Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Founded Year | 5-10 years |

| Company Name | Success Finance Group |

| Regulation | Regulated in Hong Kong |

| Minimum Deposit | Not specified |

| Spreads | Not specified |

| Trading Platforms | Not specified |

| Tradable Assets | Securities, Precious Metals, Loans, Foreign Exchange (Forex), Crude Oil |

| Account Types | Standard real trading accounts (specific details not provided) |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Telephone: +852 2587 8000<br>Email: enquiry@successfn.com |

| Payment Methods | Cash, Bank Transfer, FPS, Check, Wire Transfer |

Overview of Success Finance

Success Finance is a financial institution operating in Hong Kong, consisting of three licensed institutions: Success Futures and Foreign Exchange Limited, Success Securities Limited, and 實德金銀投資有限公司. Each institution is regulated by the Securities and Futures Commission of Hong Kong. However, there are several concerns associated with Success Finance. The regulatory status of Success Futures and Foreign Exchange Limited has been revoked, indicating potential risks. Additionally, there have been numerous complaints about this broker, which has led to a reduction in its WikiFX Score. Furthermore, there is limited information available about the licensed institution dealing with gold and silver investments, and no contact details are provided.

Success Finance offers a range of market instruments, including securities, precious metals, loans, foreign exchange, and crude oil. These instruments cater to the investment needs of clients, allowing them to participate in various markets. However, it is important to exercise caution when considering Success Finance as a broker due to the associated warnings and concerns mentioned above.

Pros and Cons

Success Finance, a financial institution operating in Hong Kong, has both positive aspects and drawbacks that should be considered. On the positive side, the company is regulated by the Securities and Futures Commission of Hong Kong, providing a level of oversight and protection for clients. It offers a diverse range of market instruments, including securities, precious metals, loans, foreign exchange, and crude oil, allowing investors to diversify their portfolios. Additionally, Success Finance provides customer support during office hours and offers multiple payment methods. However, there are notable drawbacks to be aware of. The regulatory status of one of its licensed institutions has been revoked, and the broker has received several complaints within the past three months, indicating potential risks. Moreover, specific details about account types, the trading platform, and withdrawal requirements are not provided, which may raise concerns for potential clients. It is crucial for individuals considering Success Finance to thoroughly evaluate the available information and exercise caution when dealing with this broker.

| Pros | Cons |

| Regulated by the Securities and Futures Commission of Hong Kong | Regulatory status of one licensed institution revoked |

| Offers a variety of market instruments | Received several complaints within the past three months |

| Provides customer support during office hours | Lack of specific details about account types, trading platform, and withdrawal requirements |

| Accepts multiple payment methods | Potential risks associated with the broker |

Is Success Finance Legit?

Success Finance is a financial institution that operates in Hong Kong. It consists of three licensed institutions: Success Futures and Foreign Exchange Limited, Success Securities Limited, and 實德金銀投資有限公司. Each institution is regulated by the Securities and Futures Commission of Hong Kong.

Success Futures and Foreign Exchange Limited, licensed under AGN056, had its regulatory status revoked. The institution was involved in leveraged foreign exchange trading. The effective date of the license was December 6, 2005. The contact email address for this institution is agnesc@successug.com. However, there is no available phone number provided.

Success Securities Limited, licensed under AEZ190, exceeded its licensed business scope of dealing in securities. The effective date of the license was January 4, 2005. The contact email address for this institution is emily.diu@successfn.com. Like the previous institution, no phone number is provided.

實德金銀投資有限公司, licensed under Type AA License with license number 003, is a licensed institution that deals with gold and silver investments. The effective date, expiry date, email address, website, and phone number for this institution are not provided in the information given.

It is worth noting that there are warnings associated with Success Finance. WikiFX has received six complaints about this broker in the past three months, indicating a potential risk. Additionally, the regulatory status of AGN056 is marked as revoked, further emphasizing the need for caution. Furthermore, the information suggests that this broker does not have a trading software, which should also be taken into consideration.

Market Instruments

Success Finance is a financial institution that offers a wide array of market instruments to cater to the diverse investment needs of its clients:

SECURITIES:

Securities play a significant role in the market instruments offered by Success Finance. These financial instruments represent ownership or debt in a publicly-traded company or government entity. The company offers a diverse range of securities, including stocks, bonds, and derivatives, allowing investors to participate in the growth potential of various industries and economies.

PRECIOUS METALS:

Success Finance recognizes the value of precious metals as an investment option. Gold (XAUCNH) and silver (LLS) are among the precious metals available for investment purposes. These commodities are known for their stability and long-term value, often considered as a hedge against inflation or economic uncertainty.

LOANS:

Another category of market instruments provided by Success Finance is loans. Loans can serve as a means of financing for individuals and businesses, enabling them to meet their financial needs or pursue investment opportunities. Success Finance offers different types of loans, such as personal loans, business loans, and mortgage loans, catering to a wide range of borrowing requirements.

FOREIGN EXCHANGE (FOREX):

Success Finance offers a variety of foreign exchange (Forex) instruments, allowing investors to trade different currency pairs. The Forex market provides opportunities for investors to speculate on the fluctuating exchange rates between various currencies. Success Finance offers major currency pairs like EUR/USD, GBP/USD, USD/JPY, as well as other currency pairs including EUR/JPY, EUR/GBP, GBP/JPY, and EUR/CNH.

CRUDE OIL:

Crude oil is another market instrument offered by Success Finance. Crude oil (LLG) holds significant importance as a global commodity due to its use in various industries and as a source of energy. Investors can trade crude oil futures contracts, benefiting from price fluctuations in this essential resource.

| Pros | Cons |

| Offers a diverse range of securities | Lack of specific information on market instrument details |

| Recognizes the value of precious metals | Limited information on the availability and terms of precious metal investments |

| Provides various types of loans | Insufficient details regarding loan options and terms |

| Offers a variety of foreign exchange instruments | Limited information on forex trading conditions and options |

| Includes crude oil as a market instrument | Insufficient details on crude oil trading conditions and options |

Account Types

Aside from the free demo account, the company provides standard real trading accounts, although specific details regarding the account opening threshold are not specified.

Spreads

The bid-ask spread for local London gold is US$0.5/oz, while the spread for local London silver is US$0.04/oz. These spreads represent the difference between the highest buying price and the lowest selling price for gold and silver in the respective markets. They provide an indication of liquidity and transaction costs associated with trading these commodities in the local London market.

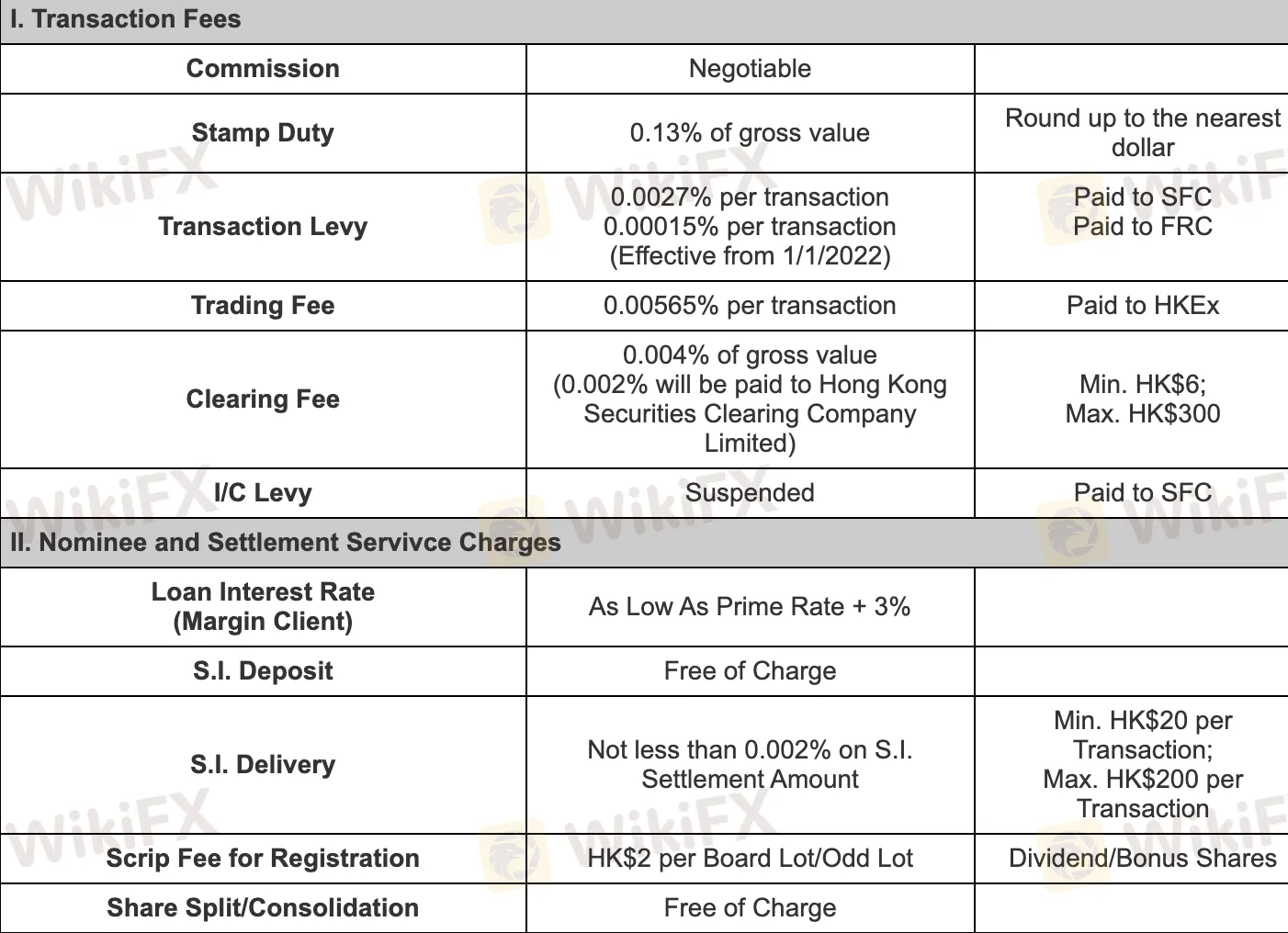

Fees

The fees associated with the mentioned services include negotiable commission rates, stamp duty at 0.13% of the gross value, transaction levy paid to SFC and FRC, trading fee paid to HKEx, clearing fee ranging from HK$6 to HK$300, and suspended I/C levy. Nominee and settlement services involve fees for S.I. delivery, scrip fee for registration, shares & bonus warrants/cash dividend collection, transfer deed stamp duty, stock custody fee, withdrawal of physical shares, subscription of warrants/rights/open offer/preferential offer, IPO financing, and other miscellaneous fees such as returned cheque and remittance charges based on related bank fees.

| Pros | Cons |

| Negotiable commission rates | Transaction fees can increase overall costs |

| Fees structure stated for nominee and settlement | Clearing fees vary and may impact transaction costs |

| Comprehensive list of fees for various services | Miscellaneous fees, such as returned cheque charges, can add to expenses |

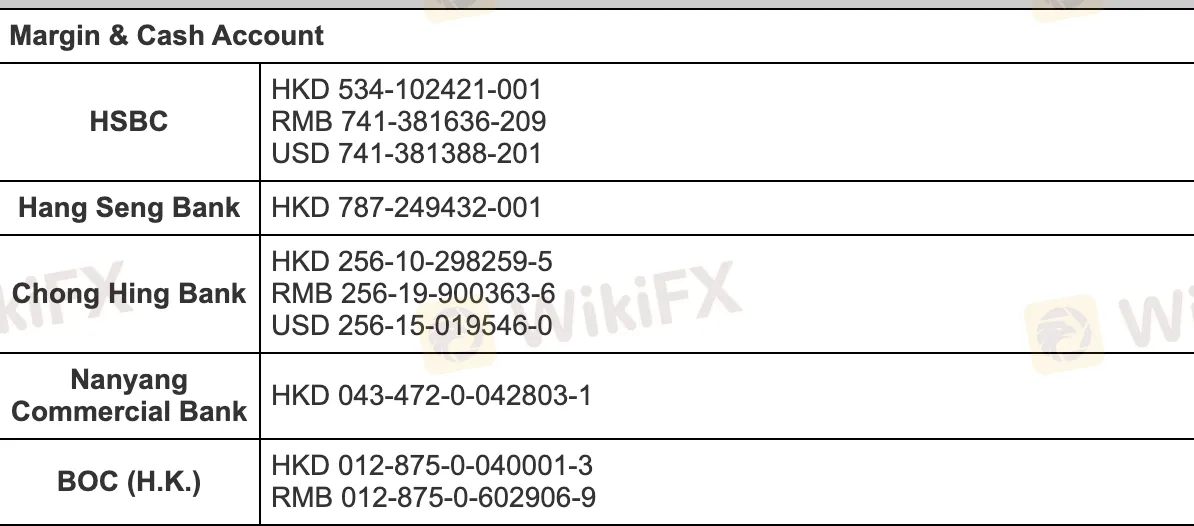

Deposit & Withdrawal

Deposit:

Third-Party Deposits: Success Finance does not accept any form of third-party fund deposits or transfers/cheques issued by joint bank accounts of clients and third parties. If a third-party deposit occurs, Success may request information about the third party for identification. If the requested information is not provided or rejected by Success, the deposit may be rejected or returned. Clients are responsible for any associated bank charges and risks resulting from deposit failures.

Deposit Notice: Clients should write the Success Securities Limited account number and client name on the deposit slip and send it directly to the Settlement Department via email, fax, WhatsApp, or WeChat before 5 p.m. on the same day. Deposits received after 5 p.m. will be considered as deposited on the following trading day. Due to the coronavirus outbreak, fax deposits are not accepted, and there are early closure times for some banks.

Cheque Deposit: Clients must provide an image of the cheque, along with the deposit advice, for verification purposes. Failure to provide the image may incur an administrative fee for cheque retrieval. The fund will not be credited until the depositor's information is obtained from the bank, which may take up to 14 business days. Third-party fund deposits are not accepted.

Cash Deposit: The maximum cash deposit amount is HK$300,000. Clients must provide a deposit slip with their signature for verification. Suspicious or cash deposits exceeding HK$300,000 may be rejected.

Bank Transfer: Clients must provide valid proof of the transfer for verification. If no proof is provided, Success may request additional evidence that the transfer came from the client's bank account. Funds will not be credited until sufficient evidence is provided.

Withdrawal:

Pre-Registered Bank Account: Withdrawals can only be made to pre-registered bank accounts. Clients need to download, complete, and fax or email the client withdrawal form to the company's Settlement Department or contact their account manager or visit the company in person.

Withdrawal Time: Withdrawals proposed before 11:30 a.m. will have cheques deposited into the client's bank account on the same day. Withdrawals proposed after 11:30 a.m. will be processed on the next business day.

Bank Account Requirements: The provided bank account must be in the client's name. Third-party bank accounts or cheques payable to a third party are not accepted for deposit requests.

| Pros | Cons |

| Deposit methods are clearly defined and explained | Third-party fund deposits are not accepted, limiting deposit options |

| Deposit notice provides instructions for timely deposits | Deposit restrictions during the coronavirus outbreak, including no acceptance of fax deposits |

| Image verification for cheque deposits enhances security | Lengthy processing time for cheque deposits, which may take up to 14 business days |

| Cash deposits are accepted up to a maximum amount | Suspicious or large cash deposits exceeding HK$300,000 may be rejected |

| Bank transfer verification ensures fund origin confirmation | Insufficient evidence of transfer origin may result in delays in fund crediting |

| Withdrawals can be made to pre-registered bank accounts | Withdrawal time depends on the proposal timing, with post-11:30 a.m. requests processed on the next business day |

| Cheques are deposited into the client's bank account on the same day for early requests | Third-party bank accounts or cheques payable to a third party are not accepted for deposits |

| Bank account requirements ensure withdrawal security | Limited information provided about withdrawal procedures and requirements |

Trading Platform

A trading platform offered by Success Finance is an electronic system designed for conducting trading activities. While specific details about the platform are not provided, it serves as a tool for users to engage in various trading activities.

Payment Method

Success Finance offers a range of payment methods, including cash, bank transfer, FPS, check, and wire transfer. These options provide customers with options in making their payments, whether it's through traditional means like cash and checks, or modern electronic methods like bank transfer and FPS.

Customer Support

Customer Support at Success Finance Group is available during office hours from Monday to Friday, 9:00 a.m. to 6:00 p.m. They can be reached via telephone at (852) 2587 8000 or through fax at (852) 2587 8001. Additionally, customers can contact them via email at enquiry@successfn.com.

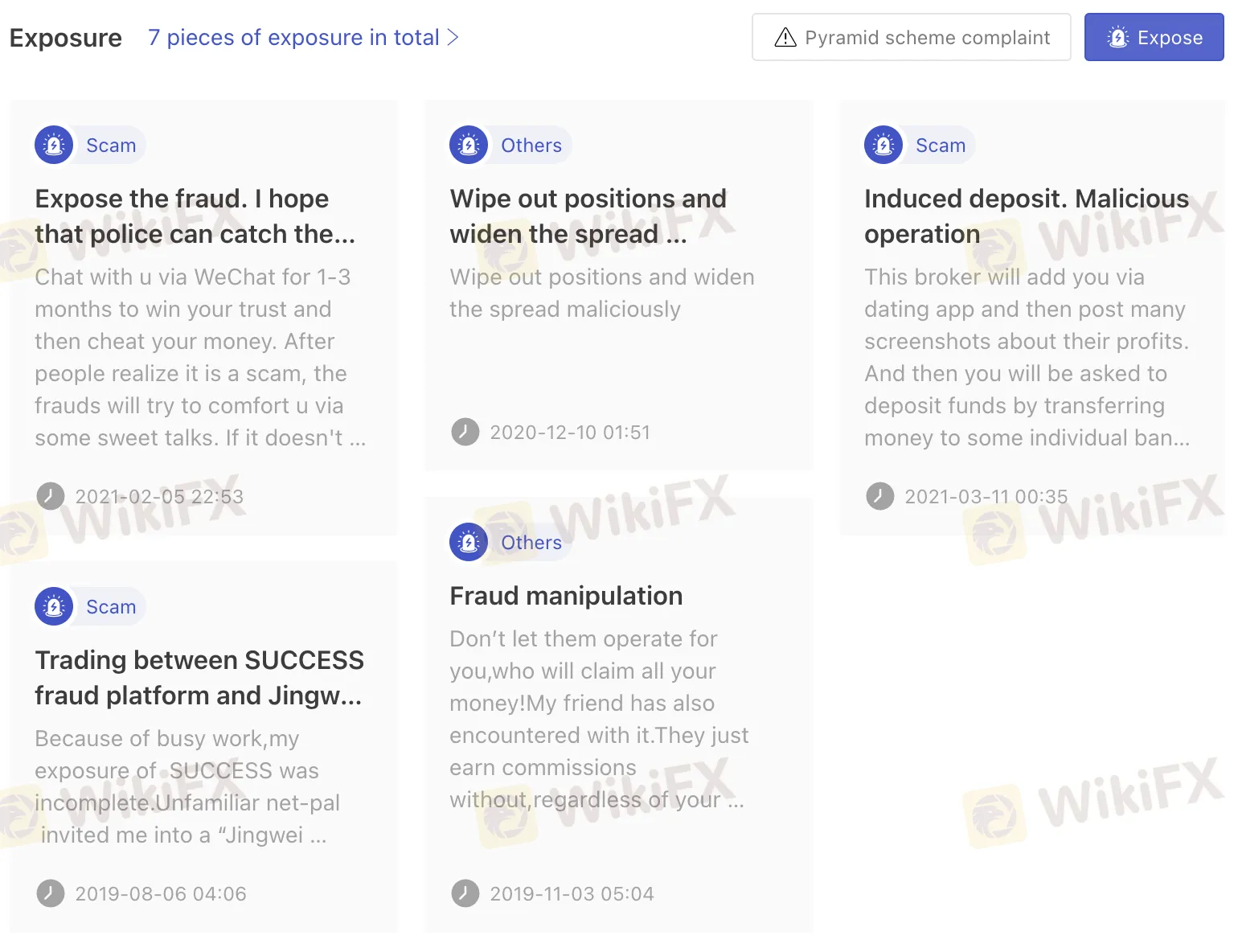

Reviews

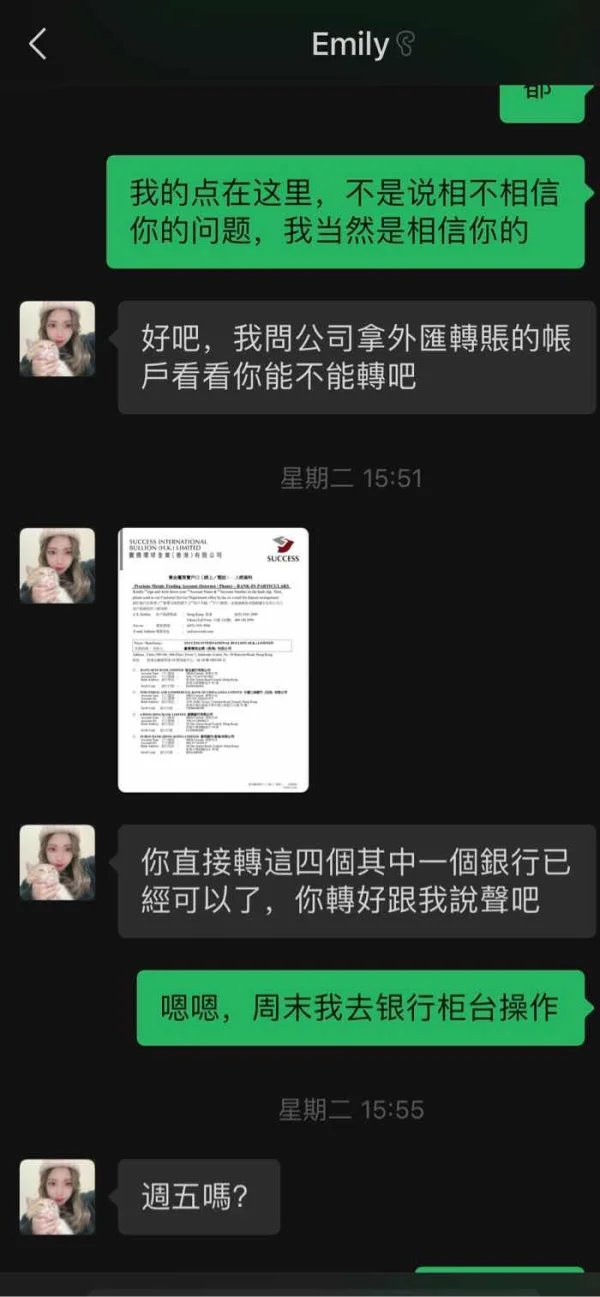

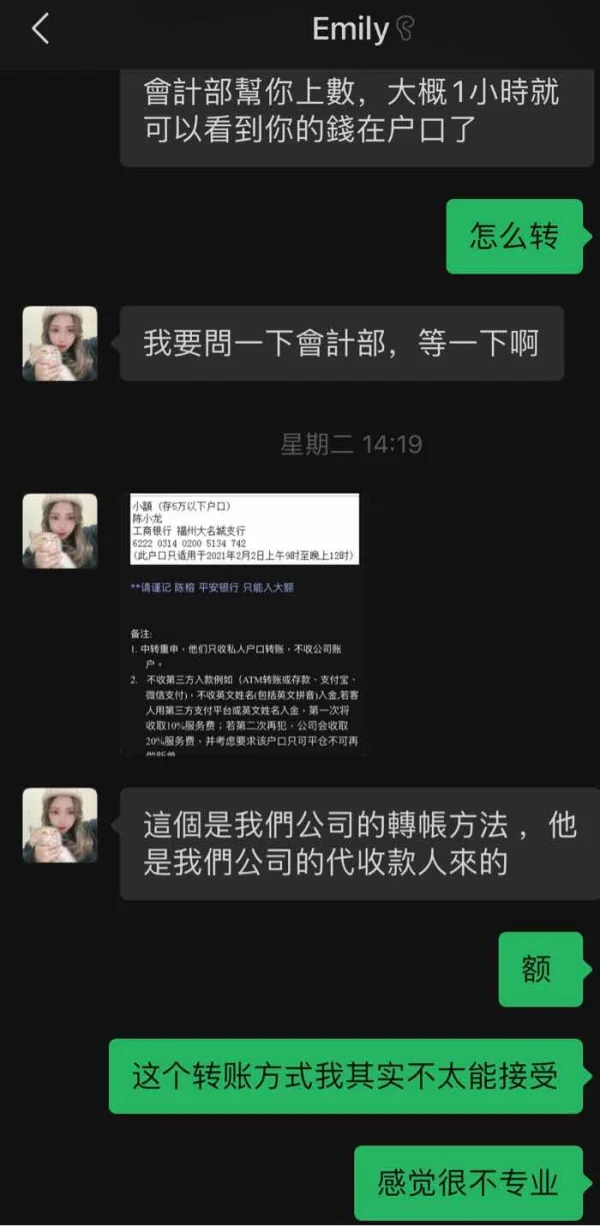

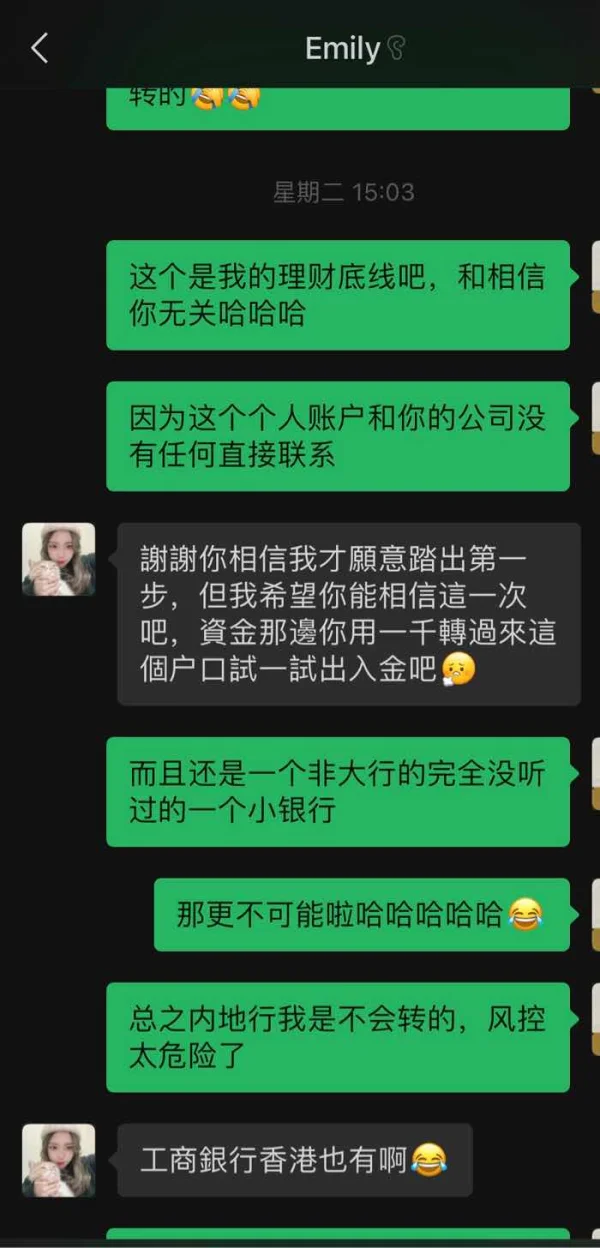

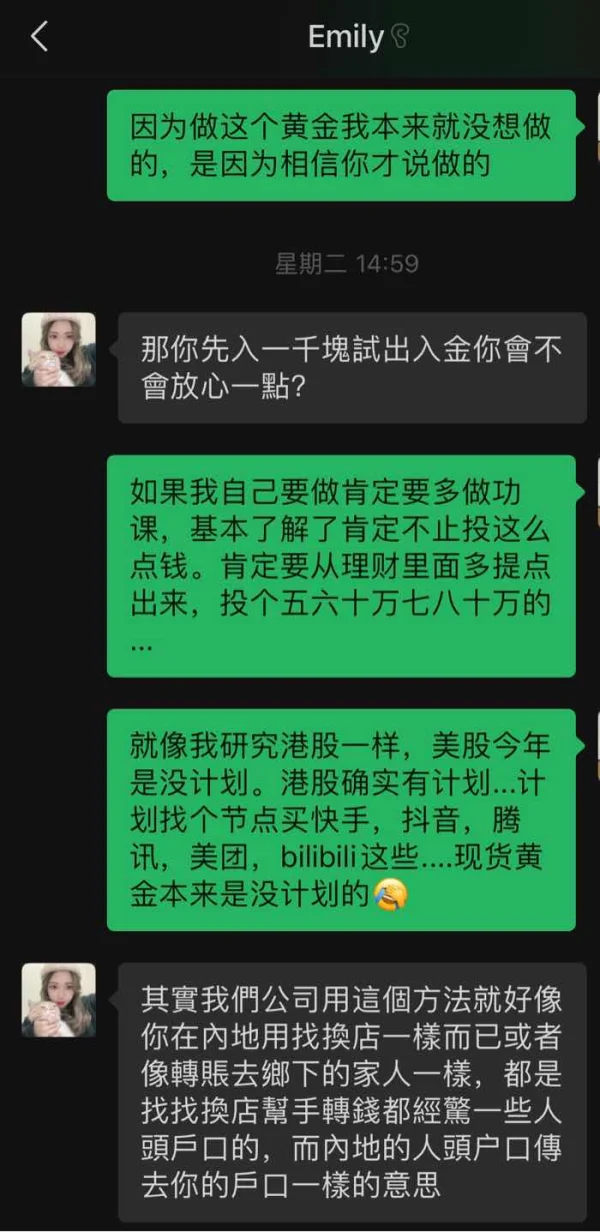

The reviews of Success Finance on WikiFX indicate that the broker is involved in fraudulent activities. There are multiple instances of scam-related complaints where users were induced to deposit funds through misleading tactics and then experienced malicious operations resulting in the loss of their money. Some reviewers mentioned being contacted through dating apps and shown screenshots of profitable trades before being asked to transfer funds to individual bank accounts. The broker was accused of preventing withdrawals, wiping out positions, widening spreads, and manipulating trades. There are also unresolved cases where deposits were not credited to user accounts, and attempts to contact customer service went unanswered. Overall, the reviews suggest that Success Finance is an untrustworthy broker engaged in fraudulent practices.

Conclusion

In conclusion, Success Finance is a financial institution operating in Hong Kong that offers a range of market instruments including securities, precious metals, loans, foreign exchange (Forex), and crude oil. The company consists of three licensed institutions, each regulated by the Securities and Futures Commission of Hong Kong. However, there are several disadvantages associated with Success Finance. The WikiFX Score of this broker has been reduced due to numerous complaints, and there are regulatory warnings indicating potential risks. Reviews on WikiFX suggest that Success Finance is involved in fraudulent activities, including inducing deposits, preventing withdrawals, manipulating trades, and operating maliciously. There are also unresolved cases where deposits were not credited and customer service was unresponsive. It is advised to approach this broker with caution.

FAQs

Q: Is Success Finance a legitimate financial institution?

A: Yes, Success Finance is a financial institution operating in Hong Kong and consists of three licensed institutions regulated by the Securities and Futures Commission.

Q: What market instruments does Success Finance offer?

A: Success Finance offers securities, precious metals, loans, foreign exchange (Forex), and crude oil as market instruments for investment purposes.

Q: What are the account types and spreads offered by Success Finance?

A: Details regarding account types and spreads are not specified in the provided information.

Q: How can I deposit and withdraw funds with Success Finance?

A: Success Finance accepts various methods for deposits, including bank transfer, cash, and checks. Withdrawals can only be made to pre-registered bank accounts.

Q: How can I contact the customer support of Success Finance?

A: Customer support at Success Finance can be reached during office hours via telephone, fax, or email.

Q: What do the reviews on WikiFX say about Success Finance?

A: Reviews on WikiFX suggest that Success Finance is involved in fraudulent activities, including inducing deposits, preventing withdrawals, and engaging in malicious operations.

明82395

Hong Kong

I deposited 10 thousand yuan on July 1st, but it hasn’t arrived to my account yet. No service replied to me.

Exposure

薛68984

Hong Kong

Wipe out positions and widen the spread maliciously

Exposure

不离不弃77649

Hong Kong

Now they absconded with money

Exposure

FX3115948706

Hong Kong

This broker will add you via dating app and then post many screenshots about their profits. And then you will be asked to deposit funds by transferring money to some individual bank accounts. After that, they will operate for u and you will lose all the money. But later, you are asked to add more. You money should be transferred to company account if the broker is a formal one. Do not trust this broker.

Exposure

沈月

Hong Kong

Chat with u via WeChat for 1-3 months to win your trust and then cheat your money. After people realize it is a scam, the frauds will try to comfort u via some sweet talks. If it doesn't work, they will blacklist and delete u. Hong Kong is the home to frauds now.

Exposure

FX8882803320

Hong Kong

Don’t let them operate for you,who will claim all your money!My friend has also encountered with it.They just earn commissions without,regardless of your plight.

Exposure

奋斗青年97241

Hong Kong

Because of busy work,my exposure of SUCCESS was incomplete.Unfamiliar net-pal invited me into a “Jingwei university E ”Wechat group.The group owner was Hanbo Wei,who guided us to pick stocks and earned a little at first.With three teacher in the broadcasting room(namely,group owner Hanbo We,lecturer Jiaming Wang and Xinyue Tang )whose website is http://pb.abenben.com/v/yu0p2, claimed that the stock profit would be doubled with private equity.While they recommended us to enter stock-index industry later because of the unhealthy market.On the teacher’s recommendation,I added Qin zhou,the customer service of SUCCESS,opening an account and depositing 50 thousand yuan in it. I operated DAX1906 space on the afternoon of 21st,June,2019,which slipped 94 points seriously.My deposit was compulsively closed out,thus becoming debt.After that,I searched that an net-pal expose the SUCCESS fraud platform on Baidu and also couldn’t find any related information on CNGOLD.Knowing that I have been cheated ,I decide to expose this broadcasting room and fraud platform.

Exposure