No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

The WikiFX Score of this broker is reduced because of too many complaints!

Halifax

Australia | 5-10 years |

Australia | 5-10 years | Suspicious Regulatory License | Suspicious Scope of Business | Australia Market Making License (MM) Revoked | High potential risk

http://halifaxchina.com.au/eng/

Website

Rating Index

Contact

+61 2 8319 5638

http://halifaxchina.com.au/eng/

The WikiFX Score of this broker is reduced because of too many complaints!

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Keywords

5-10 years

Suspicious Regulatory License

Suspicious Scope of Business

Australia Market Making License (MM) Revoked

High potential risk

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

5

Basic Information

Registered Region  Australia

Australia

Australia

Australia Operating Period

5-10 years

Company Name

Halifax

Abbreviation

Halifax

Company employee

--

Customer Service Email Address

support@halifax.com.au

Contact Number

+61 2 8319 5638

Company Website

QQ

4001059388

7

Website

Genealogy

Related Companies

Employees

Comment

Users who viewed Halifax also viewed..

XM

9.10

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

XM

Score

9.10

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

TMGM

8.55

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

TMGM

Score

8.55

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

HANTEC MARKETS

8.63

Score ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

HANTEC MARKETS

Score

8.63

ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

Official Website

VT Markets

8.68

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

VT Markets

Score

8.68

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Website

halifaxonline.com.au

111.65.227.169halifaxchina.com.au

47.89.5.243

Genealogy

Download APP

Related Companies

"Halifax"(Latvia)

Active

Latvia

Registration No.

40008312405

Established

HALIFAX AMERICA LLC(Delaware (United States))

Active

United States

Registration No.

5160956

Established

HALIFAX INVESTMENT SERVICES PTY LTD(Australia)

Unknown

Australia

Registration No.

096980522

Established

HALIFAX NEW ZEALAND LIMITED(New Zealand)

Abnormal

New Zealand

Registration No.

2130897

Established

Employees

User Reviews7

Scroll down to view more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 7

Write a comment

7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

WallJay

Hong Kong

How long will the bankruptcy proceeding be? When I withdraw fund?

Exposure

Aaron44993

Hong Kong

The customer service said the withdrawal will arrive in a couple of days but it has been delayed with excuses. It has been two weeks now.

Exposure

whiu

Hong Kong

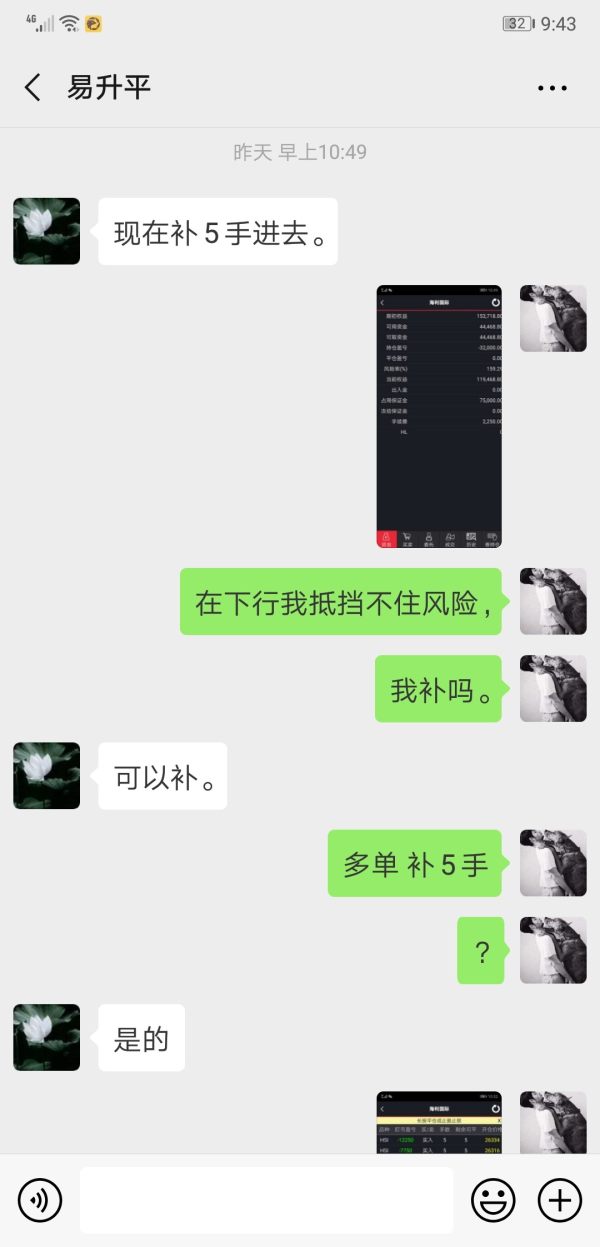

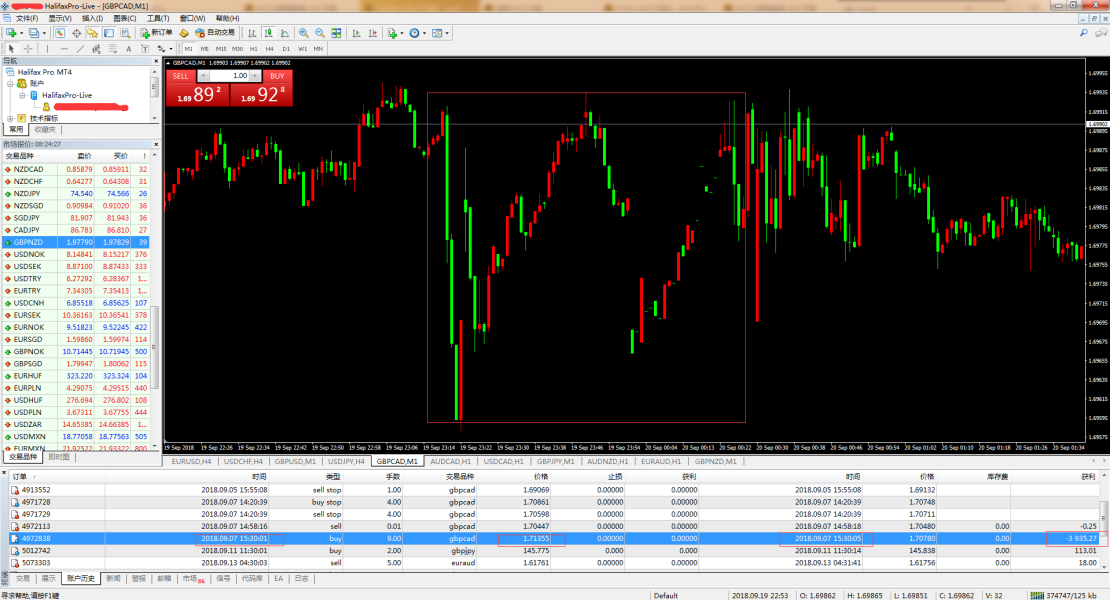

The person who gives order recommendation cooperates with Haili International platform to become its customer service,listening to their order.At the beginning,the person will ask you to control the position,then require you to submit the screenshots and follow their high-risk orders,which leads to forced liquidation and great losses.

Exposure

空心人

Hong Kong

The platform announced an email saying that they are changing shareholders. My account was frozen and I can’t withdraw. This kind of conduct is illegal. They have no right to freeze my account.

Exposure

Shape of you

Hong Kong

I opened an account on Halifax in early March and traded. They induced to deposit a lot with an 8% bonus. I traded a lot. However, their spread multiplied dozen times for no reason on March 23th, which made my position liquidated. It was obviously manipulated by them. Later they gave me no reasonable explanation, saying it was a technical problem of myself. They deliberately hid their risks, boasted their profit, gave me wrong directions, induced me to invest with bonus and made my position liquidated by increasing their spread.

Exposure

FX8519968893

Hong Kong

They deliberately produce slippage to make clients lose. It’s been two weeks, they still gave us no solution. 20 days! All their people are pushing the buck. Scammers!

Exposure