Abstract:As a forex investor, it is very necessary to know about forex regulators as some scams are designed to deceive newbies in the market.

Take fraudster FinexTrader, it falsely claims to be regulated, but none of the regulators it mentions are true. If you don't know what forex regulators are in the world, you are likely to fall into this kind of trap.

Invalid “Regulations”

Opening the Regulation of FinexTrader, a rookie may be convinced that the broker is regulated. The three “forex regulators” mentioned on the website include:

1)International Regulators & Brokerage E-Markets (IRBEM);

2)Market Financial Authority (MFA);

3)Swiss Financial Securities (SFINS).

Notably, none of the “regulators” are authorities that can regulate forex brokers or issue forex licenses.

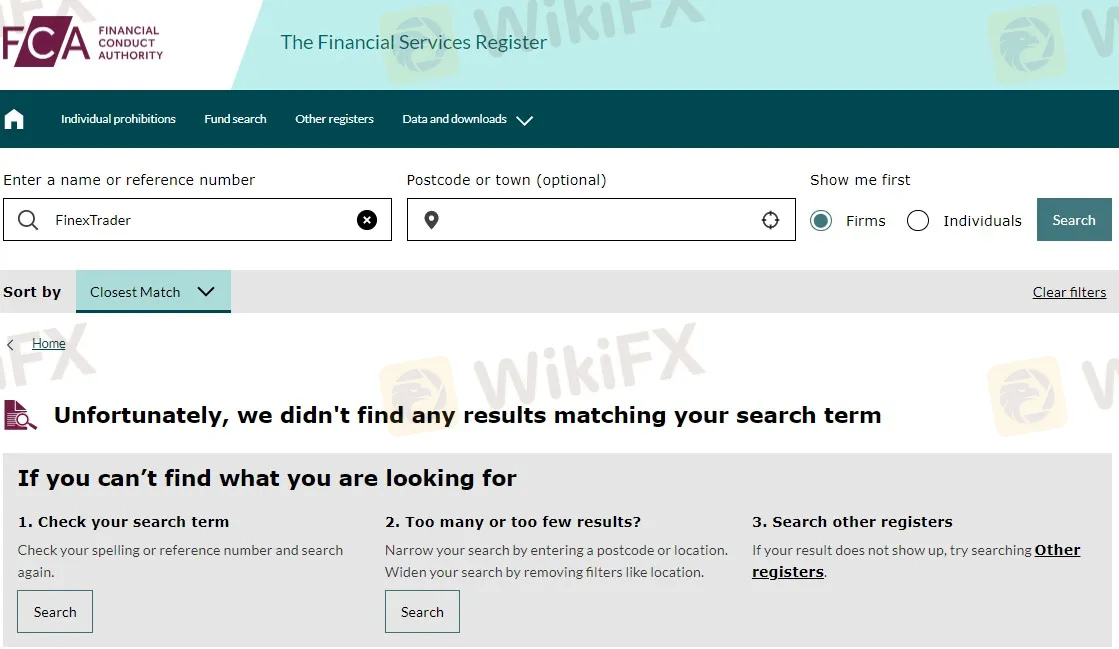

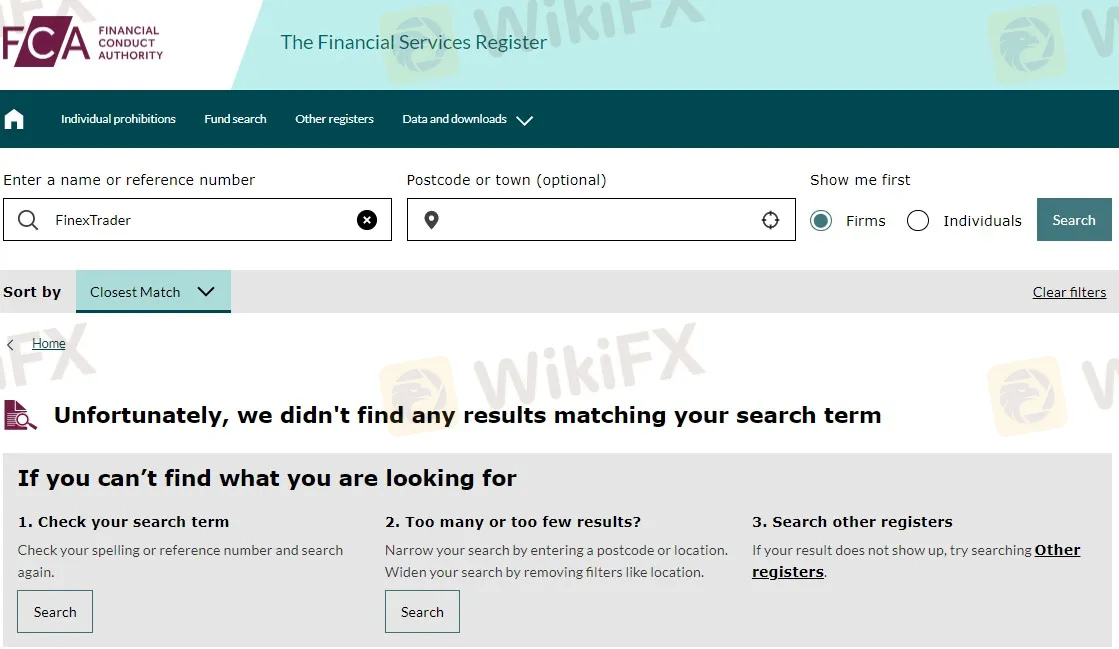

According to the website, the broker is located in the UK. As per the United Kingdom laws, it shall obtain a forex license issued by UK FCA. However, we cannot find any regulatory information on this broker in UK FCA.

In other words, FinexTrader is not overseen by any real regulatory body in the world.

Unreasonable Clause

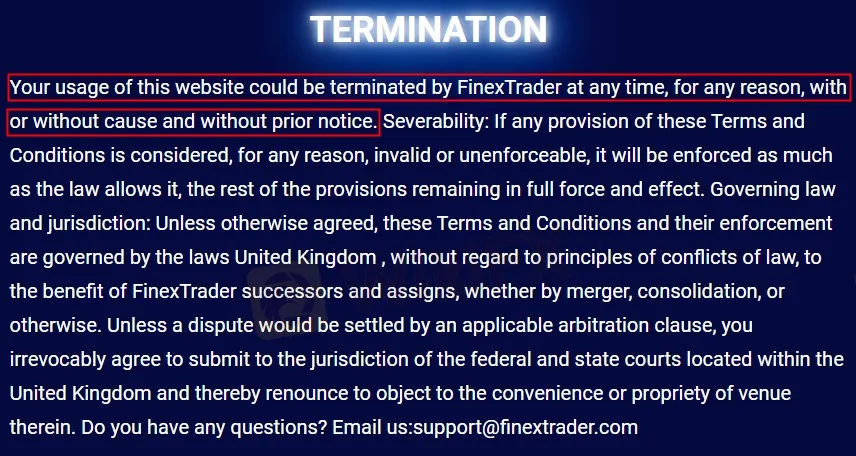

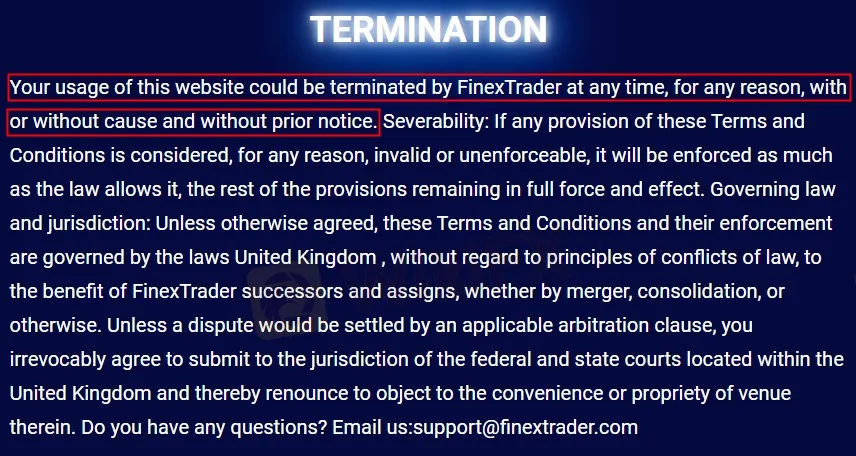

Many people are not used to reading the Terms and Conditions carefully, so some scammers will secretly write some unreasonable terms and claim that everything is agreed by the investor in advance when there is a problem with the trades.

Just like FinexTrader, it says it can suspend a client's use of the website at any time without any reason or prior notice to the client. Once a customer signs such an unreasonable clause, whether it is legal or not, it will become an excuse for fraudsters when you encounter disputes.

Multiple Warnings

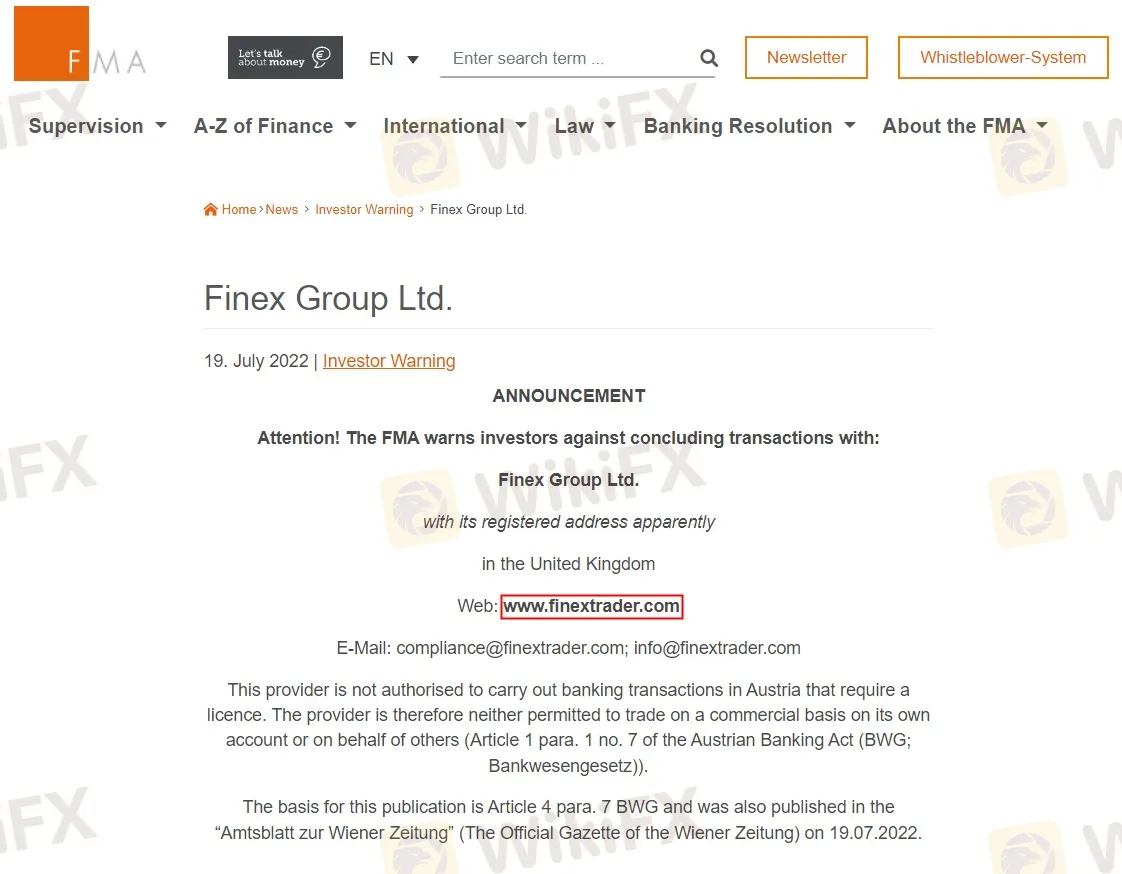

We uncovered the scam about two months ago. Scammers have come under increasing scrutiny from regulators over time. In the past three months, FinexTrader has received warnings from three different forex regulators.

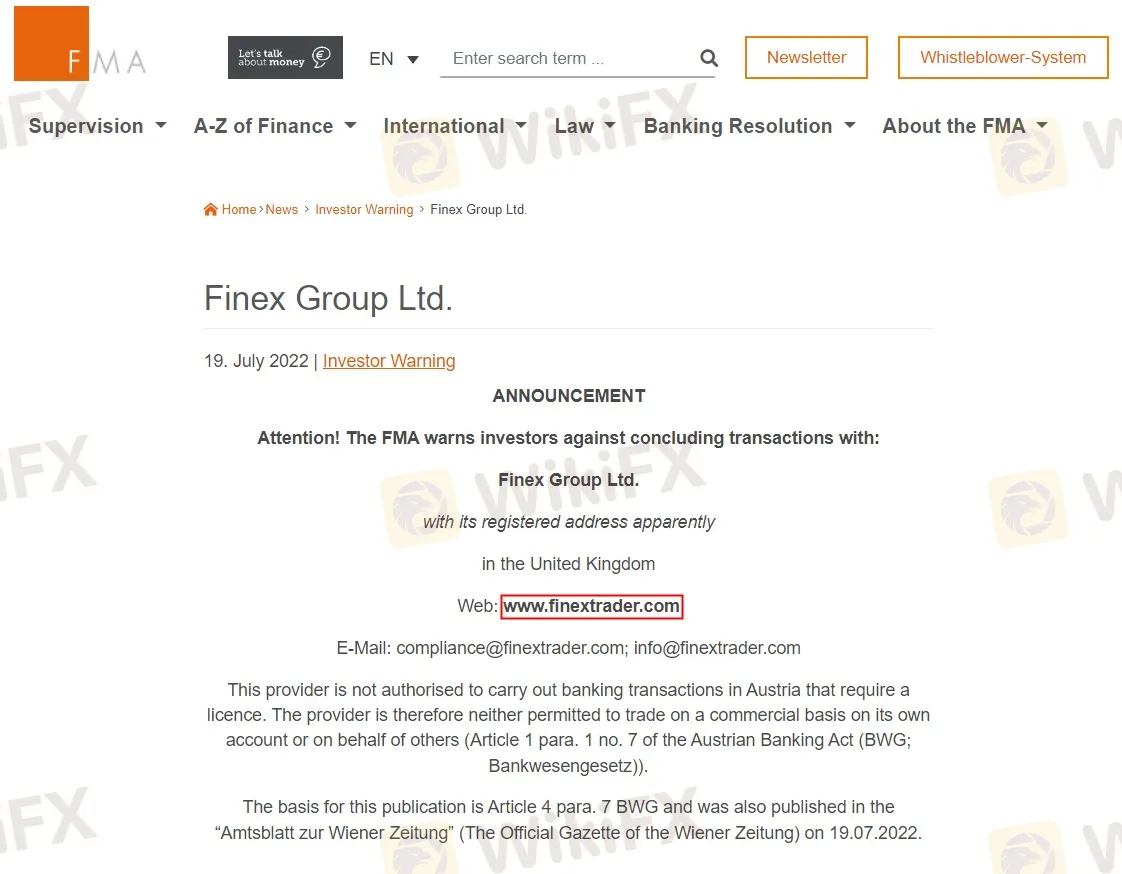

On 19 July 2022, the Austrian Financial Market Authority (Austria FMA) issued a warning that FinexTrader is not authorized to carry out banking transactions in Austria that require a license, which means the company is not permitted to conduct forex trade.

The France Autorité des Marchés Financiers (AMF) and the Italy Commissione Nazionale per le Società e la Borsa (CONSOB) also warned that FinexTrader is not authorized to provide forex services in France or Italy.

Every forex trader needs to know about forex regulators, and the column Regulators on WikiFX may be able to help you.