Abstract:The article discusses the increasing number of forex brokers in the foreign exchange market, citing reasons such as technological advancements and the growing popularity of forex trading among individual buyers. The increase in the number of brokers has led to improved trading conditions and increased competition, but also resulted in a rise in scams and deception. The article suggests that regulators need to monitor and control the industry to ensure a fair and open market, while traders need to exercise caution when choosing a broker.

Introduction

The foreign exchange (FX) market is the largest financial market in the world, with daily average transactions exceeding $6.6 trillion. It is not unexpected that there are more currency dealers now given the market's large traffic and income possibilities. This essay will examine the reasons for this development as well as how it affects individual shops and the business as a whole.

Reasons Behind the Increase

A few important reasons are to blame for the rise in forex dealers. First, technological developments have made it simpler and less expensive to launch a currency exchange. Forex firms no longer require costly infrastructure investments to perform deals thanks to the development of online trading tools and automatic trading systems. Due to the reduced entrance requirements for new agents, there is now an increase in rivalry.

The increasing popularity of forex dealing among individual buyers is another factor contributing to the rise in forex dealers. More people are looking to trade forex as a means to spread their assets and possibly make high yields as online trading sites have grown in popularity and information is more readily available. Because of this, there is a demand for forex dealers who give traders the resources and instruments they need.

The most popular and pioneer forex brokers in the industry

IG Markets

Oanda

Saxo Bank

Plus500

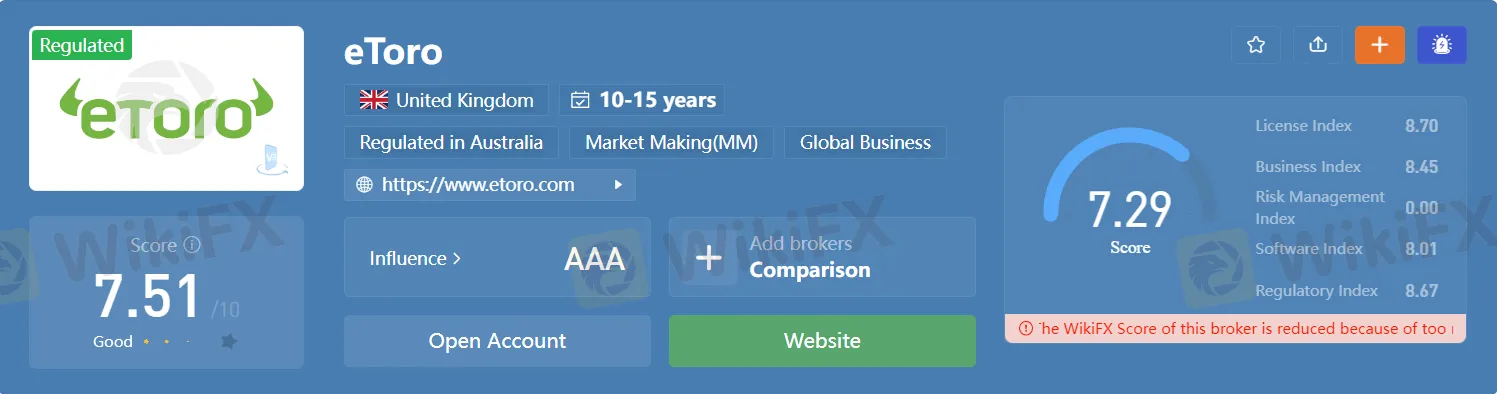

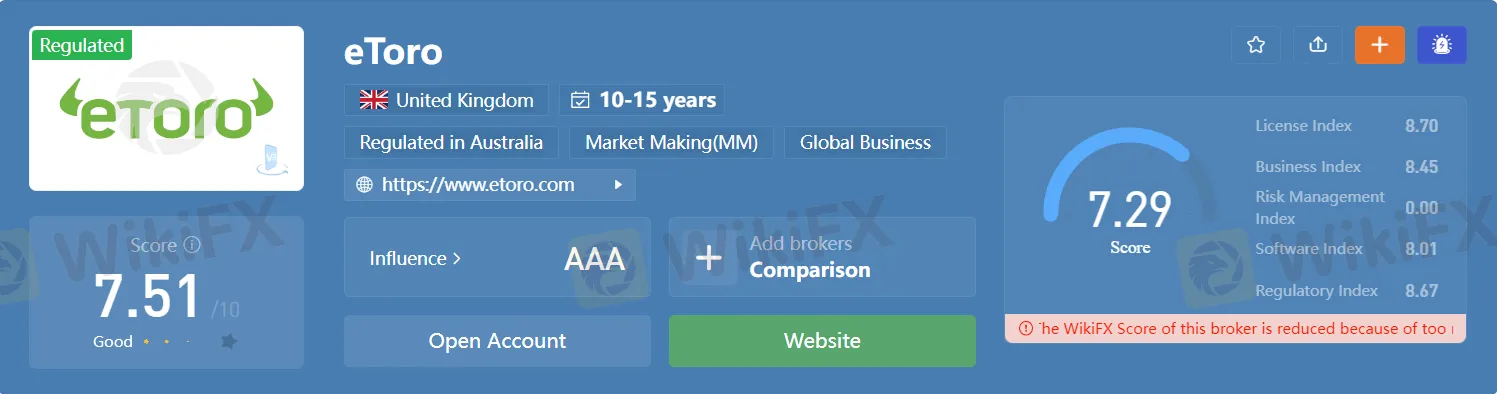

eToro

XM

AvaTrade

CMC Markets

FXCM

Pepperstone

The currency market is also very tightly controlled, which has contributed to a rise in traders. Companies must follow stringent rules and acquire permits from governing organizations in order to function as currency brokers. Because of this, the industry has become more trustworthy and open, attracting more agents and buyers equally.

Impact on Traders and the Industry

The proliferation of forex dealers has affected consumers and the sector in both good and bad ways. On the one hand, reduced margins, improved trading circumstances, and more options for dealers have resulted from the increased firm rivalry. This has improved market efficiency and made currency dealing more approachable for regular people.

Contrarily, as there have been more spies, there have also been more deceptions and plots. Buyers might find it challenging to discern which brokers are real from those who aren't because so many new agents are entering the market. In order to protect merchants and uphold an open and equitable market, this has highlighted the need for increased control and oversight.

Conclusion

The number of currency dealers is rising, and it's likely to keep increasing in the upcoming years. While it has increased rivalry and better-dealing circumstances for dealers, it has also brought about problems like a rise in scams. Regulators must continue to monitor and control the industry to guarantee a fair and open market, and dealers must use prudence and due investigation when selecting a broker.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3