Basic Information

Australia

Australia

Score

Australia

|

5-10 years

|

Australia

|

5-10 years

| https://www.bcu.com.au/

Website

Rating Index

Influence

B

Influence index NO.1

Australia 7.22

Australia 7.22 Licenses

LicensesLicensed Entity:Bananacoast Community Credit Union Ltd

License No. 241077

Australia

Australia bcu.com.au

bcu.com.au Australia

Australia

| BCU Bank | Basic Information |

| Company Name | BCU Bank |

| Headquarters | Australia |

| Regulations | Not regulated |

| Products | Home loans, investment loans, personal loans, car loans, credit cards, home insurance, car insurance, landlords insurance, travel insurance |

| Account Types | Transaction Accounts, Savings Accounts, Term Deposits |

| Payment Methods | Digital Wallets, Osko & PayID |

| Trading Platforms | BCU iBank, BCU Bank App, mymo |

| Trading Tools | Calculators |

| Customer Support | Email (mail@bcu.com.au)Phone (1300 228 228 or +61 2 6560 7491) |

Based in Australia, BCU Bank has been serving customers with a wide array of financial services since its inception. Its product portfolio encompasses home loans, investment loans, personal loans, car loans, credit cards, home insurance, car insurance, landlords insurance, and travel insurance. With a focus on meeting diverse banking needs, BCU Bank offers Transaction Accounts, Savings Accounts, and Term Deposits. Despite providing flexible and accessible services, it's important to note that BCU Bank operates without regulatory oversight. This absence of regulation underscores the need for caution, considering the potential risks associated with unregulated financial operations.

BCU Bank is not regulated. It's crucial to acknowledge that this broker operates without valid regulation, which implies a lack of oversight from established financial regulatory authorities. Traders should proceed with caution and understand the potential risks involved when contemplating trading with an unregulated broker like BCU Bank. Such brokers may offer limited options for resolving disputes, raising concerns about the safety and security of funds, and displaying a lack of transparency in their operations. It's recommended for traders to conduct thorough research and carefully evaluate a broker's regulatory status before participating in trading activities to safeguard a more secure and trustworthy trading experience.

BCU Bank stands out for its diverse range of product offerings, catering to various financial needs of customers. With multiple account types available, customers have flexibility in choosing the banking solutions that best suit their preferences and requirements. Moreover, the bank offers tailored contact methods, ensuring that different needs are addressed promptly and efficiently. However, a notable drawback is the absence of regulatory supervision, which may expose traders to potential risks due to the lack of oversight from recognized financial authorities. Additionally, the availability of educational materials is insufficient, limiting the resources available for customers to enhance their financial knowledge and decision-making.

| Pros | Cons |

|

|

|

|

|

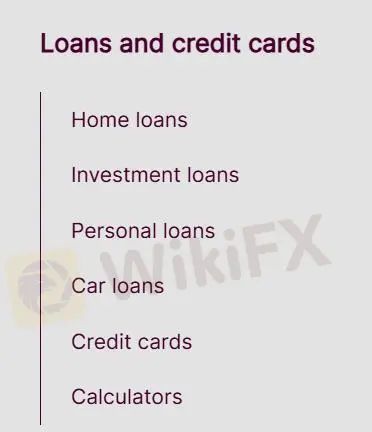

BCU Bank offers a diverse range of financial products to cater to various needs. These include home loans, investment loans, personal loans, car loans, credit cards, home insurance, car insurance, landlords insurance, and travel insurance.

For home loans, BCU Bank provides options such as Fixed Rate Home Loans, Offset Home Loans, and Line of Credit Loans, each tailored to different preferences and financial situations. Investment loans are available in various forms, including Basic Investment Loans, Variable Home Loans for investment properties, Investment Fixed Rate Loans, and Investment Line of Credit Loans, providing flexibility and competitive rates for investors.

Personal loans offered by BCU Bank include New Car Loans for purchasing vehicles, and Freedom Loans Unsecured, providing financial freedom without the need for collateral. Their credit card options consist of Classic Credit Cards and Rewards Credit Cards, offering different benefits and rewards for cardholders.

In addition to lending products, BCU Bank also provides insurance options such as home insurance, car insurance, landlords insurance, and travel insurance, ensuring customers have comprehensive coverage for their assets and travel needs.

BCU Bank offers a comprehensive range of account types tailored to meet various banking needs:

Transaction Accounts:

Access Account: An all-encompassing transaction account designed to address everyday banking requirements. Easily open online and receive instant access to your Visa Debit card.

Advantage Saver Account: Specifically for individuals over 55, this flexible everyday account offers a competitive interest rate. Open online quickly and access your Visa Debit card instantly.

Concession Account: Ideal for those with eligible Commonwealth Government concession cards, this fee-free transaction account allows convenient access to funds via Visa Debit card, BCU iBank, or the BCU Bank app.

Savings Accounts:

Kids Savings Account: The Scoot Super Saver offers competitive interest rates on balances under $50,000, providing a solid foundation for children's savings.

Bonus Saver: Kickstart your savings journey with an introductory interest rate for the first 4 months upon opening this account.

iSaver Account: Offering a higher interest rate as savings grow, this online savings account provides easy access to funds via BCU iBank and the BCU Bank app.

Term Deposits:

Standard Term Deposits: Secure competitive returns on investments ranging from 1 month to 3 years, with deposits starting from $1,000.

Regular Income Term Deposits: Opt for regular interest payments while allowing your savings to grow with flexible term options.

Term Deposits for Over 55s: Members aged 55 and above benefit from special rates, providing security and growth for their funds.

Farm Management Deposit: Designed for primary producers, these products help secure reserves during cash flow positive years to meet demands during slower periods.

BCU Bank offers convenient and secure payment methods to streamline transactions:

Digital Wallets:

BCU Bank supports popular digital wallets like Apple Pay, Google Pay, and Samsung Pay. These digital wallets allow users to make payments easily and securely using their smartphones with Visa Debit or Credit cards.

Osko & PayID:

BCU Bank leverages Osko by BPAY and PayID to provide faster and simpler payments. Osko enables users to send and receive payments 24/7, with funds clearing in as little as 15 seconds. PayIDs offer a convenient way to send and receive payments using various identifiers such as mobile numbers, email addresses, ABNs, or Organisation IDs.

BCU Bank offers a suite of digital platforms to enhance the banking experience:

BCU iBank:

With an intuitive interface and a host of features, BCU iBank provides convenient internet banking accessible anytime, day or night.

BCU Bank App:

The BCU Bank app offers secure and user-friendly mobile banking on the go.

Budgeting App (mymo by BCU):

mymo by BCU serves as a personal financial assistant, offering a holistic view of accounts across multiple financial institutions in one place. With mymo, users can leverage handy features tailored to optimize their finances, ensuring that their money works for them.

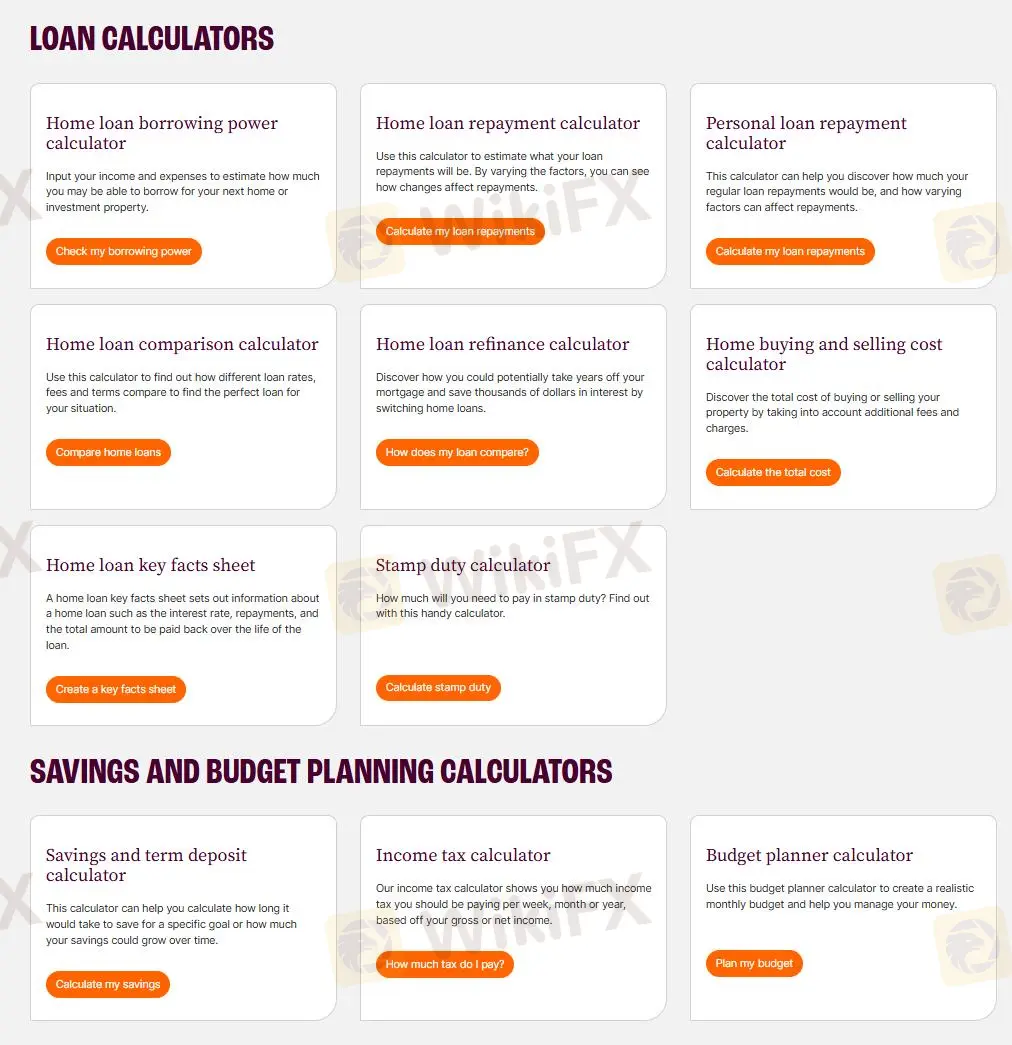

BCU Bank provides a range of helpful calculators and tools to assist customers with various financial decisions:

Loan Calculators:

Home Loan Borrowing Power Calculator: Estimate your borrowing capacity for your next home or investment property by inputting your income and expenses.

Home Loan Repayment Calculator: Determine your loan repayments based on different factors, allowing you to see how changes affect repayments.

Personal Loan Repayment Calculator: Discover your regular loan repayments and how adjustments to factors can impact repayments.

Home Loan Comparison Calculator: Compare different loan rates, fees, and terms to find the ideal loan for your situation.

Home Loan Refinance Calculator: Explore the potential savings and shortened mortgage duration by switching home loans.

Home Buying and Selling Cost Calculator: Calculate the total cost of buying or selling your property, considering additional fees and charges.

Home Loan Key Facts Sheet: Access essential information about a home loan, including interest rates, repayments, and total repayment amount over the loan term.

Stamp Duty Calculator: Determine the stamp duty amount you need to pay based on property value.

Savings and Budget Planning Calculators:

Savings and Term Deposit Calculator: Estimate the time required to save for a specific goal or project how much your savings could grow over time.

Income Tax Calculator: Determine your income tax liability per week, month, or year based on your gross or net income.

Budget Planner Calculator: Create a realistic monthly budget to manage your finances effectively and achieve your financial goals.

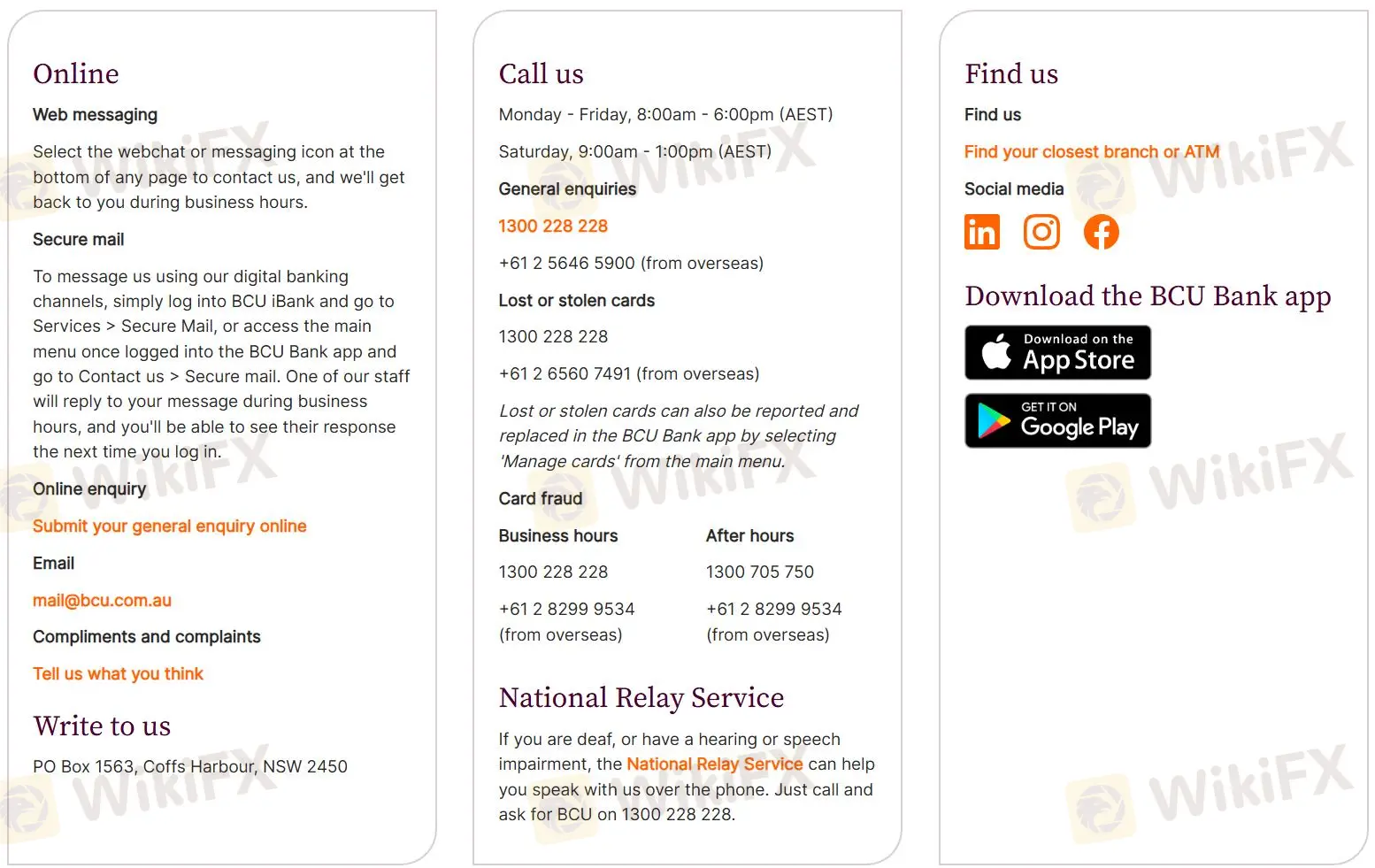

BCU Bank offers comprehensive customer support services to assist customers with their inquiries and concerns:

Contact Information:

Email: Customers can reach out to BCU Bank via email at mail@bcu.com.au.

Phone Support: BCU Bank's phone support is available during the following hours:

Monday to Friday: 8:00am to 6:00pm (AEST)

Saturday: 9:00am to 1:00pm (AEST)

General Enquiries: For general inquiries, customers can contact BCU Bank at 1300 228 228. For calls from overseas, the number is +61 2 5646 5900.

Lost or Stolen Cards: In case of lost or stolen cards, customers can contact BCU Bank at 1300 228 228. For calls from overseas, the number is +61 2 6560 7491.

Card Fraud:

Business Hours: During business hours, customers can report card fraud by calling 1300 228 228. For calls from overseas, the number is +61 2 8299 9534.

After Hours: After business hours, customers can report card fraud by calling 1300 705 750. For calls from overseas, the number is +61 2 8299 9534.

In conclusion, BCU Bank offers a comprehensive array of financial products, providing customers with diverse options to meet their banking needs effectively. The availability of multiple account types grants customers flexibility in selecting the most suitable banking solutions tailored to their preferences and requirements. Additionally, the bank's provision of tailored contact methods ensures prompt and efficient assistance for different customer needs. However, the absence of regulatory oversight poses potential risks, potentially impacting the safety and security of transactions. Moreover, the limited availability of educational resources may hinder customers seeking comprehensive guidance on financial matters.

Q: Is BCU Bank regulated?

A: No, BCU Bank operates without regulation, meaning it lacks oversight from recognized financial regulatory authorities.

Q: What financial products does BCU Bank offer?

A: BCU Bank offers a diverse range of financial products to cater to various needs. These include home loans, investment loans, personal loans, car loans, credit cards, home insurance, car insurance, landlords insurance, and travel insurance.

Q: What account types does BCU Bank offer?

A: BCU Bank provides various account types, including Transaction Accounts, Savings Accounts, and Term Deposits, catering to different banking preferences and needs.

Q: How can I contact BCU Bank's customer support?

A: You can reach BCU Bank's customer support primarily through email at mail@bcu.com.au. For general inquiries, customers can also contact BCU Bank at 1300 228 228. For calls from overseas, the number is +61 2 5646 5900.

Trading online carries substantial risk, and there's a possibility of losing your entire invested capital. It's crucial to understand that online trading may not be suitable for every trader or investor. Therefore, it's essential to thoroughly comprehend the associated risks and be aware that the information provided in this review could be subject to change due to ongoing updates in the company's services and policies. Additionally, the date of this review's generation is significant, as information may have evolved since then. It's advisable for readers to independently verify updated information directly from the company before making any decisions or taking action. Ultimately, the responsibility for using the information provided in this review lies solely with the reader.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now