Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

Score

Saint Vincent and the Grenadines | 2-5 years |

Saint Vincent and the Grenadines | 2-5 years |http://quantum-exchange.com

Website

Rating Index

Forex License

Forex License No forex trading license found. Please be aware of the risks.

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines | Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | Quantum Capital |

| Regulation | Not subject to regulation; no valid regulatory oversight |

| Minimum Deposit | $10 USD |

| Maximum Leverage | Most accounts: 1:500, Promo account: 1:200 |

| Spreads | Pro accounts: 0 pips, Max accounts: 2 pips, Plus accounts: 5 pips |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Equity derivatives, currency derivatives, interest rate derivatives, commodity derivatives, futures contracts, options contracts |

| Account Types | Max, Pro, Plus, Promo, Manage, Swap-Free |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: (+44) 7823 944773, Email: support@quantum-exchange.com |

| Payment Methods | Bank transfer, credit card, debit card, cryptocurrency |

| Educational Tools | Not specified |

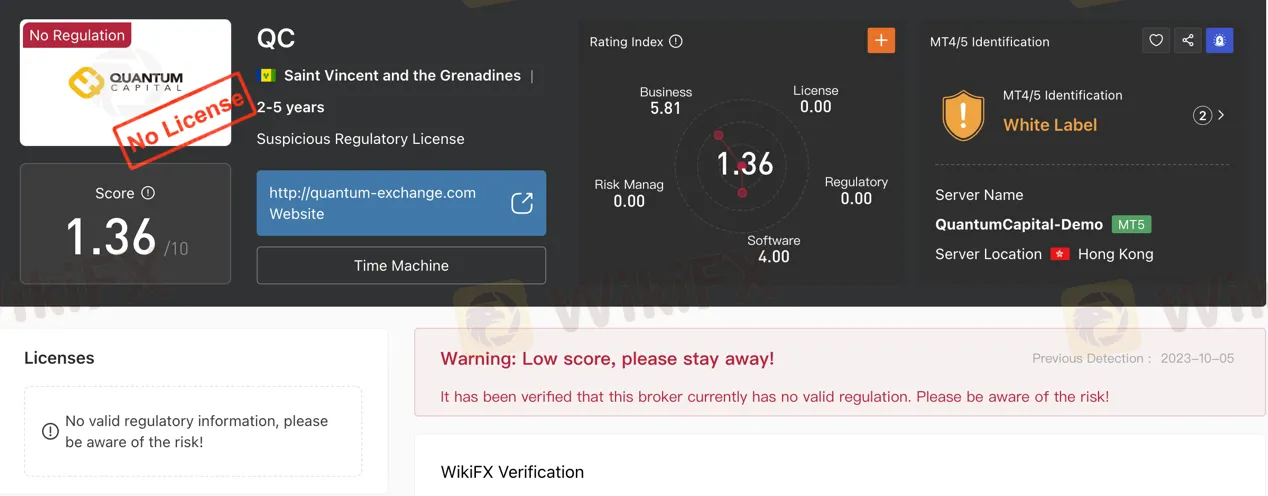

Quantum Capital (QC) is a financial company operating in Saint Vincent and the Grenadines for the past 2-5 years. However, it's important to note that QC operates without any regulatory oversight, making it a potentially risky choice for individuals considering its services. The lack of regulatory supervision raises concerns about the legitimacy of QC, and potential clients are advised to exercise caution and conduct thorough research before engaging with this entity.

QC offers a variety of market instruments, including equity derivatives, currency derivatives, interest rate derivatives, commodity derivatives, futures contracts, and options contracts. These instruments allow traders to speculate on a wide range of financial assets. QC provides different account types, each with varying levels of leverage and spreads. They support multiple deposit and withdrawal methods, including bank transfers, credit cards, debit cards, and cryptocurrency. The minimum deposit amount is $10 USD, and withdrawal processing times vary depending on the method used. The trading platform offered by QC is MetaTrader 5 (MT5), known for its features like charting tools, technical indicators, and support for automated trading strategies. Customer support is available in Traditional Chinese (HK) via phone and email. However, there is a single concerning review on WikiFX that raises issues related to withdrawal problems and suggests caution when dealing with QC. In conclusion, QC operates in a regulatory gray area, and potential clients should approach its services with caution, considering the lack of regulatory oversight and the concerns raised in the available review.

Quantum Capital (QC) presents a range of advantages and disadvantages for potential traders. On the positive side, QC offers a diverse selection of financial derivatives and provides traders with high leverage options. Additionally, the broker boasts competitive spreads starting from 0.0 pips, and it supports various deposit and withdrawal methods. QC also utilizes the popular MetaTrader 5 (MT5) trading platform. However, traders should exercise caution due to the lack of regulatory oversight, limited information about account types, and concerns raised by a negative review. Furthermore, bank transfer deposits can have extended processing times, and it's worth noting that the main website is currently unavailable.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Quality control (QC) in this context is not subject to regulation. It is important to note that there is no valid regulatory oversight in place for this broker, which may pose potential risks for those considering its services. It is advisable to exercise caution and conduct thorough research before engaging with this entity.

EQUITY DERIVATIVES:

Quantum Exchange offers a range of equity derivatives, including stock options, which provide the holder with the right to buy or sell a specified number of shares of a stock at a predetermined price within a set timeframe. Additionally, they provide futures contracts for buying or selling financial instruments like stocks or commodities at agreed-upon prices and dates in the future. Similar to futures, Quantum Exchange also offers forward contracts tailored to the specific requirements of buyers and sellers.

CURRENCY DERIVATIVES:

In the realm of currency derivatives, Quantum Exchange provides forex options that grant the holder the right to buy or sell a specified amount of currency at a predetermined price within a specified timeframe. Furthermore, they offer forex futures contracts for the purchase or sale of a fixed amount of currency at prearranged prices on future dates. Similarly, Quantum Exchange provides customized forex forwards, although these are not exchange-traded and are tailored to individual buyer and seller needs.

INTEREST RATE DERIVATIVES:

Quantum Exchange facilitates interest rate derivatives, including interest rate swaps, allowing the exchange of interest payments on two different loan types. They also offer interest rate futures contracts for buying or selling a fixed interest rate over a defined period. Additionally, Quantum Exchange provides interest rate options, granting the holder the right to buy or sell a fixed interest rate within a specified time frame.

COMMODITY DERIVATIVES:

Commodity derivatives at Quantum Exchange encompass commodity futures contracts, enabling the purchase or sale of specific quantities of commodities like oil or gold at agreed-upon prices on predetermined future dates. Furthermore, they offer commodity options, providing the holder with the right to buy or sell a set quantity of a commodity at a predetermined price within a specified timeframe.

FUTURES CONTRACTS:

Quantum Exchange features futures contracts, including E-mini S&P 500 futures, allowing trading of fractional portions of the S&P 500 stock index. They also offer E-mini Nasdaq 100 futures, facilitating trading of a fraction of the Nasdaq 100 stock index. In addition, Quantum Exchange provides WTI crude oil futures contracts, allowing the purchase or sale of a specified quantity of West Texas Intermediate crude oil.

OPTIONS CONTRACTS:

Quantum Exchange offers options contracts, such as call options on Apple stock, which grant the holder the right to purchase a specific number of Apple shares at a predetermined price within a specified timeframe. They also provide put options on Amazon stock, enabling the holder to sell a specified number of Amazon shares at an agreed-upon price within a defined timeframe. Furthermore, Quantum Exchange offers Eurodollar options, which give the holder the right to buy or sell a fixed interest rate over a specified period.

| Pros | Cons |

| Diverse range of financial derivatives, including equity, currency, interest rate, and commodity derivatives. | Customized forex forwards are not exchange-traded. |

| Offers options, futures, and forward contracts, providing flexibility for traders. | Limited information about the liquidity and trading volume of these instruments. |

| Availability of options contracts for various assets, allowing for risk management strategies. | Complexity in understanding and managing different types of derivatives. |

The Max account type offers a maximum leverage of 1:500 with no specified minimum deposit requirement. It features spreads starting from 2 pips and accepts deposits via VISA and MASTER cards.

The Pro account type provides a maximum leverage of 1:500 with no specified minimum deposit requirement. It offers minimum spreads starting from 0.

The Plus account type offers a maximum leverage of 1:500 with no specified minimum deposit requirement. It features spreads starting from 5 pips.

The Promo account type offers a maximum leverage of 1:200 and does not charge any commission fees.

The Manage account type provides a maximum leverage of 1:500 and accepts deposits through MASTER and VISA cards.

The Swap-Free account type offers a maximum leverage of 1:500 and accepts deposits via VISA and MASTER cards.

Pros and Cons

| Pros | Cons |

| High maximum leverage (1:500) for most accounts. | Lack of information on minimum deposit requirements. |

| Variety of account types to choose from. | Different spreads for each account type. |

| Availability of a Swap-Free account option. | Limited variety in terms of commission fees. |

Quantum Exchange provides a maximum leverage of 1:500 for most account types, with the exception of the Promo account, which offers a maximum leverage of 1:200.

Quantum Exchange offers spreads ranging from 0 pips for Pro accounts, 2 pips for Max accounts, and 5 pips for Plus accounts. The Promo account has no commission fees, but specific commission rates for other account types are not provided.

The minimum deposit amount is $10 USD.

QC supports deposits and withdrawals via bank transfer, credit card, debit card, and cryptocurrency. The minimum withdrawal amount is $30 USD. Bank transfer deposits typically take 3-5 business days to process, while credit and debit card deposits typically take 1-3 business days. Cryptocurrency deposits and withdrawals are typically processed instantly.

| Pros | Cons |

| Multiple deposit methods including bank transfer and cryptocurrency. | Bank transfer deposits can take 3-5 business days to process. |

| Low minimum withdrawal amount of $30 USD. | Credit and debit card deposits may take 1-3 business days. |

| Cryptocurrency deposits and withdrawals are typically processed instantly. |

MT5 (MetaTrader 5): The trading platform offered by QC is MetaTrader 5 (MT5). MT5 is a commonly used trading platform known for its features like charting tools, technical indicators, and support for automated trading strategies. It provides traders with access to a wide range of financial instruments, including forex, commodities, and stocks. MT5 allows traders to execute orders, analyze market data, and manage their trading accounts.

| Pros | Cons |

| Comprehensive charting tools and technical indicators. | Limited information about other available platforms. |

| Support for automated trading strategies. | May not be suitable for traders preferring alternative platforms. |

| Access to a wide range of financial instruments. |

Quantum Exchange offers customer support in Traditional Chinese (HK) at the phone number (+44) 7823 944773. Additionally, customers can reach out via email at support@quantum-exchange.com for assistance.

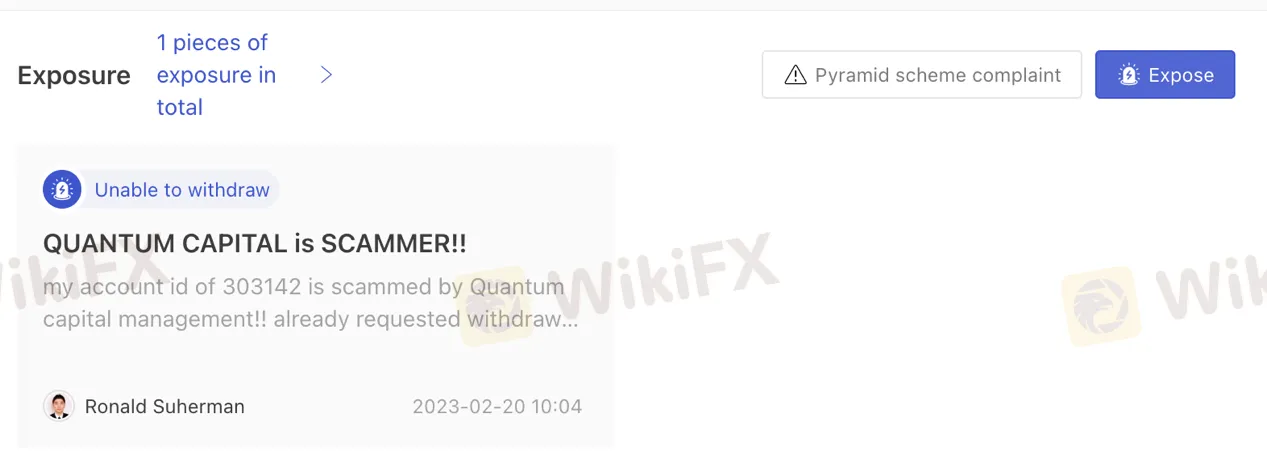

There is a single review of Quantum Capital (QC) on WikiFX, and it raises concerns about the company. The review highlights issues related to withdrawal problems and accuses Quantum Capital of being involved in fraudulent activities. The reviewer claims to have faced difficulties in withdrawing their funds and suggests that others should be cautious when dealing with Quantum Capital.

In conclusion, Quantum Capital (QC) presents certain advantages and disadvantages. On the positive side, the broker offers a variety of market instruments, including equity derivatives, currency derivatives, interest rate derivatives, commodity derivatives, futures contracts, and options contracts. They also provide multiple account types with high leverage ratios, a range of deposit and withdrawal options, and access to the MetaTrader 5 trading platform. However, it's crucial to note that QC lacks regulatory oversight, which may pose potential risks to clients. Additionally, a single review on WikiFX raises concerns about withdrawal issues and alleges fraudulent activities, indicating a need for caution when considering QC's services. Potential clients are advised to conduct thorough research and exercise caution before engaging with this entity.

Q: Is Quantum Capital (QC) a regulated broker?

A: No, QC is not subject to regulation, and there is no valid regulatory oversight for this broker.

Q: What market instruments does Quantum Exchange offer?

A: Quantum Exchange offers a variety of market instruments, including equity derivatives, currency derivatives, interest rate derivatives, commodity derivatives, futures contracts, and options contracts.

Q: What are the different account types offered by QC?

A: QC offers several account types, including Max, Pro, Plus, Promo, Manage, and Swap-Free, each with its own features and benefits.

Q: What is the maximum leverage provided by Quantum Exchange?

A: Quantum Exchange provides a maximum leverage of 1:500 for most account types, except for the Promo account, which offers a maximum leverage of 1:200.

Q: How can I contact Quantum Exchange's customer support?

A: You can reach Quantum Exchange's customer support via phone at (+44) 7823 944773 or through email at support@quantum-exchange.com for assistance.

Forex trading continues to attract global investors, but with its growing popularity comes an increase in fraudulent activity. UK’s Financial Conduct Authority (FCA) has recently exposed several unregulated and scam forex brokers targeting traders. Checkout the list of scam brokers below.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now