Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| CIBfx Review Summary in 10 Points | |

| Founded | 2015 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex currencies, commodities, indices and stocks |

| Demo Account | Available |

| Leverage | 1:100 (Standard Account1)1:200 (Standard Account 2 / Micro Account) |

| EUR/ USD Spreads | From 1 pip |

| Trading Platforms | MT4 trading platform |

| Minimum Deposit | $ 10,000 (Standard Account1)$ 1000 (Standard Account 2)$ 500 (Micro Account) |

| Customer Support | Live chat, Facebook, Twitter, Instagram, Linkedin and Youtube |

What is CIBfx?

Founded in 2015, CIBfx Limited is a Saint Vincent and the Grenadines registered broker which does not hold any legit license, so it unsafe to invest with this broker. It offers trading solutions and educational material for both beginners and professionals. The broker provides access to a range of financial instruments including forex, commodities, indices, and cryptocurrencies. Besides, CIBfx offers flexible account types, allowing clients to choose the account type that best suits their trading needs. The broker provides traders with the MetaTrader 4 (MT4).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

CIBfx Alternative Brokers

There are many alternative brokers to CIBfx depending on the specific needs and preferences of the trader. Some popular options include:

FXTM - A well-regarded broker with a range of financial instruments and flexible account types, including Islamic accounts.

IC Markets - A well-regulated broker with low spreads and fast execution speeds.

eToro - A popular social trading platform that allows traders to follow and copy the trades of other successful traders.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is CIBfx Safe or Scam?

CIBfxcurrently has no valid regulation and there are many reports of scams. Based on the information, it appears that CIBfx may not be a safe and legitimate broker. The lack of valid regulation and reports of non-withdrawals and scams are red flags that should raise concerns about the reliability and trustworthiness of the company. It is always recommended to thoroughly research a broker before engaging in any financial transactions with them to avoid potential risks or losses.

Market Instruments

CIBfx offers a variety of trading instruments across different asset classes, including forex currencies, commodities, indices and stocks.

One of the key areas in which it provides access to is the forex market, where traders can buy and sell over 50 currency pairs, including major and exotic currencies. Traders can take advantage of marginal trading to boost their leverage, which allows them to take larger positions in the market using smaller amounts of capital.

The broker also provides access to the commodities market, including both precious metals such as gold, silver and platinum, as well as energy products such as crude oil and natural gas. These assets are popular among traders seeking. Traders can access commodity trading via CFDs, taking advantage of margin trading, which allows larger trades with a smaller deposit. Though commodity trading is subject to higher risk, it is often integrated in both short-term and long-term strategies, whether for hedging or speculation.

CIBfx also offers the opportunity for traders to invest in indices. The broker allows access to popular indices such as the S&P 500, the Dow Jones, and the NASDAQ, among others.

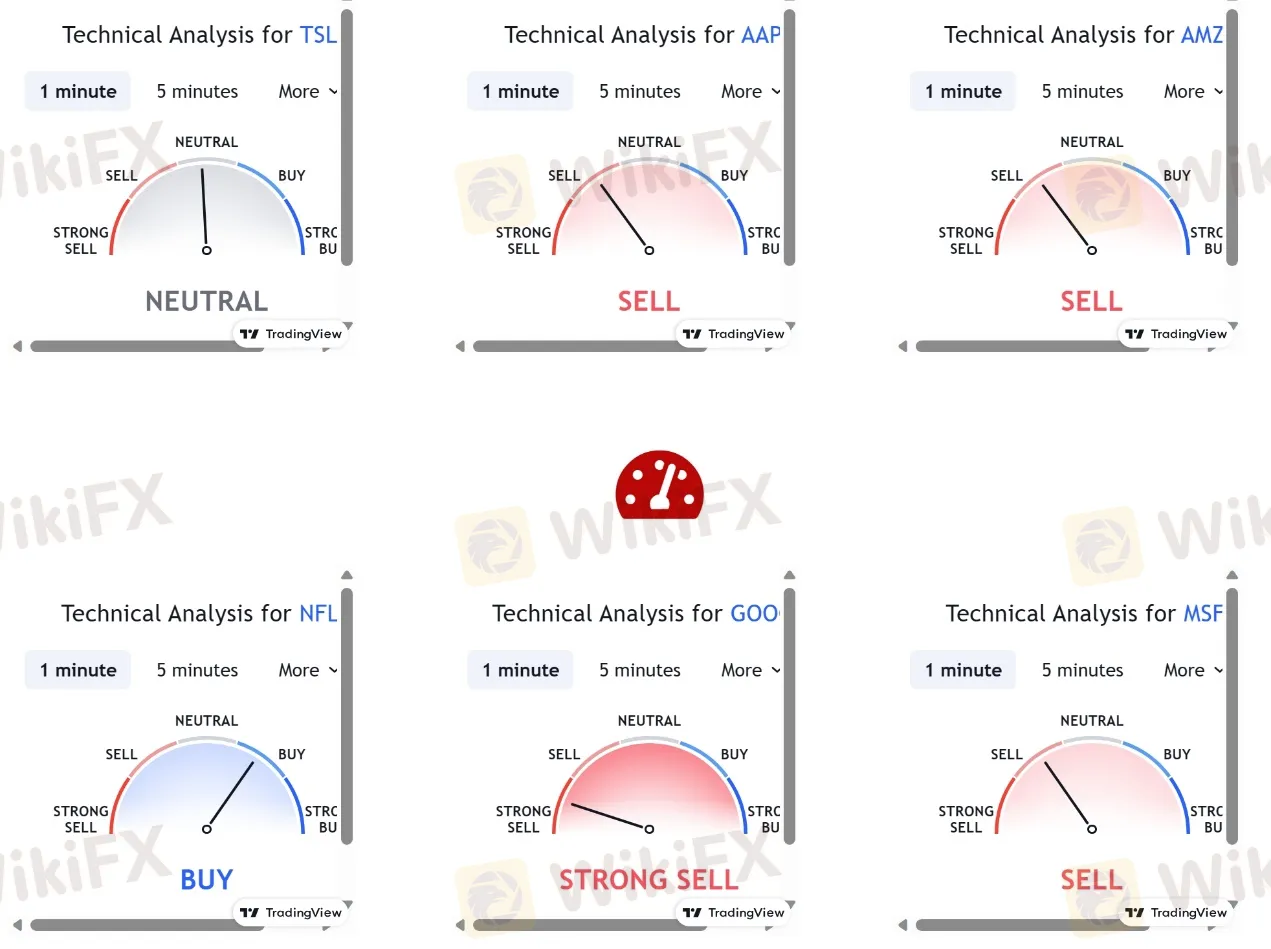

Lastly, CIBfx provides access to stocks trading. Traders can buy or sell shares in some of the world's largest companies, such as Apple, Google, BP ,Facebook and so on. Shares trading can be utilised in long-term investment and in the diversification of a portfolio.

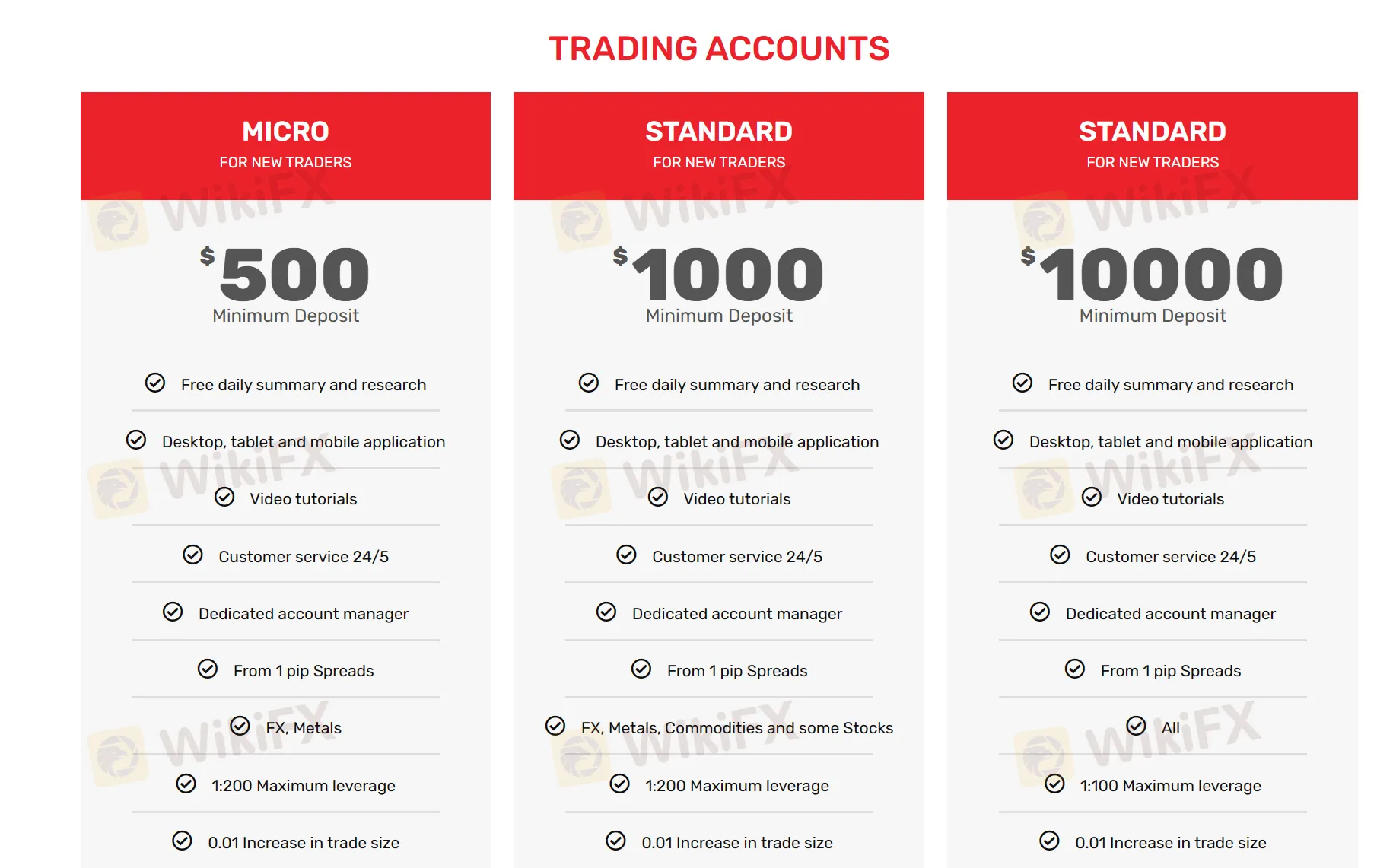

Accounts

CIBfx offers three live account types including the Micro account, Standard account 1 and Steandard 2, with the minimum deposit requirement of $500, $10,000, and $1000 respectively. The micro account is a good option for traders who are just starting out or who want to test the platform at low risk. The Standard account 1 is suitable for more experienced traders who want greater flexibility in their trades. The Standard account 2 includes additional features such as a personal account manager and access to exclusive market analysis and research, so it is suitable for beginners.

Besides, CIBfx also offers swap-free accounts. The accounts are offered to those who cannot earn or pay interest for religious reasons. However, in compliance with some restrictions, these swap-free Forex accounts may not be charged, nor will they earn the interest that comes with supporting Forex trading.

Leverage

CIBfx offers a maximum leverage of 1:200 for Standard and Micro accounts and of 1:100 for Executive account to its clients, which means that traders can open positions that are up to 200 times larger than their account balance. This feature is commonly known as margin trading and it allows traders to increase the potential return on their investments. Leverage amplifies both profits and losses, and therefore it is important that traders understand the risks associated with trading with leverage.

Leverage means that traders can control larger positions with a smaller amount of capital, which can enable traders to open more positions or pursue larger trades than they would be able to otherwise. For example, if a trader wishes to take a position of $20,000 on a currency pair, a 1:200 leverage would require a margin of $100. This means that the trader would only need to have $100 in their account to take the position, and the remaining amount would be borrowed from the broker.

While leverage can significantly boost your returns, it also entails an additional degree of risk as losses may be amplified compared to an account that trades without leverage. It is essential that traders employ strict risk management procedures to minimize potential losses, especially when dealing with highly leveraged trades.

| Account Type | Micro account | Standard account | Executive account |

| Leverage | 1:200 | 1:200 | 1:100 |

Spreads & Commissions

CIBfx offers spreads on major pairs from 1 pip, which is a relatively tight spread compared to other brokers in the market. Tighter spreads translate into lower trading costs and can increase the potential for profits for the trader. However, it is important to keep in mind that spreads may vary depending on market conditions, such as liquidity and volatility.

Unlike some other brokers, CIBfx does not charge any commission for its trading accounts. This means that traders do not have to pay any additional fees on top of the spreads to open or close positions. Instead, the broker generates its revenue through the spreads that it charges. This structure can be beneficial for traders who want to avoid the additional costs of commissions, especially for those trading frequently or with larger volumes.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| CIBfx | 1.0 pip | None |

| FXCM | 0.2 pips | $4 per lot |

| IC Markets | 0.1 pips | $3 per lot |

| eToro | 3 pips | $3.50 per lot |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

CIBfx offers the popular and widely-used MT4 trading platform to its clients. MT4 is a powerful platform for trading in the Forex market, providing traders with advanced charting tools, customizable indicators, and real-time data analysis capabilities. The platform is known for its user-friendly interface and intuitive design, making it easy for traders of all levels to navigate and use.

One of the key features of the MT4 platform offered by CIBfx is its ability to facilitate fully automated trading through the use of expert advisors (EAs). EAs are computer programs that can analyze market data and execute trades automatically based on pre-set rules and parameters. This feature allows traders to take advantage of market opportunities without having to constantly monitor the market.

In addition to its advanced charting and analysis capabilities, the MT4 platform offered by CIBfx also allows traders to execute trades quickly and easily. The platform supports one-click trading and can execute trades in real-time, ensuring that traders can take advantage of market opportunities as soon as they arise.

Overall, CIBfx's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| CIBfx | MT4 |

| FXCM | Trading Station |

| IC Markets | MT4, MT5, cTrader |

| eToro | Proprietary |

Trading Tools

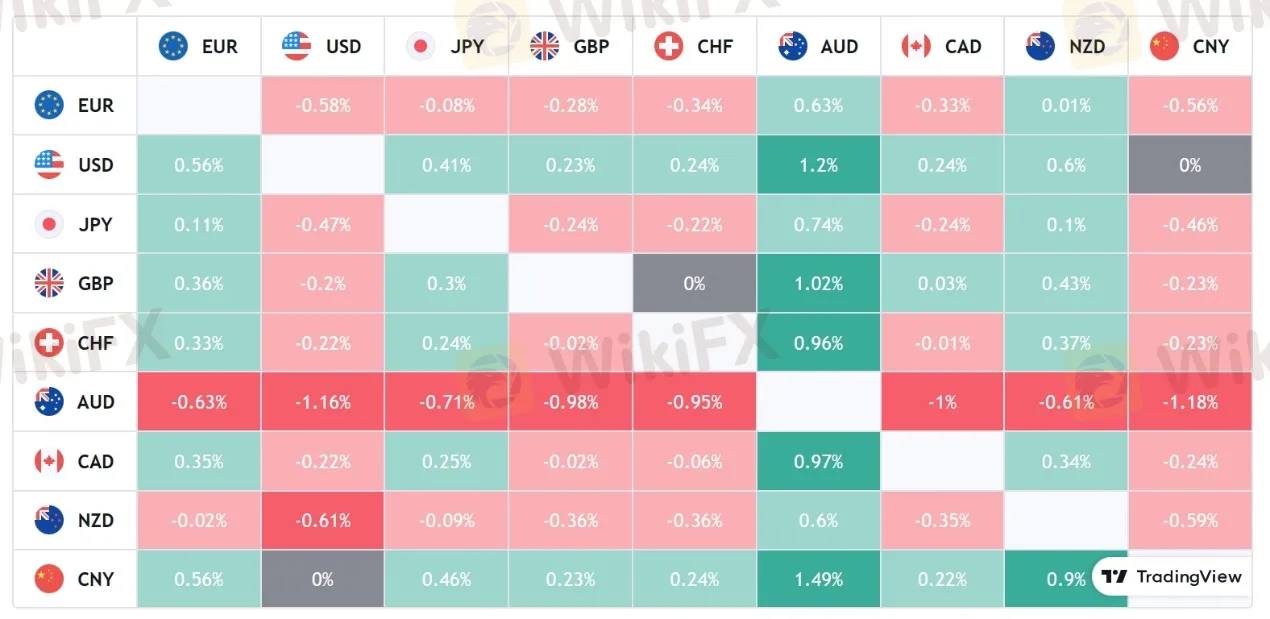

CIBfx offers economic calendar, forex rates, forex heat maps, technical analysis and interest rates.

One such tool is its economic calendar, which provides up-to-date information on important economic events and indicators that can impact the financial markets. Traders can use this tool to plan their trades based on upcoming market-moving events and adjust their strategies accordingly.

Another useful tool offered by CIBfx is its forex rates monitor, which allows traders to track live currency exchange rates in real-time. This tool can help traders stay on top of market trends and make informed decisions about when to enter or exit trades.

CIBfx also offers forex heat maps, which provide a visual representation of currency strength and weakness over a specified period. These heat maps can help traders identify potential trading opportunities based on trends in currency movements.

In addition to its market analysis tools, CIBfx also provides technical analysis resources for traders. This includes charting tools and technical indicators that can be used to identify patterns and trends in market data, as well as establish entry and exit points for trades.

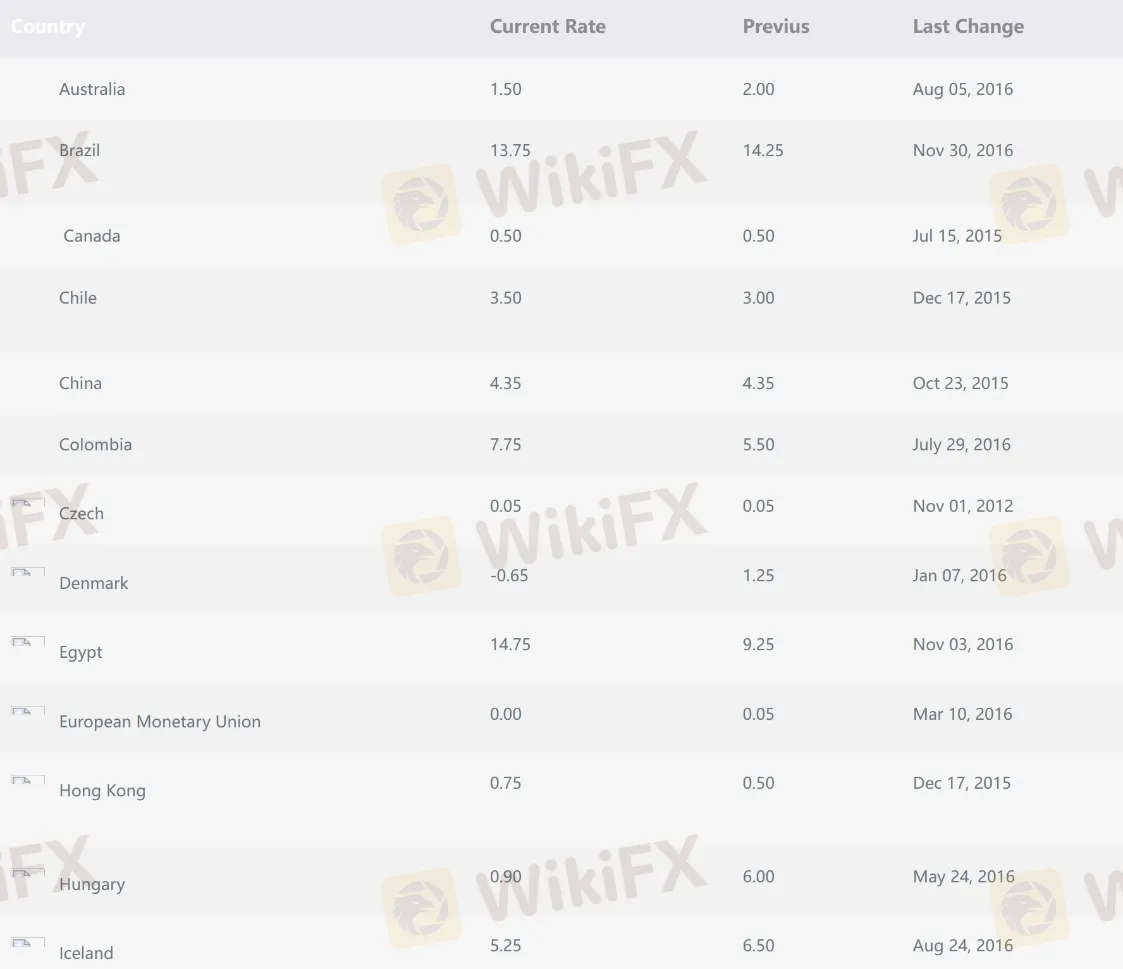

CIBfx provides information on interest rates, which can be a critical factor in determining currency values and market movements. Traders can use this information in their analysis and decision-making processes, particularly when trading in interest rate-sensitive currency pairs.

Overall, the trading tools offered by CIBfx can be valuable resources for traders who want to stay on top of market trends and make informed trading decisions. The combination of economic data, live forex rates, and technical analysis tools can help traders to develop effective trading strategies and manage their risk effectively.

Deposits & Withdrawals

CIBfx accepts its traders to fund their accounts through Visa, MasterCard, AstroPay as well as Bank Transfer.

One of the most popular options is to make a deposit using Visa or MasterCard credit or debit cards. This is a quick and easy option, with deposits typically being credited to a client's account instantly. However, it is worth noting that some credit card providers may charge additional fees for withdrawing funds from a trading account, so clients should check with their respective banks before proceeding.

Another popular payment method offered by CIBfx is AstroPay. This is a virtual payment card that can be purchased online and then used to transfer funds to a trading account. The main advantage of AstroPay is that it is a secure payment method that provides clients with greater anonymity compared to other payment options.

For clients who prefer traditional methods of payment, CIBfx also accepts bank transfers. This is a more labor-intensive option, as clients will typically need to wait several business days for their deposit to be processed. However, bank transfers are generally considered to be a secure and reliable option for transferring funds, particularly for larger deposits.

CIBfx minimum deposit vs other brokers

| CIBfx | Most other | |

| Minimum Deposit | $500 (Micro Account) | $100 |

Fees

As a broker, CIBfx charges fees for some of its services. Client accounts in which there have been no trades, for a period of more than 30 calendar days, will be considered by the Company as being dormant accounts. Such 30 days period shall begin from the first day following the lapse of the 30 days period of time in which no transaction was undertaken. Any new Trading Account for which the client requests a withdrawal before the first 30 calendar days of its operation, will be considered by the Company as being Dormant Account and will be subject to a dormancy fee of 150 USD per month. Company may at its own discretion and time deduct the amount per month and/or over a longer period of inactivity. Furthermore, the dormant fees can be applied with retroactive effect.

User Exposure on WikiFX

On our website, you can see reports about scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

The CIBfx customer support can be reached through live chat as well as some social media platforms including Facebook, Twitter, Instagram, Linkedin and Youtube.

https://twitter.com/CIBforex

https://www.facebook.com/cibfx

https://www.instagram.com/cib_fx/?hl=en

https://www.youtube.com/channel/UCPIYiD0KgfJ-_zimPXHeXjg

https://www.linkedin.com/company/cibfx-capital-investment-brokers/

Pros and cons of customer service of CIBfx

| Pros | Cons |

|

|

|

|

|

Note:These pros and cons are subjective and may vary depending on the individual's experience with CIBfx's customer service.

Education

CIBfx offers a range of educational resources that are designed to help traders improve their trading skills and knowledge. One such resource is its trading glossary, which provides definitions and explanations of key trading terms and concepts. This can be particularly useful for new traders who may be unfamiliar with some of the jargon associated with trading, as well as more experienced traders who want to refresh their knowledge.

In addition to its trading glossary, CIBfx also offers a series of educational videos that cover a variety of topics related to trading. These videos cover everything from basic trading concepts to advanced trading strategies, and are presented in a way that is easy to understand and accessible to traders of all levels of experience.

In addition to these resources, CIBfx also provides clients with access to a range of trading tools, as well as access to real-time market data and news. This can be particularly useful for traders who want to stay on top of market trends and make informed trading decisions.

Conclusion

In conclusion, CIBfx is a forex broker that offers a range of trading services and features for its clients. The broker provides access to a wide range of financial instruments such as forex, commodities, CFDs and more. CIBfx offers flexible account types, allowing traders to choose the account type that suits their trading needs, and its trading platforms are intuitive and user-friendly, providing traders with a smooth trading experience.

CIBfx also provides many educational resources, such as its trading glossary and educational videos, which make it a good option for both new and experienced traders. Additionally, the brokers customer support team is responsive, knowledgeable, and able to offer informed answers to clients' questions and concerns.

On the other hand, while CIBfx does not charge fees for many of its services, the broker reserves the right to charge fees on a case-by-case basis for specific services or transactions. Additionally, its customer service is not available 24/7, and there is no option for in-person support.

However, CIBfxcurrently has no valid regulation and there are many reports about scams.

| Q 1: | Is CIBfx regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At CIBfx, are there any regional restrictions for traders? |

| A 2: | Yes. CIBfx does not provide services to residents of the E.U, UK, U.S., Canada, Israel, New Zealand, Japan, Iran and North Korea. |

| Q 3: | Does CIBfx offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does CIBfx offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for CIBfx? |

| A 5: | The minimum initial deposit to open an account is $10,000 for Executive Account, $1,000 for Standard Account and $500 for Micro Account. |

| Q 6: | Is CIBfx a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners because of its unregulated condition. |

Robinson 338

Dominica

I want to get my money back. I want you to help me with that. Please, I want you to answer me from the fund recovery company.

Exposure

Nico Nava

Argentina

I think that the favorable opinions about CIBfx are the ones who send them because it is not true that the money can be withdrawn. They do not even want to give me the investment after I was operating for three months and obtaining some profits. They told me that supposedly I had to quintuple the amount equivalent to my investment plus a "virtual" bonus that the Broker supposedly "invested" in my account so that they could "authorize" some withdrawal. Obviously I never knew this until I tried to get them to answer me first, since when I mentioned by WathsApp that I wanted to withdraw from my funds, they left me. Now, they were refusing to continue operating and trying to withdraw my capital and blocked me. For me it is a vulgar scam!

Exposure

sandra101

United States

stop wasting your time and money cause this scam brokers will not allow you to make a withdraw from your investment account keep asking for more fee luckily i was able to get back all my investment including the bonus with the help of maiI ; nick jover4 at gmaiI com , if you have a withdrawing issue with your investment broker reach out to him for solution

Neutral

苹果968

United Kingdom

A few weeks ago I saw an advertisement for CIBfx on the Internet, and out of curiosity I came to wikifx to check and found out that it is a company without any regulation. I think really good companies don't need to advertise themselves everywhere.

Positive

ken_goh

Ecuador

I have noticed that this company does not have any regulatory license. I think there is a high chance that it is unreliable. I would not invest here out of caution, I have much better options.

Positive