Abstract:There are a few trading patterns that the technical trader seems to return to time and time again. The "head and shoulders pattern" is without a doubt one of the most popular. In fact, some traders would exclusively trade this pattern, but there are a few factors to take in mind before using it, as with everything else.

There are a few trading patterns that the technical trader seems to return to time and time again. The “head and shoulders pattern” is without a doubt one of the most popular. In fact, some traders would exclusively trade this pattern, but there are a few factors to take in mind before using it, as with everything else.

Defining the pattern is the first step.

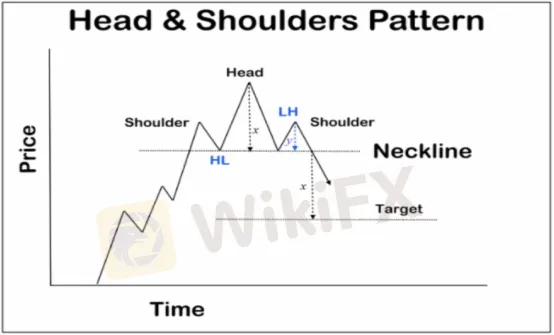

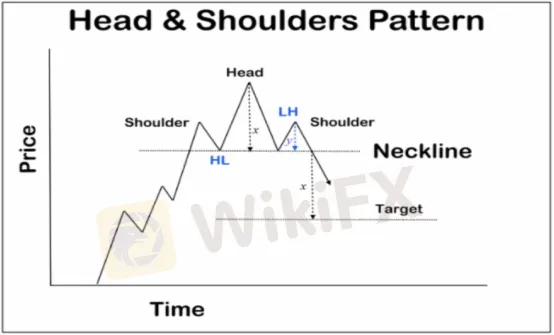

The first step is to figure out what pattern we're dealing with. The left shoulder, the head, and the right shoulder are the three sections of the head and shoulders pattern. It's a pattern in which a high arises, then a retreat, a higher high, and finally a low or high. In other words, the right shoulder, the third section of the pattern, is a lower height from the head.

It is not necessary for all head and shoulders patterns to be negative.

There is an inverse pattern, as is the case with many technical patterns. This is essentially a sequence of three lows, beginning with a rebound back to the upside on the left hand shoulder, then a break down to create the head, a bounce back to the upside, and finally a “higher low” producing the third shoulder. It's a “upside down head and shoulders design,” to put it simply. This indicates that the selling are losing steam, and the market might be poised for a strong rally. Take a look at the graph below to understand how this works in reverse. It should be obvious that it is the exact same thing, only inverted.

Head and shoulders patterns don't have to be negative all of the time.

An inverse pattern exists, as it does with many technical patterns. This is merely a sequence of three lows, beginning with a rebound back to the upside on the left hand shoulder, then a break down to create the head, a bounce back to the upside, and finally a “higher low” producing the third shoulder. It's a “inverted head and shoulders pattern,” to put it simply. This indicates that the sellers' impetus is fading, and the market may be poised for a strong rally. See how this works in an inverted pattern in the graphic below. It's the same thing, but inverted.

Remember, if you require other people to go along with you, simplicity is one of the features of a strong trading method. These clear patterns are beneficial since the rest of the market can be pushed in the same direction as you.