Monaxa Scam Exposed: Withdrawal Delays and Fraud

Monaxa scam exposed: denied payouts, downtime, profit manipulation, weak offshore license. Protect your money—read full broker review now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

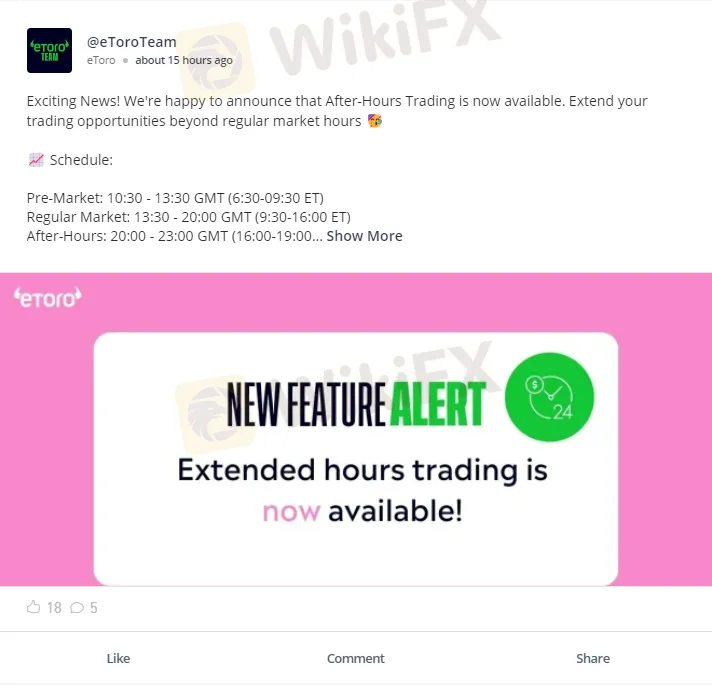

Abstract:eToro introduces After-Hours Trading, offering extended trading hours and more asset options. This article breaks down the schedule, available assets, benefits, and potential risks of this new feature. Stay informed and maximize your trading opportunities with eToro's latest addition.

In a move to provide traders with even more flexibility, eToro has announced the launch of its new After-Hours Trading feature. This innovative addition will enable traders to extend their trading hours beyond the typical market timings, granting them more opportunities to react to market changes.

The trading timings will now be segmented into three main windows:

Pre-Market: 10:30 - 13:30 GMT (6:30-09:30 ET)

Regular Market: 13:30 - 20:00 GMT (9:30-16:00 ET)

After-Hours: 20:00 - 23:00 GMT (16:00-19:00 ET)

Several prominent assets will be available for After-Hours Trading. This includes big names like Tesla (TSLA.EXT), Amazon (AMZN.EXT), Apple (AAPL.EXT), and more. It's important to note that these extended markets trading (both pre and post-market hours) will be offered exclusively through leveraged CFD and can be identified by a separate symbol ending with .EXT.

To simplify, the .EXT symbol denotes an extended-hours trade. These symbols represent the same stock but are distinguished from regular trading hours. They come with a separate asset page displaying similar data, feed, and other content, with the added “Extended” icon to mark its difference from the regular assets.

Immediate Reaction to News and Earnings Reports: Numerous companies release crucial information outside of the standard trading hours, causing potential significant price movements. This feature will allow traders to respond instantly.

Greater Flexibility: Depending on individual schedules, traders now have more options to execute trades.

Opportunity for Better Prices: The potential exists for traders to purchase stocks at more favorable prices during these hours.

Preparation for Standard Hours: Insight into the potential opening price of a stock during extended hours can set traders up for success during regular market timings.

It's crucial for traders to understand that the extended-hours market usually sees less trading volume. This could lead to more volatile price movements which might not always represent the broader market sentiment.

Those looking to explore the new feature can find extended-hours stocks on eToro's Discover page or simply use the search bar in the eToro app. Input the name of the desired stock and look for the .EXT asset.

The process remains straightforward. Traders can enter post-market orders using the same screens they would for regular CFD trades.

In conclusion, eToro's new feature offers traders more opportunities and flexibility, but as with all trading, understanding the system and potential risks is vital. Happy trading!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Monaxa scam exposed: denied payouts, downtime, profit manipulation, weak offshore license. Protect your money—read full broker review now!

ProMarkets, an unregulated St. Vincent broker, faces WikiFX warnings, frozen withdrawals, and fake profits. Avoid deposits—check reviews and protect your funds.

When you look up information about UPFOREX Deposit and UPFOREX Withdrawal, you want clear answers about how to move your capital. You need to know the ways to do it, the costs, and how long it takes. We will give you those details, but first, we must talk about something more important: keeping your capital safe. How a transaction works doesn't matter if the investments made aren't protected. The most important thing that keeps your capital safe is whether a broker follows government rules. Our detailed study of public government records shows that UPFOREX works without proper approval from any trusted financial authority. This fact completely changes what any deposit or withdrawal means. It turns a simple bank transaction into a very risky gamble. Our research, checked against independent verification websites, gives this broker a very low trust score. This shows major warning signs that all potential and current users must think about before doing any transaction. This article give

TradingMoon, an offshore Seychelles broker (FSA SD042), faces high fraud risk Read our exposure on fraud alerts—protect funds now!