简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

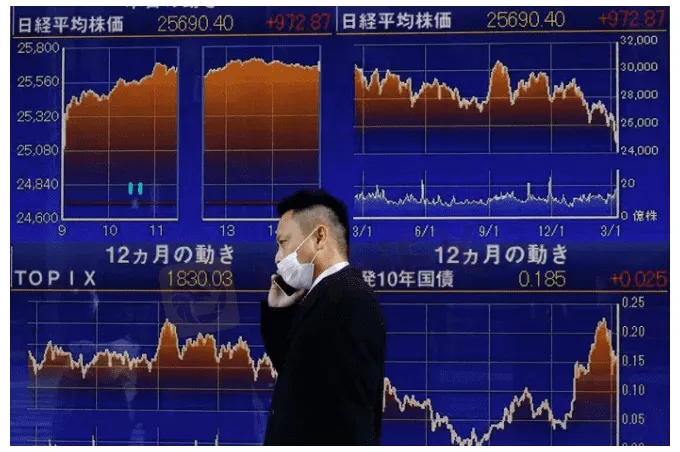

Asia stocks skid as Ukraine war, Chinas COVID surge weigh

Abstract:Asian stocks were in the red on Tuesday as surging COVID-19 cases in China hit the confidence of investors who are already worried about the Ukraine war and the first U.S. interest rate rise in three years, which could come this week.

MSCIs broadest index of Asia-Pacific shares outside Japan was down 1.91%, led by Chinese stocks. The index is down 8.2% so far this month.

Hopes that talks between Russia and Ukraine due to resume on Tuesday could provide a resolution to the conflict prompted a sharp fall in global oil prices.

However, the fourth round of negotiations began Monday with no major progress seen, adding to the nervousness in equity markets.

During the Asian session, U.S. crude slipped a further 2.54% to $100.44 a barrel, in line with broader asset selling. Brent crude was down 2.27% to $104.42 per barrel.

In U.S trading, oil prices had fallen as much as 5.8% as prospects of a positive outcome in Ukraine talks eased concerns about major supply disruptions.

But adding to the overall negative sentiment are rising case numbers of COVID-19 in China, which investors fear will hurt the mainlands economic growth in the first quarter.

“Right now everyone is looking at the Chinese cases and realising that has to have an effect on production,” said Hong Hao, BOCOM Internationals head of research.

“China‘s growth in the first quarter could be closer to zero than 5.5%. There’s a ripple effect. Theres Ukraine, the risk of U.S. sanctions on China and rising Chinese domestic COVID cases – it does not look good.”

Hong Kong‘s Hang Seng Index remains mired in negative territory, dropping 3.8% early on Tuesday, following an almost 5% selloff one day earlier. Hong Kong’s main board is down 17% so far in March.

Chinas CSI300 index was down 2.3%.

China on Tuesday reported 3,602 new confirmed coronavirus cases compared with 1,437 on Monday, according to the National Health Commission.

Investor focus is also on the U.S Federal Reserve, which meets on Wednesday and is expected to hike interest rates for the first time in three years to offset rising inflation.

Australian shares slipped 0.5% while Tokyos Nikkei Index was marginally higher, up 0.17%.

U.S. stocks experienced a mixed session, with declining technology companies prompting most indexes to close lower Monday.

The Dow Jones Industrial Average was mostly flat, the S&P 500 lost 0.74% and the Nasdaq Composite dropped 2.04%.

The yield on the benchmark 10-year Treasury notes rose to 2.1419% compared with its U.S. close of 2.14% on Monday.

The two-year yield, which rises with traders expectations of higher Fed fund rates, touched 1.865%, up from 1.849%.

Gold was also weaker in Asia with the spot price at $1,949.21 per ounce. [GOL/]

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

In-Depth Review of Stonefort Securities Trading Conditions and Execution – What Traders Should Know

This in-depth review dissects Stonefort Securities trading conditions and execution, leveraging primary data from the global broker inquiry app WikiFX and corroborating it with public user feedback. We will analyze the broker's regulatory standing, cost profile, execution quality, and overall operational reliability to provide a clear verdict on whether it is a trustworthy partner for long-term trading.

In-Depth Review of MH Markets Regulation and Compliance Profile – What Traders Should Really Know

This in-depth analysis provides a data-driven examination of the MH Markets regulation and compliance profile. Drawing primarily on verified data from the global broker inquiry app WikiFX, supplemented by public records, we will dissect the broker's multi-jurisdictional licensing, evaluate the real-world protections offered to traders, and interpret the warnings and ratings that define its standing in the competitive forex and CFD landscape.

In-Depth Uniglobe Markets Regulation and License Overview: A Trader's Due Diligence Report

This in-depth overview will conduct a thorough Uniglobe Markets regulatory status and financial authority check. By dissecting data from regulatory bodies, corporate registries, and user-reported experiences, we will provide a clear, data-driven analysis of the protections—or lack thereof—afforded to clients. The central question we aim to answer is whether Uniglobe Markets meets the stringent safety standards required by serious, long-term traders.

Scandinavian Capital Markets Exposed: Traders Cry Foul Play Over Trade Manipulation & Fund Scams

Does Scandinavian Capital Markets stipulate heavy margin requirements to keep you out of positions? Have you been deceived by their price manipulation tactic? Have you lost all your investments as the broker did not have risk management in place? Were you persuaded to bet on too risky and scam-ridden instruments by the broker officials? These are some burning issues traders face here. In this Scandinavian Capital Markets review guide, we have discussed these issues. Read on to explore them.

WikiFX Broker

Latest News

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

EPlanet Broker Review: Detailed Look at Regulation, User Experiences & Reported Complaints

ThinkMarkets Review: Why High Ratings Are Masking a "Withdrawal Black Hole"

Delta Fx Review: Are Technical Glitches and Scam-Like Practices Draining Trader Profits?

Deriv Review and Global Regulation Explained

FXGROW Exposed: Complete Review & Customer Complaints Analysis

The Impossible Two Percent: Why Central Banks Cannot Afford Price Stability

Key Events This Busy Week: ISM Mfg and Services, ADP, Core PCE And More

Currency Calculator