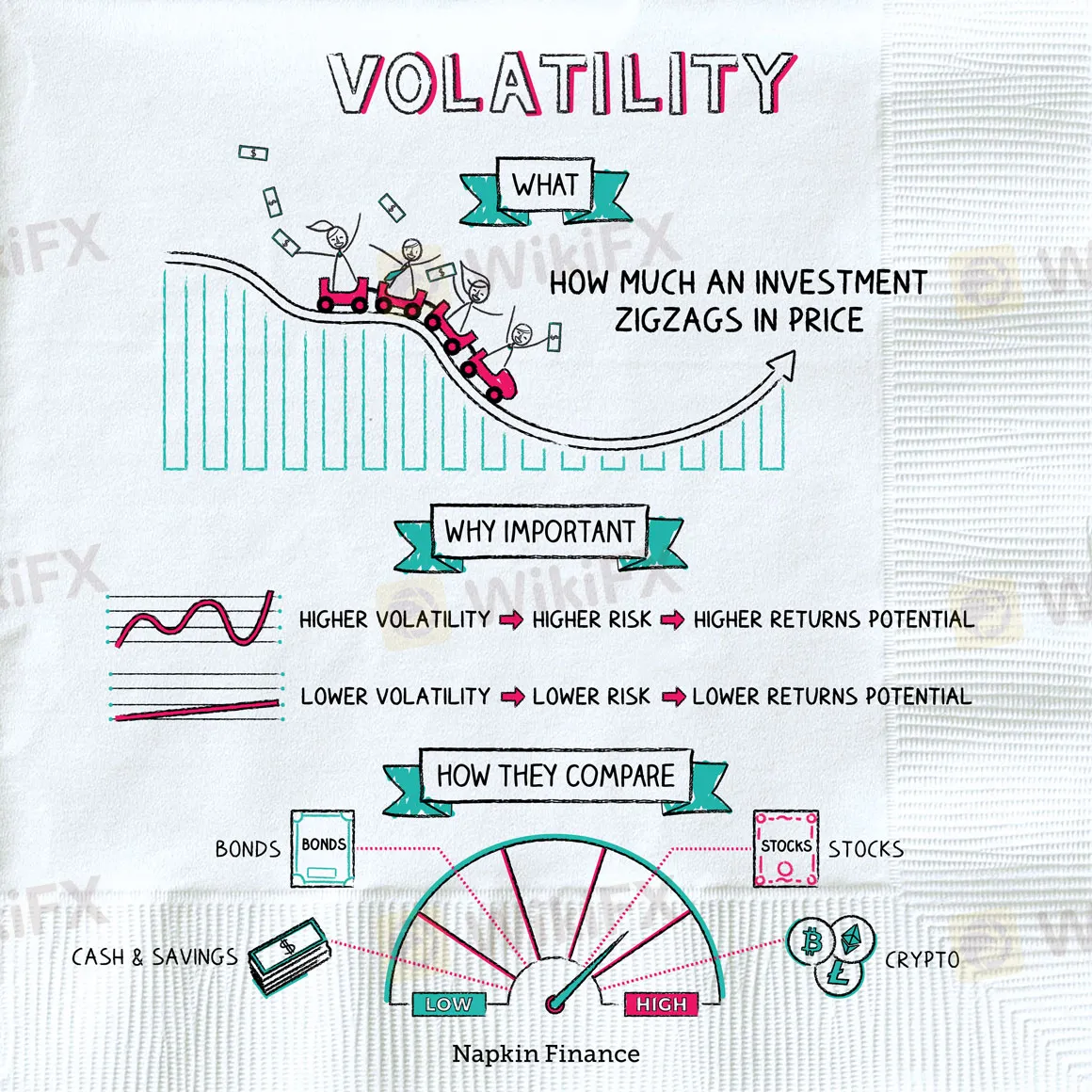

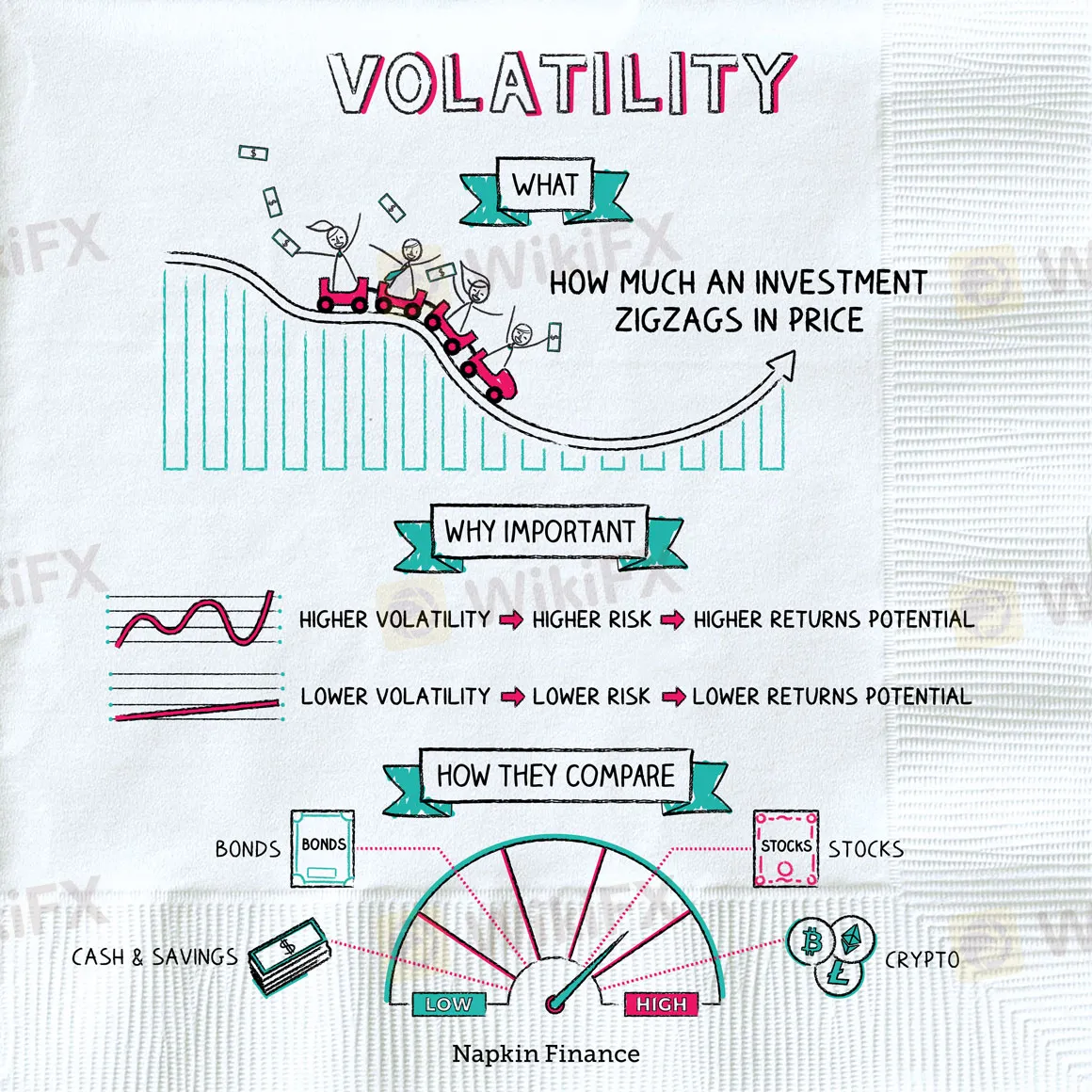

Abstract:Volatility is one of the factors that investors in the financial markets analyse when making trading decisions. Financial market volatility is defined as the rate at which the price of an asset rises, or falls, given a particular set of returns. It is often measured by looking at the standard deviation of annual returns over a set period of time.

Volatility is one of the factors that investors in the financial markets analyse when making trading decisions. Financial market volatility is defined as the rate at which the price of an asset rises, or falls, given a particular set of returns. It is often measured by looking at the standard deviation of annual returns over a set period of time.

FXChoice Broker has announced Scheduled events for the most widely-traded currencies, that may also affect indices and commodities. Times are GMT+2.

Tuesday, 21st December

• 09:00: CHF — Trade Balance

Wednesday, 22nd December

• 09:00: GBP — GDP

• 15:30: USD — GDP

• 17:30: USD — Crude Oil Inventories

Thursday, 23rd December

• 15:30: CAD — GDP

Friday, 24th December

• 01:30: JPY — CPI

Holiday schedule

Also the Broker has announced the Holiday schedule for their clients to take notes, as:

Friday, 24 December – Sunday, 2 January: trading hours and our working hours will change around the holidays. Look out for a detailed announcement in your inbox and in Company news early in the week.

BrentCrud expiration expiration

Wednesday, 29th December, at market close

— BrentCrud expiration trades will be closed as the CFD prepares to switch over to the next months futures contract.

* All times are Server Time (GMT+2).

This is a warning of potentially significant price movements and not an encouragement to trade them. The Broker do not predict which direction prices will go in therefore clients are to trade with cautions.