WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we will conduct a comprehensive examination of Oroku Edge, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Oroku Edge, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2021 and headquartered in Saint Vincent and the Grenadines, Oroku Edge operates as an online brokerage specializing in trading exchanged CFDs.

Oroku Edge offers a variety of financial instruments for trading, including currency pairs, precious metals, global indices, energy products, and cryptocurrencies.

Additionally, Oroku Edge offers a copy trading service through its Copytrade Standard Account, enabling money managers and traders to improve efficiency, profitability, and generate passive income through copy trading.

The official website of Oroku Edge is https://www.orokuedgemarkets.com/. Currently, the website only supports English, which may cause inconvenience for users from non-English savvy users.

At present, Oroku Edge only accepts clients from Asia & Pacific confederation specifically from South East Asia. Oroku Edge does not provide services to residents of the Americas region, Arab states, CIS countries, and European nations.

Types of Accounts:

Oroku Edge offers four account options: the Prime Account, the Flex Bonus Account, the ECN Account, and the Raw Account. Swap-free Islamic Account is also available for each account type. Please refer to the attached image below for detailed information on each corresponding account.

Deposits and Withdrawals:

Oroku Edge offers a limited selection of deposit and withdrawal methods, including online banking options such as Surepay and Help2Pay, as well as local depositors like RBY Resources and Tasma Network. However, it's worth noting that WikiFX suggests that a reputable broker typically offers a broader range of established options, such as Visa and Mastercard.

While Oroku Edge states that client funds are securely held in a Tier 1 Bank, there is a lack of further information or evidence provided to substantiate this claim.

Oroku Edge enforces minimum requirements for both deposit and withdrawal transactions. Clients have the option to make deposits 24/7, with a minimum amount of $10 per transaction, utilizing online banking or local depositors. For withdrawal requests, a minimum amount of $11.37 is required, using the initial deposit method through online banking or local depositors. Oroku Edge asserts that withdrawal requests will be processed within 24 working hours.

Trading Platforms:

Oroku Edge exclusively offers the renowned MetaTrader (MT4) trading platform as its sole option. The MT4 platform, accessible on PC, mobile, and web, is widely utilized across the industry for its advanced features. It provides a comprehensive suite of tools for precise trading analysis, including one-click trading, quick order execution, VPS hosting, and up to four pending order types, alongside trailing stops. The platform offers a highly customizable interface with thousands of online tools available for integration. Additionally, it supports fully customizable and in-depth charts, detailed trading history, and allows users to create or import Expert Advisors (EAs) for automating trading strategies.

Research and Education:

Oroku Edge's official website does not offer information on research and educational resources.

Customer Service:

Oroku Edge provides customer service support through email at support@orokuedge.com and the Website Live Chat. However, there is no available information regarding foreign language support. No direct contact number is provided to reach Oroku Edge directly. The address stated on the website is First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

As mentioned earlier, the official website of Oroku Edge only supports English, which may inconvenience users who are not proficient in the language.

Conclusion:

To summarize, here's WikiFX's final verdict:

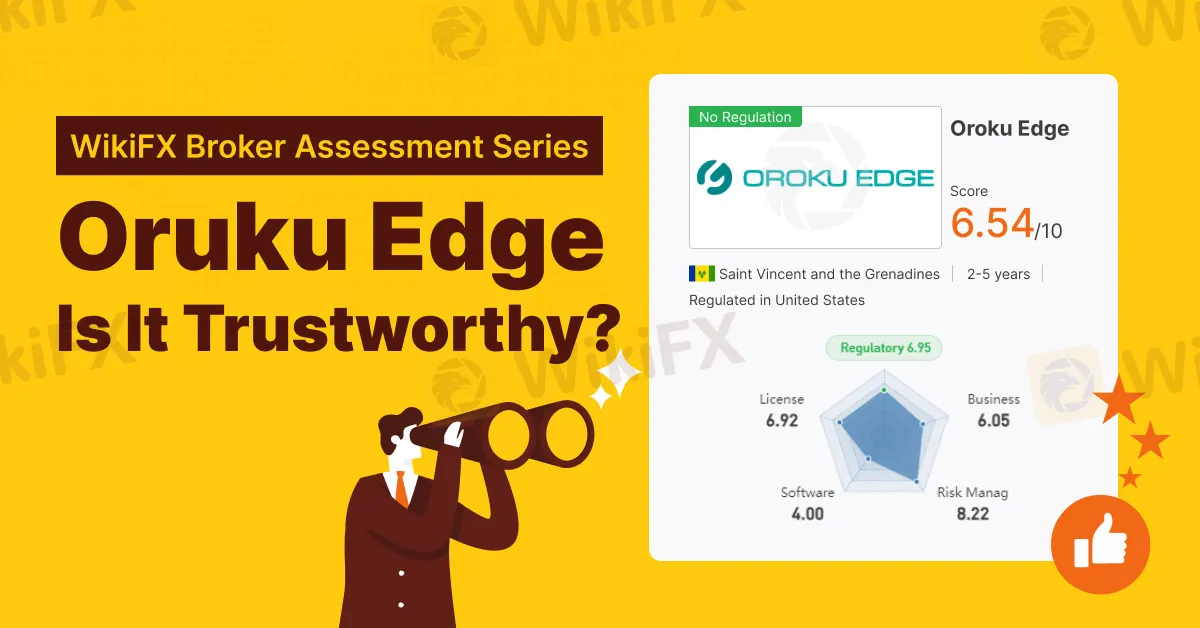

WikiFX, a global forex broker regulatory platform, has assigned Oroku Edge a WikiScore of 6.54 out of 10.

Upon examining Oroku Edge‘s license, WikiFX found that the broker is only registered with the United States’ National Futures Association.

In light of the various shortcomings mentioned earlier, WikiFX urges our users to consider opting for another broker with a higher WikiScore to ensure better protection and trading experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.