worldwide government bonds—including those from Japan, the US, and the UK. Leverage up to 1:200 makes this a critical addition to portfolio diversification and hedging.

- Indices CFDs: IC Markets Global provides 25 indices from key worldwide markets including the US30 and AUS200. Start with 0.4 points and use leverage up to 1:200.

- Commodities CFDs: Trade metals like gold, oil, wheat, and coffee; trade energy and agriculture. Leverage offers adjustable lot sizes for different trading approaches and spans up to 1:500.

- Stocks CFDs: From significant exchanges including the ASX, NYSE, and NASDAQ, choose from more than 2,105 large-cap companies. Leverage spans 1:20; dividend income is also easily available.

- Futures CFDs: Access 4 global futures, such as the ICE Dollar Index and CBOE VIX IndexFutures CFDs offer leverage right up to 1:200.

ETFs and mutual funds are 2 items you won't find here, since IC Markets Global just focuses on CFDs. But the great variety of Forex, stocks, and commodities gives traders lots of chances to create a varied portfolio.

Tradable Instruments

| Instrument | Supported |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Stocks CFDs | ✔ |

| Commodities CFDs | ✔ |

| Indices CFDs | ✔ |

| Bonds CFDs | ✔ |

| Futures CFDs | ✔ |

| ETFs | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

IC Account Types

From novices to experienced experts, IC Markets Global provides a range of account types catered to fit the requirements of various traders. Low minimum deposits, competitive trading conditions, and access to modern trading platforms define every account type.

Account Comparison

| Account Type | Platform | Spreads From | Commission | Target Audience |

| Raw Spread (cTrader) | cTrader, TradingView | 0.0 pips | $3.0 per $100k traded | Day traders, scalpers, algo-traders |

| Raw Spread (MetaTrader) | MT4, MT5 | 0.0 pips | $3.5 per lot per side | Expert advisors (EAs), scalpers |

| Standard | MT4, MT5 | 0.8 pips | None | Discretionary traders |

| Islamic | All | As per chosen type | None or as applicable | Sharia-compliant traders |

Raw Spread (with spreads starting from 0.0 pips and a $3.5 commission per lot), Standard (commission-free with spreads from 0.8 pips), and cTrader Raw Spread (spreads from 0.0 pips and a $3.0 commission every $100,000). IC Markets Global offers three basic account types: Although sophisticated traders may find less customized tools, this range guarantees reasonably priced solutions for newbies and scalpers.

IC Fee Structure

Focusing on low trading expenses for several sorts of traders, IC Markets Global provides a clear and competitive charge structure throughout all account forms. The fees are broken out here in great detail:

| Account Type | Platform | Spreads From | Commission |

| Raw Spread (cTrader) | cTrader, TradingView | 0.0 pips | $3.0 per $100,000 traded per side |

| Raw Spread (MetaTrader) | MT4, MT5 | 0.0 pips | $3.5 per lot per side |

| Standard | MT4, MT5 | 0.8 pips | No commission |

Spreads

- IC Markets Global offers low spreads, starting from 0.0 pips on Raw Spread accounts.

- Average spreads for major currency pairs:

- EUR/USD: 0.1 pips

- GBP/USD: 0.3 pips

- AUD/USD: 0.2 pips

Commissions

- Raw Spread (cTrader): $3.0 per $100,000 traded per side.

- Raw Spread (MetaTrader): $3.5 per lot per side ($7.0 round turn).

- Standard Account: No commission, but spreads start from 0.8 pips.

Deposit & Withdrawal Fees

- IC Markets Global does not charge fees for deposits or withdrawals. However, third-party fees (e.g., bank transfers) may apply.

Leverage

- IC Markets offers max to 1:500 leverage.

Fee Comparison with Competitors

Though its low-cost trading policies set IC Markets Global apart, how does it measure against other top brokers in terms of fees?

| Broker | Spreads From | Commission | Deposit Fee | Withdrawal Fee | Non-Activity Fee |

| IC Markets Global | 0.0 pips (Raw Spread) | $3.0 per $100k (cTrader) / $3.5 per lot (MetaTrader) | None | None | None |

| XM | 0.6 pips (Standard) | None | None | None | None |

| Pepperstone | 0.0 pips (Razor) | $3.5 per lot (MetaTrader) | None | None | None |

| Exness | 0.3 pips (Standard) | None | None | None | None |

| FP Markets | 0.0 pips (Raw) | $3.0 per lot per side (MetaTrader) | None | None | None |

Among the lowest in the business, IC Markets Global distinguishes itself mostly for its raw spreads beginning from 0.0 pip. It provides low commission fee MetaTrader and cTrader platforms unlike many rivals. Furthermore, more affordable than brokers charging for these services are IC Markets Global's fee-free deposits, withdrawals, and inactivity.

IC Markets Global Review on Trading Platforms and Tools

IC Markets Global gives traders a wide spectrum of tools and platforms meant to improve their trading experience. These systems include tools for manual, algorithmic, and social trading, therefore serving traders of various kinds.

Trading Platforms

Offering MT4, MT5, cTrader, and tradingView, IC Markets gives traders flexible platform choices. These dependable systems enable sophisticated capabilities including one-click trading, algorithmic trading, and customisable charts.

| Platform | |

| MetaTrader 5 (MT5) | Windows, Mac, iOS, Android |

| MetaTrader 4 (MT4) | Windows, Mac, iOS, Android |

| cTrader | Web, iPhone/iPad, Android, iMac |

| TradingView | Web, desktop, mobile |

Trading Tools

| Tools | |

| Virtual Private Server (VPS) | Ensures fast and secure automated trading with low latency. |

| Trading Servers | Optimized for low-latency order execution, hosted in Equinix NY4 data center. |

| MetaTrader Advanced Tools | Includes additional indicators, expert advisors, and technical analysis add-ons. |

| IC Insights | Market data and actionable insights for informed trading decisions. |

| Trading Central | Provides technical analysis, strategy recommendations, and trading alerts. |

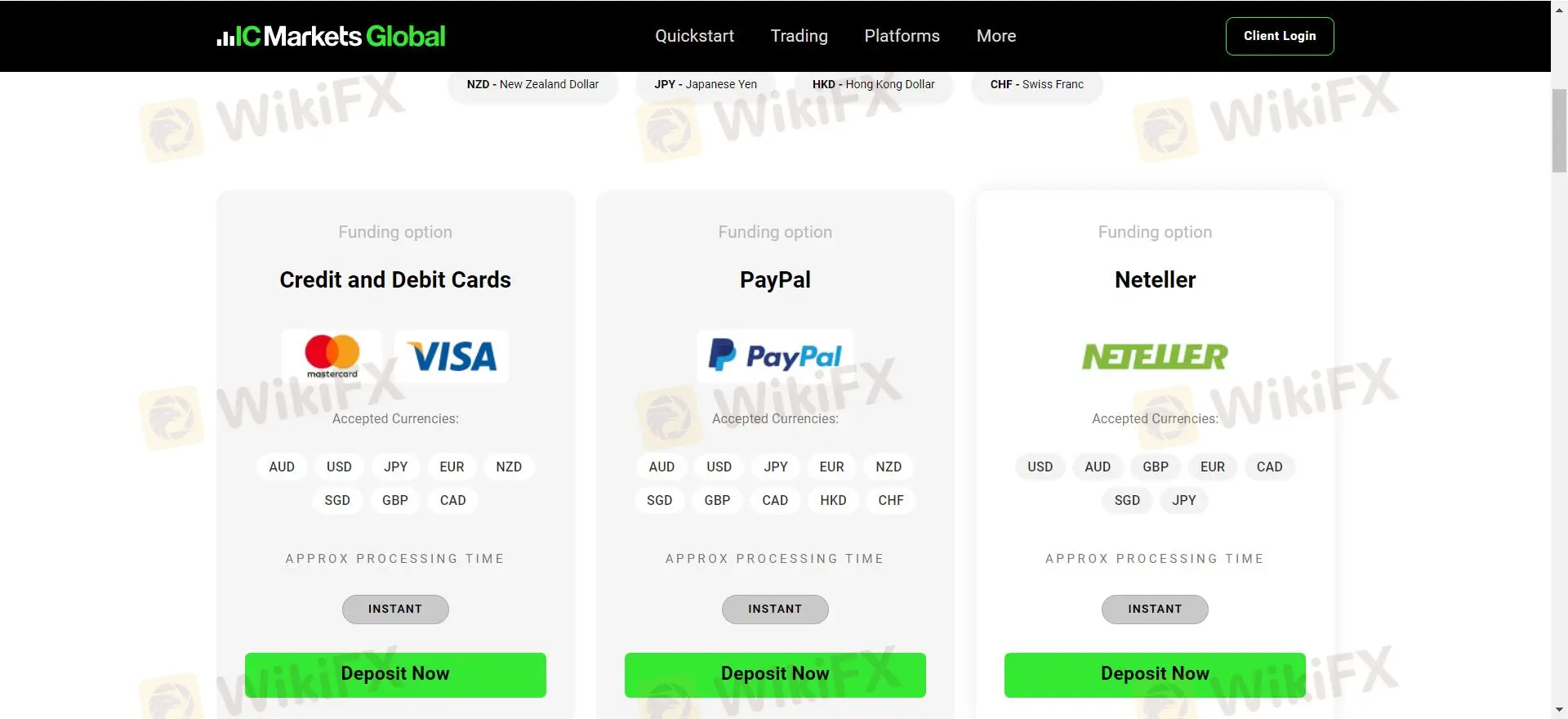

Funding and Withdrawal Methods

IC Markets Global offers over 15 funding methods in 10 base currencies. It's convenient for global traders.

| Funding Method | Currencies | Processing Time | Fee |

| Credit/Debit Card | AUD, USD, EUR, JPY, GBP, CAD | Instant | None |

| PayPal | AUD, USD, EUR, JPY, GBP, HKD | Instant | None |

| Neteller/Skrill | AUD, USD, EUR, JPY, GBP, SGD | Instant | None |

| UnionPay | RMB | Instant | None |

| Bank Wire Transfer | AUD, USD, EUR, JPY, GBP | 2–5 business days | Bank fees may apply |

| POLi/Bpay (Australia) | AUD | Instant/12–48 hours | None |

| Rapidpay/Klarna | EUR, GBP | Up to 2 business days | None |

Also, for both manual and automatic as well as social traders, IC Markets Global's platform range and sophisticated tools make it a flexible choice.

Is IC Markets Global Suitable for Beginners?

For beginners, IC Markets Global is regarded as a good choice since it provides tools that streamline the trading procedure yet preserve a professional-grade knowledge.

| Why Its Suitable | |

| Low Spreads | Spreads starting from 0.0 pips help beginners minimize trading costs. |

| User-Friendly Platforms | Supports intuitive platforms like MetaTrader and TradingView, with a straightforward learning curve. |

| Demo Accounts | Free demo accounts allow new traders to practice without risking real money. |

| No Hidden Fees | Transparent pricing with no deposit, withdrawal, or inactivity fees ensures cost predictability for new traders. |

| Flexible Funding Methods | Offers 15+ funding options with instant processing for most, simplifying account setup. |

Thanks to its low-cost trading environment, many platforms, and thorough support options, IC Markets Global is, all things considered, a great broker for novices. For those prepared to invest time, IC Markets Global offers a great basis for a profitable trading path.

For a comprehensive evaluation, you can check IC Markets Global's score on WikiFX at https://www.wikifx.com/en/dealer/9641842942.html. IC Markets boasts an impressive dynamic score of 9.1, highlighting its excellent overall performance. With beginner-friendly features like low spreads, transparent fees, and extensive support, it stands out as a safe and reliable choice for new traders looking to enter the market confidently.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator