Company Summary

| The Capital GroupReview Summary | |

| Founded | 1998 |

| Registered Country/Region | Taiwan |

| Regulation | Taipei Exchange |

| Market Instruments | Stock,Future |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Customer Support | Address : 11F., No. 156, Sec. 3, Minsheng E. Rd., Songshan Dist., Taipei City 105, Taiwan (R.O.C.) |

| Tel : 886-2-412-8878 | |

| E-mail : service@capital.com.tw | |

The Capital Group information

Founded in 1998, The Capital Group is registered in Taiwan and regulated by Taipei Exchange under the supervision of Unreleased. It offers stock and options trading.

Pros and Cons

| Pros | Cons |

| Regulated | Lack trading instruments |

| Demo account unavailable | |

| MT4/MT5 unavailable | |

| Lack of Spread information | |

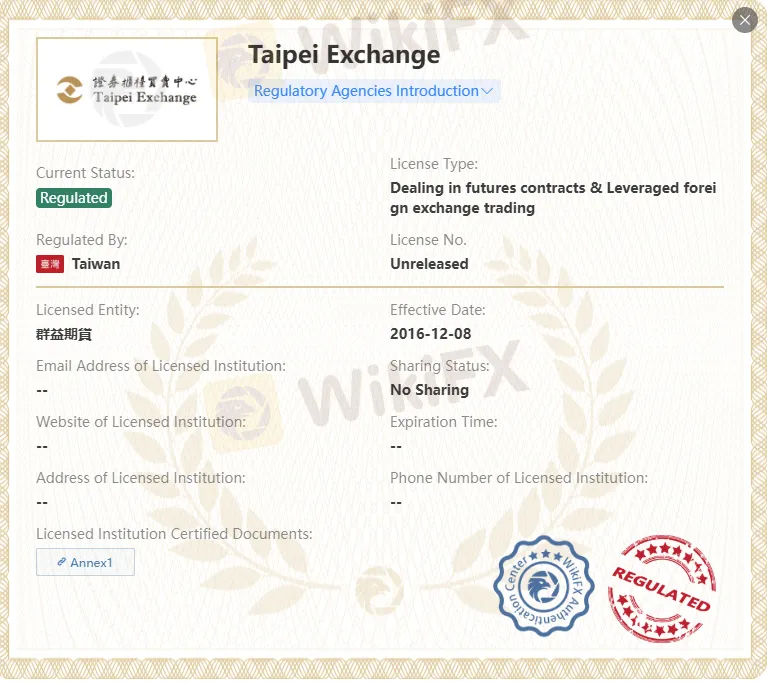

Is The Capital Group Legit?

Yes. The Capital Group is licensed by Taipei Exchange to offer services.

| Regulator | Current Status | Regulated Entity | License Type | License No. |

| Taipei Exchange | Regulated | 群益期貨 | Dealing in futures contracts & Leveraged foreign exchange trading | Unreleased |

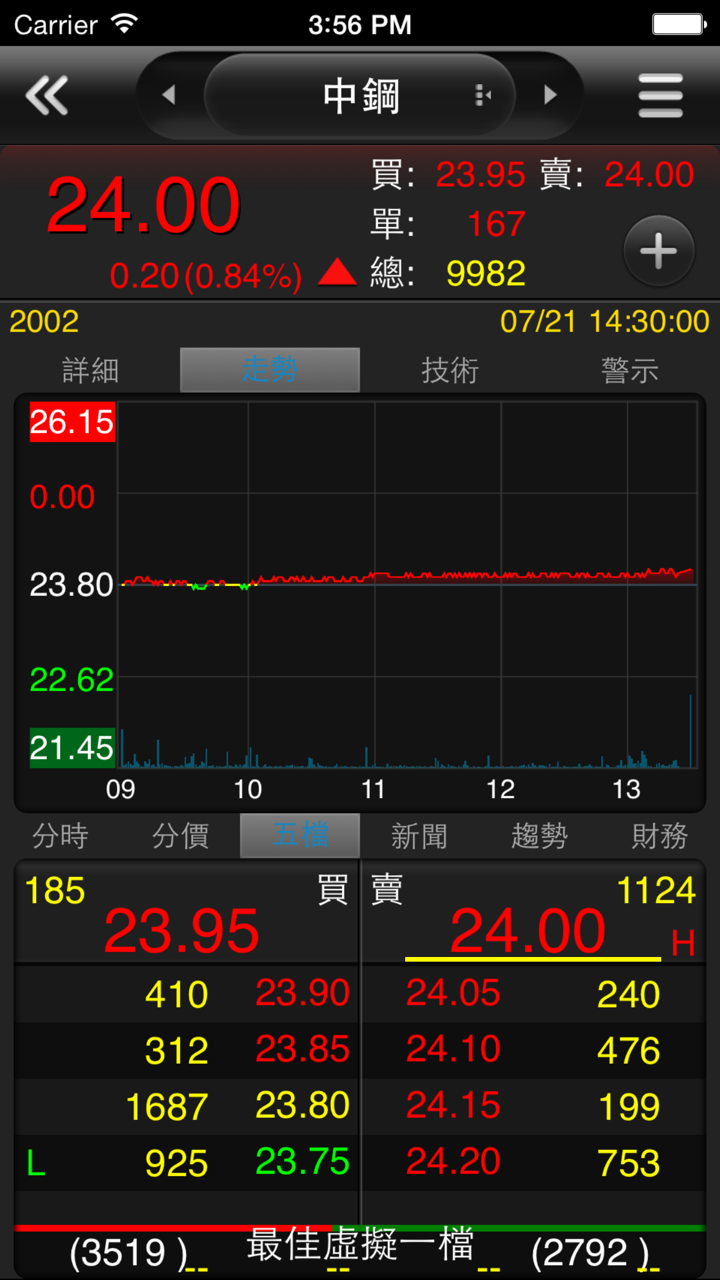

What Can I Trade on The Capital Group?

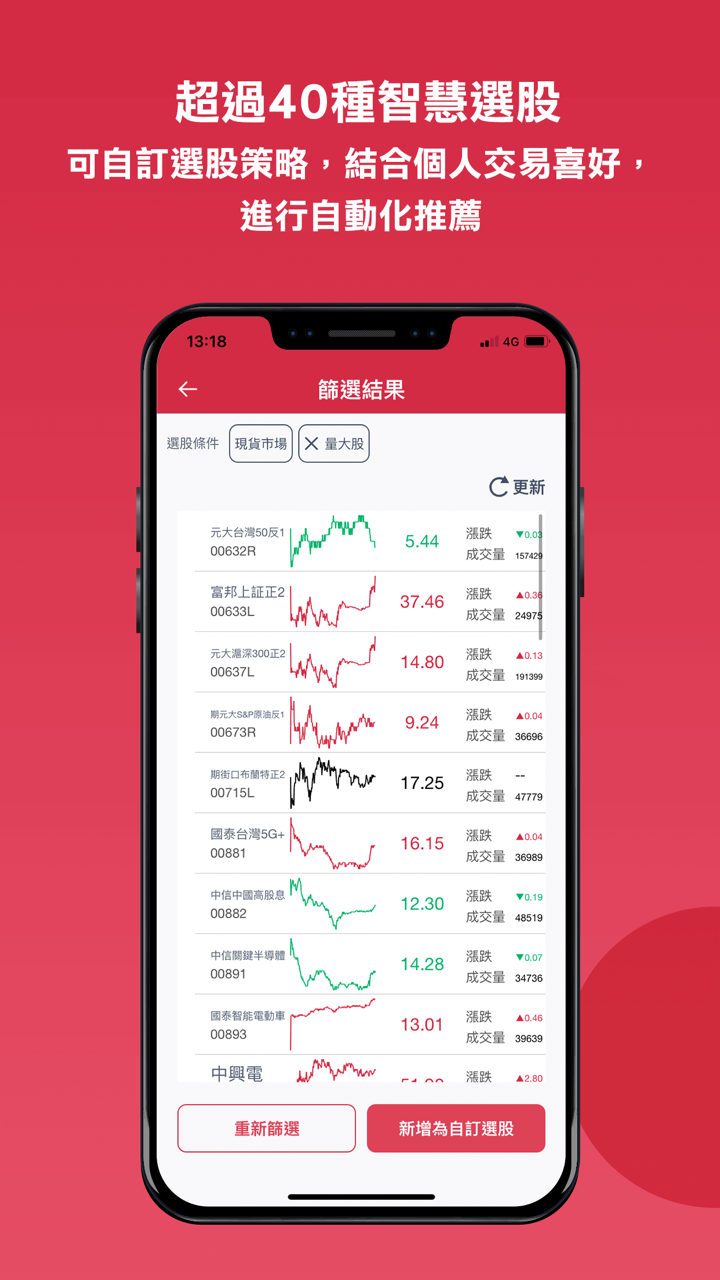

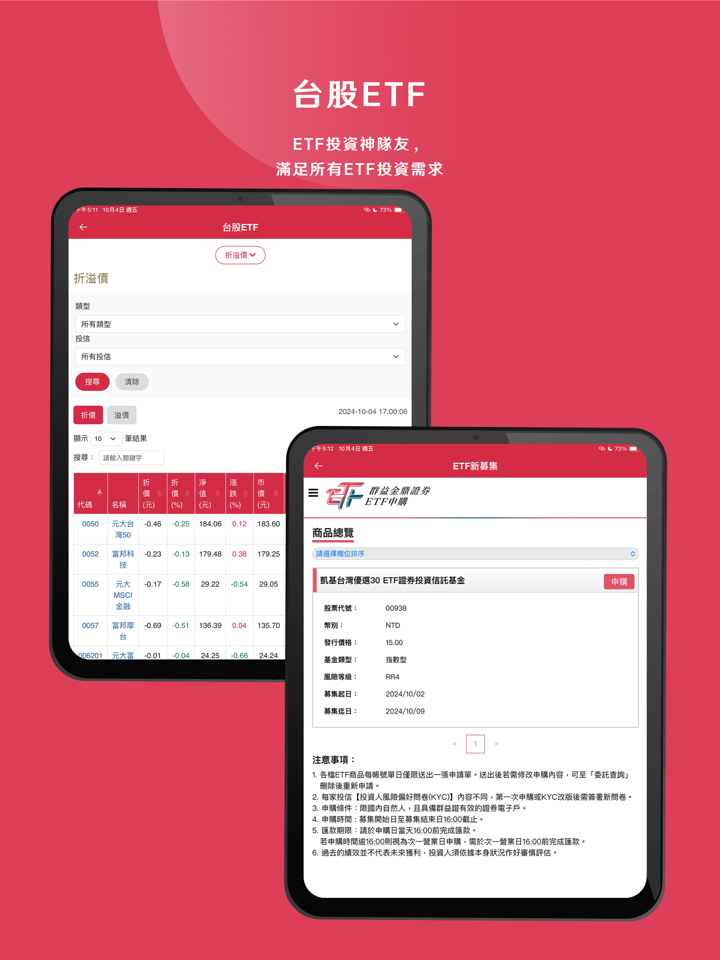

The Capital Group provides stocks and futures.

There's no ETFs trading or bonds trading. You will not have a good mix of investment options.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

FX3792673861

Hong Kong

90% of the scams on the market start with "recommended stocks"! Most scams start with "recommended stocks". The stocks recommended by the so-called "recommended stock masters" will make you a little bit profitable. After acquiring your trust, they start recommending to do something else, to open an account on another platform. Then they will make you lose all fund deliberately,keeping shirking and urging you to add fund. Otherwise, you be removed off the group.If you continue to deposit, it will only enable you to lose more. Please identify these platform routines and avoid being deceived: 1.By wrapping itself, the facade company induce clients to trade. The trading software is also manipulated by the company. 2 As long as clients make profits, the platform will freeze their accounts, thus the share-selling will be unfeasible. Then the trader will modify the price to make clients suffer losses. 3. In their wonderful phrase, they will will close positions compulsorily to avoid losses when you make profits. At this time, clients have no idea since they don’t know the numbers of the company. 4. By controlling the trading platform, they inject the virtual fund and manipulate the market to make clients suffer losses. 5. By enlarging the trading leverage of 10 or 100 times, they operated the market to make clients suffer losses.

Exposure

欧阳73633

Hong Kong

Can’t withdraw funds at all. Ask me to pay margin with varied reasons when I profited but I can’t withdraw funds. I’m wondering why doesn’t the big broker allow me to withdraw funds?

Exposure

FX1460433056

Thailand

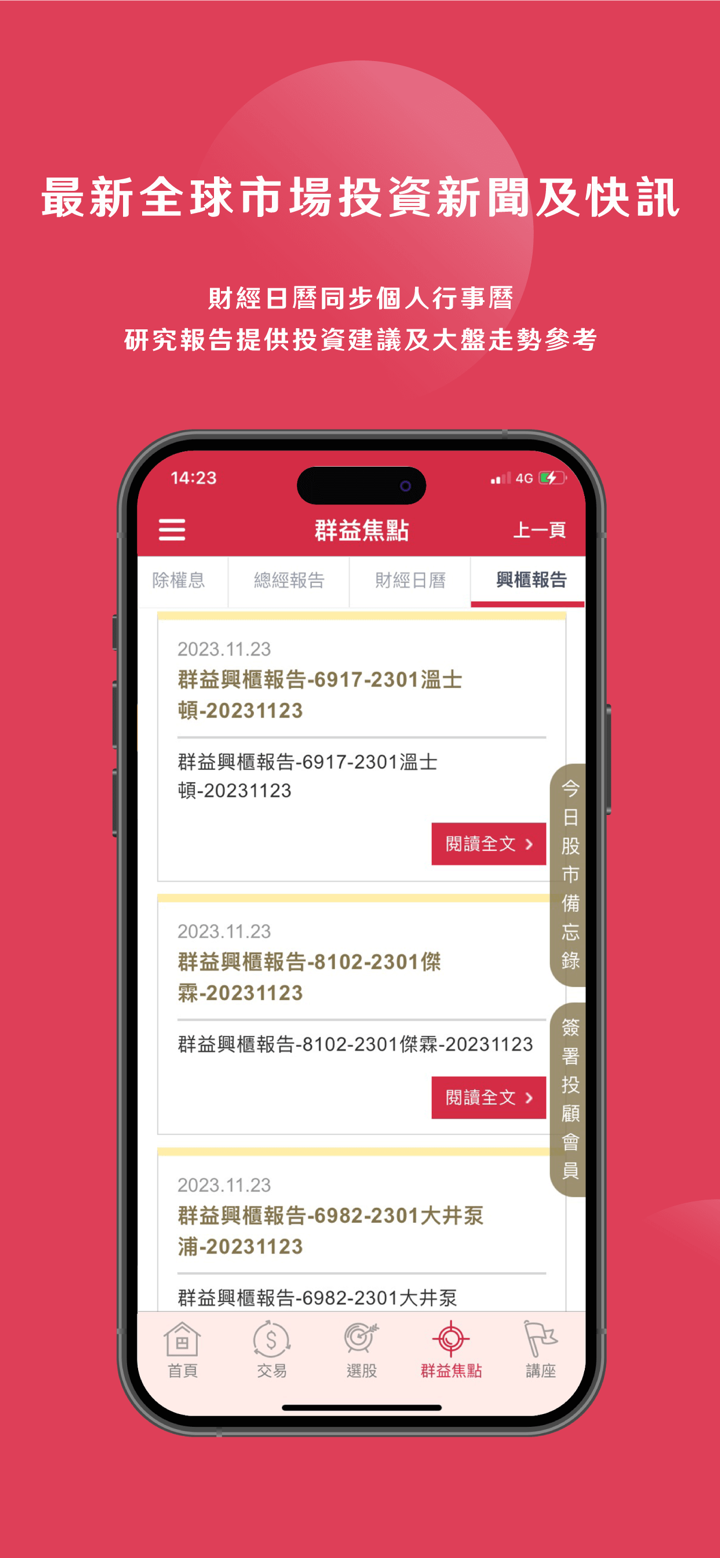

The Capital Group has got you covered with a bunch of trading products, from stocks to futures, options, and forex. This means you can spread your investments across different markets and minimize risks. Their trading platforms are pretty sweet too, with all the bells and whistles you need to trade and track your investments like a pro. I'm pretty stoked with the range of products and features they offer.

Neutral

S MD

Singapore

The Capital Group to be a great choice due to their competitive fees and commissions. There are no hidden fees or charges, which is a huge plus for me. The broker offers low spreads and transparent pricing, making trading with them a cost-effective experience. I appreciate the fact that I am not hit with unexpected fees or charges, and I can easily calculate the cost of my trades.

Positive

FX1036206024

Argentina

There is not much to say, I think that the service provided by Capital Group is satisfactory for me. Security is the most important thing when I choose a broker, and my money is safe right now.

Positive