1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Euro area governments will have to adjust budgets for higher interest expenses as the ECB tries to contain inflation, underlying need for growth-boosting reforms to help sustain elevated public debt.

This year‘s supply-side and terms-of-trade shocks will ensure inflation runs well above the ECB’s 2% target in 2023-24, resulting in further interest-rate increases as the ECB attempts to defend its inflation-fighting credentials. The resulting higher budgetary costs, together with the weak economic outlook, will prevent the large euro area economies – Germany, France, Italy and Spain – from significantly reducing debt next year, with debt-to-GDP ratios remaining close to their 2022 levels.

The ECB‘s large-scale government bond purchases over recent years had assured the sustainability of public debt in the euro area while helping the central bank’s efforts to increase inflation to 2% after many years of below-target performance. Now, these objectives are colliding. The need to tame accelerating inflation has forced the ECB, along with most central banks, to increase interest rates.

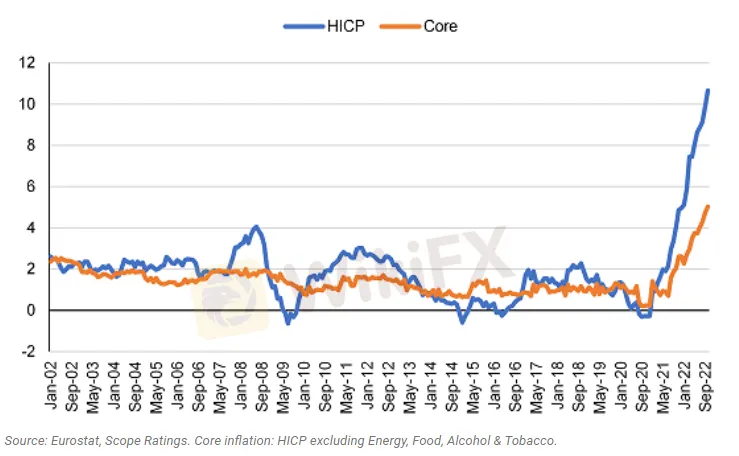

Figure 1. Euro area inflation

%-change, YoY

The scale of future ECB interest-rate increases will depend on the inflation outlook, the evolution of the economy, including higher recession risks, as well as the monetary policy of peer central banks, most crucially the Federal Reserve. The new high inflation environment will test the ECBs independence and ability to stabilise prices without igniting a sovereign debt crisis.

However, if monetary policy is to bring overall euro area inflation down to 2%, it will likely require a significant reduction in overall demand, particularly since inflation is driven by mostly supply factors – not higher growth and rising wages. The ECB is unlikely to hit its 2% target without quantitative tightening, that is, the reduction of the stock of government bonds on its balance sheet.

The question remains of the degree to which high inflation, which has accelerated since the end of 2021 (Figure 1), is driven by transitory or permanent factors.

Multiple trends support the view that inflation may be higher for longer, at least above 2% well into 2023-24. These include pandemic-driven supply-side changes and disruptions, uncertainty over trade policies and growing regional rather than global trade, in addition to structural shifts in the energy market, the impact of the green transition, rising wages and implications of a prolonged war in Ukraine.

Conversely, factors that are at least to some degree transitory, such as higher energy and food prices, contributed a combined 6.7pps to the annual HICP inflation of 9.9% in the euro area in September. Adding transport costs, which are highly correlated with energy prices, contributed another 1.6pps. These three categories accounted for around 84% of overall inflation. Headline inflation is likely to come down over 2023-24 as energy prices stabilise due to market forces or government intervention, and as higher interest rates start slowing down economic activity.

Still, the longer some of these transitory factors last, the more they feed into higher core inflation, hence the need for further rises in interest rates to lower demand. Following this path, the ECB risks causing a more severe economic downturn in 2023, and in addition, higher funding costs for governments. This will challenge euro area governments efforts to stabilise public debt and may increase the pressure on the ECB to slow down, and eventually halt, its rate hikes.

It is worth remembering the ECBs determination not just to maintain price stability but also to avoid fragmentation in the transmission of monetary policy by keeping government bond spreads within certain undisclosed thresholds. A trade-off seems likely: higher rates at the short-end to fight inflation, and only a very gradual unwinding of government bonds at the long-end, with additional interventions, if needed, to preserve financial stability. The combined effect is a higher and flatter yield curve.

This matters for government budgets across the euro area as higher rates will magnify debt sustainability challenges over coming years, even if significant country-specific yield increases are curtailed. In addition, nominal market rates may remain elevated or shift even higher regardless of ECB policies, if the ECB were to tolerate higher inflation and stop hiking rates, for example, due to a sharper-than-expected slowdown in H1 2023.

Finally, growing structural demands on euro area government budgets from age-related welfare spending, upward pressure on defence expenditure and the demands of the energy transition will complicate efforts to adjust primary balances. Under these circumstances, the implementation of growth-enhancing reforms is thus critical to ensure public debt sustainability.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.