GO Markets

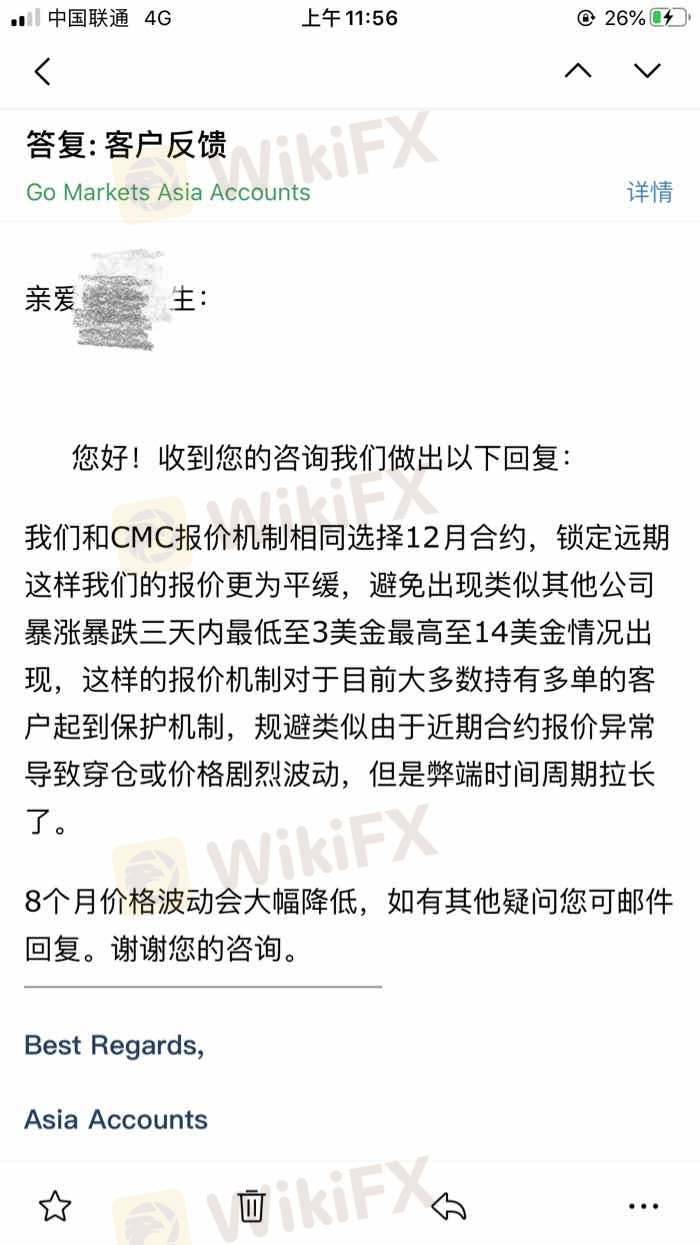

GO MarketsThe spot crude oil on the market is quoted by liquidity suppliers, and the principle is based on the price of futures. The difference between the quotations of GO Markets and some other platforms is that the latter group use two recent futures contracts (contracts in June and July at present), while the former now uses December futures. The method used to calculate quotes has never changed. When the market is stable, we will use the most recent futures contract as the basis for calculating the spot price because it is considered the most liquid. As time advances to the expiry date of futures, the price of spot will gradually approach the price of futures. When the futures expire, the spot will start to quote the price of the futures in the next month because there is no expiration in the spot. This is the mechanism of spot quotation. In order to avoid the price difference between spot and futures causing sudden and large fluctuations in the spot price, this price difference will be calculated into the daily holding costs to avoid arbitrage. The problem in the recent market is that the price of futures in recent months is no longer stable and may fall below 0 near the expiration date. Therefore, in order to avoid this situation affecting the spot price, we decided not to use the nearest month futures contract (June contract) but to use the farther month futures contract (December contract). As mentioned in the previous point, every day the spot contract price tends to the near-term contract price, and the holding fee also reflects this (holding fees should be paid for long positions because the spot price is rising close to the futures price). Finally, GO Markets has always been committed to providing customers with good internal and external communication channels and high-quality trading environment. After receiving the confirmation from the upstream liquidity supplier on April 22nd, the internal functional department quickly activated the communication response mechanism, made the decision as soon as possible, and notified all customers by mass mailing in written form on April 24th. This was not what the customer said that there was no advance announcement and no reminder.

ShaoDASHUAI

ShaoDASHUAI WikiFX Overseas Customer Service

WikiFX Overseas Customer Service WikiFX Mediation Center

WikiFX Mediation Center ShaoDASHUAI

ShaoDASHUAI