Company Summary

| Nissan Securities Review Summary | |

| Founded | 1948 |

| Registered Country/Region | Japan |

| Regulation | Regulated by FSA |

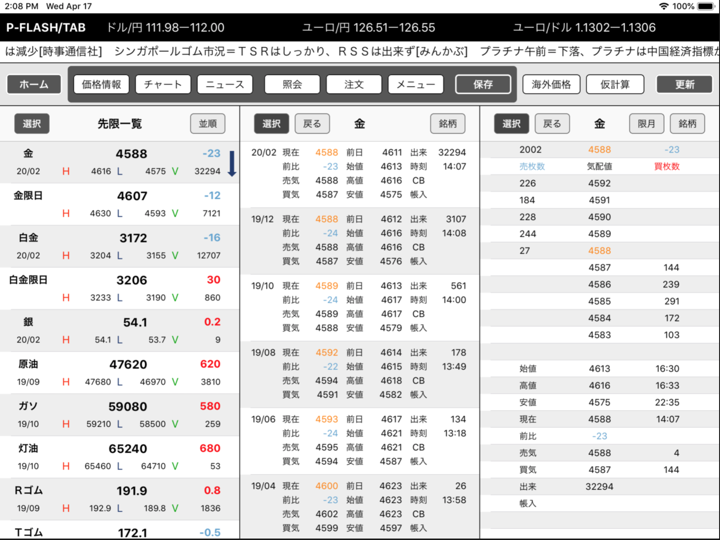

| Market Instruments | Derivatives, Commodities, FX |

| Demo Account | ❌ |

| Customer Support | Contact form |

| 6-10-1, Ginza, Chuo-ku, Tokyo 104-0061, Japan (Head Office) | |

NISSAN SECURITIES is a financial company based in Japan. It was founded in January, 1948 and provides inclding derivatives, commodities, and FX through ISV/Trading Platforms. It is currently under FSA .

Here is the home page of this brokers official site:

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited customer support options |

| Many years industry experiences | No funding methods mentioned |

| ISV/Trading Platforms provided |

Is Nissan Securities Legit?

Nissan Securities is regulated by the Financial Services Agency (FSA). It holds Retail Forex License, with 関東財務局長(金商)第131号.

| Regulatory Status | Regulated |

| Regulated by | Japan |

| Licensed Institution | 日産証券株式会社 |

| Licensed Type | Retail Forex License |

| Licensed Number | 関東財務局長(金商)第131号 |

What Can I Trade on Nissan Securities?

Nissan Securities offers derivatives, commodities, and FX. Their products provide access to Japanese and global markets, and encompass clearing, execution, and brokerage services.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Derivatives | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

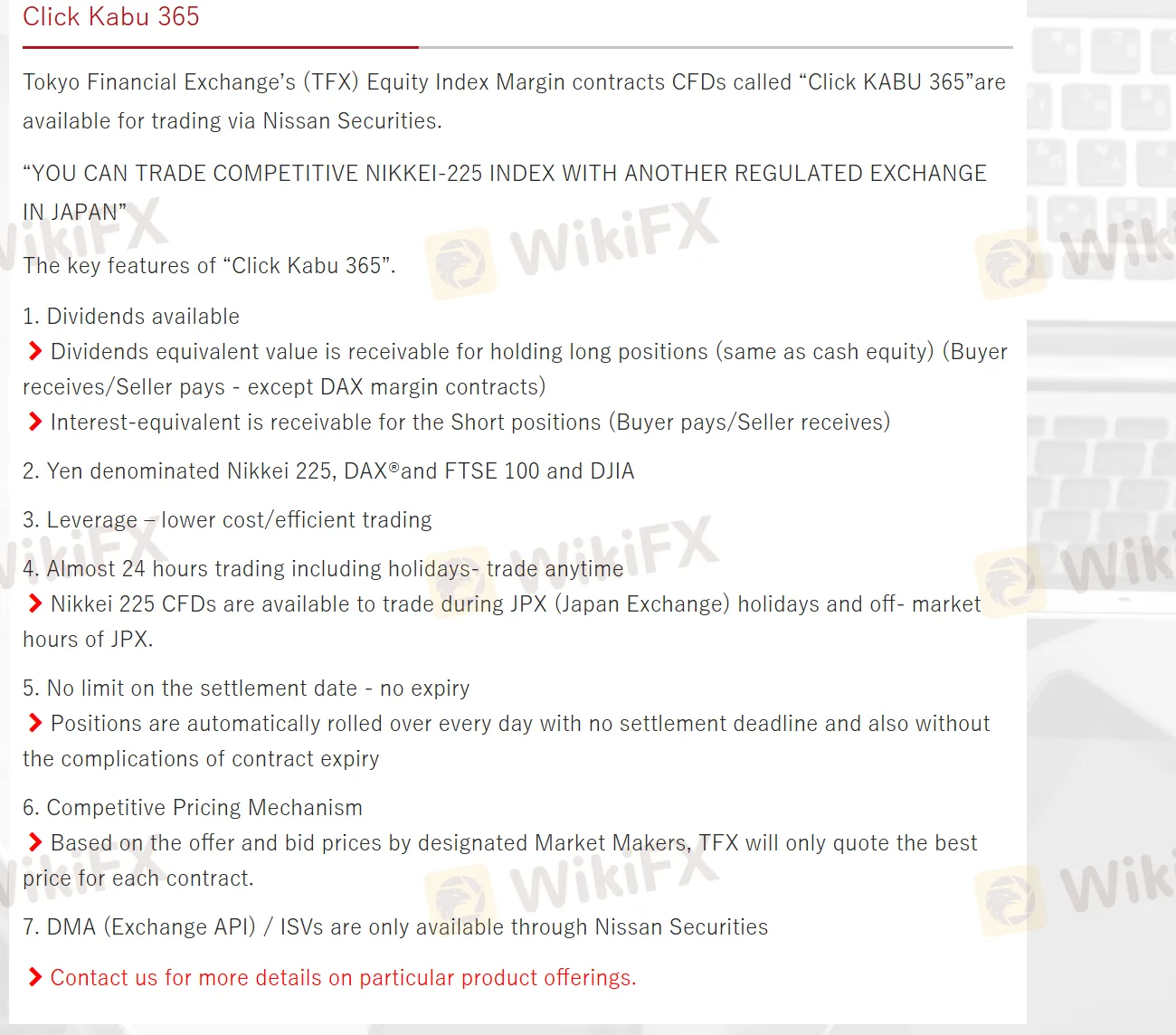

Click KABU 365

Nissan Securities offers trading opportunities for the Equity Index Margin contracts CFDs known as “Click KABU 365,” which are provided by the Tokyo Financial Exchange. It provides trading on TFX‘s CFDs. For long positions, dividends equivalent value can be received (except DAX margin contracts), and for short positions, interest-equivalent is receivable. There’s a leverage option for cost - efficient trading, and it offers almost 24 - hour trading including holidays. Nikkei 225 CFDs can be traded during JPX holidays and off-market hours.

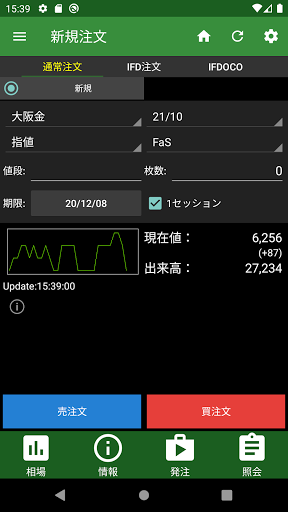

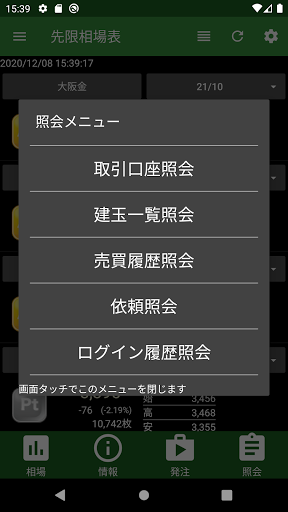

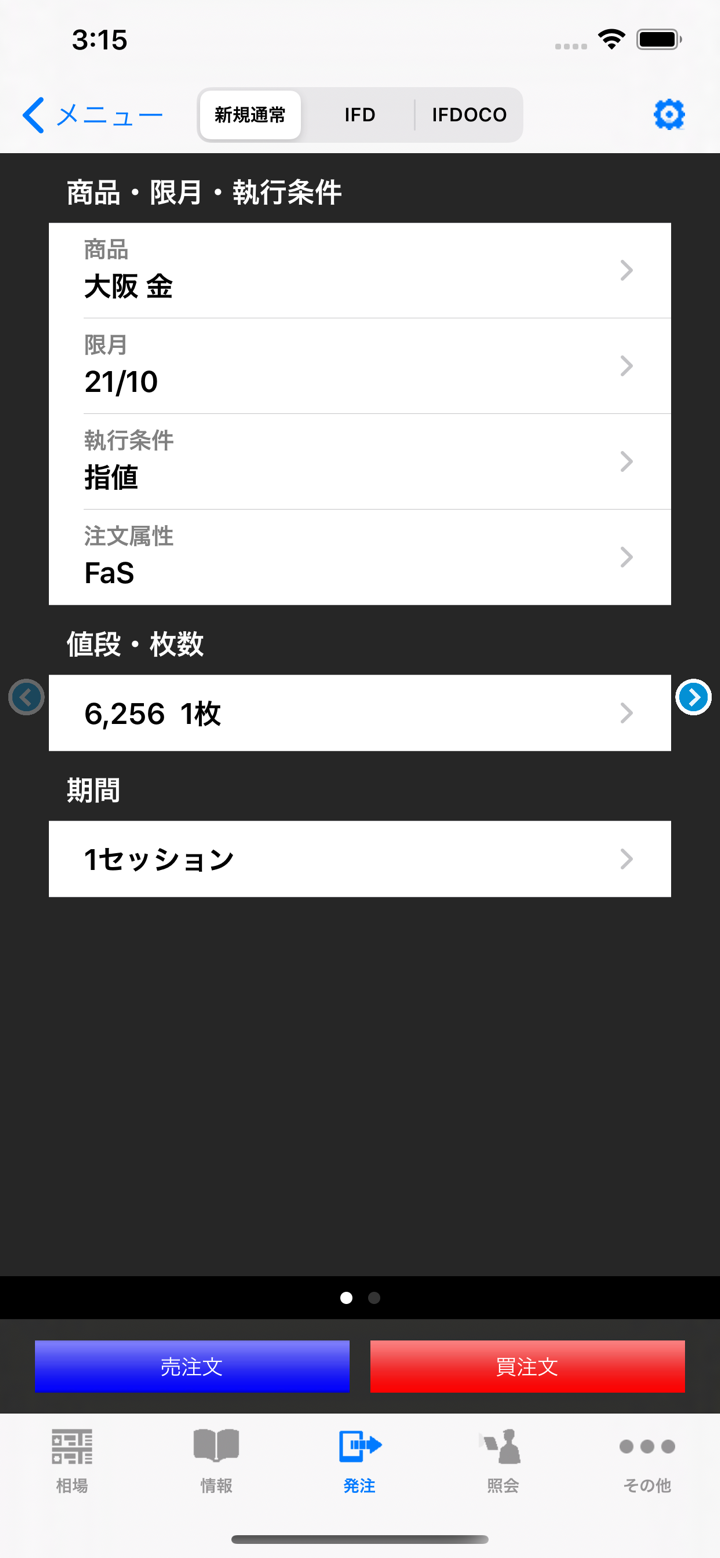

Trading Platform

In addition to support for Native API's and systems, Nissan Securities also offers ISV/Trading platforms including Trading Technologies, Bloomberg, CQG, Stellar, and TORA.