Abstract:Accumarkets is an online forex broker offering a bunch of financial instruments. Recently this broker has come to our eyes. In this article, we want to show you the reliability of Accumarkets by analyzing different aspects.

About Accumarkets

Registered in South Africa, Accumarkets, owned by Elite Financial Services(Pty) Ltd, is an online forex broker offering traders various financial instruments, including Forex, Shares, Indices, Metals, and so on. This broker is newly established and the target market is South Africa. According to WikiFX, this broker has multiple business addresses.

Lack of Information on The Website

The website of this broker looks pretty shabby. There is a lot of information we cannot find on its website. We dont know what the leverage is and what trading platform Accumarkets use.

Is It Legit?

Accumarkets claimed to be regulated by FSCA. However, we found out that this broker exceeds the business scope regulated by FSCA with license number: 52677. Therefore, we cannot consider Accumarkets a regulated broker. Investing in an unlicensed broker is extremely dangerous as your money can not be protected under the regulation. WikiFX has given this broker a low score of 3.12/10. Investors need to think carefully before making a decision.

Account Types & Minimum Deposit

Accumarkets offers traders three different types of accounts. They are Cent Account, 100% Bonus Account, and Standard Account. The minimum deposit of this broker is $5.

Accumarkets on Social Media

Although Accumarkets does not have a long history in the industry, it has made a lot of efforts on social media platforms in order to promote itself. It has established official accounts on both Facebook and Instagram.

Withdrawal & Deposit

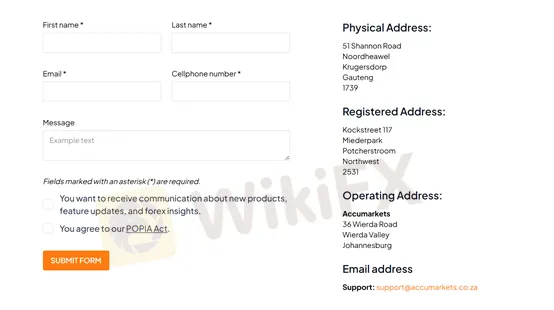

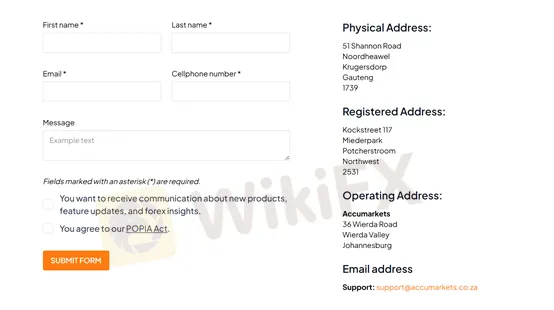

Contact Information

Accumarkets offers multiple choices for investors to contact them. Investors can contact Accumarkets via phone calls and sending emails.

Conclusion: Should We Trust Accumarkets?

As an unregulated broker, Accumarkets cannot protect traders funds if something goes wrong. You may lose all your fund if you invest in an unregulated broker. Besides, this broker has been given a low score by WikiFX, which is another red flag you should be aware of. WikiFX. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.