Abstract:CTL Markets is yet another broker that WikiFX would advise you to stay clear of.

CTL Markets claims to be a reliable forex and CFDs brokerage firm that takes you to the next level of trading - is this true? WikiFX doesnt think so. Read the following CTL Markets(ctlmarkets.com) review to see why WikiFX does NOT recommend this broker for trading.

CTL Markets Regulatory Status

First lets search CTL Markets on WikiFX APP to take a look at the details page. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/2075051272.html), CTL Markets currently has no valid regulatory license and the score is rather negative - only 1.19/10.

Whats more, WikiFX also found that the Financial Conduct Authority (FCA) in the UK had already exposed CTL Markets as a scam including all of their currently active domain names–ctl-markets.com and ctlmarkets2.com. Take a look at the FCA warning on the screenshot below.

And the Financial Services and Markets Authority (FSMA) in Belgium also issued a warning against the broker:

CTL Markets lies about its address, claiming to be a EU broker headquartered in Bulgaria when it lacks a license to operate within the Union! Here is CTL Markets supposed address:

Bulgaria has been a member-state of the EU since 2007 – and this means brokers within it are required to comply with pan-European licensing requirements. We know for a fact that CTL Markets fails to do so – the company does not have any idea of said regulations, as it breaches one of them quite fragrantly – the broker offers bonuses, when the EU has specifically outlawed this.

The EU has placed some strict protections for the retail trader, requiring brokers to prove they are not running any kind of scam – they have to report on a daily basis on open and closed trades, for example. That prevents any kind of market manipulation from taking place. Without a license, CTL Markets is not required to do so – and can therefore not prove it is not running a scam!

CTL Markets Trading Platform

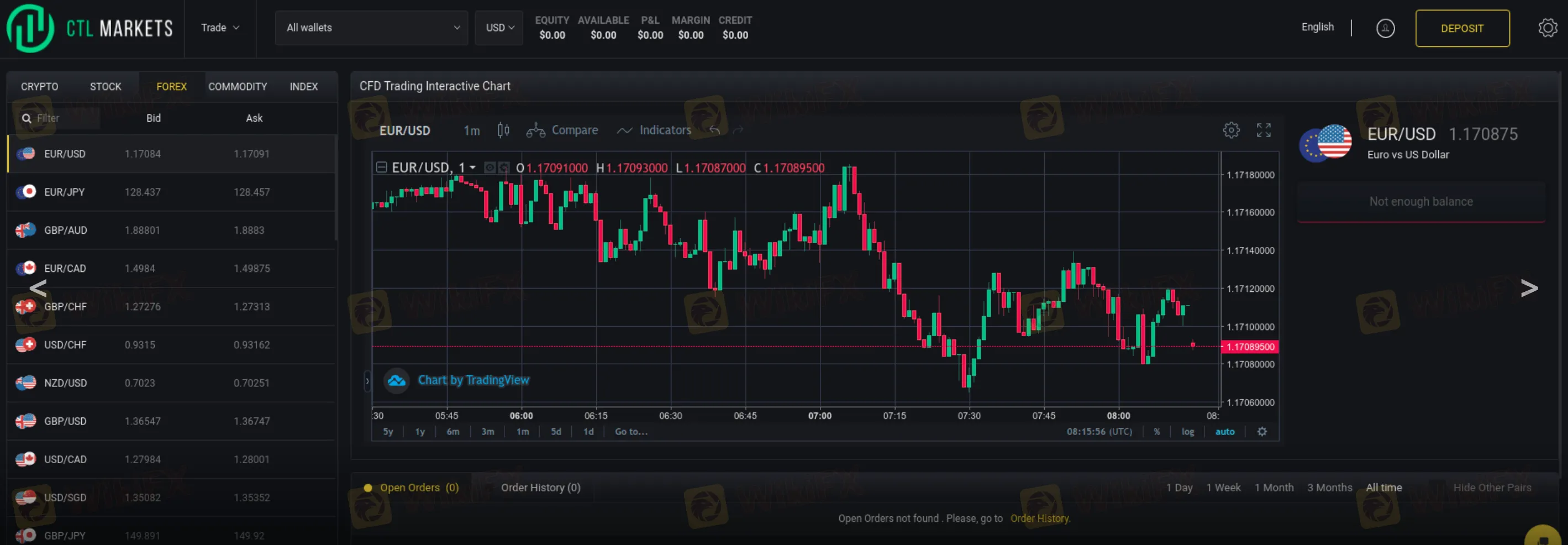

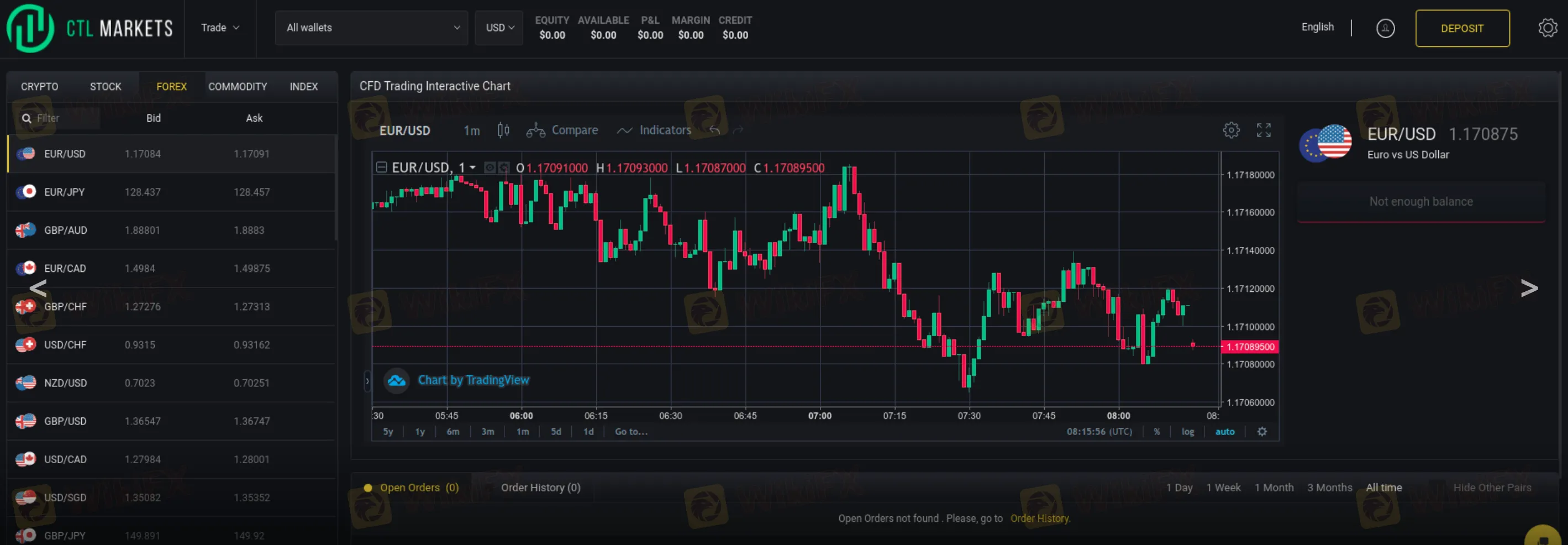

CTL Markets has a distribution of a web-based platform to offer – unfortunately, that platform is rather weak when compared to industry standard Metatrader 5, as it lacks any sort of automated trading. Here is what the platform looks like:

The EUR/USD spread delivered by the CTL Markets‘ platform is seemingly good- 0.7 pips, meaning that trading isn’t costly in general ($7 per lot traded). However, the seemingly affordable service isnt relevant in this case- we are still talking about a scam.

As to leverage, WikiFX is not sure about the actual level because the platform doesn‘t reveal it, and on top of that, CTL Markets give inconsistent pieces of information- it’s either 1:150 or 1:500. Whatever the case, though, Bulgarian and other EU licensed companies cant offer these ratios, which alone proves that the broker reviewed is illegal.

In fact, leverage is so dangerous that its been regulated for quite some time by many reputable authorities. In particular, due to regulations, licensed EU, British and Australian brokers have to limit retail clients to 1:30 for FX majors, while Canadian brokers and US brokers to 1:50. In contrast, most of the high-leverage brokers are unregulated, so you should be very careful with them.

CTL Markets Deposit & Withdrawal

The minimum deposit is $250, but weirdly enough, it‘s $10 000 according to the Account Type page, as you can see below. The funding methods are allegedly Credit/Debit cards and Wire Transfers, but since that’s a scam, you shouldnt send these fraudsters any sum whatsoever.

The minimum withdrawal is said to be $100, but that‘s a fraudulent piece of information- CTL Markets won’t pay anything back. Anyway, each transaction allegedly costs 5% for Credit/Debit cards and up to $25 for Wire Transfers. Too expensive nonetheless.

However, inactivity is even more expensive. According to the clause, a client must pay $100 per month if he hasn‘t opened at least 3 trades for 30 days. That’s a scam!

Conclusion

In this review, WikiFX exposed CTL Markets as a scam, so you should avoid dealing with it. Its wiser and safer to choose another reliable broker.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!