Abstract:A point-in-percentage, or pip, is a standardized unit used to quantify tiny changes in currency pair pricing. Even modest market swings may offer potentially profitable trade settings as well as possible losses. Therefore, the tiny pip increment guarantees that constant trading chances are accessible. Furthermore, the pip dramatically improves order accuracy and spread specificity. All of our platforms automatically count pips to calculate the profit or loss of your transaction.

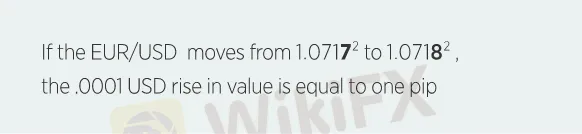

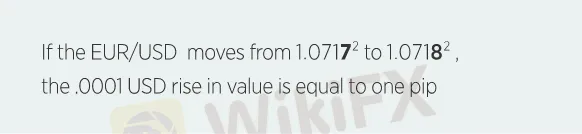

Currency values are generally reported in pips or percentages in points since they vary in such small increments. A pip is often defined as the fourth decimal point of a price, which is equivalent to 1/100th of one percent.

Pips in Fractions

The fractional pip, which is 1/10th of a pip, is represented by the superscript number at the end of each price. The fractional pip indicates price fluctuations much more precisely.

Pips in Action

Determining the worth of a pip

A pip's value fluctuates depending on the currency pairings you trade as well as which currency is the base currency and which currency is the counter currency.

Using the same example, you purchase 10,000 euros at 1.10550 versus the US dollar (EUR/USD) and earn $1 for every pip rise in your favor. You would profit $10 if you sold at 1.10650 (a 10-pip gain).

If all of the above conditions were met, but you sold at 1.10450 (a ten-pip drop), you would lose $10.

Consider the USD/JPY pair, in which the US dollar serves as the base currency.

The USD/JPY exchange rate determines the value of one pip in this situation.

So, using the same example, you purchase 10,000 US dollars at 106.20 yen and make $0.94 for every pip rise in your favor. You would profit $18.80 if you sold at 106.40 (a 20-pip gain).

If the aforementioned conditions were the same but you sold at 106.00 (a 20-pip decline), you would lose $18.80.

More WikiFX educational articles may be found at the following address: https://www.wikifx.com/en/education/education.html.