Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Founded Year | 2018 |

| Company Name | Currenex |

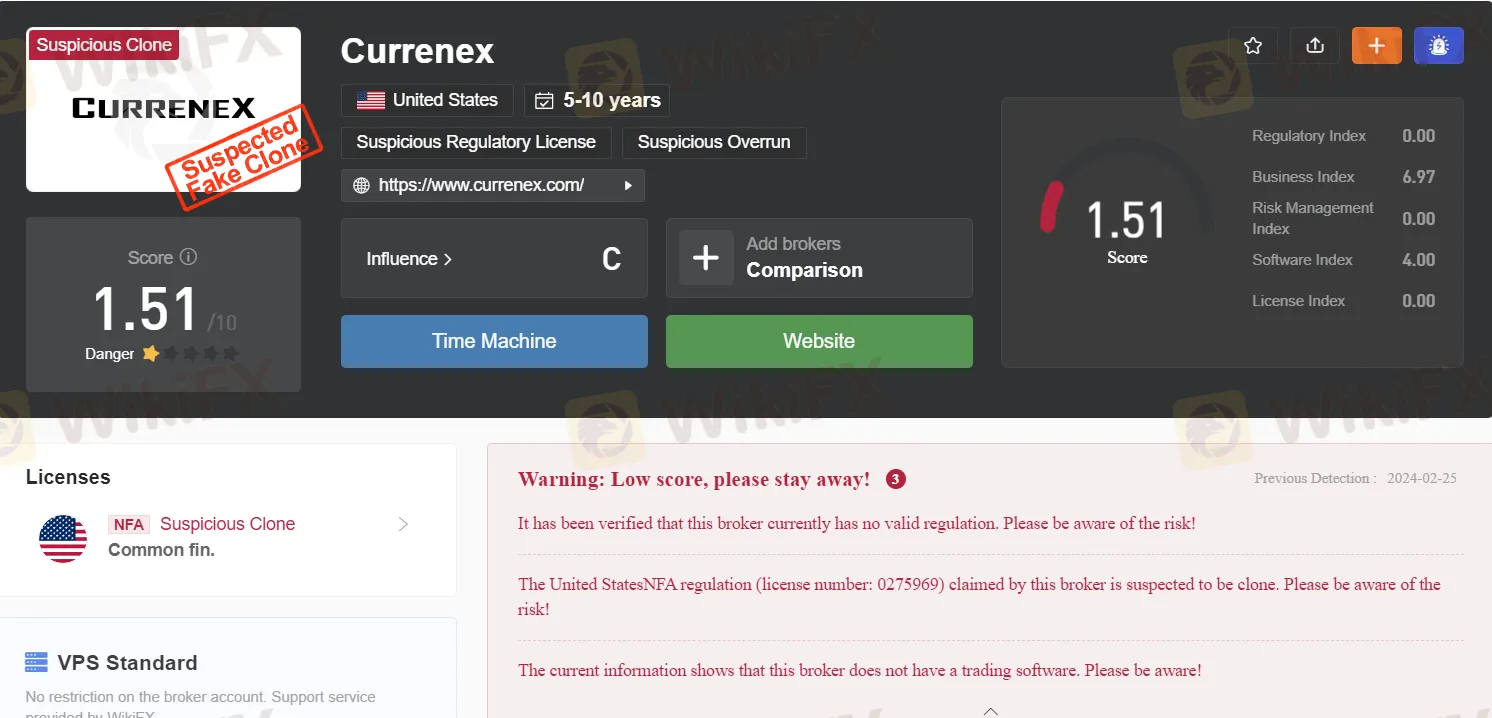

| Regulation | Suspected NFA regulation license number 0275969, raising concerns about legitimacy |

| Services |

|

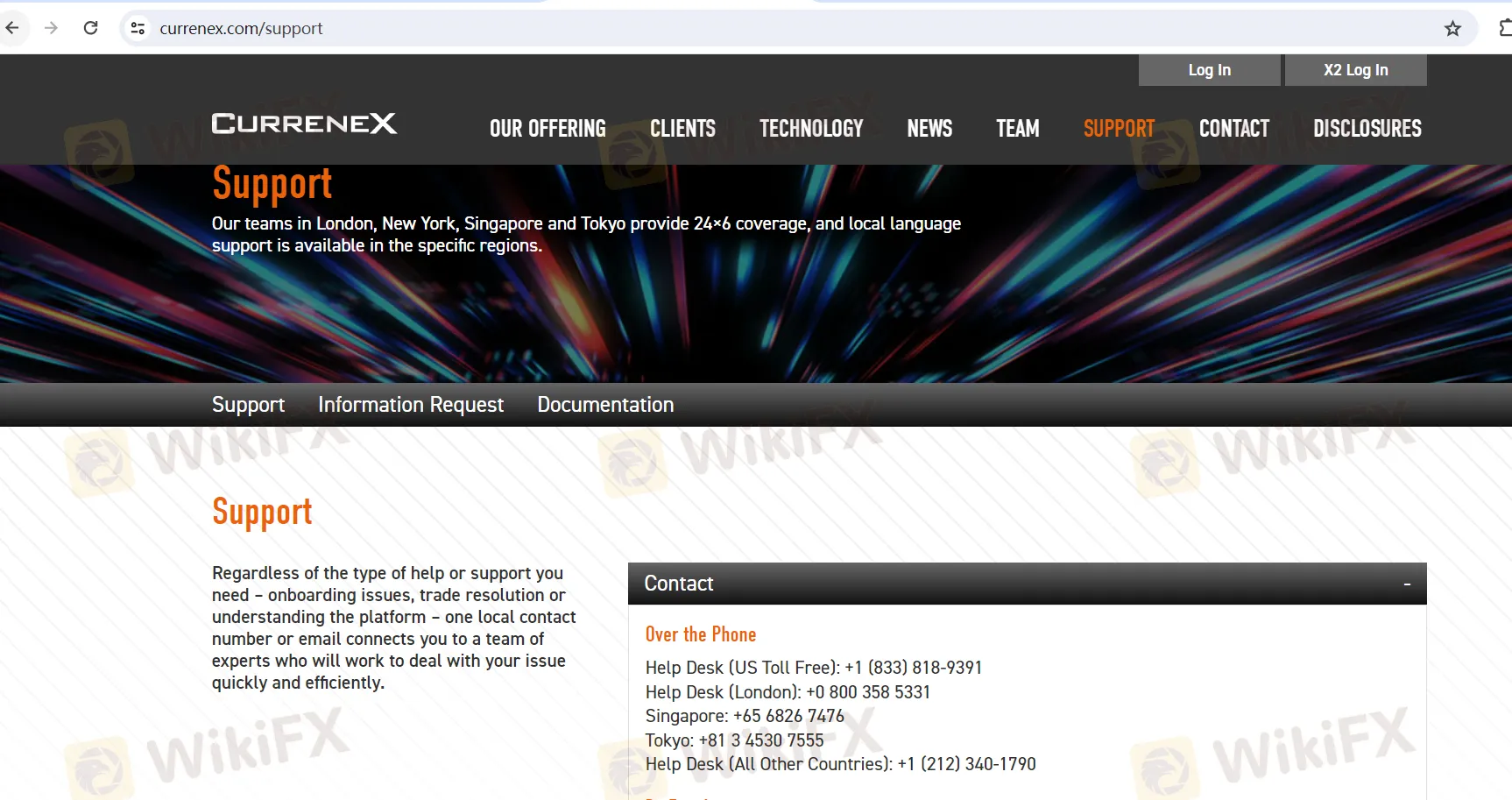

| Customer Support | - Phone support via toll-free numbers for different regions - Email support for assistance and issue resolution |

Overview

Currenex, founded in 2018 and headquartered in the United States, operates under a suspected NFA regulation license number 0275969, sparking concerns regarding its legitimacy. Despite regulatory uncertainties, the company offers a range of services including diverse execution methods, customizable liquidity configurations, a wide array of order types and algorithms, as well as real-time and historical market data solutions. Additionally, Currenex provides comprehensive customer support through phone assistance via toll-free numbers for various regions and email support for issue resolution.

Regulation

The United States NFA regulation license number 0275969 claimed by Currenex is suspected to be a clone, raising significant concerns regarding the legitimacy of the broker. It's imperative for investors to exercise caution and thorough research before engaging with such entities to mitigate potential risks associated with fraudulent activities. Vigilance and due diligence are paramount when dealing with financial services providers to safeguard one's investments and financial well-being.

Pros and Cons

Currenex offers a comprehensive suite of services for traders, including diverse execution methods, liquidity configurations, order types, and market data solutions. These features cater to various trading objectives, providing flexibility and customization options. Additionally, Currenex's robust technology infrastructure and customer support channels ensure a seamless trading experience for its clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

The table above summarizes the pros and cons of Currenex's services. While the platform offers diverse execution methods, customizable liquidity configurations, a wide range of order types and algorithms, and comprehensive customer support, the suspected NFA regulation license raises concerns about its legitimacy.

Services

Currenex offers a comprehensive suite of execution methods and liquidity configurations tailored to meet diverse trading objectives:

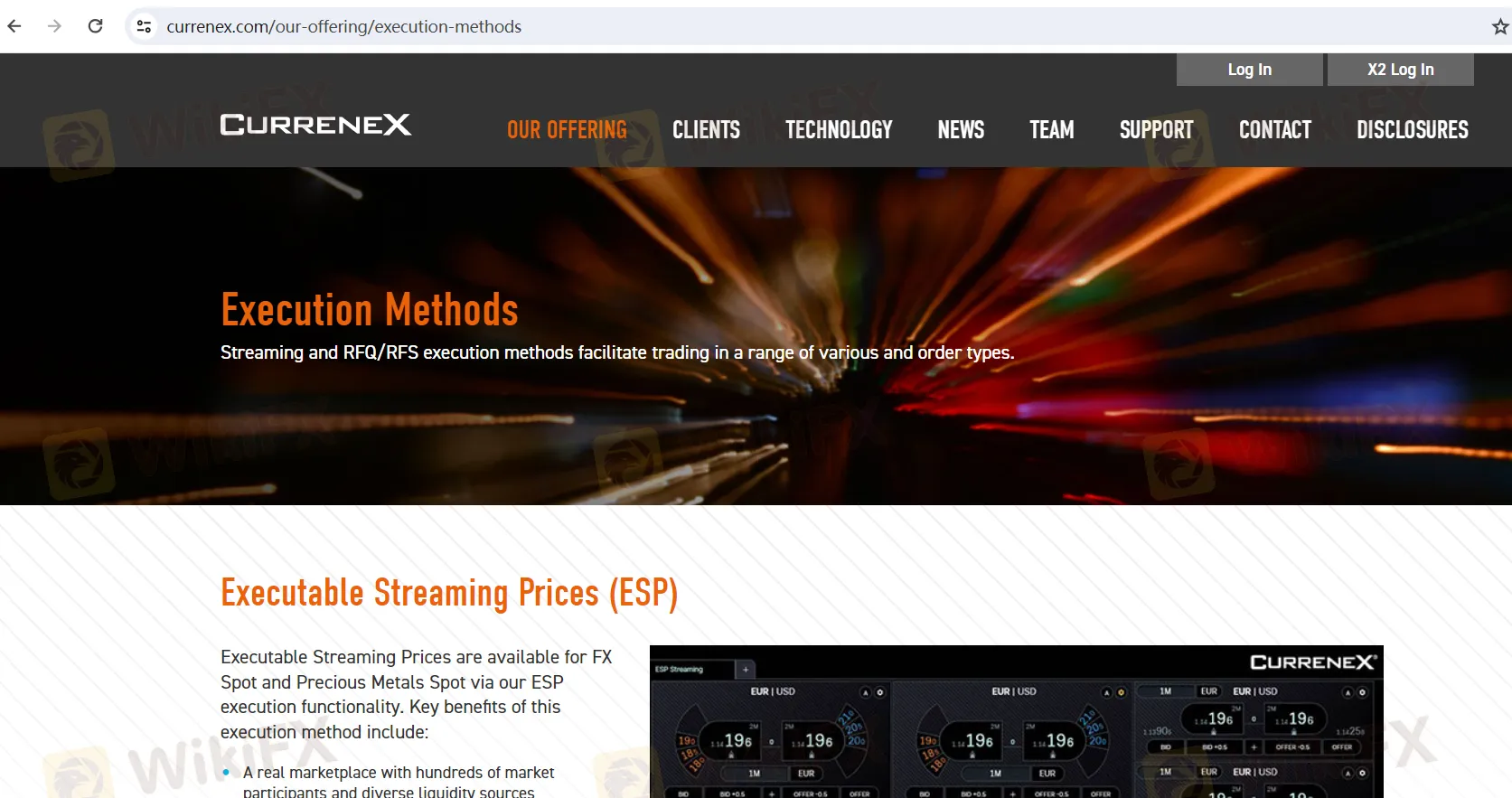

Execution Methods

Currenex offers streaming and RFQ/RFS execution methods for various order types. Executable Streaming Prices (ESP) provide precision pricing, diverse liquidity sources, and customizable liquidity streams. Request for Stream/Request for Quote (RFS/RFQ) allows real-time comparison and analysis of price providers.

Liquidity Configurations

The platform provides co-mingled anonymous and disclosed execution through FXTradesTM and disclosed liquidity from numerous market makers. Anonymous trading options include Sweepable and Full amount categories for ESP and RFS/RFQ execution. Disclosed trading options offer liquidity under similar categories, catering to different execution needs.

Order Types & Algos

Currenex offers a variety of order types such as Market, Limit, Hidden, Iceberg, Stop, and more. Execution algorithms include TWAP Fixed Time, TWAP Randomized, and Floating Passive, among others.

Market Data

Currenex provides real-time and historical data solutions through products like Currenex NOW and Currenex VIEW. Currenex NOW offers tick-by-tick streaming order book data with insight into order book density. Currenex VIEW delivers top-of-book indicative data feed for Spot FX prices.

Private Label Services

The platform enables operating trading venues without hardware investment through robust and customizable technology. It offers liquidity sourcing and aggregation services for accessing pools of liquidity in FX, money markets, and precious metals. Additionally, Currenex provides market risk and credit management tools, along with multiple front-end dealing interfaces and APIs for tailored trading experiences.

Technology

Technology Capabilities:

Currenex claims to utilize high-performing, robust technology and a low-latency network to power its streaming and RFQ/RFS execution venues. Their technology offers a range of capabilities tailored to clients' specific trading strategies. This includes connectivity options such as internet, extranet with cross-connects via Points-of-Presence (POPs) in key data centers, direct access via a private network, and dedicated service.

Messaging Protocols

Currenex offers a range of messaging APIs, allowing clients to tailor their programmatic access to Currenex liquidity. Messaging Protocols include FIX, ITCH, and OUCH, supporting market data retrieval, order execution, and straight-through processing (STP). These protocols are industry-proven, offering efficient and minimal-latency access to market data and order execution functionalities.

Customer Support

Currenex provides dedicated customer support to address clients' needs efficiently and effectively.

Contact Methods:

Phone Support: Clients can directly reach the help desk using toll-free numbers designated for different regions:

Email Support: Clients can also contact support or sales departments via email:

US Toll Free: +1 (833) 818-9391

London: +0 800 358 5331

Singapore: +65 6826 7476

Tokyo: +81 3 4530 7555

All Other Countries: +1 (212) 340-1790

Help Desk: support@currenex.com

Sales: sales@currenex.com

Issue Resolution:

Currenex assists with various issues, including platform access problems, information requests, and other business-related inquiries, aiming for quick and tailored resolutions.

Additional Services:

Documentation Access: Clients can access relevant documentation through the platform, with login information available upon request from support.

Currenex strives to prioritize customer satisfaction by offering accessible support channels, ensuring clients receive timely assistance whenever needed.

FAQs

Q1: What are Currenex's primary execution methods?

A1: Currenex offers streaming and RFQ/RFS execution methods for various order types.

Q2: What liquidity configurations does Currenex provide?

A2: Currenex offers co-mingled anonymous and disclosed execution through FXTradesTM, catering to different trading needs.

Q3: What order types and algorithms are available on Currenex?

A3: Currenex provides a variety of order types such as Market, Limit, Hidden, Iceberg, along with execution algorithms like TWAP Fixed Time.

Q4: How does Currenex handle market data?

A4: Currenex provides real-time and historical data solutions through products like Currenex NOW and Currenex VIEW.

Q5: What customer support options does Currenex offer?

A5: Currenex offers phone support via toll-free numbers for different regions and email support for assistance and issue resolution.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.