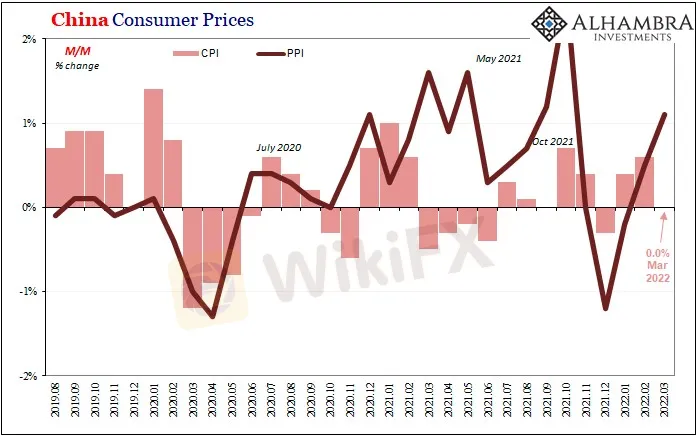

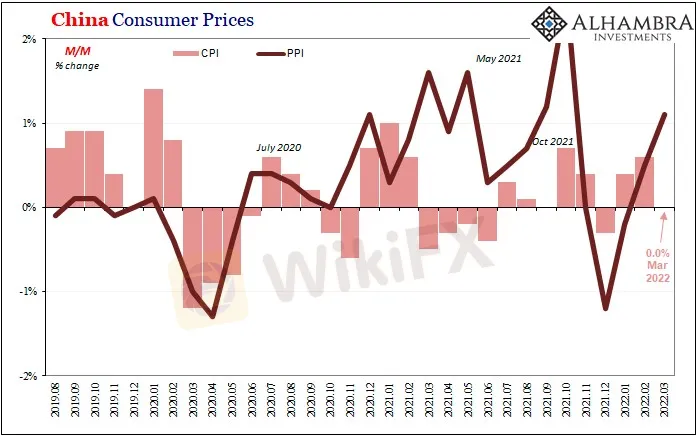

Abstract:By consumer and non-energy producer prices, there is a big difference China from the US or Europe.

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to Chinas NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before.

Keeping energy but removing food, Chinas CPI would only have gained 0.3% for the month, and just 2.2% year-over-year. With food, the overall consumer price increase was just 1.5% year-over-year.

We should be so lucky.

Wait, strike that.

China‘s lack of “inflation” comes at the expense of…something. Many would say it is the coronavirus, or rather the government’s absurd, increasingly unjustified commitment to not having any of the disease anywhere. To the point now the horror stories and accompanying 1984-style videos have managed to filter out from the notoriously censorious country.

But why?

Is this Zero-COVID really about COVID? There are rumors of discord among the upper echelon, more political intrigue by which Emperor Xi might have to flex his multi-faceted internal muscle. Don‘t like the direction China’s lackluster economy is taking, too bad because you‘ll learn to love it or your entire city doesn’t get to eat (yes, this is slight hyperbole).

That would seem to be the direction of Chinese prices, both consumer and producer. By that I mean the uninspiring economy leading to the overly sensitive cracking down. In terms of producer prices, the yearly change continues to trend lower despite two months in a row with extremely high contributions from energy.

The NBS said gasoline prices for producers spiked 14% in just March alone, after rising more than 10% during just February. Yet, apart from materials costs and those in other commodities, producer prices have been decelerating and, in many cases, outright declining. Its just these are overshadowed by the external forces which popped crude the last few months.